A Guam Employee Shareholder Escrow Agreement is a legal contract that facilitates the transfer of ownership of company shares from an employee to a shareholder. This agreement typically governs the conditions and details of the transfer, ensuring that both parties involved are protected and that the process is carried out smoothly. The purpose of this escrow agreement is to secure the interests of all parties involved in the transfer, creating a framework to handle potential disputes, protect the shares, and maintain confidentiality. The Guam Employee Shareholder Escrow Agreement is tailored specifically to the laws and regulations of Guam, ensuring compliance with local requirements. It ensures that the transfer of shares meets all legal formalities, including necessary documentation and approvals. Different types of Guam Employee Shareholder Escrow Agreements may exist depending on various factors, such as the duration of the escrow period or the specific conditions of the transfer. Some common types include: 1. Fixed-term escrow agreement: This type of agreement sets a specific period during which the shares are held in escrow. It could be a predetermined timeframe, such as six months or one year. This allows for a smooth transition of ownership while providing a period for any potential disputes or issues to be addressed. 2. Performance-based escrow agreement: In certain cases, the transfer of shares may be contingent on certain performance-related milestones or achievements. This type of agreement ensures that the transferred shares are held in escrow until the agreed-upon performance target is met. 3. Conditional escrow agreement: This agreement type establishes specific conditions that must be fulfilled before the transfer of shares is completed. For example, the escrow may only release the shares once all necessary regulatory approvals or legal requirements are met. 4. Standby escrow agreement: This type of agreement serves as a backup in case the original transfer or acquisition agreement falls through. The shares are held in escrow until a specific event, such as the failure of the primary agreement, triggers their release or return to the original shareholder. Regardless of the specific type of Guam Employee Shareholder Escrow Agreement, it plays a crucial role in protecting the rights and interests of both parties involved in the share transfer. It ensures a transparent and legally compliant process, providing greater clarity and security throughout the transaction.

Guam Employee Shareholder Escrow Agreement

Description

How to fill out Guam Employee Shareholder Escrow Agreement?

If you need to comprehensive, obtain, or print legal record templates, use US Legal Forms, the biggest assortment of legal forms, which can be found on-line. Make use of the site`s simple and convenient search to get the files you need. Numerous templates for organization and specific reasons are categorized by types and says, or keywords and phrases. Use US Legal Forms to get the Guam Employee Shareholder Escrow Agreement within a couple of clicks.

If you are currently a US Legal Forms buyer, log in for your accounts and then click the Down load button to have the Guam Employee Shareholder Escrow Agreement. You can even entry forms you earlier downloaded from the My Forms tab of your accounts.

If you work with US Legal Forms the first time, follow the instructions beneath:

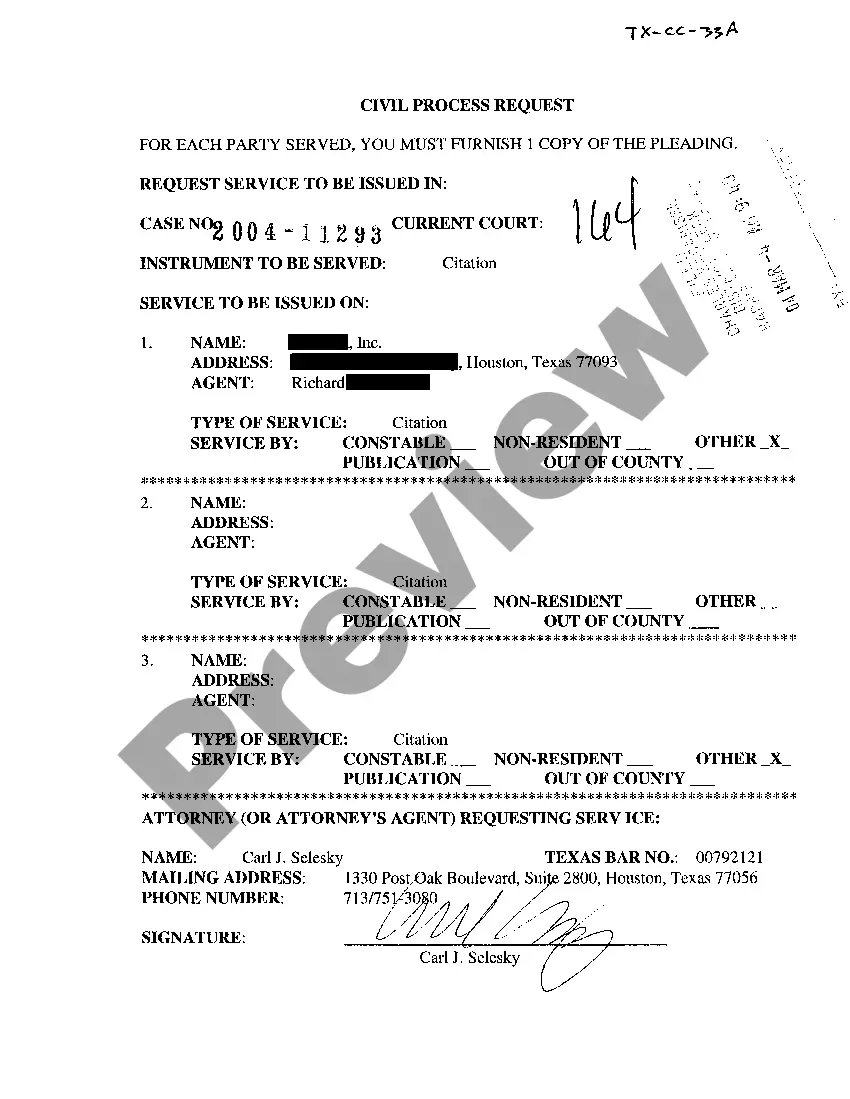

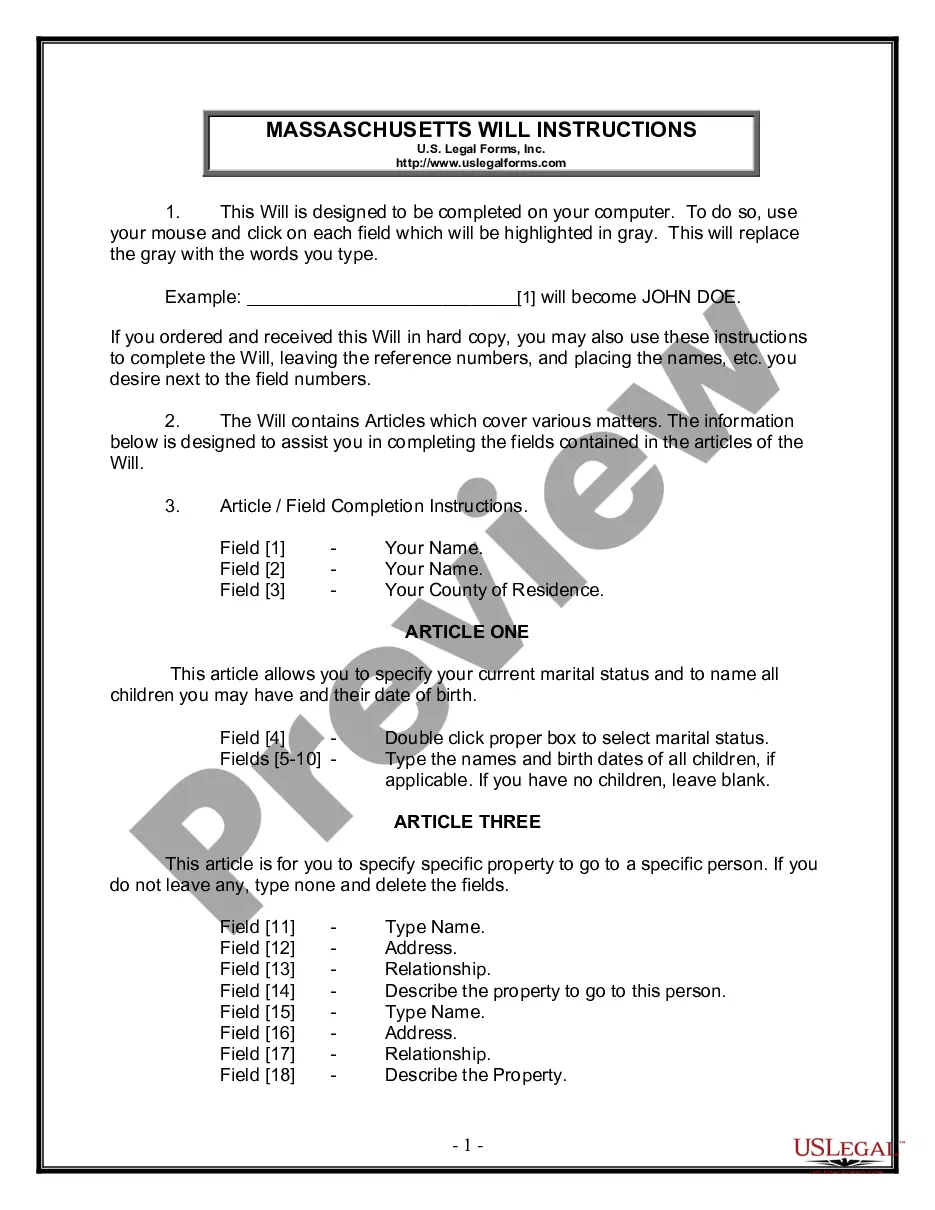

- Step 1. Ensure you have chosen the form for your correct area/region.

- Step 2. Take advantage of the Review method to look over the form`s articles. Never neglect to see the information.

- Step 3. If you are not happy with all the type, take advantage of the Research field at the top of the display screen to get other variations from the legal type format.

- Step 4. After you have found the form you need, click the Get now button. Select the prices program you prefer and include your qualifications to sign up to have an accounts.

- Step 5. Method the deal. You can utilize your bank card or PayPal accounts to accomplish the deal.

- Step 6. Find the structure from the legal type and obtain it on the device.

- Step 7. Total, change and print or indicator the Guam Employee Shareholder Escrow Agreement.

Each legal record format you buy is yours permanently. You may have acces to each type you downloaded in your acccount. Click on the My Forms portion and choose a type to print or obtain again.

Be competitive and obtain, and print the Guam Employee Shareholder Escrow Agreement with US Legal Forms. There are millions of specialist and status-distinct forms you may use to your organization or specific demands.

Form popularity

FAQ

An escrow agreement is a contract that outlines the terms and conditions between parties involved, and the responsibility of each. Escrow agreements generally involve an independent third party, called an escrow agent, who holds an asset of value until the specified conditions of the contract are met.

The escrow holder prepares written escrow instructions* that reflect the terms of the purchase agreement and all conditions of the transaction. The buyer and seller will sign the escrow instructions, and make any necessary earnest money deposits.

In California, there are two forms of escrow instructions generally employed: bilateral (i.e., executed by and binding on both buyer and seller) and unilateral (i.e., separate instructions executed by the buyer and seller, binding on each).

Typically, the role of the escrow agent will be played by representatives from a title company, mortgage lender, or an attorney, but it can depend on the laws and customs in your state.

Escrow agents may work for a title insurance company, real estate attorney, as an affiliate of a lender or as an independent escrow company. However, they do not work for the buyer or seller and must remain neutral in any real estate transaction.

The Escrow Account can be jointly opened in the name of the buyer and seller of the property, wherein the seller is the beneficiary. On the closure of the resale deal, the buyer-seller can jointly initiate the transfer of funds to the seller's account.

Escrow agreements outline the terms and conditions of large transactions. The transaction is mediated by an independent escrow agent, who holds all funds and documents until both sides have fulfilled their promises.

Additionally, the escrow agent cannot be associated with the transaction. For example, the buyer's real estate agent or the seller's attorney cannot hold the escrow account. They may, however, recommend escrow agents whom they have used.