Guam Subscription Agreement and Shareholders' Agreement

Description

How to fill out Subscription Agreement And Shareholders' Agreement?

Have you been within a placement the place you need to have documents for possibly business or individual purposes almost every day time? There are a lot of lawful document web templates available on the Internet, but finding kinds you can rely is not straightforward. US Legal Forms delivers thousands of develop web templates, just like the Guam Subscription Agreement and Shareholders' Agreement, which can be written to fulfill federal and state needs.

In case you are previously acquainted with US Legal Forms internet site and also have a free account, just log in. Next, you may obtain the Guam Subscription Agreement and Shareholders' Agreement template.

If you do not have an profile and would like to begin using US Legal Forms, adopt these measures:

- Find the develop you want and make sure it is for your right area/state.

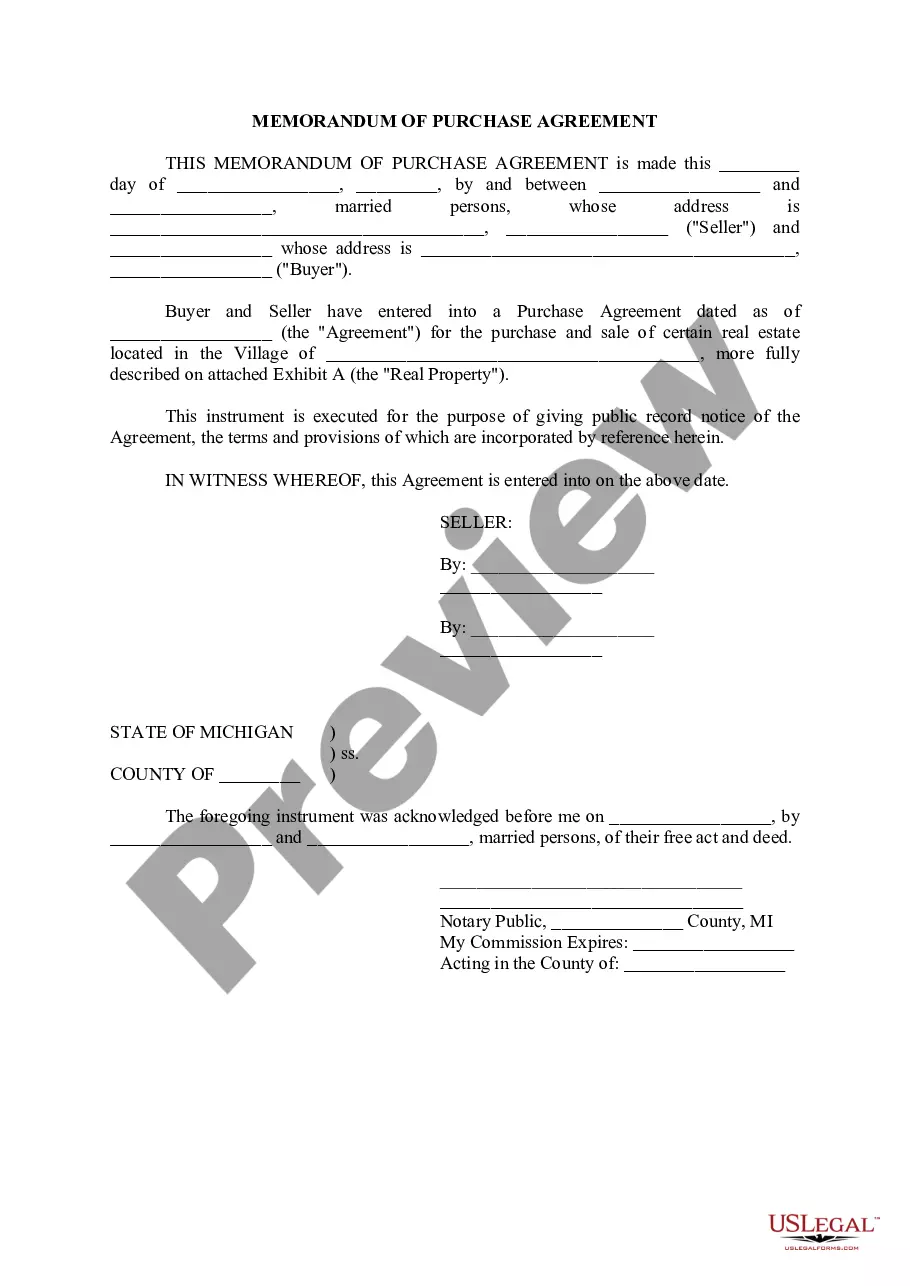

- Utilize the Preview option to review the form.

- See the explanation to actually have selected the correct develop.

- In case the develop is not what you`re seeking, make use of the Search discipline to get the develop that meets your requirements and needs.

- If you obtain the right develop, click on Buy now.

- Pick the pricing strategy you would like, complete the required info to make your account, and pay money for your order utilizing your PayPal or charge card.

- Select a convenient paper file format and obtain your version.

Locate every one of the document web templates you possess purchased in the My Forms menus. You can aquire a additional version of Guam Subscription Agreement and Shareholders' Agreement whenever, if required. Just go through the essential develop to obtain or print out the document template.

Use US Legal Forms, one of the most substantial collection of lawful forms, to save time as well as avoid faults. The assistance delivers expertly produced lawful document web templates that can be used for a variety of purposes. Generate a free account on US Legal Forms and begin generating your life easier.

Form popularity

FAQ

1.1 The Agreement provides for the sale of ________ [insert number and type of shares] to the Buyer by the Seller at a price of ______ [insert price per share], par value per share (the ?Shares?). 1.2 Purchase and Sale. The Seller agrees to sell and the Buyer agrees to buy the Shares. 1.3 Delivery of Shares.

What to Think about When You Begin Writing a Shareholder Agreement. ... Name Your Shareholders. ... Specify the Responsibilities of Shareholders. ... The Voting Rights of Your Shareholders. ... Decisions Your Corporation Might Face. ... Changing the Original Shareholder Agreement. ... Determine How Stock can be Sold or Transferred.

What to Think about When You Begin Writing a Shareholder Agreement. ... Name Your Shareholders. ... Specify the Responsibilities of Shareholders. ... The Voting Rights of Your Shareholders. ... Decisions Your Corporation Might Face. ... Changing the Original Shareholder Agreement. ... Determine How Stock can be Sold or Transferred.

The shareholders' agreement, on the other hand, stipulates the terms for the future partnership and is not directly related to the investment itself. The subscription agreement refers to the shareholders' agreement and typically they are signed at the same time.

Subscription agreement vs shareholders agreement? A share subscription agreement is essentially an agreement for the purchase of shares from a company. In contrast, a shareholders agreement contains terms that govern the ongoing relationship between shareholders.

A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

Example of Under Subscription of shares: ABC limited issued 1,00,000 shares @ 10 each but public subscribed 9,50,000 shares only. So, In this case, is known as under subscription of share, and the company will pass all journal entries and make the next calls for subscribed capital i.e. 9,50,000 shares.

Introduction. Many people wonder whether it is possible to write their own shareholders' agreement or whether a solicitor is required. We believe that it is quite possible to draw it yourself, provided that you use a good template as a basis (such as our own).