To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

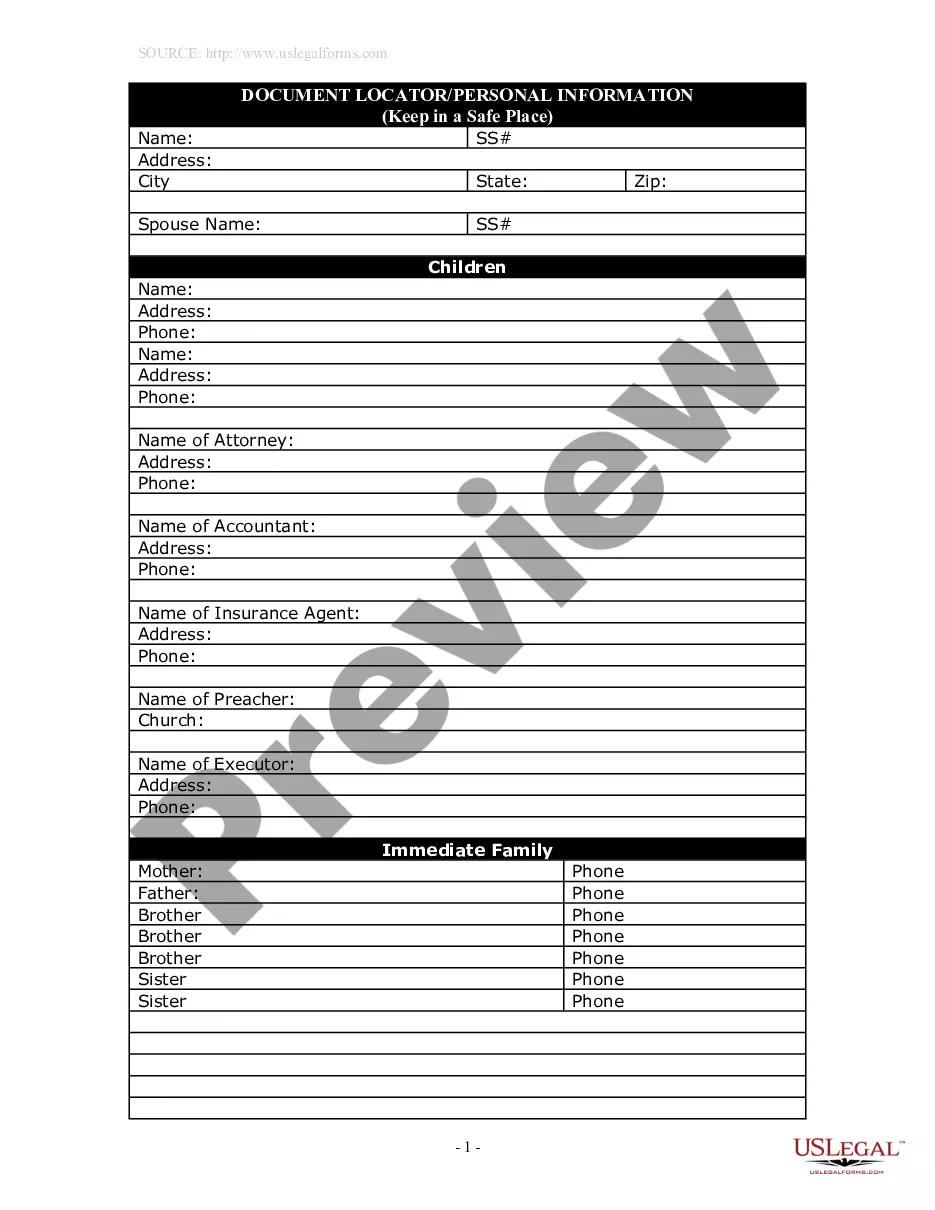

The Guam Accredited Investor Verification Letter is a crucial document required by financial institutions to confirm an individual's accredited investor status. This letter serves as proof that the investor meets the defined criteria set by the U.S. Securities and Exchange Commission (SEC) to participate in certain investment opportunities. Accredited Investor Verification Letters are essential in ensuring compliance with securities laws and regulations, especially when offering private placements, hedge funds, or other investment opportunities that are typically limited to accredited investors. These letters help protect both the investor and the issuing institution by validating the investor's eligibility and preventing unauthorized participation. The Guam Accredited Investor Verification Letter — Individual Investor includes several key elements, such as: 1. Personal Information: The letter begins by providing detailed personal information about the individual investor, including their full name, address, contact number, and Social Security number. This information helps in accurately identifying and verifying the investor's identity. 2. Accredited Investor Criteria: The letter clearly states the specific criteria that the investor meets to be considered an accredited investor as defined by the SEC. These criteria often include meeting income or net worth thresholds, professional certifications, or designated positions in financial institutions. 3. Supporting Documentation: Along with the letter, the individual investor is required to submit supporting documentation proving their accredited investor status. This may include recent tax returns, bank statements, salary slips, investment portfolios, or any other financial records necessary to verify their income or net worth. 4. Certification: The letter includes a section where the individual investor certifies the accuracy and completeness of the information provided. This provides a legal declaration and allows the issuing institution to rely on the investor's representations. While the Guam Accredited Investor Verification Letter — Individual Investor is the primary type, there may be additional variations of this letter depending on the specific requirements of different financial institutions or investment opportunities. Some institutions might have their own customized versions, but they generally follow a similar format and include the key elements mentioned above. It is important to note that the Guam Accredited Investor Verification Letter is not a guarantee of investment success or protection against investment risks. Instead, it serves as a tool to confirm an individual's eligibility to participate in specific investment opportunities restricted to accredited investors. Investors should always conduct thorough due diligence and seek professional advice before making any investment decisions.