Guam Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company

Description

How to fill out Pooling And Servicing Agreement Contemplating The Sale Of Mortgage Loans To Trustee For Inclusion In The Trust Fund By The Company?

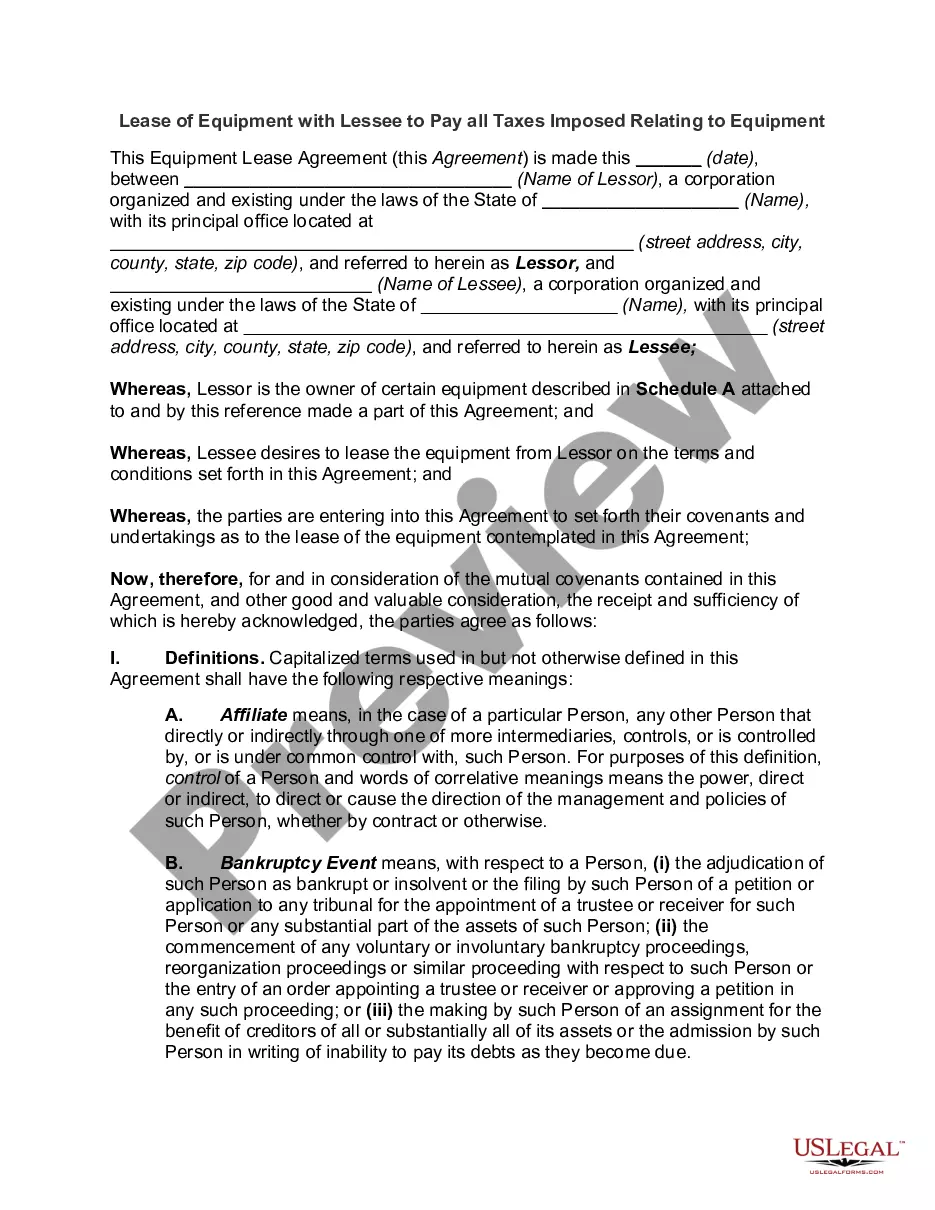

Discovering the right lawful document template can be quite a have a problem. Needless to say, there are tons of layouts accessible on the Internet, but how will you obtain the lawful kind you require? Take advantage of the US Legal Forms website. The assistance offers thousands of layouts, such as the Guam Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company, that you can use for enterprise and private requirements. All of the types are checked by experts and satisfy state and federal demands.

When you are previously authorized, log in to your profile and click the Download option to get the Guam Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company. Utilize your profile to look with the lawful types you may have ordered in the past. Proceed to the My Forms tab of your respective profile and have another version of your document you require.

When you are a whole new user of US Legal Forms, allow me to share straightforward instructions that you can stick to:

- Initially, make certain you have selected the appropriate kind for your personal metropolis/state. It is possible to check out the shape utilizing the Preview option and study the shape explanation to ensure it is the best for you.

- In case the kind will not satisfy your preferences, utilize the Seach field to find the correct kind.

- When you are positive that the shape is acceptable, select the Buy now option to get the kind.

- Select the pricing program you would like and enter in the needed information. Create your profile and buy the order with your PayPal profile or credit card.

- Select the document formatting and obtain the lawful document template to your device.

- Total, revise and produce and indication the attained Guam Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company.

US Legal Forms may be the largest library of lawful types that you can find various document layouts. Take advantage of the service to obtain skillfully-produced files that stick to express demands.

Form popularity

FAQ

The servicing of your mortgage loan is being transferred, effective [Date]. This means that after this date, a new servicer will be collecting your mortgage loan payments from you. Nothing else about your mortgage loan will change. [Name of present servicer] is now collecting your payments.

Federal law protects borrowers when loans are bought and sold by requiring that both the old and new lenders notify you in writing within 15 days of a sale that a transfer has taken place. The letters should provide the name of the new lender, how and where payments can be made, and when your next payment is due.

Notice of Transfer of Mortgage Loan Ownership If the holder of your mortgage loan sells the debt to a different entity, federal law requires the new owner or assignee to notify you about the change of ownership no later than 30 days after the sale, transfer, or assignment.

The lender must also provide the borrower with a Mortgaging Service Disclosure Statement. This statement must advise the borrower whether the lender intends to service the loan or transfer it to another lender.

A loan secured by the borrower's vacation home is not a ?mortgage loan? for these purposes. Pursuant to Section 131(g), the new owner or assignee of a mortgage loan must notify the borrower in writing within 30 days after his mortgage loan is sold or otherwise transferred.

The ?Pooling and Servicing Agreement? is the legal document that contains the responsibilities and rights of the servicer, the trustee, and others over a pool of mortgage loans.

The transferor and transferee servicers may provide a single notice, in which case the notice shall be provided not less than 15 days before the effective date of the transfer of the servicing of the mortgage loan.

A collateralized mortgage obligation (CMO) is a fixed-income security with a pool of mortgage loans that are similar in a variety of ways, like credit score or loan amount, and are combined and resold as a single packaged investment to investors called a security.