Guam Senior Debt Term Sheet

Description

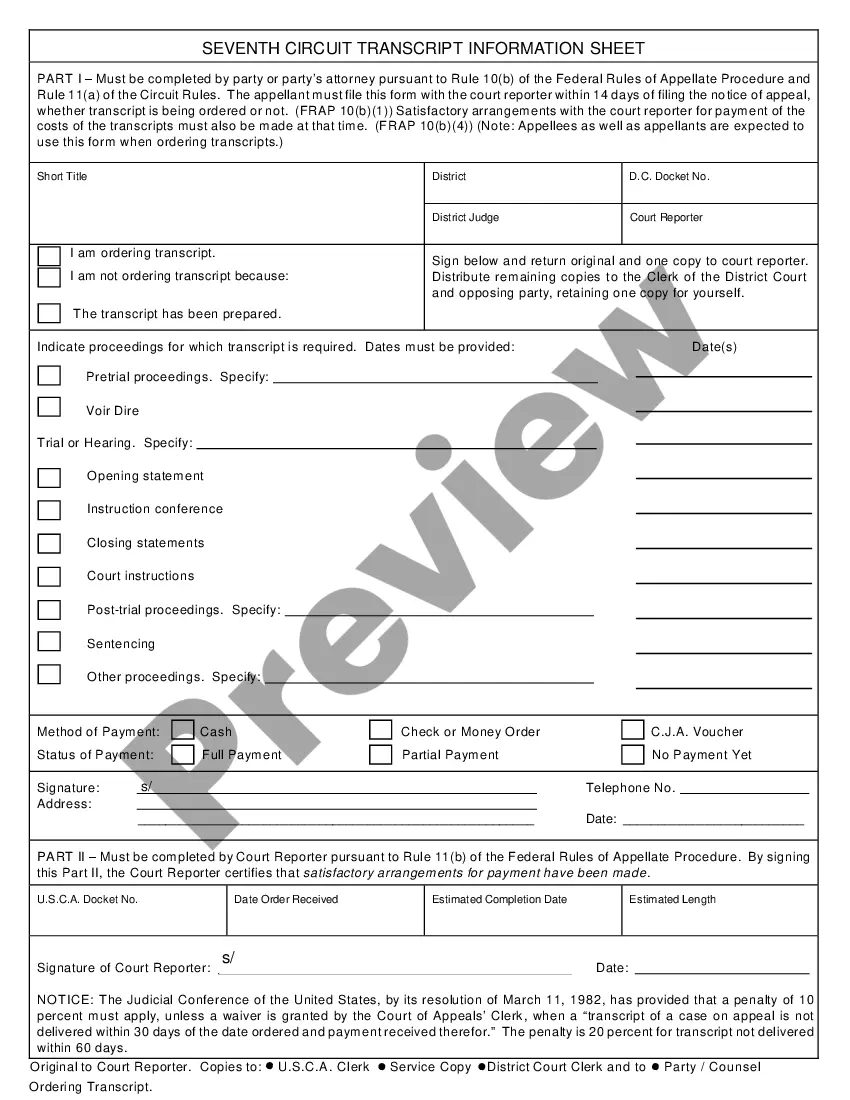

How to fill out Senior Debt Term Sheet?

If you need to complete, download, or printing lawful file templates, use US Legal Forms, the greatest collection of lawful kinds, which can be found on-line. Utilize the site`s basic and practical look for to discover the paperwork you require. Various templates for enterprise and specific purposes are sorted by classes and claims, or search phrases. Use US Legal Forms to discover the Guam Senior Debt Term Sheet with a couple of mouse clicks.

Should you be previously a US Legal Forms consumer, log in to the account and click the Obtain button to find the Guam Senior Debt Term Sheet. You can also access kinds you previously delivered electronically in the My Forms tab of the account.

If you work with US Legal Forms the first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the form for the right city/country.

- Step 2. Use the Preview solution to check out the form`s content. Do not forget to read the description.

- Step 3. Should you be not happy with the type, take advantage of the Look for field near the top of the monitor to find other types of your lawful type template.

- Step 4. Once you have located the form you require, go through the Buy now button. Choose the pricing strategy you favor and add your qualifications to register for the account.

- Step 5. Approach the deal. You may use your charge card or PayPal account to finish the deal.

- Step 6. Choose the format of your lawful type and download it in your system.

- Step 7. Complete, change and printing or signal the Guam Senior Debt Term Sheet.

Every lawful file template you get is the one you have permanently. You have acces to every type you delivered electronically with your acccount. Go through the My Forms section and decide on a type to printing or download once more.

Compete and download, and printing the Guam Senior Debt Term Sheet with US Legal Forms. There are many skilled and condition-particular kinds you may use for your enterprise or specific requires.

Form popularity

FAQ

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions.

Senior Debt Ratio means, with respect to any Loan, the ratio of Senior Total Funded Debt to TTM EBITDA of the related Obligor, calculated in ance with the corresponding amount or ratio in the underlying Related Documents for such Loan utilizing the most recently delivered financial results for the related Obligor ...

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

On the other hand, senior debt financing is a high-priority loan backed by collateral and offered at a lower interest rate. How is senior debt calculated? Senior loan or debt is 2 to 3 times EBITDA (Earnings before Interest, Taxes, Depreciation, and Amortization).

Senior debts are loans secured by collateral (assets) that must be paid off before any other debts when a company goes into default. The lender in this case is paid out of the sale of the company's assets in priority sequence. Their priority position makes senior debts less risky for lenders.

Senior debt is debt and obligations which are prioritized for repayment in the case of bankruptcy. Senior debt has the highest priority and therefore the lowest risk. Thus, this type of debt typically carries or offers lower interest rates.

Any debt with higher priority over other forms of debt is considered senior debt. For example, a company has debt A that totals $1 million and debt B that totals $500,000. Debt A is senior debt, and debt B is subordinated debt. If the company files for bankruptcy, it must liquidate all of its assets to repay the debt.

The term (or duration) of a senior term cash flow loan is usually around 5 years. The rate of interest for a cash flow term loan is typically higher than an asset based term loan but pricing depends on current market rates and the company's financial characteristics and performance.