Guam Instructions for Completing Request for Loan Modification and Affidavit RMA Form

Description

How to fill out Guam Instructions For Completing Request For Loan Modification And Affidavit RMA Form?

If you wish to comprehensive, acquire, or produce lawful file templates, use US Legal Forms, the largest selection of lawful varieties, which can be found on the web. Utilize the site`s simple and hassle-free lookup to get the papers you require. Numerous templates for company and individual purposes are sorted by types and suggests, or key phrases. Use US Legal Forms to get the Guam Instructions for Completing Request for Loan Modification and Affidavit RMA Form with a few click throughs.

If you are previously a US Legal Forms buyer, log in to your account and then click the Obtain button to get the Guam Instructions for Completing Request for Loan Modification and Affidavit RMA Form. You may also accessibility varieties you in the past downloaded inside the My Forms tab of the account.

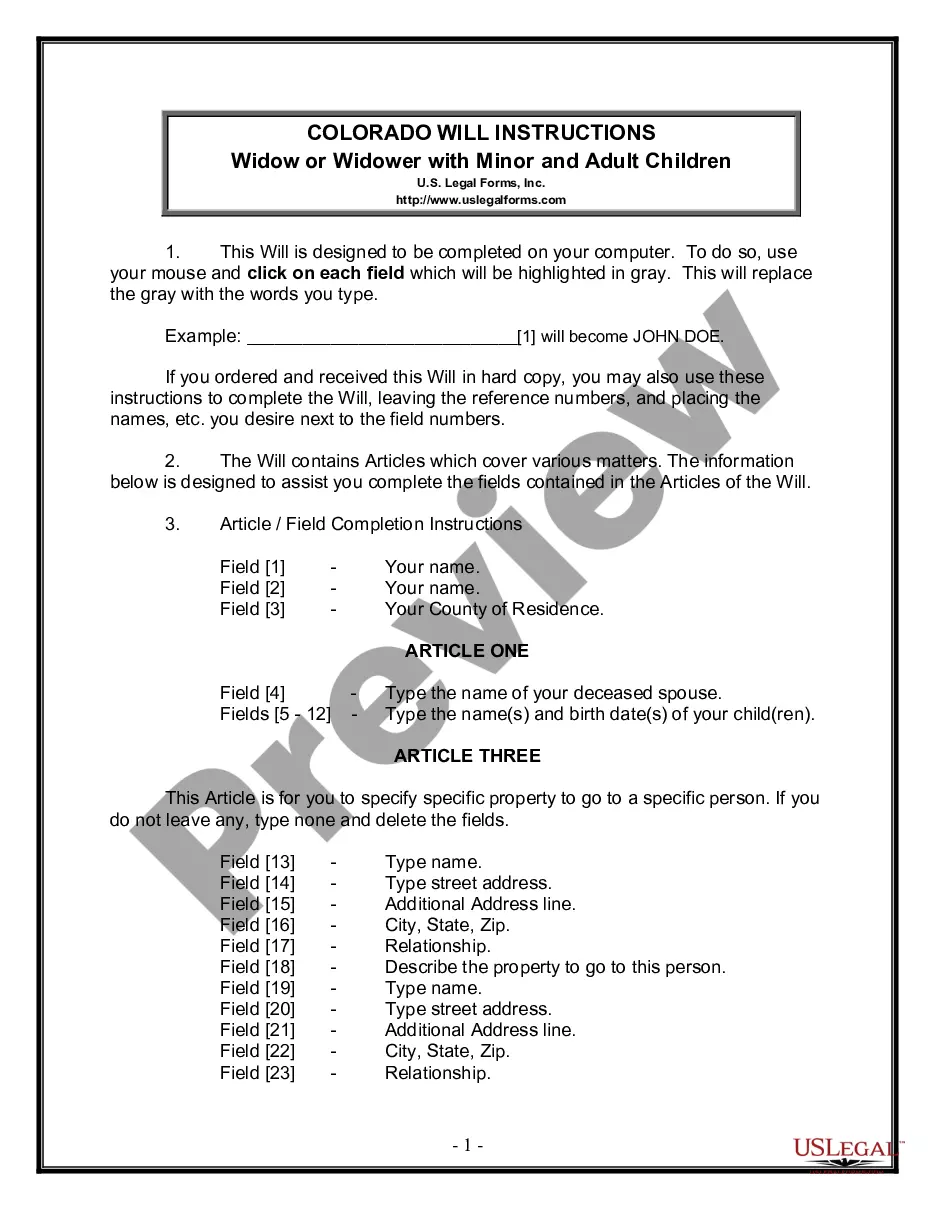

Should you use US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have selected the form for your proper area/land.

- Step 2. Utilize the Review option to look over the form`s information. Don`t neglect to read through the information.

- Step 3. If you are not happy with all the kind, utilize the Research area on top of the display to discover other models of the lawful kind web template.

- Step 4. After you have discovered the form you require, click on the Acquire now button. Select the rates strategy you choose and add your credentials to sign up on an account.

- Step 5. Process the financial transaction. You can use your charge card or PayPal account to finish the financial transaction.

- Step 6. Pick the file format of the lawful kind and acquire it in your device.

- Step 7. Full, modify and produce or sign the Guam Instructions for Completing Request for Loan Modification and Affidavit RMA Form.

Each and every lawful file web template you purchase is the one you have permanently. You have acces to every single kind you downloaded in your acccount. Click on the My Forms section and pick a kind to produce or acquire again.

Contend and acquire, and produce the Guam Instructions for Completing Request for Loan Modification and Affidavit RMA Form with US Legal Forms. There are millions of expert and state-certain varieties you can utilize for your company or individual needs.

Form popularity

FAQ

How do I get a mortgage loan modification? Contact your mortgage servicer or lender immediately to alert them of your financial hardship and ask about loan modification options available. Be ready to provide all documentation requested, which can include financial statements, pay stubs, tax returns, and more.

What is the purpose of a Notice of Right to Cancel form? Under federal law, some but not all mortgages include a right of rescission, which gives the borrower 3 business days following the signing of a loan document package to review the terms of the transaction and cancel the transaction.

A loan modification is a change to the original terms of your mortgage loan. Unlike a refinance, a loan modification doesn't pay off your current mortgage and replace it with a new one. Instead, it directly changes the conditions of your loan.

In most instances, a recorded modification will not be necessary. However, in some circumstances, a recorded modification may be required to ensure that the lender is protected.

How to get a loan modificationGather information about your financial situation. You'll need to give your lender or servicer everything from tax returns to pay stubs to demonstrate you're experiencing financial hardship and are unable to make your monthly mortgage payments.Plan out your case.Contact your servicer.

Whether the mortgage loan modification agreement will need to be recorded in the public records after it is executed, and. an address to which the executed mortgage loan modification agreement should be returned.

The loan modification process typically takes 6 to 9 months, depending on your lender.

The loan modification processTalk to your servicer. Communicate with your servicer.Utilize the 90-day right to cure If a servicer or lender claims you are in default, they must give you a written notice.Organize your documents.Understand what a modification can and cannot do.Reporting issues with mortgage servicers.

A loan modification agreement is a long-term solution. A loan modification may involve a reduced interest rate, a longer period to repay, a different type of loan, or any combination of these.

Technically, a loan modification should not have any negative impact on your credit score. That's because you and the lender have agreed to new terms for paying off your loan, so if you continue to meet those terms, there shouldn't be anything negative to report.