A Guam Plan of Merger is a legal document that outlines the process and terms of a merger between Micro Component Technology, Inc. (MCT), MCT Acquisition, Inc., and ASECB Corporation. This type of merger involves the consolidation of these three companies into a single entity, creating synergies and maximizing their combined resources and capabilities. The Guam Plan of Merger is a crucial step in the merger process, as it lays out the rights, obligations, and duties of each party involved. It typically includes a detailed description of the structure of the merged entity, the allocation of assets and liabilities, the share exchange ratios, and the management and governance of the new company. The agreement may also address potential conditions or contingencies that need to be met before the merger can be completed. This could include obtaining regulatory approvals, securing financing, or obtaining the consent of shareholders. Additionally, the document may outline the timeline for the merger, including key milestones and expected completion dates. Different types of Guam Plan of Merger between MCT, MCT Acquisition, and ASECB Corporation may include variations in the terms and conditions depending on the specific goals and circumstances of the merger. For example, there could be mergers that focus on combining specific business units or divisions, while others may involve a complete consolidation of all operations. The details of the mergers can vary based on factors such as the size of the companies, their respective market positions, and the desired outcome of the merger. Overall, the Guam Plan of Merger between MCT, MCT Acquisition, and ASECB Corporation is a comprehensive legal document that carefully outlines the terms and conditions of the merger, ensuring a smooth and efficient integration of these three companies into a single, stronger entity.

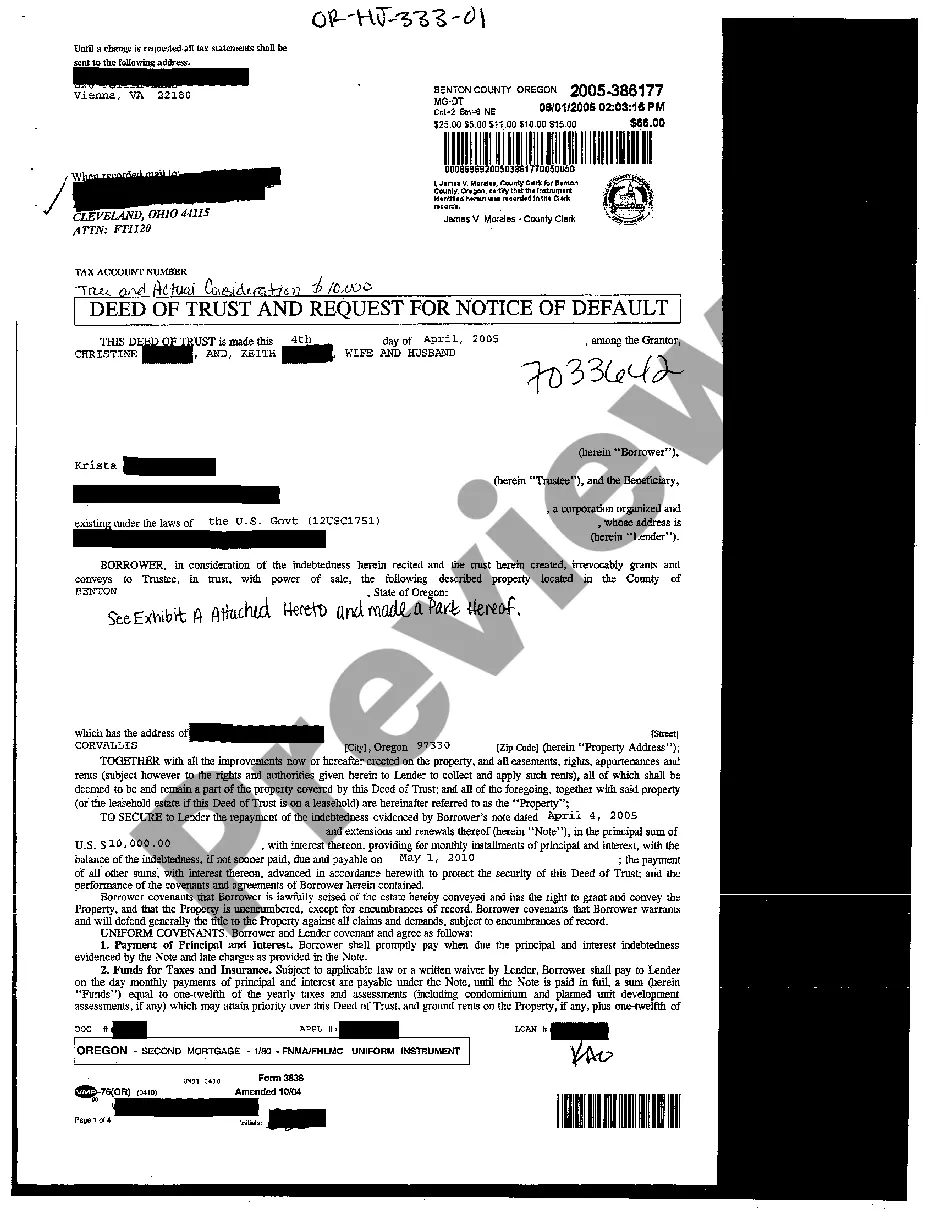

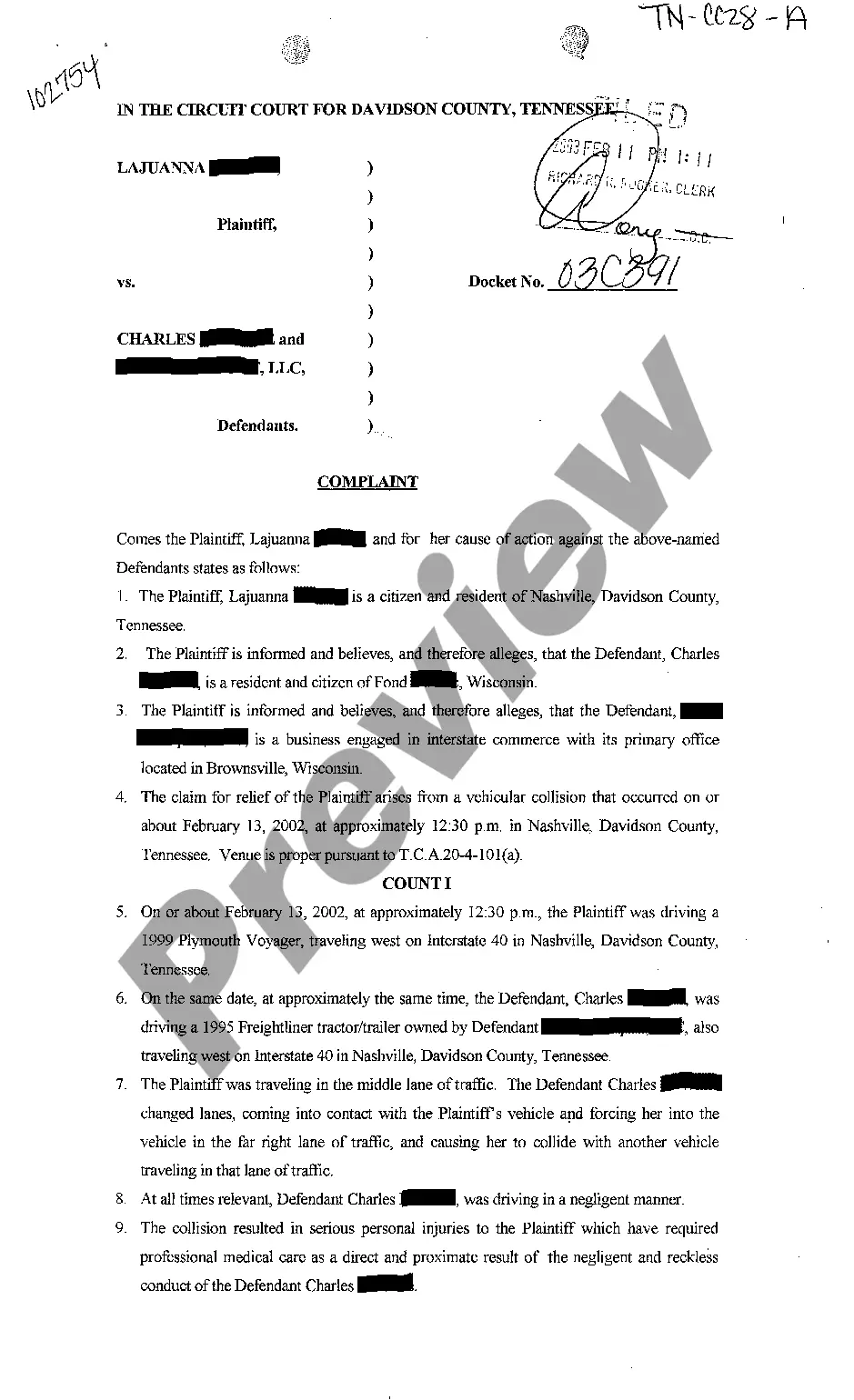

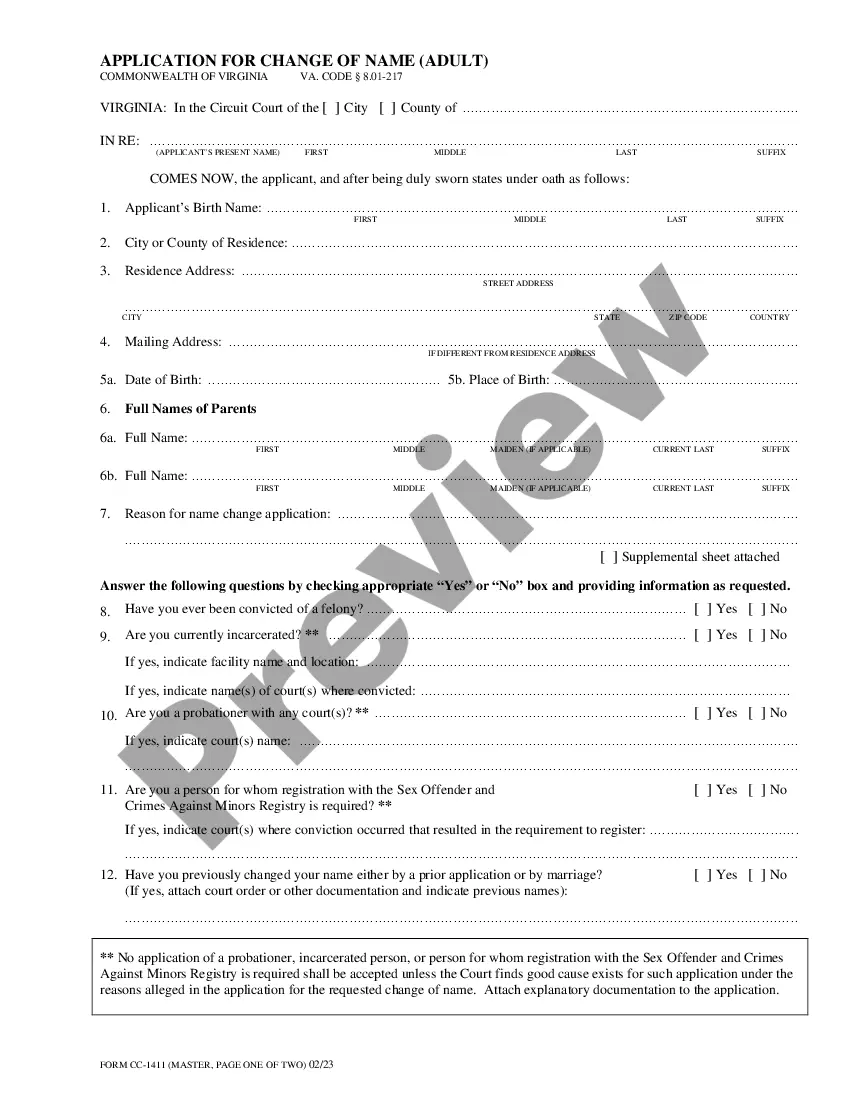

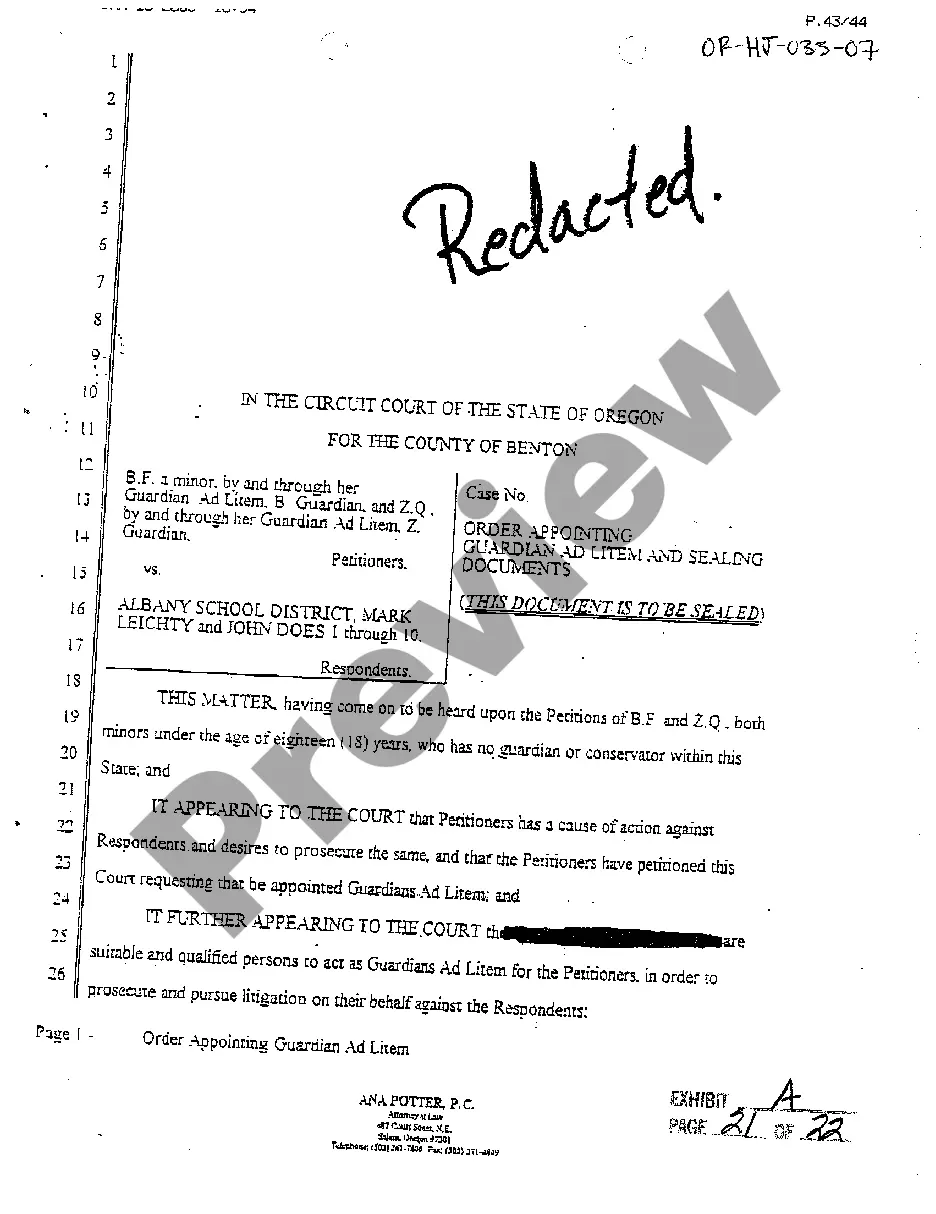

Guam Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation

Description

How to fill out Guam Plan Of Merger Between Micro Component Technology, Inc., MCT Acquisition, Inc. And Aseco Corporation?

If you wish to total, obtain, or printing legitimate papers web templates, use US Legal Forms, the biggest selection of legitimate varieties, that can be found on the web. Utilize the site`s simple and easy hassle-free search to obtain the paperwork you will need. Numerous web templates for company and personal purposes are categorized by groups and claims, or keywords and phrases. Use US Legal Forms to obtain the Guam Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation in a handful of mouse clicks.

In case you are currently a US Legal Forms client, log in to your bank account and then click the Obtain option to obtain the Guam Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation. You may also accessibility varieties you previously acquired within the My Forms tab of the bank account.

Should you use US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Ensure you have chosen the form for that appropriate town/nation.

- Step 2. Use the Review solution to look through the form`s information. Never neglect to see the explanation.

- Step 3. In case you are unsatisfied together with the develop, utilize the Lookup industry on top of the display screen to locate other versions of your legitimate develop design.

- Step 4. When you have identified the form you will need, click the Buy now option. Choose the pricing plan you like and put your accreditations to register to have an bank account.

- Step 5. Approach the deal. You may use your credit card or PayPal bank account to accomplish the deal.

- Step 6. Select the file format of your legitimate develop and obtain it on your own gadget.

- Step 7. Comprehensive, change and printing or sign the Guam Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation.

Every legitimate papers design you purchase is the one you have forever. You possess acces to every single develop you acquired within your acccount. Go through the My Forms segment and pick a develop to printing or obtain yet again.

Be competitive and obtain, and printing the Guam Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation with US Legal Forms. There are many expert and condition-certain varieties you can use for the company or personal requirements.