Guam Escrow Agreement: A Comprehensive Overview of the Trident Group, Inc., Finger Security holders, Stuart Schloss, and Bankers Trust Co.'s Arrangement Introduction: In the business world, Escrow Agreements play a vital role in ensuring the secure transfer of assets or funds. The Guam Escrow Agreement between The Trident Group, Inc., Finger Security holders, Stuart Schloss, and Bankers Trust Co. holds immense significance in the context of safeguarding financial interests and establishing trust among parties involved. This detailed description aims to shed light on the essence, purpose, and potential variations of Guam Escrow Agreements involving the aforementioned stakeholders. Definition and Purpose: A Guam Escrow Agreement refers to a legally binding contract where a neutral third party, namely Bankers Trust Co., holds assets, funds, or securities on behalf of the Trident Group, Inc., Finger Security holders, and Stuart Schloss. It ensures that the agreed-upon conditions, terms, and obligations are met by the involved parties before the release of the assets or funds to the intended recipient. Keywords: Guam Escrow Agreement, Trident Group, Inc., Finger Security holders, Stuart Schloss, Bankers Trust Co. Primary Stakeholders: 1. The Trident Group, Inc.: As a prominent healthcare technology company, The Trident Group, Inc. utilizes the Guam Escrow Agreement to secure financial transactions, primarily related to acquisitions, mergers, or joint ventures. By entrusting Bankers Trust Co., the Trident Group ensures that funds or assets are safely held until predetermined conditions are fulfilled. 2. Finger Security holders: The Finger Security holders, commonly comprising individuals or entities holding securities of Finger, utilize the Guam Escrow Agreement to protect their interests during corporate actions such as mergers, acquisitions, or liquidation. This arrangement offers them assurance that the agreed-upon funds or assets will only be released when conditions are met, guaranteeing fairness and transparency. 3. Stuart Schloss: Stuart Schloss, a key individual involved in the Guam Escrow Agreement, benefits from this arrangement by having Bankers Trust Co. hold funds or assets on his behalf. Whether for personal or business purposes, this ensures the fulfillment of obligations by respective parties before the release of the entrusted assets. 4. Bankers Trust Co.: Acting as the neutral third party, Bankers Trust Co. assumes the role of the escrow agent in the Guam Escrow Agreement. With extensive expertise, trustworthiness, and regulatory compliance, they maintain a position of impartiality to safeguard the assets or funds until the conditions specified in the agreement are satisfied. Types of Guam Escrow Agreements: 1. Acquisition Escrow Agreement: In the context of an acquisition, the Trident Group, Inc. may enter into an Escrow Agreement with Finger Security holders, Stuart Schloss, and Bankers Trust Co. to ensure a smooth transfer of funds or assets. This agreement may outline the conditions for the release of BS crowed funds, ensuring compliance with regulatory requirements and adherence to contractual obligations. 2. Merger Escrow Agreement: Similar to the acquisition escrow, a merger escrow agreement could be established by the Trident Group, Inc., Finger Security holders, Stuart Schloss, and Bankers Trust Co. This type of agreement aims to secure funds or assets during a merger transaction, guaranteeing a fair distribution upon meeting predefined conditions. 3. Liquidation Escrow Agreement: In cases of liquidation, where the Trident Group, Inc. or Finger Security holders engage in winding down operations or selling assets, a liquidation escrow agreement may be arranged. Bankers Trust Co. would oversee the disbursal of funds or assets to ensure equitable distribution among parties involved in compliance with applicable laws and regulations. Conclusion: The Guam Escrow Agreement between The Trident Group, Inc., Finger Security holders, Stuart Schloss, and Bankers Trust Co. offers a secure and transparent framework for managing financial transactions while protecting the interests of involved parties. Whether facilitating acquisitions, mergers, or liquidations, these agreements foster trust, reliability, and compliance. Understanding the nuances and potential variations of Guam Escrow Agreements enables informed decision-making and reinforces the stability of financial transactions.

Guam Escrow Agreement between The TriZetto Group, Inc., the Finserv Securityholders, Stuart Schloss and Bankers Trust Co.

Description

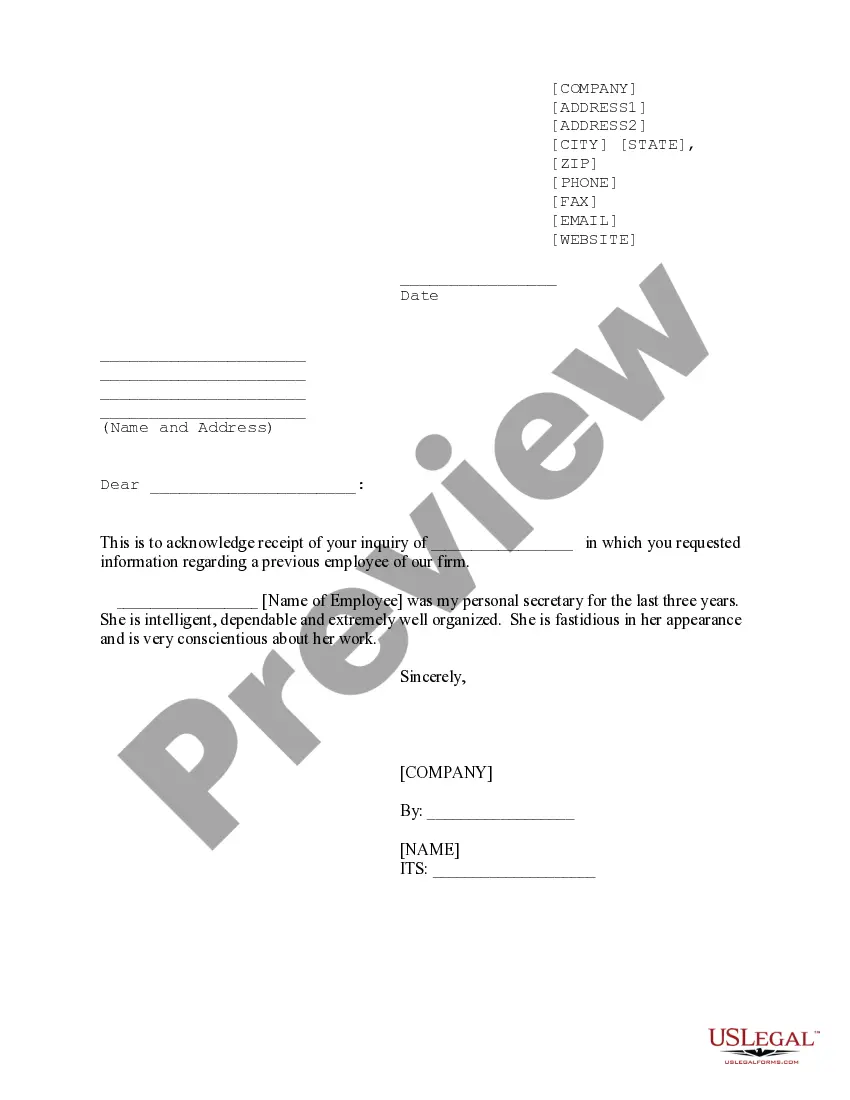

How to fill out Guam Escrow Agreement Between The TriZetto Group, Inc., The Finserv Securityholders, Stuart Schloss And Bankers Trust Co.?

Are you currently in the placement the place you will need documents for both business or person uses virtually every time? There are a variety of authorized document templates available on the net, but finding kinds you can rely isn`t easy. US Legal Forms offers 1000s of form templates, like the Guam Escrow Agreement between The TriZetto Group, Inc., the Finserv Securityholders, Stuart Schloss and Bankers Trust Co., which are published in order to meet federal and state needs.

If you are currently acquainted with US Legal Forms internet site and also have an account, simply log in. Following that, you may obtain the Guam Escrow Agreement between The TriZetto Group, Inc., the Finserv Securityholders, Stuart Schloss and Bankers Trust Co. web template.

If you do not offer an profile and would like to begin to use US Legal Forms, follow these steps:

- Obtain the form you will need and ensure it is for the right metropolis/region.

- Utilize the Preview switch to check the form.

- Read the explanation to ensure that you have selected the proper form.

- When the form isn`t what you are looking for, take advantage of the Look for discipline to find the form that fits your needs and needs.

- When you find the right form, simply click Purchase now.

- Choose the prices plan you desire, fill in the specified info to generate your bank account, and buy the order making use of your PayPal or Visa or Mastercard.

- Select a practical paper file format and obtain your copy.

Get every one of the document templates you have bought in the My Forms food selection. You can get a further copy of Guam Escrow Agreement between The TriZetto Group, Inc., the Finserv Securityholders, Stuart Schloss and Bankers Trust Co. any time, if possible. Just click the essential form to obtain or printing the document web template.

Use US Legal Forms, one of the most substantial variety of authorized forms, to save efforts and steer clear of errors. The support offers professionally made authorized document templates that can be used for a range of uses. Create an account on US Legal Forms and start making your lifestyle a little easier.