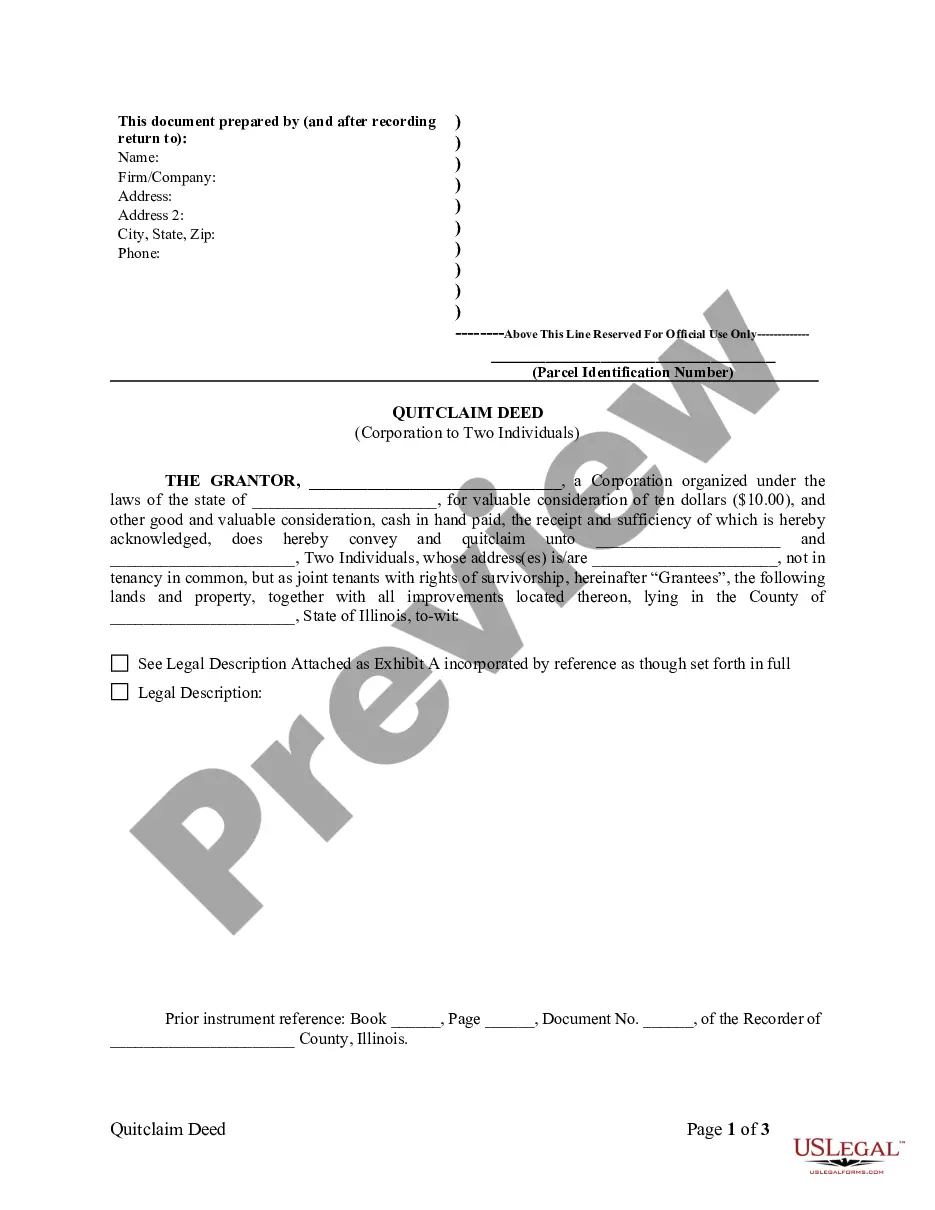

Guam Sample Subsequent Mortgage Loan Purchase Agreement of Ameriquest Mortgage is a legal document that outlines the terms and conditions between Ameriquest Mortgage, as the seller, and the buyer, for the purchase and sale of subsequent mortgage loans in Guam. This agreement serves as a binding contract between the parties involved. Keywords: Guam, Sample Subsequent Mortgage Loan Purchase Agreement, Ameriquest Mortgage, terms and conditions, purchase and sale, subsequent mortgage loans, seller, buyer, legal document, binding contract. Types of Guam Sample Subsequent Mortgage Loan Purchase Agreement of Ameriquest Mortgage: 1. Fixed-Rate Subsequent Mortgage Loan Purchase Agreement: This type of agreement pertains to subsequent mortgage loans with a fixed interest rate. It outlines the specific terms, interest rate, repayment schedule, and other agreed-upon conditions between the buyer and Ameriquest Mortgage. 2. Adjustable-Rate Subsequent Mortgage Loan Purchase Agreement: This agreement deals with subsequent mortgage loans that have an adjustable interest rate. It includes provisions regarding the initial interest rate period, adjustment intervals, and how the interest rate is determined, offering flexibility for the buyer and seller. 3. Jumbo Subsequent Mortgage Loan Purchase Agreement: In the case of larger loan amounts that exceed the conforming loan limits set by Fannie Mae and Freddie Mac, this agreement is specifically designed for subsequent mortgage loans of higher value. It may have additional terms and conditions applicable to jumbo loans. 4. Refinance Subsequent Mortgage Loan Purchase Agreement: This agreement is tailored for subsequent mortgage loans that are refinanced. It covers the terms, conditions, and requirements for refinancing, including any fees or penalties associated with the refinancing process. 5. Variable-Rate Subsequent Mortgage Loan Purchase Agreement: For subsequent mortgage loans with a variable or floating interest rate, this agreement includes provisions related to the index used to calculate the interest rate, margin, and frequency of rate adjustment, providing flexibility to borrowers. It is important to note that the above types of loan purchase agreements are examples and may vary depending on the specific requirements and terms established by Ameriquest Mortgage for purchasing subsequent mortgage loans in Guam.

Guam Sample Subsequent Mortgage Loan Purchase Agreement of Ameriquest Mortgage

Description

How to fill out Guam Sample Subsequent Mortgage Loan Purchase Agreement Of Ameriquest Mortgage?

You may invest several hours on the web attempting to find the lawful record template which fits the state and federal specifications you want. US Legal Forms provides thousands of lawful varieties that happen to be examined by experts. You can actually download or printing the Guam Sample Subsequent Mortgage Loan Purchase Agreement of Ameriquest Mortgage from my services.

If you have a US Legal Forms accounts, it is possible to log in and then click the Acquire button. Afterward, it is possible to full, change, printing, or signal the Guam Sample Subsequent Mortgage Loan Purchase Agreement of Ameriquest Mortgage. Every lawful record template you acquire is your own property permanently. To acquire an additional copy of any obtained type, visit the My Forms tab and then click the related button.

Should you use the US Legal Forms site the first time, stick to the straightforward directions below:

- Initial, make certain you have chosen the proper record template to the county/metropolis of your choosing. See the type description to ensure you have picked the proper type. If accessible, make use of the Preview button to look through the record template as well.

- If you would like get an additional edition of your type, make use of the Research industry to discover the template that meets your requirements and specifications.

- After you have identified the template you want, click Purchase now to move forward.

- Find the costs prepare you want, type in your credentials, and register for an account on US Legal Forms.

- Full the deal. You may use your bank card or PayPal accounts to purchase the lawful type.

- Find the formatting of your record and download it to the system.

- Make modifications to the record if necessary. You may full, change and signal and printing Guam Sample Subsequent Mortgage Loan Purchase Agreement of Ameriquest Mortgage.

Acquire and printing thousands of record themes using the US Legal Forms web site, that offers the largest collection of lawful varieties. Use expert and express-certain themes to handle your small business or specific needs.

Form popularity

FAQ

SISA: SISA stands for Stated Income Stated Asset. These loans are made without needing to verify the borrower's income or assets.

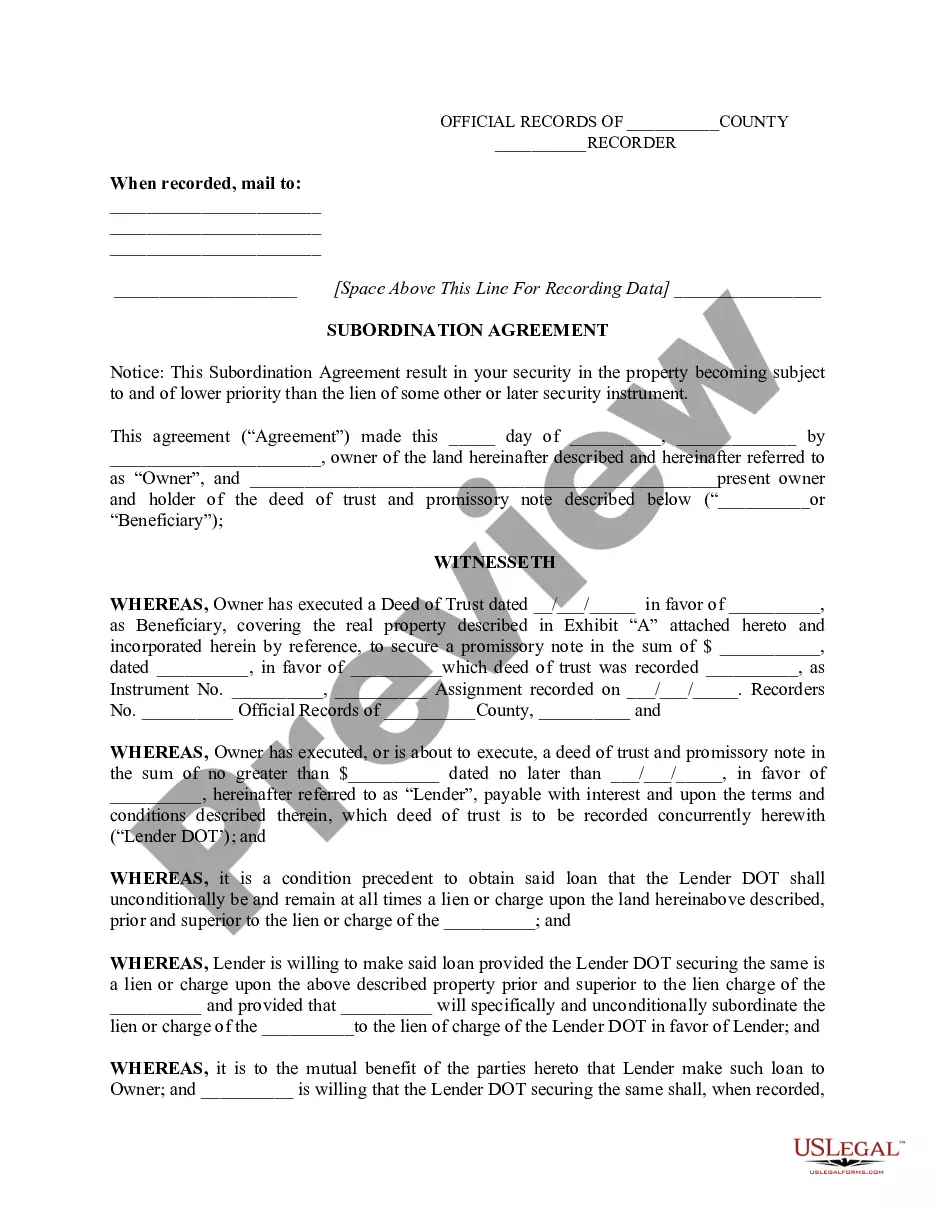

Most real estate transactions must be in writing. The most common real estate written contracts are leases longer than one year, sale of interest in or deed of real property, and mortgage agreements.

How to Write a Mortgage Deed Step 1 ? Fill In the Effective Date. ... Step 2 ? Enter Borrower and Lender Details. ... Step 3 ? Write Loan Information. ... Step 4 ? Fill In Property Details. ... Step 5 ? Identify Assigned Rents. ... Step 6 ? Enter Acceleration Upon Default. ... Step 7 ? Choose the Power of Sale Option.

On September 1, 2007, Citigroup completed its acquisition of Argent Mortgage and AMC Mortgage Services, shutting down Ameriquest Mortgage.

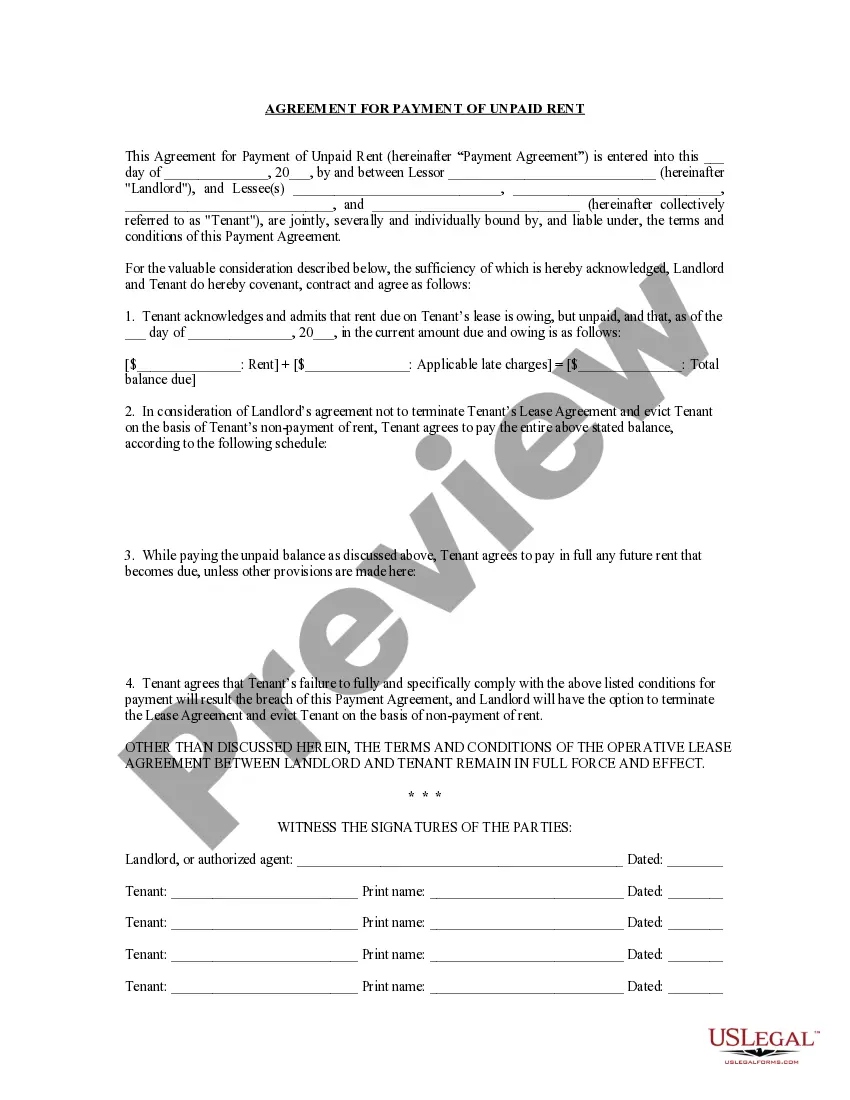

A loan purchase agreement is an agreement between a lender and borrower that states how a secured financial asset, such as real estate or equipment, will be purchased. The buyer of this type of security agrees to buy the asset at some point for an agreed-upon price.

How to make a family loan agreement The amount borrowed and how it will be used. Repayment terms, including payment amounts, frequency and when the loan will be repaid in full. The loan's interest rate. ... If the loan can be repaid early without penalty, and how much interest will be saved by early repayment.

However, the do-it-yourself approach is perfectly acceptable and just as legally enforceable. Once you have both agreed on the terms, you may want to have the personal loan contract notarized or ask a third party to act as a witness during the signing.

How to Write a Mortgage Deed Step 1 ? Fill In the Effective Date. ... Step 2 ? Enter Borrower and Lender Details. ... Step 3 ? Write Loan Information. ... Step 4 ? Fill In Property Details. ... Step 5 ? Identify Assigned Rents. ... Step 6 ? Enter Acceleration Upon Default. ... Step 7 ? Choose the Power of Sale Option.