Guam Letter to Experian - formerly TRW - Requesting Free Copy of Your Credit Report based on Denial of Credit

Description

How to fill out Letter To Experian - Formerly TRW - Requesting Free Copy Of Your Credit Report Based On Denial Of Credit?

Are you presently inside a situation the place you will need documents for sometimes company or person purposes nearly every day time? There are a variety of legitimate file templates available on the net, but getting ones you can rely isn`t simple. US Legal Forms offers thousands of develop templates, much like the Guam Letter to Experian - formerly TRW - Requesting Free Copy of Your Credit Report based on Denial of Credit, which can be created to fulfill federal and state demands.

If you are currently familiar with US Legal Forms web site and have an account, simply log in. Afterward, you are able to obtain the Guam Letter to Experian - formerly TRW - Requesting Free Copy of Your Credit Report based on Denial of Credit format.

If you do not provide an accounts and would like to begin to use US Legal Forms, abide by these steps:

- Get the develop you need and ensure it is for the right area/region.

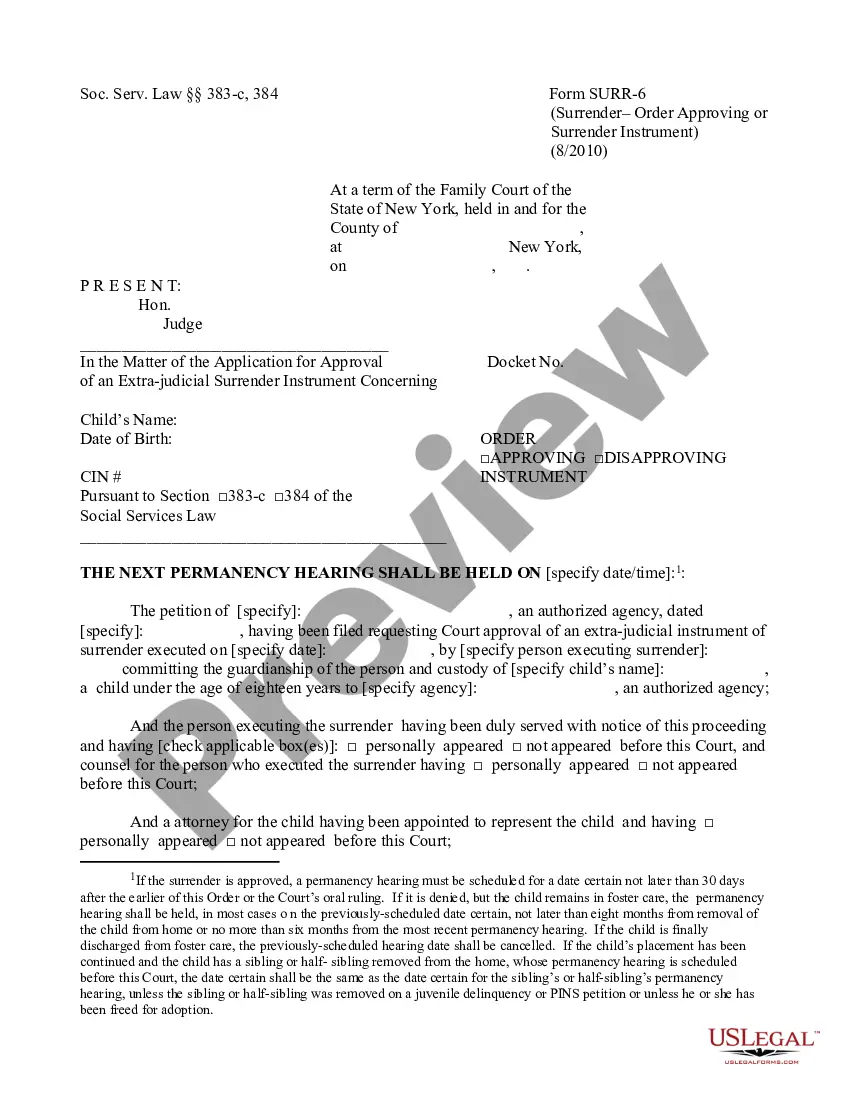

- Use the Review button to analyze the form.

- See the description to actually have chosen the proper develop.

- In the event the develop isn`t what you are seeking, utilize the Research discipline to find the develop that fits your needs and demands.

- If you get the right develop, simply click Purchase now.

- Choose the rates prepare you desire, submit the desired info to produce your account, and pay for your order with your PayPal or bank card.

- Choose a convenient paper structure and obtain your duplicate.

Get every one of the file templates you have bought in the My Forms menu. You may get a further duplicate of Guam Letter to Experian - formerly TRW - Requesting Free Copy of Your Credit Report based on Denial of Credit whenever, if required. Just select the required develop to obtain or produce the file format.

Use US Legal Forms, probably the most substantial assortment of legitimate types, to save some time and avoid blunders. The service offers skillfully made legitimate file templates which you can use for a selection of purposes. Make an account on US Legal Forms and begin producing your daily life a little easier.