Guam Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One

Description

How to fill out Pooling And Servicing Agreement Between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. And Bank One?

If you have to complete, acquire, or printing lawful file themes, use US Legal Forms, the greatest variety of lawful kinds, which can be found on the Internet. Take advantage of the site`s easy and practical look for to get the papers you need. Various themes for organization and personal purposes are categorized by classes and claims, or key phrases. Use US Legal Forms to get the Guam Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One in a handful of clicks.

If you are previously a US Legal Forms consumer, log in in your accounts and click the Download switch to obtain the Guam Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One. You can also entry kinds you previously delivered electronically in the My Forms tab of the accounts.

If you use US Legal Forms the first time, follow the instructions listed below:

- Step 1. Make sure you have chosen the form for that right metropolis/nation.

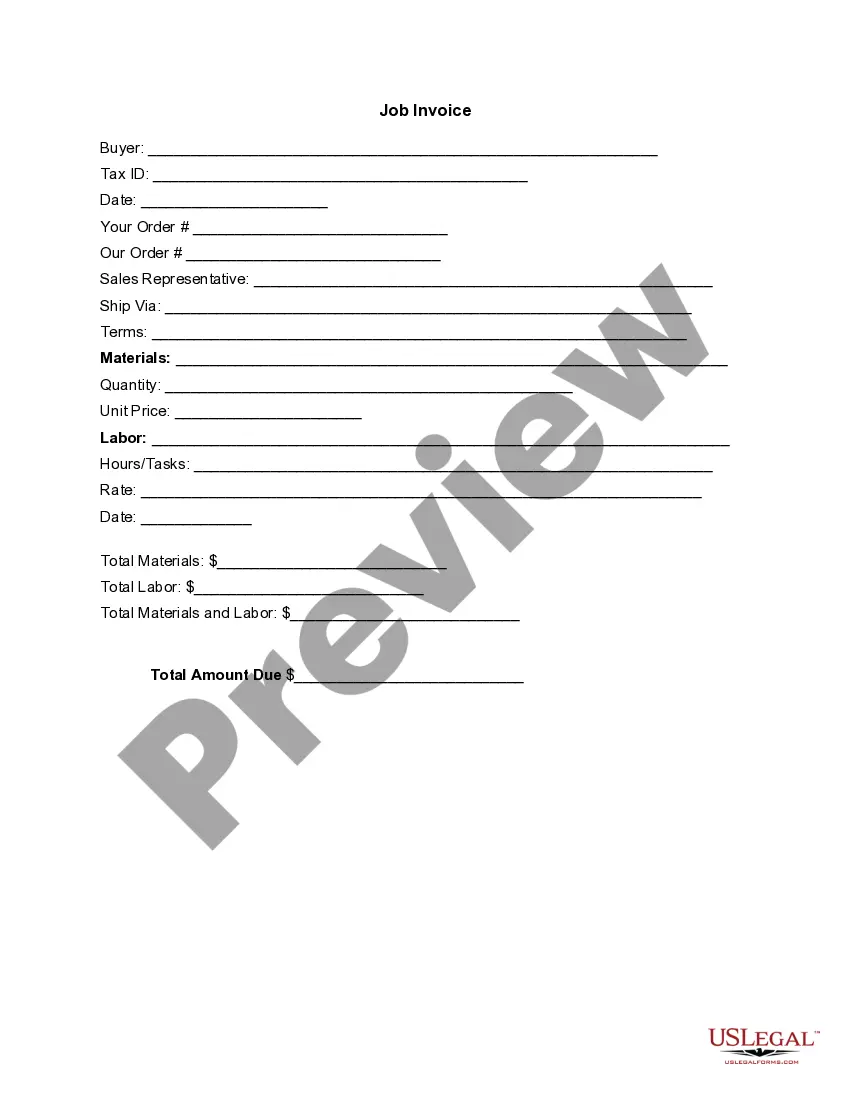

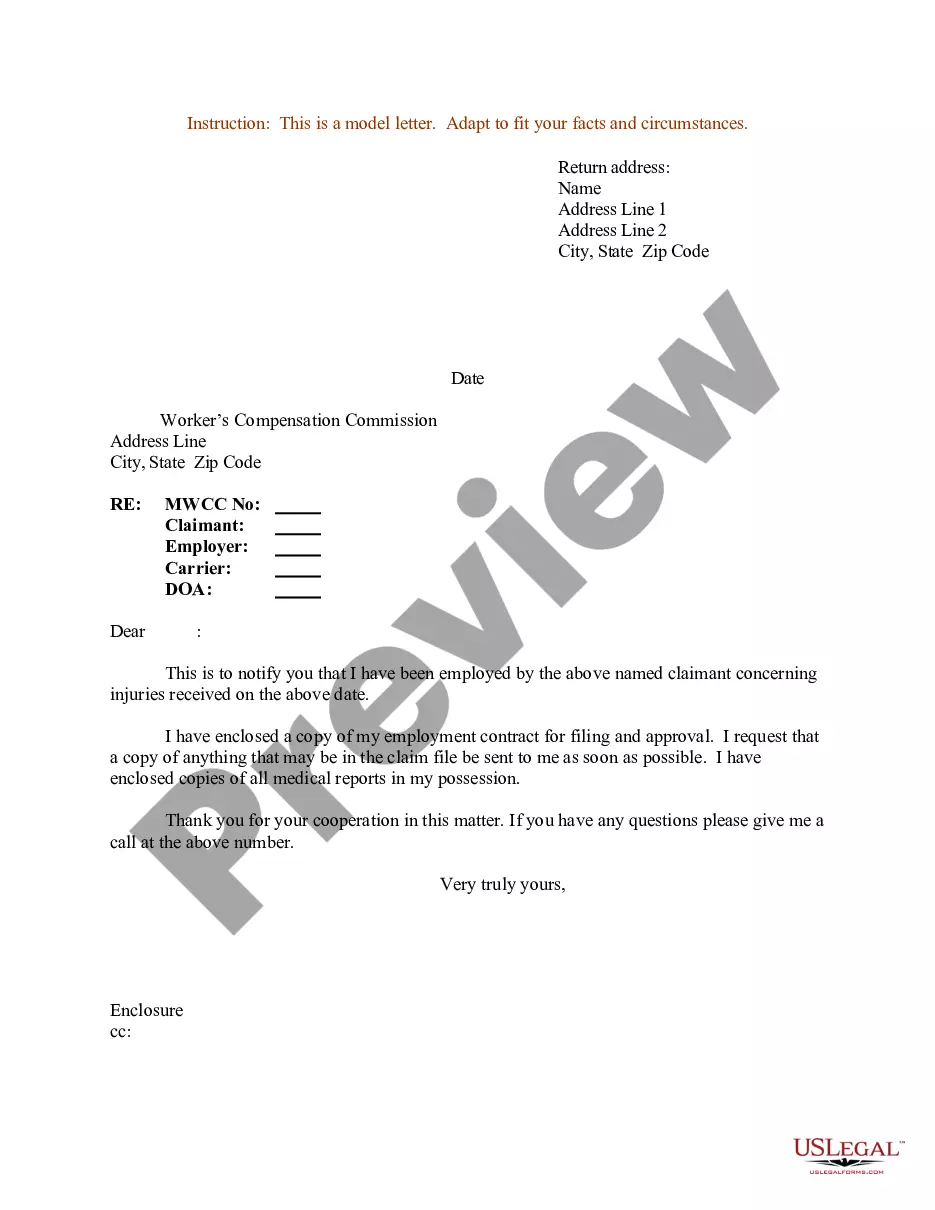

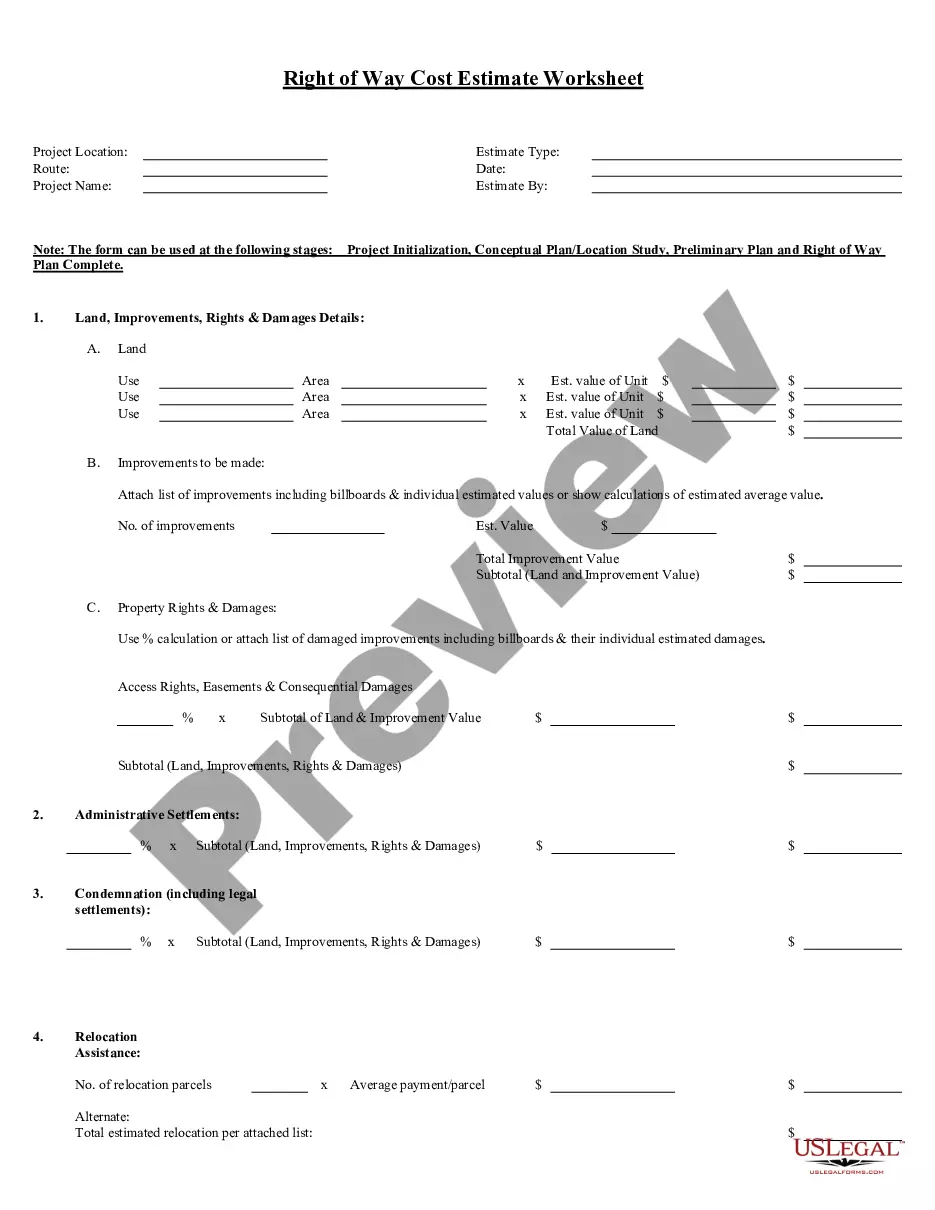

- Step 2. Make use of the Review option to check out the form`s information. Do not forget about to read through the information.

- Step 3. If you are unhappy using the type, take advantage of the Look for industry on top of the display screen to discover other models of the lawful type format.

- Step 4. Upon having found the form you need, click on the Buy now switch. Choose the prices prepare you favor and add your accreditations to sign up for the accounts.

- Step 5. Procedure the transaction. You may use your bank card or PayPal accounts to perform the transaction.

- Step 6. Choose the formatting of the lawful type and acquire it on the gadget.

- Step 7. Complete, modify and printing or indication the Guam Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One.

Each lawful file format you purchase is your own forever. You may have acces to every single type you delivered electronically within your acccount. Go through the My Forms segment and pick a type to printing or acquire yet again.

Remain competitive and acquire, and printing the Guam Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One with US Legal Forms. There are many professional and express-certain kinds you may use for your organization or personal needs.

Form popularity

FAQ

A mortgage servicing disclosure provides information from the lender about whether or not the servicing of the loan may be transferred, sold, or assigned to some other person or entity during the life of the loan.

The transferee servicer shall provide the notice of transfer to the borrower not more than 15 days after the effective date of the transfer.

NOTE: Another way to find a PSA is to go to the SEC EDGAR search index page: .

The servicing of your mortgage loan is being transferred, effective [Date]. This means that after this date, a new servicer will be collecting your mortgage loan payments from you. Nothing else about your mortgage loan will change.

Homeowners are often transferred to SPS once they become delinquent on their mortgage payments. Many lenders try to protect their brand when it comes to foreclosing on homeowners.

Know your rights under the law You have a 60-day grace period after a transfer to a new servicer.