Guam Changing state of incorporation

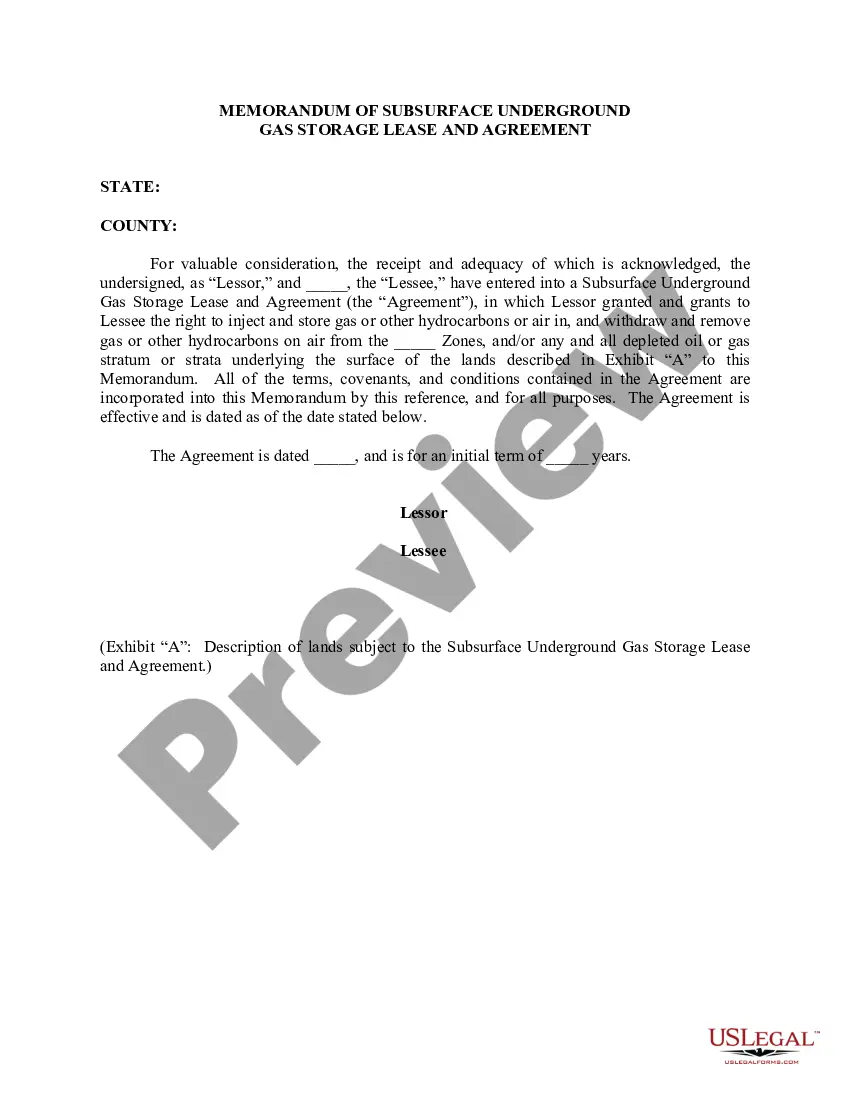

Description

How to fill out Changing State Of Incorporation?

Discovering the right lawful document web template can be a have difficulties. Obviously, there are tons of layouts accessible on the Internet, but how can you find the lawful form you want? Take advantage of the US Legal Forms internet site. The support gives thousands of layouts, including the Guam Changing state of incorporation, which you can use for business and personal requires. All the kinds are checked out by experts and meet state and federal demands.

If you are previously signed up, log in to the profile and click the Obtain key to have the Guam Changing state of incorporation. Utilize your profile to search throughout the lawful kinds you have acquired in the past. Proceed to the My Forms tab of your respective profile and acquire one more copy in the document you want.

If you are a whole new user of US Legal Forms, listed here are basic directions so that you can follow:

- Very first, make sure you have selected the proper form for the city/area. You are able to check out the shape making use of the Review key and read the shape explanation to ensure it is the best for you.

- In the event the form does not meet your preferences, utilize the Seach field to discover the correct form.

- Once you are certain that the shape is acceptable, select the Buy now key to have the form.

- Pick the costs prepare you need and enter in the required information and facts. Design your profile and pay for the order utilizing your PayPal profile or bank card.

- Choose the data file formatting and acquire the lawful document web template to the product.

- Total, change and print and indicator the acquired Guam Changing state of incorporation.

US Legal Forms will be the largest local library of lawful kinds where you can find a variety of document layouts. Take advantage of the service to acquire skillfully-manufactured papers that follow status demands.

Form popularity

FAQ

You may apply for an EIN in various ways, and now you may apply online . Contact Information: Taxpayers can obtain an EIN immediately by calling the Business & Specialty Tax Line (800-829-4933). The hours of operation are a.m. - p.m. local time, Monday through Friday.

STEPS ON HOW TO START A CORPORATION IN GUAM STEP 1: CHOOSING A NAME. ... STEP 2: DIRECTORS, SHAREHOLDERS, AND OFFICERS. ... STEP 3: FILING YOUR ARTICLES. ... STEP 4: ORGANIZATION AND BYLAWS. ... STEP 5: GET A GUAM GENERAL BUSINESS LICENSE. ... STEP 6: GUAM MANAGING AGENT / GUAM REGISTERED AGENT. ... STEP 7: BUSINESS PRIVILEGE TAX REQUIREMENTS.

How to Start an LLC in Guam Name Your LLC. ... Designate a Registered Agent. ... Submit LLC Articles of Organization. ... Write an LLC Operating Agreement. ... Get an EIN. ... Open a Bank Account. ... Fund the LLC. ... File State Reports & Taxes.

The Guam Business Corporation Act (the "Guam Act") updates Guam's general corporation laws, creating uniformity with the corporate laws of other jurisdictions, while tailoring certain statutes to accomplish Guam's long-standing objective to attract off-island interest and facilitate investment in local businesses.

In order to establish a business entity on Guam, you must obtain a business license prior to starting business operations. Business entities other than sole proprietorships must also register the type of entity they will be operating under.

You are not required to incorporate in the state where your business operates; you have the freedom to choose from any one of the 50 states or the District of Columbia. The key thing to know is that you must be registered to do business in the state where your business is located.

Ready to Start a Business in Guam? Pick a Business Structure. Name Your Business. File Formation Paperwork. Draft Internal Records. Get Guam Business Licenses. Get Business Insurance. File the Guam Sworn Annual Report. Build Your Business Website.

Guam LLC Cost. The main cost of starting a Guam LLC is the $250 fee to register with the Department of Revenue and Taxation. You'll also have a yearly fee of $100 to file your Guam Sworn Annual Report, which keeps your business up-to-date and legally authorized to do business in Guam.