Guam Amendment to Agreement for the Purchase and Sale of Assets between Moore North America, Inc., Vista DMS, Inc. and Vista Information Solutions, Inc.

Description

How to fill out Amendment To Agreement For The Purchase And Sale Of Assets Between Moore North America, Inc., Vista DMS, Inc. And Vista Information Solutions, Inc.?

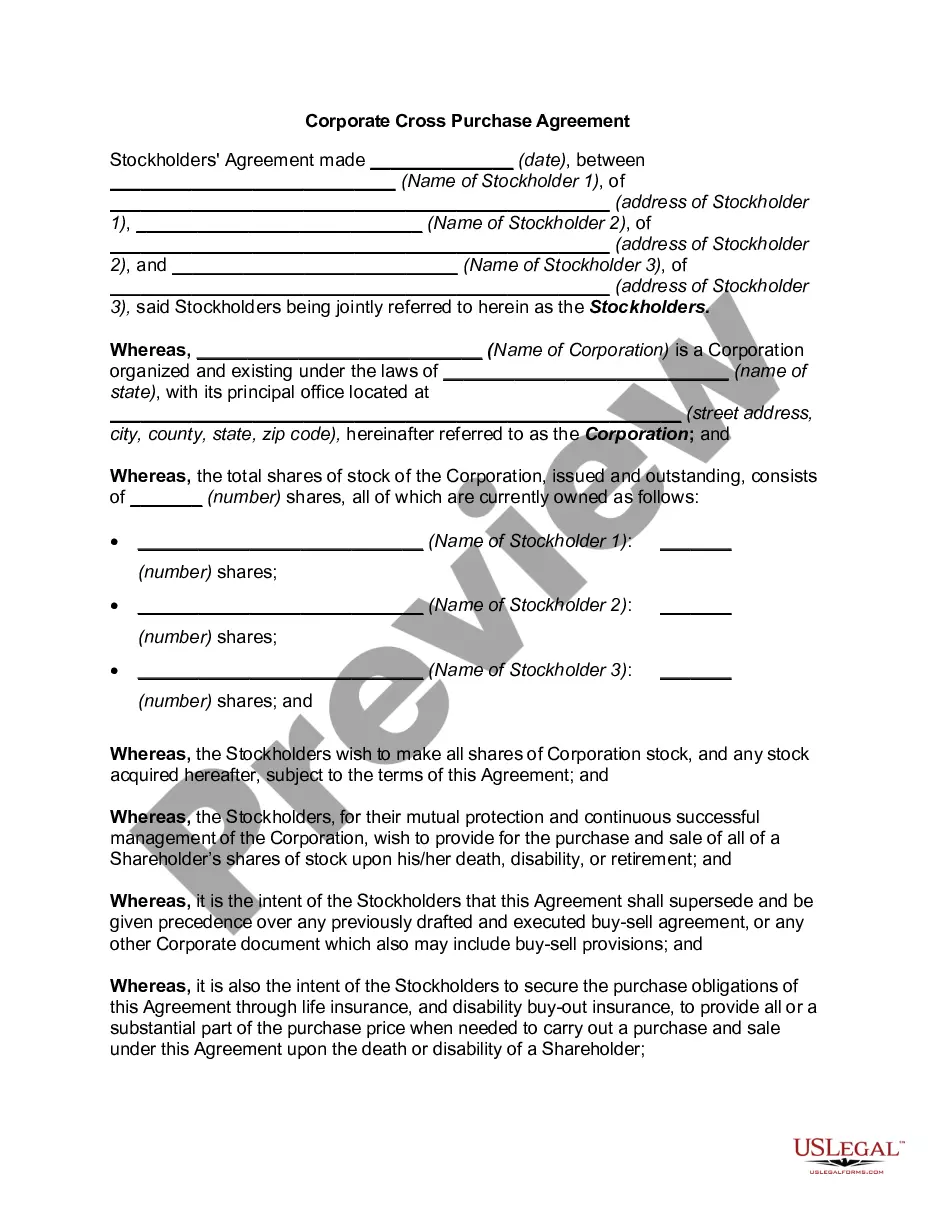

You can spend hrs on the Internet searching for the authorized document web template that suits the state and federal demands you want. US Legal Forms offers 1000s of authorized kinds that happen to be examined by pros. It is simple to down load or print out the Guam Amendment to Agreement for the Purchase and Sale of Assets between Moore North America, Inc., Vista DMS, Inc. and Vista Information Solutions, Inc. from my service.

If you currently have a US Legal Forms profile, you are able to log in and click on the Acquire button. Next, you are able to complete, modify, print out, or indicator the Guam Amendment to Agreement for the Purchase and Sale of Assets between Moore North America, Inc., Vista DMS, Inc. and Vista Information Solutions, Inc.. Each and every authorized document web template you get is your own permanently. To have an additional copy associated with a bought develop, proceed to the My Forms tab and click on the related button.

If you are using the US Legal Forms web site for the first time, keep to the easy directions under:

- First, be sure that you have selected the best document web template for your state/metropolis of your liking. Read the develop information to ensure you have chosen the appropriate develop. If available, utilize the Review button to search from the document web template also.

- In order to get an additional variation of the develop, utilize the Research industry to discover the web template that meets your requirements and demands.

- Upon having identified the web template you need, click Buy now to continue.

- Choose the costs program you need, key in your accreditations, and register for your account on US Legal Forms.

- Total the deal. You can use your credit card or PayPal profile to fund the authorized develop.

- Choose the structure of the document and down load it to the device.

- Make alterations to the document if needed. You can complete, modify and indicator and print out Guam Amendment to Agreement for the Purchase and Sale of Assets between Moore North America, Inc., Vista DMS, Inc. and Vista Information Solutions, Inc..

Acquire and print out 1000s of document templates utilizing the US Legal Forms site, which offers the greatest selection of authorized kinds. Use specialist and state-specific templates to take on your small business or specific needs.