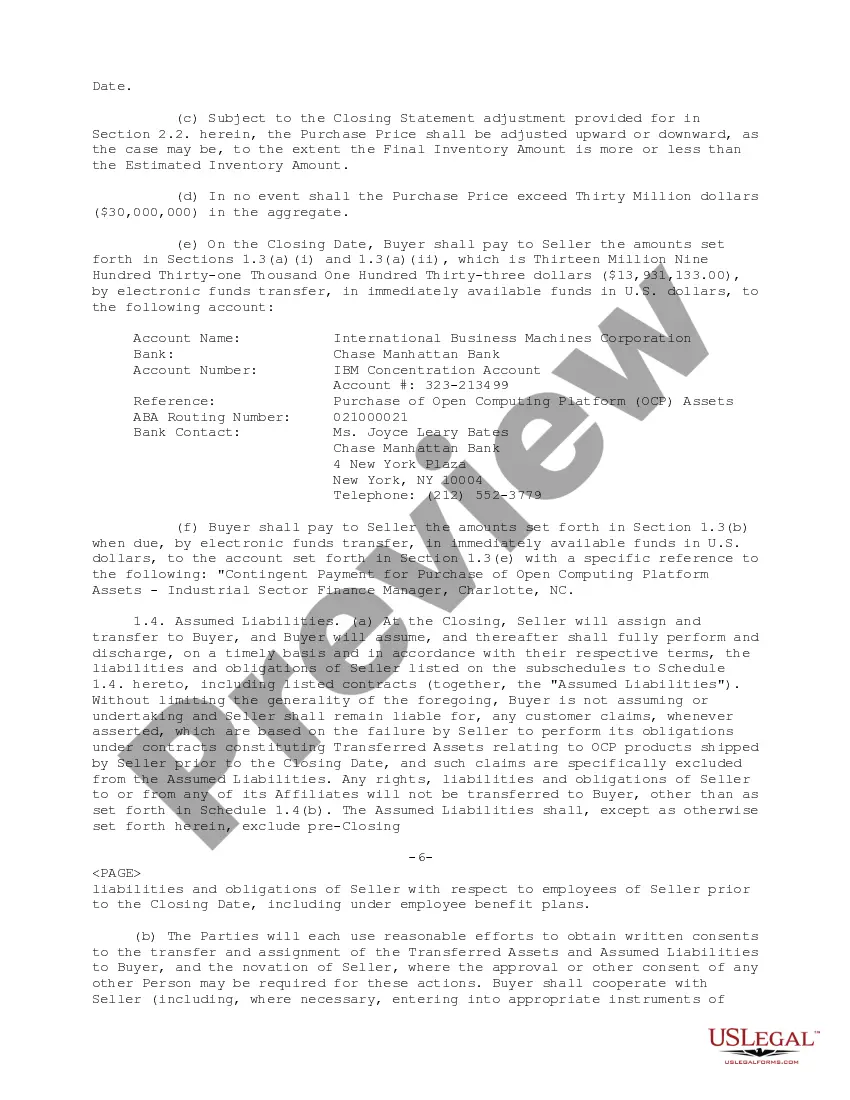

Title: Understanding Guam Sample Asset Purchase Agreement between Radius Corporation and International Business Machines Corporation — Sample Introduction: The Guam Sample Asset Purchase Agreement between Radius Corporation and International Business Machines Corporation is a legally binding document that outlines the terms and conditions for the purchase and transfer of specific assets from Radius Corporation to International Business Machines Corporation. This article aims to provide a detailed description of this agreement, its purpose, and key elements, including any potential variations or types of asset purchase agreements. What is Guam Sample Asset Purchase Agreement? The Guam Sample Asset Purchase Agreement is a comprehensive agreement that establishes the framework for Radius Corporation to sell and International Business Machines Corporation to acquire specific assets. The assets may include tangible properties, intellectual property, equipment, software, technology, trademarks, patents, licenses, customer contracts, and more. Key Elements of the Guam Sample Asset Purchase Agreement: 1. Parties Involved: The agreement identifies the buyer (IBM) and the seller (Radius Corporation) as the main parties involved. 2. Transaction Details: It includes the effective date, a brief background about both companies, the purpose and scope of the agreement, and any specific conditions or warranties associated with the asset transfer. 3. Purchase Price: The agreement specifies the amount or consideration to be paid by the buyer to the seller in exchange for the assets. 4. Assets Included: The agreement provides a detailed list of the specific assets being transferred, including their description, location, condition, and any limitations. 5. Excluded Assets: Any assets that are explicitly excluded from the purchase can also be listed in the agreement. 6. Representations and Warranties: Both parties may provide assurances regarding the ownership, validity, accuracy, and condition of the assets being transferred. 7. Confidentiality: The agreement may include provisions to protect the confidentiality of sensitive information exchanged during the transaction. 8. Closing Conditions: The conditions that need to be fulfilled before the closing of the agreement, such as obtaining necessary approvals, consents, or third-party agreements. 9. Indemnification: The agreement may specify the responsibilities and liabilities of each party, including indemnification clauses for any potential losses, claims, or disputes arising from the transaction. 10. Governing Law and Jurisdiction: The agreement identifies the jurisdiction and laws applicable to the agreement in case of any legal disputes. Types of Guam Sample Asset Purchase Agreements: While the Guam Sample Asset Purchase Agreement serves as a general template, there may be variations based on the specific requirements of the parties involved. Some types of asset purchase agreements commonly observed include: 1. Stock Purchase Agreement: In this agreement, the buyer purchases all outstanding shares of the target company's stock, effectively acquiring all its assets and liabilities. 2. Asset Purchase Agreement: This type specifically outlines the purchase and transfer of selected assets from the seller to the buyer, enabling the buyer to cherry-pick desired assets while avoiding unwanted liabilities. 3. Intellectual Property Purchase Agreement: In this agreement, the focus is on the transfer of intellectual property assets, including patents, copyrights, trademarks, or trade secrets. Conclusion: The Guam Sample Asset Purchase Agreement between Radius Corporation and International Business Machines Corporation showcases the complexities and intricacies involved in such an agreement. Understanding its purpose and key elements is crucial for any party engaging in a similar business transaction. Remember that it is always recommended consulting legal professionals to ensure compliance with applicable laws and to tailor the agreement to the specific needs of both parties involved.

Title: Understanding Guam Sample Asset Purchase Agreement between Radius Corporation and International Business Machines Corporation — Sample Introduction: The Guam Sample Asset Purchase Agreement between Radius Corporation and International Business Machines Corporation is a legally binding document that outlines the terms and conditions for the purchase and transfer of specific assets from Radius Corporation to International Business Machines Corporation. This article aims to provide a detailed description of this agreement, its purpose, and key elements, including any potential variations or types of asset purchase agreements. What is Guam Sample Asset Purchase Agreement? The Guam Sample Asset Purchase Agreement is a comprehensive agreement that establishes the framework for Radius Corporation to sell and International Business Machines Corporation to acquire specific assets. The assets may include tangible properties, intellectual property, equipment, software, technology, trademarks, patents, licenses, customer contracts, and more. Key Elements of the Guam Sample Asset Purchase Agreement: 1. Parties Involved: The agreement identifies the buyer (IBM) and the seller (Radius Corporation) as the main parties involved. 2. Transaction Details: It includes the effective date, a brief background about both companies, the purpose and scope of the agreement, and any specific conditions or warranties associated with the asset transfer. 3. Purchase Price: The agreement specifies the amount or consideration to be paid by the buyer to the seller in exchange for the assets. 4. Assets Included: The agreement provides a detailed list of the specific assets being transferred, including their description, location, condition, and any limitations. 5. Excluded Assets: Any assets that are explicitly excluded from the purchase can also be listed in the agreement. 6. Representations and Warranties: Both parties may provide assurances regarding the ownership, validity, accuracy, and condition of the assets being transferred. 7. Confidentiality: The agreement may include provisions to protect the confidentiality of sensitive information exchanged during the transaction. 8. Closing Conditions: The conditions that need to be fulfilled before the closing of the agreement, such as obtaining necessary approvals, consents, or third-party agreements. 9. Indemnification: The agreement may specify the responsibilities and liabilities of each party, including indemnification clauses for any potential losses, claims, or disputes arising from the transaction. 10. Governing Law and Jurisdiction: The agreement identifies the jurisdiction and laws applicable to the agreement in case of any legal disputes. Types of Guam Sample Asset Purchase Agreements: While the Guam Sample Asset Purchase Agreement serves as a general template, there may be variations based on the specific requirements of the parties involved. Some types of asset purchase agreements commonly observed include: 1. Stock Purchase Agreement: In this agreement, the buyer purchases all outstanding shares of the target company's stock, effectively acquiring all its assets and liabilities. 2. Asset Purchase Agreement: This type specifically outlines the purchase and transfer of selected assets from the seller to the buyer, enabling the buyer to cherry-pick desired assets while avoiding unwanted liabilities. 3. Intellectual Property Purchase Agreement: In this agreement, the focus is on the transfer of intellectual property assets, including patents, copyrights, trademarks, or trade secrets. Conclusion: The Guam Sample Asset Purchase Agreement between Radius Corporation and International Business Machines Corporation showcases the complexities and intricacies involved in such an agreement. Understanding its purpose and key elements is crucial for any party engaging in a similar business transaction. Remember that it is always recommended consulting legal professionals to ensure compliance with applicable laws and to tailor the agreement to the specific needs of both parties involved.