Guam Approval of Executive Director Loan Plan Overview The Guam Approval of Executive Director Loan Plan is a financial arrangement designed to provide loan options for executive directors in Guam. This plan aims to facilitate the successful execution of various projects, initiatives, and personal financial needs of executive directors by offering feasible loan solutions. Keywords: Guam, Approval, Executive Director, Loan Plan Different Types of Guam Approval of Executive Director Loan Plans 1. Project Financing Loan Plan: This option is tailored specifically for executive directors seeking financial assistance for projects within their respective organizations. Whether it is the launch of a new product, expansion of existing operations, or implementation of advanced technologies, this loan plan supports these projects to ensure their successful completion. 2. Personal Financial Loan Plan: Executive directors often face personal financial requirements that may arise at any given time. This loan plan recognizes the unique needs of executive directors, offering them a flexible financial resource to address personal financial obligations, such as medical expenses, education fees, unexpected household repairs, or other personal financial goals. 3. Continuing Education Loan Plan: In order to maintain a competitive edge in their respective fields, executive directors may require continuous professional development. This loan plan assists executive directors in financing their continuing education, including academic courses, workshops, certifications, or seminars that enhance their knowledge and skills, ultimately benefiting their organizations. 4. Equipment and Technology Loan Plan: To remain competitive and efficient, executive directors might require upgrading or acquiring new equipment and technologies for their organizations. This loan plan provides executive directors with financial support to invest in state-of-the-art machinery, advanced software, or any other equipment and technologies essential for improving productivity and operational efficiency. 5. Bridge Loan Plan: In the event of temporary financial gaps or delays in revenue generation, the bridge loan plan offers executive directors quick access to short-term funding, ensuring smooth operations until other anticipated funds or revenues become available. This loan type bridges any financial gap and avoids disruptions in essential activities or projects of the organization. These are just a few examples of the various types of Guam Approval of Executive Director Loan Plans available. Each plan is tailored to meet the specific financial requirements of executive directors, ensuring they have access to the necessary resources to achieve their professional goals and organizational targets.

Guam Approval of executive director loan plan

Description

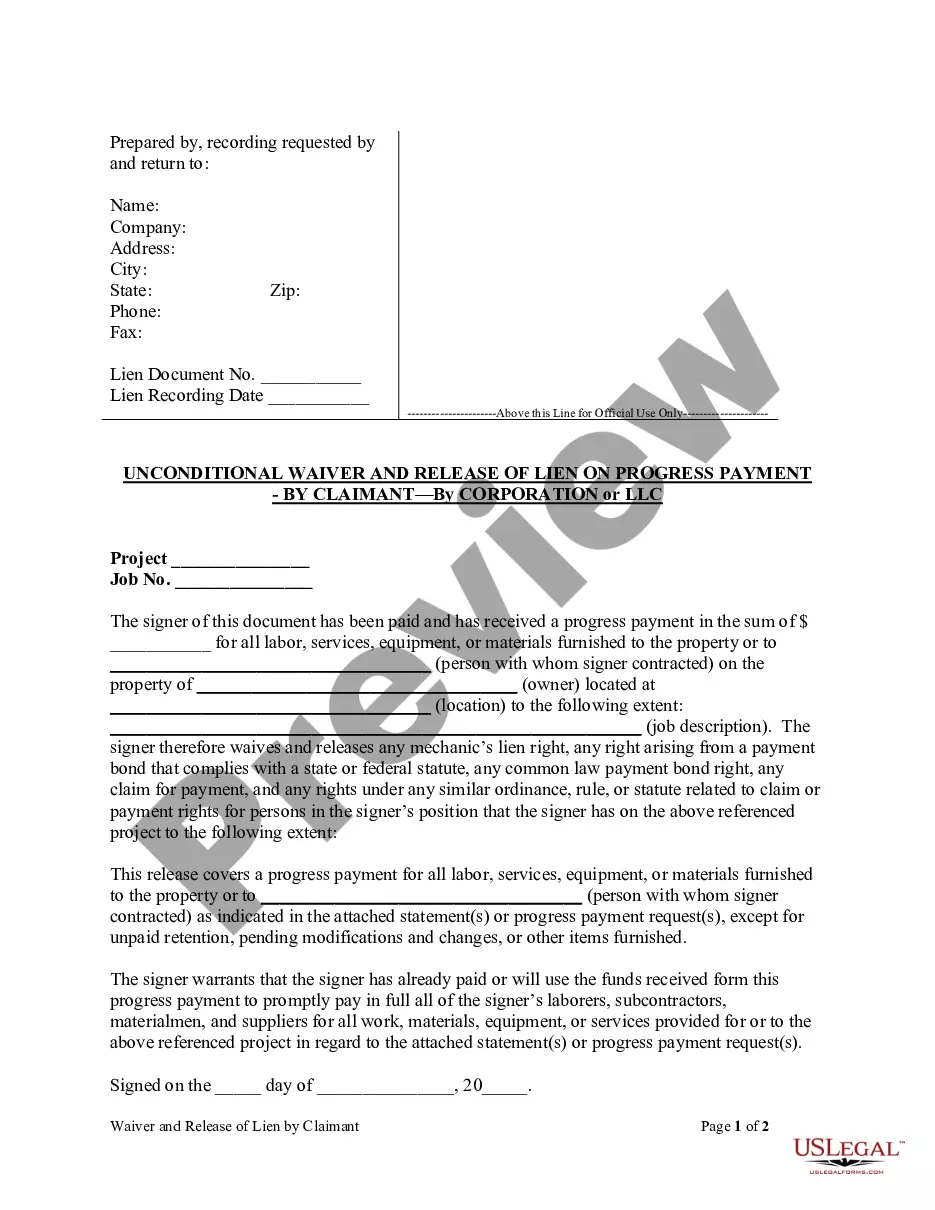

How to fill out Guam Approval Of Executive Director Loan Plan?

Choosing the right legal document web template might be a have a problem. Naturally, there are a variety of web templates available on the net, but how would you find the legal type you will need? Use the US Legal Forms site. The assistance provides 1000s of web templates, including the Guam Approval of executive director loan plan, that you can use for company and personal requires. Every one of the forms are examined by specialists and fulfill state and federal requirements.

When you are currently listed, log in to the account and then click the Acquire key to obtain the Guam Approval of executive director loan plan. Make use of account to check from the legal forms you may have acquired formerly. Visit the My Forms tab of your account and get another backup in the document you will need.

When you are a whole new customer of US Legal Forms, listed below are basic directions that you can follow:

- Initial, ensure you have selected the appropriate type for the metropolis/region. It is possible to look over the form utilizing the Preview key and browse the form explanation to make sure this is basically the best for you.

- When the type does not fulfill your preferences, use the Seach area to obtain the appropriate type.

- When you are certain the form is suitable, click on the Buy now key to obtain the type.

- Choose the prices program you would like and enter the essential details. Create your account and pay for an order making use of your PayPal account or Visa or Mastercard.

- Opt for the submit file format and download the legal document web template to the device.

- Full, modify and produce and signal the obtained Guam Approval of executive director loan plan.

US Legal Forms is definitely the most significant catalogue of legal forms where you can discover different document web templates. Use the company to download appropriately-produced documents that follow express requirements.

Form popularity

FAQ

Refunds continue to be paid weekly. Due to the surge in the volume of returns filed daily ahead of the filing deadline of April 18, 2023, for Tax Year 2022, turnaround time will continue to fluctuate between 3 weeks to just over 6 weeks.

Dafne Shimizu - Comptroller - A.B.

The Real Property Tax Assessment Branch is obligated to the conservation and updating of all property tax records, the development of the annual tax assessment roll and delinquent list, issuing the annual tax statements and arranging tax sales and tax deeds for recordation at the Department of Land Management.

Contact Information: Website: Phone Number: 671-635-1778. Email Address: legal@revtax.guam.gov. Office Address: 1240 Army Drive Barrigada GU USA 96921.

Guam has its own tax system that is independent of the tax system of the United States. It has significant differences, but it is based on the tax code of the United States.