Guam Management Stock Purchase Plan

Description

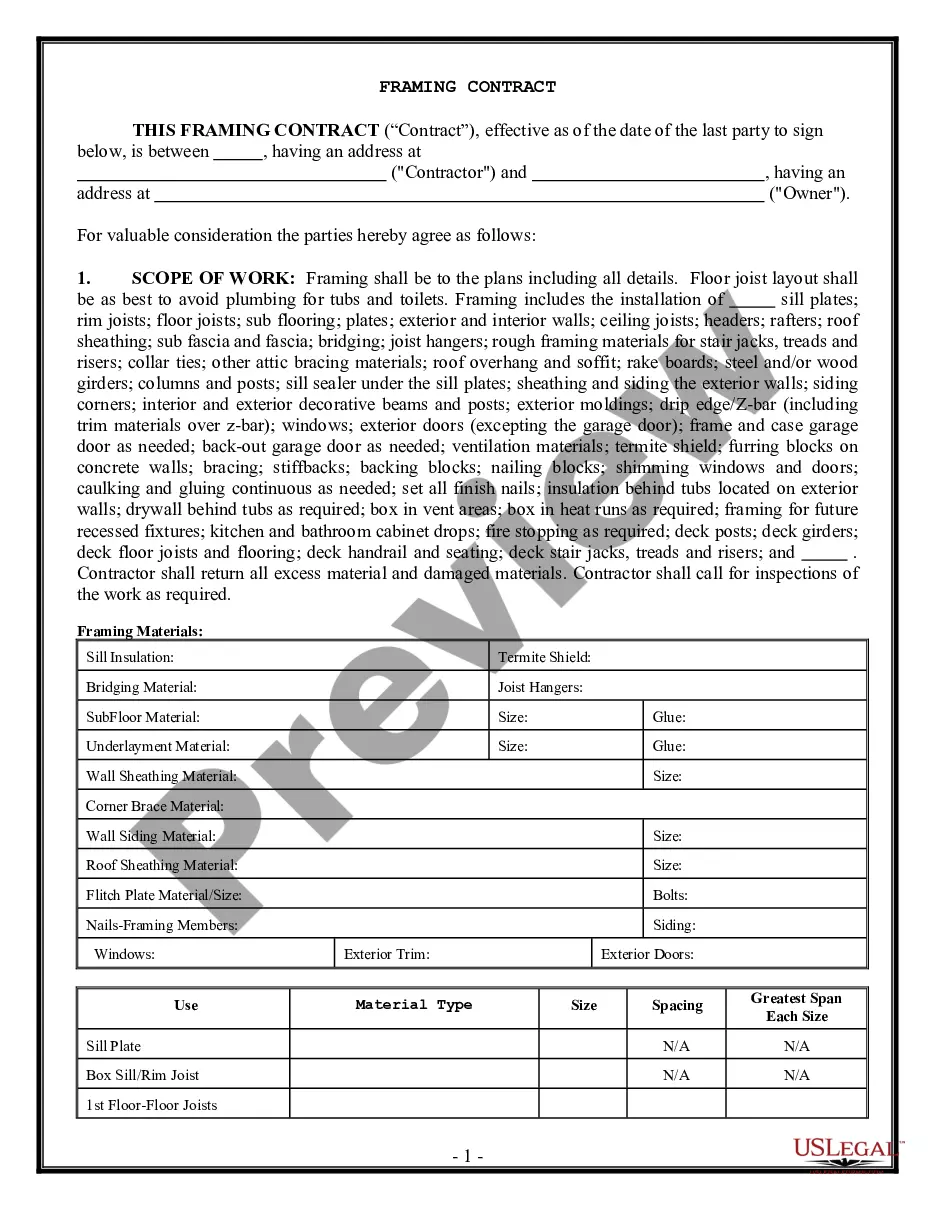

How to fill out Management Stock Purchase Plan?

Choosing the right legal record design can be a have difficulties. Needless to say, there are plenty of templates available on the Internet, but how do you find the legal type you require? Make use of the US Legal Forms web site. The service delivers a large number of templates, such as the Guam Management Stock Purchase Plan, which can be used for enterprise and personal needs. All the types are inspected by professionals and fulfill state and federal needs.

In case you are presently authorized, log in in your bank account and click the Obtain option to obtain the Guam Management Stock Purchase Plan. Make use of your bank account to look throughout the legal types you may have purchased formerly. Check out the My Forms tab of the bank account and get another backup from the record you require.

In case you are a fresh user of US Legal Forms, allow me to share straightforward recommendations that you should stick to:

- First, make sure you have selected the appropriate type for your metropolis/region. You may look over the form using the Preview option and look at the form description to ensure this is basically the best for you.

- In case the type is not going to fulfill your preferences, utilize the Seach area to find the correct type.

- Once you are certain that the form is suitable, select the Buy now option to obtain the type.

- Opt for the pricing strategy you desire and enter the necessary information and facts. Build your bank account and pay money for the order with your PayPal bank account or Visa or Mastercard.

- Pick the document format and obtain the legal record design in your system.

- Complete, edit and produce and signal the attained Guam Management Stock Purchase Plan.

US Legal Forms is the largest catalogue of legal types for which you can discover numerous record templates. Make use of the company to obtain skillfully-made documents that stick to status needs.

Form popularity

FAQ

How is the $25,000 limit calculated? The basic rule is that each employee cannot purchase more than $25,000 per year, valued using the fair market value on the date he/she enrolled in the current offering.

Employees who elect to participate in a qualified ESPP are typically able to take advantage of some tax benefits, as the discount is not recognized as taxable income until the stock is sold. When you sell the stock, the discount you received when you bought it may be taxable as income.

An employee stock purchase plan (or ESPP) can be a very valuable benefit. In general, if your employer offers an ESPP, we think you should participate at the level you can comfortably afford and then sell the shares as soon as you can.

The ESOP vs 401K Plan With a 401(k), the employer's contributions are tax-deferred, meaning that the money is taken out of each paycheck before taxes, and those wages are not taxed until withdrawal. Whereas with an ESOP, employees also do not pay taxes on the shares in their account until distribution.

How does a withdrawal work in an ESPP? With most employee stock purchase plans, you can withdraw from your plan at any time before the purchase. Withdrawals are made on Fidelity.com or through a representative. However, you should refer to your plan documents to determine your plan's rules governing withdrawals.

Disadvantages of Employee Stock Purchase Plans Ensuring the ESPP follows security and tax law guidelines can be challenging. A large amount of HR functions goes into administering the stock purchase plan. There are legal, tax, and administrative issues that go into setting up the plan.

In this situation, you sell your ESPP shares more than one year after purchasing them, but less than two years after the offering date. This is a disqualifying disposition because you sold the stock less than two years after the offering (grant) date.

The Bottom Line. Employee stock options can be a valuable part of your compensation package, especially if you work for a company whose stock has been soaring of late. In order to take full advantage, make sure you exercise your rights before they expire.