A Guam Pooling and Servicing Agreement (PSA) is a legal contract created by Ameriquest Mortgage Securities, Inc., a leading mortgage-backed securities issuer. This agreement outlines the specific terms and conditions governing the pooling and servicing of mortgage loans in Guam. The Guam Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc. is designed to ensure efficient and transparent management of mortgage-backed securities involving properties located in Guam. It allows Ameriquest Mortgage Securities, Inc. to pool individual mortgage loans and bundle them into a single investment vehicle, commonly known as a mortgage-backed security (MBS). Key elements outlined in the Guam PSA include the identification of the mortgage loans included in the pool, the rights and responsibilities of various parties involved, cash flow distributions, and the servicing of the underlying mortgage loans. These agreements are essential in enabling investors to better understand the risks associated with investing in mortgage-backed securities. There might not be different types of Guam Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc. as the name suggests a standardized agreement. However, the PSA can vary in terms of the specific mortgage loans included, the size of the pool, and the characteristics of the underlying properties. Keywords: Guam Pooling and Servicing Agreement, Ameriquest Mortgage Securities, Inc., mortgage-backed securities, pooling, servicing, mortgage loans, investment vehicle, transparency, cash flow distributions, risk, standardized agreement, properties.

Guam Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc.

Description

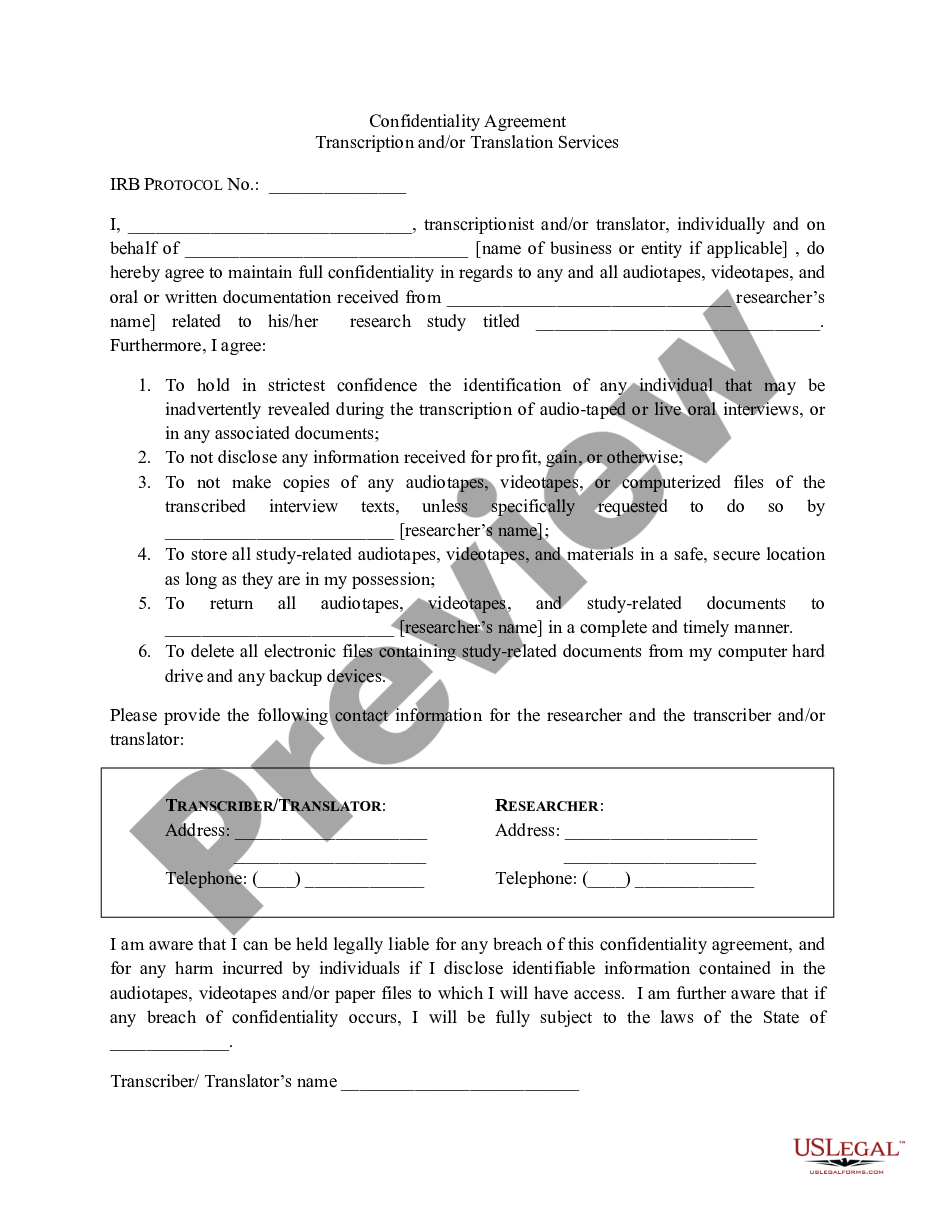

How to fill out Guam Pooling And Servicing Agreement Of Ameriquest Mortgage Securities, Inc.?

Are you in the placement where you need to have files for both enterprise or specific uses almost every day? There are a lot of authorized document themes available on the net, but discovering kinds you can rely on is not straightforward. US Legal Forms offers 1000s of develop themes, just like the Guam Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc., that happen to be composed to fulfill federal and state specifications.

When you are presently knowledgeable about US Legal Forms web site and also have an account, simply log in. Following that, you can acquire the Guam Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc. design.

Unless you provide an accounts and wish to begin to use US Legal Forms, adopt these measures:

- Obtain the develop you will need and make sure it is for the right town/region.

- Make use of the Review option to analyze the shape.

- Browse the explanation to ensure that you have chosen the proper develop.

- If the develop is not what you`re seeking, utilize the Look for discipline to find the develop that fits your needs and specifications.

- If you discover the right develop, just click Get now.

- Choose the costs strategy you want, fill in the specified information to generate your money, and buy your order with your PayPal or credit card.

- Decide on a practical data file formatting and acquire your duplicate.

Find all of the document themes you possess bought in the My Forms menu. You can aquire a further duplicate of Guam Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc. any time, if needed. Just click the required develop to acquire or produce the document design.

Use US Legal Forms, one of the most substantial selection of authorized types, to save lots of efforts and stay away from mistakes. The service offers appropriately manufactured authorized document themes which can be used for a selection of uses. Produce an account on US Legal Forms and start generating your lifestyle a little easier.

Form popularity

FAQ

On September 1, 2007, Citigroup completed its acquisition of Argent Mortgage and AMC Mortgage Services, shutting down Ameriquest Mortgage.

On September 9, 2007, Argent Mortgage was sold to Citi for an undisclosed amount. Argent was renamed Citi Residential Lending. Citi Residential Lending operated for several months before it was shut down. On September 10, 2007, Ameriquest stopped accepting loan applications.

Lenders mortgage insurance (LMI), also known as private mortgage insurance (PMI) in the US, is a type of insurance payable to a lender or to a trustee for a pool of securities that may be required when taking out a mortgage loan.

The "lender" is the financial institution that loaned you the money. The lender owns the loan and is also called the "note holder" or "holder." Sometime later, the lender might sell the mortgage debt to another entity, which then becomes the new loan owner (holder).

Status: CLOSED. Long Beach was closed by Washington Mutual in 2007. History: Originally a California-based savings and loan, founded in 1979, Long Beach Bank became a federally chartered thrift institution in 1990. In October 1994, it became Long Beach Mortgage Co.

The term "securitize" refers to the process of pooling financial assets together to create new securities that can be marketed and sold to investors. Mortgages and other forms of contractual debt are often securitized to clear them off the balance sheet of the originating company and free up credit for new lenders.

NOTE: Another way to find a PSA is to go to the SEC EDGAR search index page: .

Employer Identification No.) 1100 TOWN & COUNTRY ROAD, SUITE 1100 ORANGE, CALIFORNIA 92868 (Address of principal executive offices) (Zip Code) Registrant's Telephone Number, Including Area Code: (714) 541-9960 Item 5.