"Capital Markets Mortgage" is a American Lawyer Media form. This is a book created by the Mortgage Bankers Association of America, The National Association of Realtors, and the National Realty Committee, for the Capital Consortium explaining everything about capital markets mortgage.

Guam Capital Markets Mortgage

Description

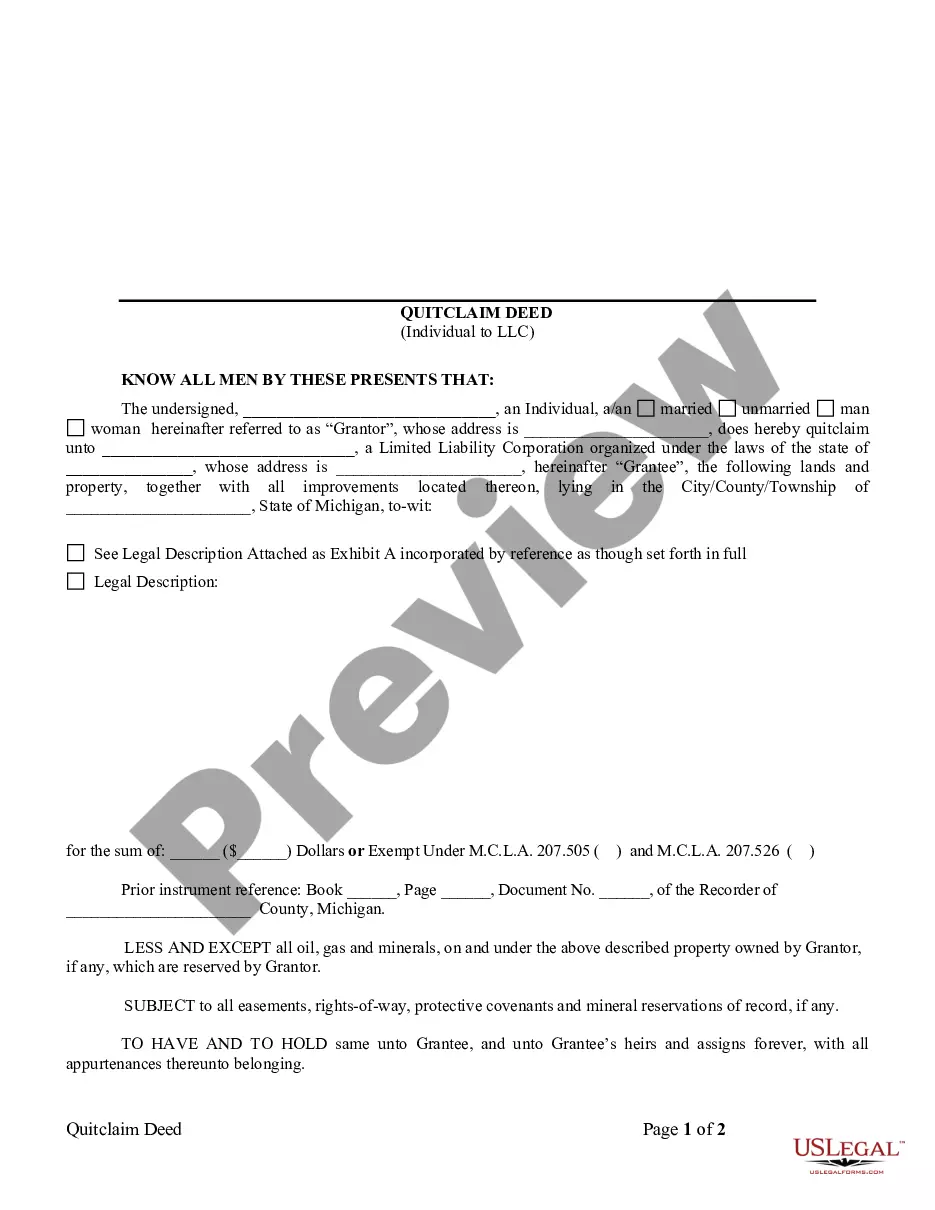

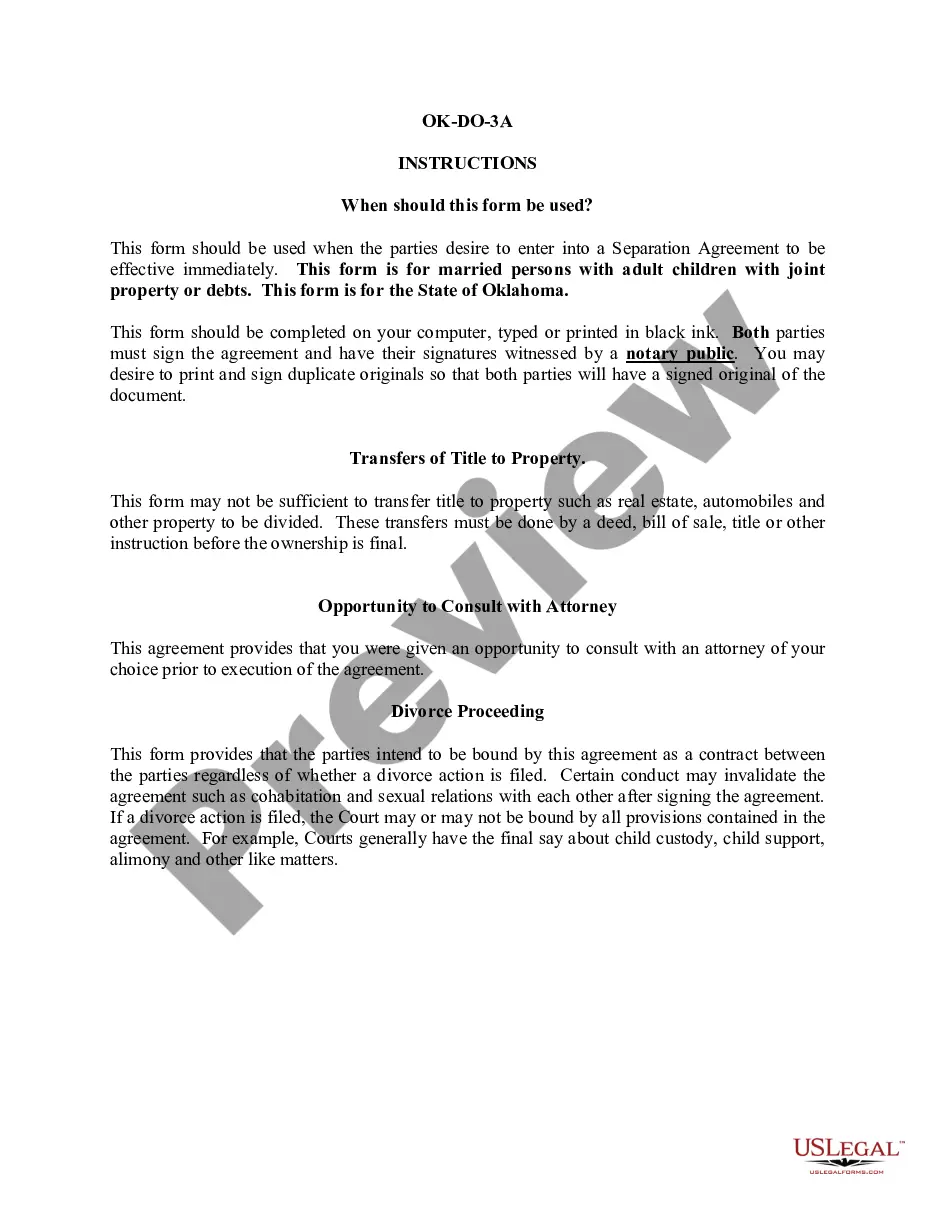

How to fill out Capital Markets Mortgage?

If you wish to complete, acquire, or printing authorized record templates, use US Legal Forms, the most important assortment of authorized kinds, that can be found on-line. Make use of the site`s basic and hassle-free search to get the papers you require. Various templates for enterprise and personal functions are categorized by classes and states, or key phrases. Use US Legal Forms to get the Guam Capital Markets Mortgage within a few click throughs.

When you are previously a US Legal Forms client, log in to your account and click the Obtain option to find the Guam Capital Markets Mortgage. You can even accessibility kinds you previously downloaded inside the My Forms tab of the account.

If you are using US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Make sure you have chosen the form to the right town/land.

- Step 2. Make use of the Review method to examine the form`s information. Never forget to read through the outline.

- Step 3. When you are not satisfied with all the develop, make use of the Search field on top of the display screen to locate other models from the authorized develop design.

- Step 4. Upon having identified the form you require, go through the Acquire now option. Select the prices strategy you prefer and add your accreditations to register on an account.

- Step 5. Approach the financial transaction. You should use your credit card or PayPal account to accomplish the financial transaction.

- Step 6. Find the formatting from the authorized develop and acquire it on the gadget.

- Step 7. Full, change and printing or indicator the Guam Capital Markets Mortgage.

Each authorized record design you acquire is your own property eternally. You have acces to every develop you downloaded inside your acccount. Select the My Forms segment and choose a develop to printing or acquire once again.

Remain competitive and acquire, and printing the Guam Capital Markets Mortgage with US Legal Forms. There are many expert and state-particular kinds you may use for your personal enterprise or personal needs.

Form popularity

FAQ

Guam Mortgage Lenders Buying real estate on Guam isn't much different than buying stateside. Although most banks in the mainland won't offer financing here, we have several local banks that provide competitive services and products for you to consider when purchasing your home on Guam.

U.S. Expat Mortgages America Mortgages offers conforming loans to U.S. Expats living and working overseas. These loans are identical to walking into your local U.S. bank but very specific to earning your income abroad as an expat overseas.

Capital Markets supports the liquidity of the mortgage markets and makes funding more available by purchasing mortgage-related securities guaranteed by Freddie Mac and other financial institutions in its investment portfolio. These investments are funded by issuing corporate debt securities.

Is Freddie Mac a government agency? No. Freddie Mac was chartered by Congress as a private company serving a public purpose. On September 6, 2008, the Director of the Federal Housing Finance Agency (FHFA), appointed FHFA as conservator of Freddie Mac.

Since mortgages generally aren't available to U.S. buyers overseas?and most U.S. banks won't lend for purchases abroad?what are some alternatives if you want to buy a home in a foreign country? Here, we look at three ways to finance your foreign real estate purchase.

Freddie Mac was chartered by Congress in 1970 to keep money flowing to mortgage lenders in support of homeownership and rental housing. Our statutory mission is to provide liquidity, stability and affordability to the U.S. housing market.

Can a U.S. Citizen Buy Property on Guam? Yes. Both U.S. citizens and permanent residents can buy property on Guam without restrictions, including houses and condos. By the way, the same isn't true of Guam's neighboring islands, the Commonwealth of the Northern Mariana Islands.

The Bottom Line Many banks and mortgage companies offer conventional and FHA home loans to non-U.S. citizens, provided they can verify their residency status, work history, and financial track record. Lenders that work with this population extensively tend to be more flexible with the documentation you need.