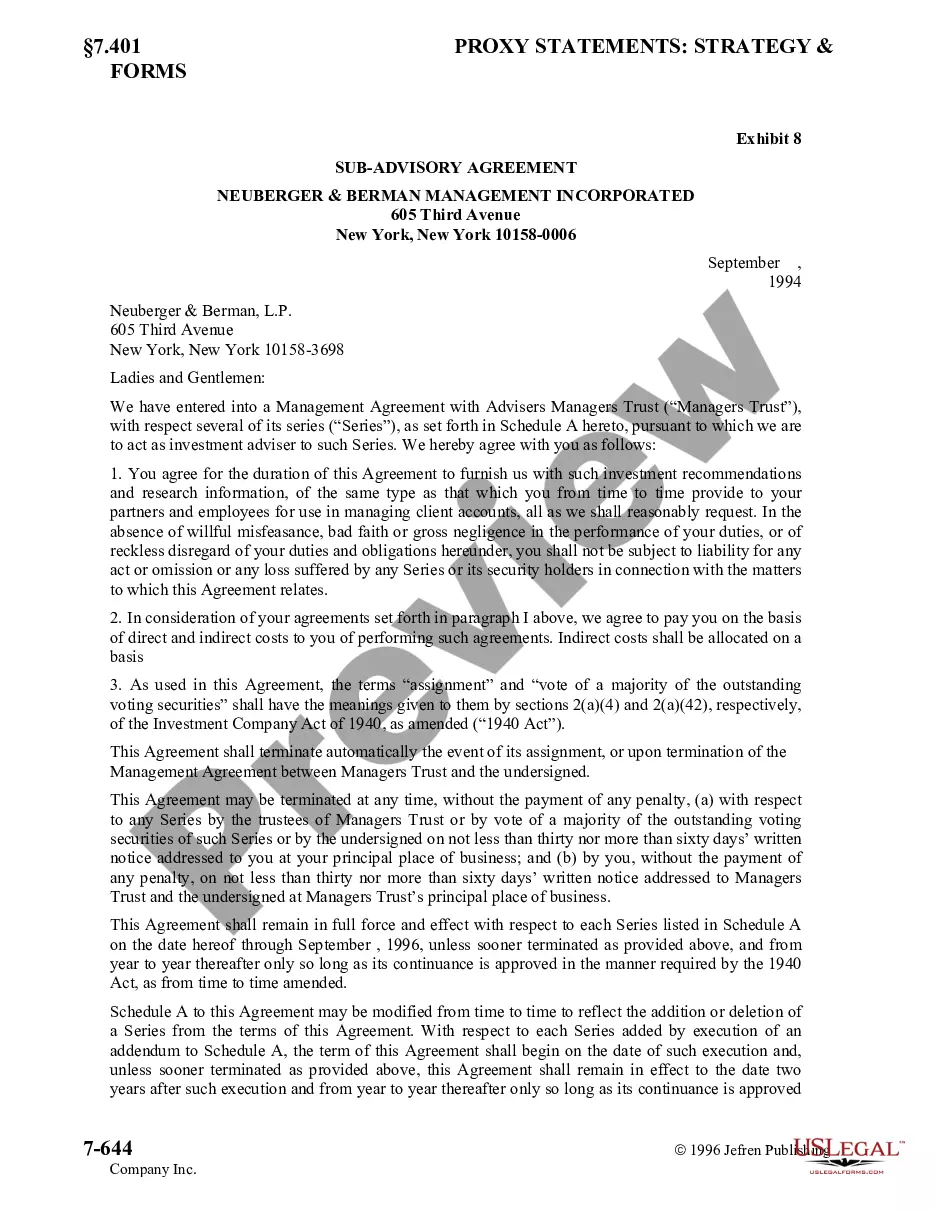

Guam Sub-Advisory Agreement of Neuberger and Berman Management, Inc.

Description

How to fill out Sub-Advisory Agreement Of Neuberger And Berman Management, Inc.?

Are you within a position where you need documents for either company or person uses virtually every day time? There are tons of legitimate record templates available on the Internet, but discovering kinds you can depend on isn`t easy. US Legal Forms offers 1000s of form templates, such as the Guam Sub-Advisory Agreement of Neuberger and Berman Management, Inc., that are published in order to meet federal and state specifications.

When you are already knowledgeable about US Legal Forms internet site and have your account, basically log in. Following that, you may down load the Guam Sub-Advisory Agreement of Neuberger and Berman Management, Inc. design.

If you do not come with an profile and would like to begin to use US Legal Forms, follow these steps:

- Get the form you require and ensure it is for your appropriate city/county.

- Use the Preview switch to examine the form.

- Read the information to ensure that you have selected the appropriate form.

- When the form isn`t what you are trying to find, take advantage of the Search area to find the form that meets your requirements and specifications.

- When you get the appropriate form, click Buy now.

- Select the pricing strategy you need, fill in the specified information to create your bank account, and purchase an order utilizing your PayPal or bank card.

- Select a hassle-free paper structure and down load your duplicate.

Get all of the record templates you might have bought in the My Forms food list. You may get a further duplicate of Guam Sub-Advisory Agreement of Neuberger and Berman Management, Inc. any time, if required. Just click the necessary form to down load or printing the record design.

Use US Legal Forms, the most comprehensive collection of legitimate types, in order to save time and prevent errors. The service offers expertly produced legitimate record templates that can be used for a range of uses. Create your account on US Legal Forms and start making your lifestyle easier.

Form popularity

FAQ

Neuberger Berman is a private, independent, employee-owned investment manager?a rare structure for a large asset management firm, almost all of which are either public or owned by other financial institutions.

Great company to work for Neuberger Berman is an established asset management company that stands for diversity, inclusion, sustainability and work-life balance. I have learned so much during my time at Neuberger and I feel that I can take what I have learned and apply it to helping any company meet its goals.

With offices in 25 countries, Neuberger Berman's diverse team has over 2,400 professionals. For eight consecutive years, the company has been named first or second in Pensions & Investments Best Places to Work in Money Management survey (among those with 1,000 employees or more).

Neuberger Berman BD LLC is a registered broker-dealer and member FINRA/SIPC. Tax, trust and estate planning are services offered by Neuberger Berman Trust Company. Form CRS | Neuberger Berman nb.com ? form-crs-nbia-nbbd nb.com ? form-crs-nbia-nbbd

Neuberger Berman Trust Company N.A. offers comprehensive fiduciary and investment services for individuals and institutions. Neuberger Berman Trust Company nb.com ? trust-company nb.com ? trust-company

Neuberger Berman is an experienced hedge fund solutions provider investing on behalf of institutional, high-net-worth and retail clients via registered liquid alternative funds, custom portfolios, and commingled products.