Guam Investment-Grade Bond Optional Redemption (without a Par Call) is a financial instrument used to raise funds by the government of Guam through the issuance of bonds. These bonds are considered investment-grade, meaning they have a relatively low risk of default and are often sought after by investors looking for secure and stable returns. This specific type of Guam bond offers an optional redemption feature without a par call. Optional redemption refers to the issuer's right to redeem the bonds before their scheduled maturity date. In this case, the bonds can be redeemed at the issuer's discretion without a predetermined call price. Instead, the redemption price is usually determined by the bond's market value at the time of redemption. The absence of a par call means that the bonds cannot be redeemed at their face value (par value) before maturity. Instead, the redemption price will be determined by market conditions and possibly offer investors the opportunity to capitalize on any potential capital appreciation. Guam Investment-Grade Bond Optional Redemption (without a Par Call) provides several benefits for both the issuer and the investor. For the government of Guam, it allows them flexibility in managing their debt portfolio while taking advantage of favorable market conditions. For investors, it offers the potential for increased returns if the market value of the bonds appreciates and the issuer chooses to redeem them early. It is important to note that there might be variations or different types of Guam Investment-Grade Bond Optional Redemption (without a Par Call). These could include subcategories based on the bond's maturity date, interest payment frequency, or specific redemption terms. It is advisable to carefully review the bond's prospectus or offering documents to understand the exact terms and conditions of a particular bond issuance. Overall, Guam Investment-Grade Bond Optional Redemption (without a Par Call) provides investors with an opportunity to invest in a financially secure instrument while offering the issuer the flexibility to manage their debt obligations effectively. Its optional redemption feature without a predetermined par call can make it an attractive choice for those seeking potentially higher returns and more control over their investment in Guam bonds.

Guam Investment - Grade Bond Optional Redemption (without a Par Call)

Description

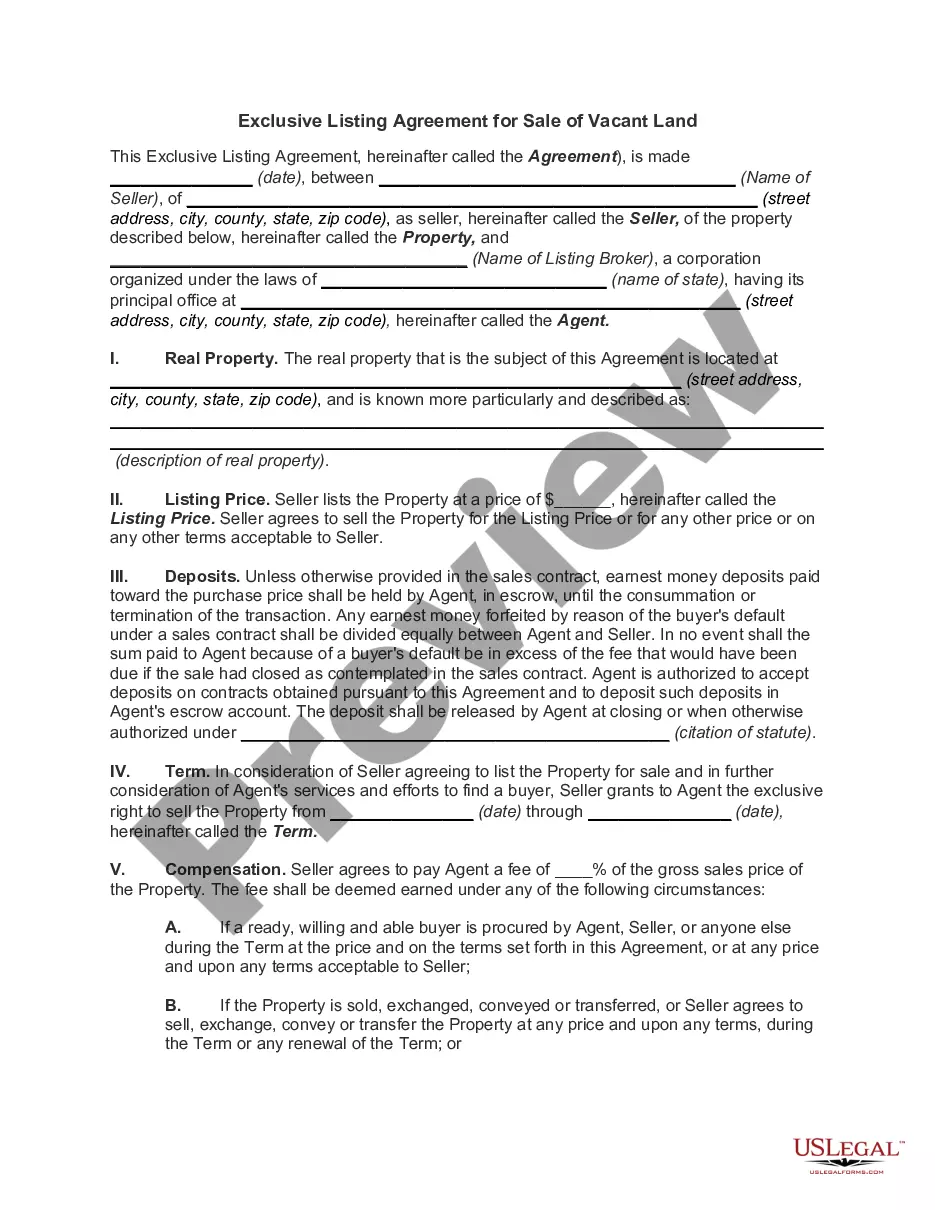

How to fill out Guam Investment - Grade Bond Optional Redemption (without A Par Call)?

If you have to total, download, or printing authorized papers web templates, use US Legal Forms, the greatest collection of authorized varieties, that can be found on the Internet. Use the site`s simple and easy handy research to obtain the papers you require. Numerous web templates for enterprise and person functions are categorized by categories and claims, or keywords. Use US Legal Forms to obtain the Guam Investment - Grade Bond Optional Redemption (without a Par Call) in just a number of click throughs.

When you are previously a US Legal Forms customer, log in to your profile and click on the Download key to find the Guam Investment - Grade Bond Optional Redemption (without a Par Call). You may also access varieties you earlier saved in the My Forms tab of the profile.

If you use US Legal Forms the first time, follow the instructions below:

- Step 1. Make sure you have chosen the shape to the proper town/land.

- Step 2. Use the Review method to examine the form`s content. Do not forget to see the description.

- Step 3. When you are unhappy with all the kind, take advantage of the Look for discipline on top of the display screen to locate other models in the authorized kind design.

- Step 4. Once you have found the shape you require, click on the Acquire now key. Select the rates strategy you prefer and put your references to sign up for an profile.

- Step 5. Process the deal. You should use your credit card or PayPal profile to complete the deal.

- Step 6. Pick the structure in the authorized kind and download it in your gadget.

- Step 7. Comprehensive, change and printing or sign the Guam Investment - Grade Bond Optional Redemption (without a Par Call).

Every single authorized papers design you get is your own property permanently. You have acces to every kind you saved inside your acccount. Go through the My Forms area and pick a kind to printing or download once again.

Remain competitive and download, and printing the Guam Investment - Grade Bond Optional Redemption (without a Par Call) with US Legal Forms. There are millions of expert and state-distinct varieties you can utilize for your enterprise or person requires.