Guam Finance Master Lease Agreement refers to a contractual agreement between a lessor (the financial institution or leasing company) and a lessee (the borrower) in the context of financial leasing in Guam. The agreement outlines the terms and conditions under which the lessor provides financing for the acquisition of various assets, typically including equipment, vehicles, machinery, or technology. The Guam Finance Master Lease Agreement serves as a comprehensive framework that governs the leasing transactions between the parties involved. It establishes the legal rights, responsibilities, and obligations of both the lessor and lessee throughout the duration of the lease. This type of agreement provides flexibility and convenience, allowing businesses in Guam to obtain necessary assets without incurring the full purchase cost upfront. Keywords: 1. Guam: Refers to the location or jurisdiction where the finance master lease agreement is implemented. 2. Finance: Highlights the financial aspect of the agreement, involving the provision of funding for the lease. 3. Master Lease Agreement: Signifies that this is a comprehensive agreement that outlines various provisions related to financial leasing. 4. Lesser: Represents the party providing the financing, typically a financial institution or leasing company. 5. Lessee: Represents the borrower or the party seeking to obtain the leased assets. 6. Financial leasing: Describes the type of leasing transaction, where the main purpose is the financing of assets rather than mere rental. 7. Assets: Refers to the goods, equipment, or other items being leased under the agreement. Different types of Guam Finance Master Lease Agreement may include: 1. Equipment Lease Agreement: Focuses solely on the financing and leasing of equipment necessary for businesses. This type of lease agreement is common in manufacturing, construction, and technology sectors. 2. Vehicle Lease Agreement: Concentrates on financing and leasing vehicles, such as cars, trucks, or vans. This type of agreement is relevant to individuals, businesses, or organizations requiring transportation solutions. 3. Machinery Lease Agreement: Pertains specifically to the financing and leasing of machinery, such as industrial or specialized equipment used across various sectors like manufacturing, agriculture, or construction. 4. Technology Lease Agreement: Centers around the financing and leasing of technology-related assets, including hardware, software, or IT infrastructure. This type of lease agreement is crucial for businesses aiming to stay updated with the latest technological advancements. Each of these types of Guam Finance Master Lease Agreements serves a specific purpose, tailored to the needs of different sectors and industries.

Guam Finance Master Lease Agreement

Description

How to fill out Guam Finance Master Lease Agreement?

If you wish to comprehensive, obtain, or print authorized document themes, use US Legal Forms, the largest collection of authorized kinds, which can be found on the web. Utilize the site`s simple and practical lookup to discover the files you will need. Different themes for company and specific purposes are sorted by groups and suggests, or key phrases. Use US Legal Forms to discover the Guam Finance Master Lease Agreement with a few mouse clicks.

When you are presently a US Legal Forms customer, log in to your account and click on the Down load switch to find the Guam Finance Master Lease Agreement. You can even gain access to kinds you in the past saved in the My Forms tab of your respective account.

If you use US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form for your correct city/nation.

- Step 2. Utilize the Preview solution to look over the form`s information. Don`t forget about to see the information.

- Step 3. When you are not happy together with the kind, take advantage of the Research field at the top of the display to discover other models of your authorized kind web template.

- Step 4. Once you have identified the form you will need, select the Acquire now switch. Pick the pricing program you choose and put your accreditations to sign up to have an account.

- Step 5. Procedure the transaction. You can use your bank card or PayPal account to accomplish the transaction.

- Step 6. Select the formatting of your authorized kind and obtain it on your own product.

- Step 7. Full, revise and print or indicator the Guam Finance Master Lease Agreement.

Each authorized document web template you purchase is yours forever. You might have acces to every kind you saved within your acccount. Go through the My Forms area and pick a kind to print or obtain yet again.

Be competitive and obtain, and print the Guam Finance Master Lease Agreement with US Legal Forms. There are thousands of expert and status-specific kinds you can use for the company or specific requires.

Form popularity

FAQ

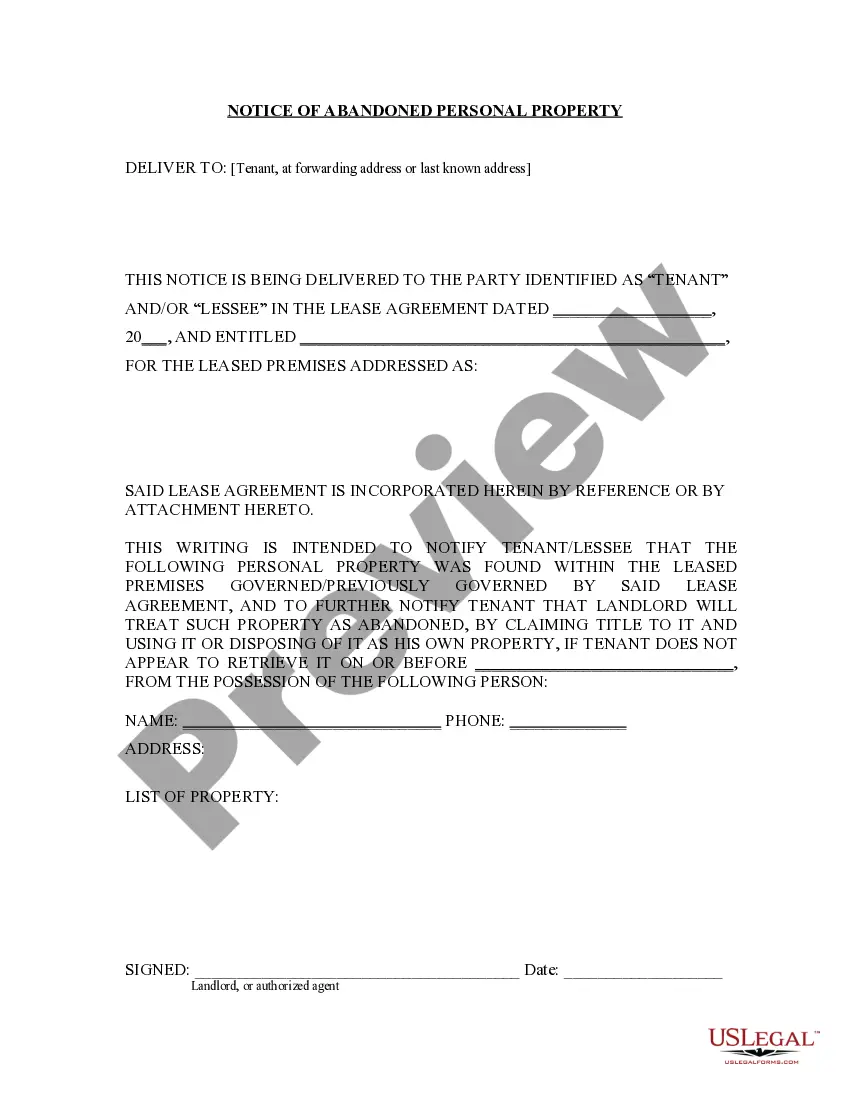

A master lease agreement is legal document where you lease an income-producing property as a single tenant-landlord and sublease to two or more tenants to produce income. One common example are shopping malls, which have many stores renting space from one landlord.

A master lease is a type of lease that gives the lessee the right to control and sublease the property during the lease, while the owner retains the legal title.

Instead of arranging the financing for one specific piece of equipment, you apply for a line of credit that is available to you for a fixed period of time. You can then lease a range of equipment types from the suppliers of your choice ? up to the amount of your credit limit.

To be contrasted with a lease contract for a single transaction involving a specific unit of equipment, a Master Lease is essentially a line of credit to draw from over time in order to purchase equipment.

You receive all profits, i.e., net cash flows after subtracting the regular lease payments and expenses. The buyer receives all tax benefits from the property. You are responsible for managing and maintaining the property, including paying utility bills, annual insurance premiums and property taxes.

For accounting purposes, a finance lease can have significant impacts on a company's financial statements. These types of leases are viewed as ownership rather than a rental, so they influence interest expenses, depreciation expenses, assets, and liabilities.