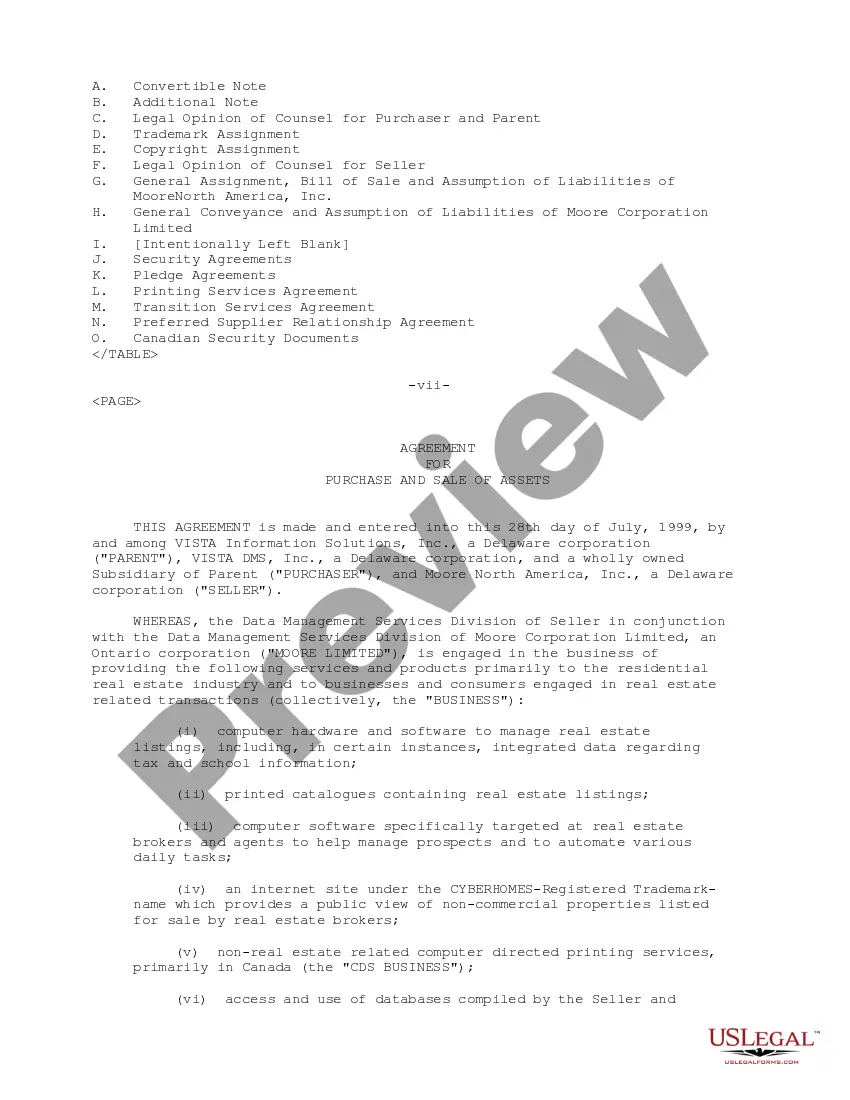

Guam Sample Purchase and Sale Agreement and Sale of Assets between Moore North America, Inc., Vista DMS, Inc. and Vista Information Solutions, Inc.

Description

How to fill out Sample Purchase And Sale Agreement And Sale Of Assets Between Moore North America, Inc., Vista DMS, Inc. And Vista Information Solutions, Inc.?

Are you currently in a placement where you will need documents for possibly organization or person purposes nearly every time? There are a lot of lawful record layouts available online, but getting types you can rely on isn`t straightforward. US Legal Forms offers 1000s of form layouts, just like the Guam Sample Purchase and Sale Agreement and Sale of Assets between Moore North America, Inc., Vista DMS, Inc. and Vista Information Solutions, Inc., that happen to be created in order to meet state and federal specifications.

If you are previously knowledgeable about US Legal Forms website and also have a merchant account, basically log in. Afterward, you can down load the Guam Sample Purchase and Sale Agreement and Sale of Assets between Moore North America, Inc., Vista DMS, Inc. and Vista Information Solutions, Inc. web template.

Should you not offer an accounts and need to begin to use US Legal Forms, adopt these measures:

- Obtain the form you will need and make sure it is to the proper town/region.

- Make use of the Preview option to examine the shape.

- See the information to ensure that you have selected the proper form.

- When the form isn`t what you`re seeking, use the Look for discipline to get the form that fits your needs and specifications.

- If you get the proper form, click on Get now.

- Pick the prices prepare you would like, complete the required info to produce your bank account, and purchase an order making use of your PayPal or Visa or Mastercard.

- Decide on a convenient data file formatting and down load your version.

Get all the record layouts you possess purchased in the My Forms food selection. You can get a extra version of Guam Sample Purchase and Sale Agreement and Sale of Assets between Moore North America, Inc., Vista DMS, Inc. and Vista Information Solutions, Inc. any time, if possible. Just click the necessary form to down load or print out the record web template.

Use US Legal Forms, the most substantial selection of lawful varieties, to save lots of some time and steer clear of errors. The support offers skillfully produced lawful record layouts which you can use for a selection of purposes. Create a merchant account on US Legal Forms and initiate creating your life a little easier.