Guam Data Entry Employment Contract - Self-Employed Independent Contractor

Description

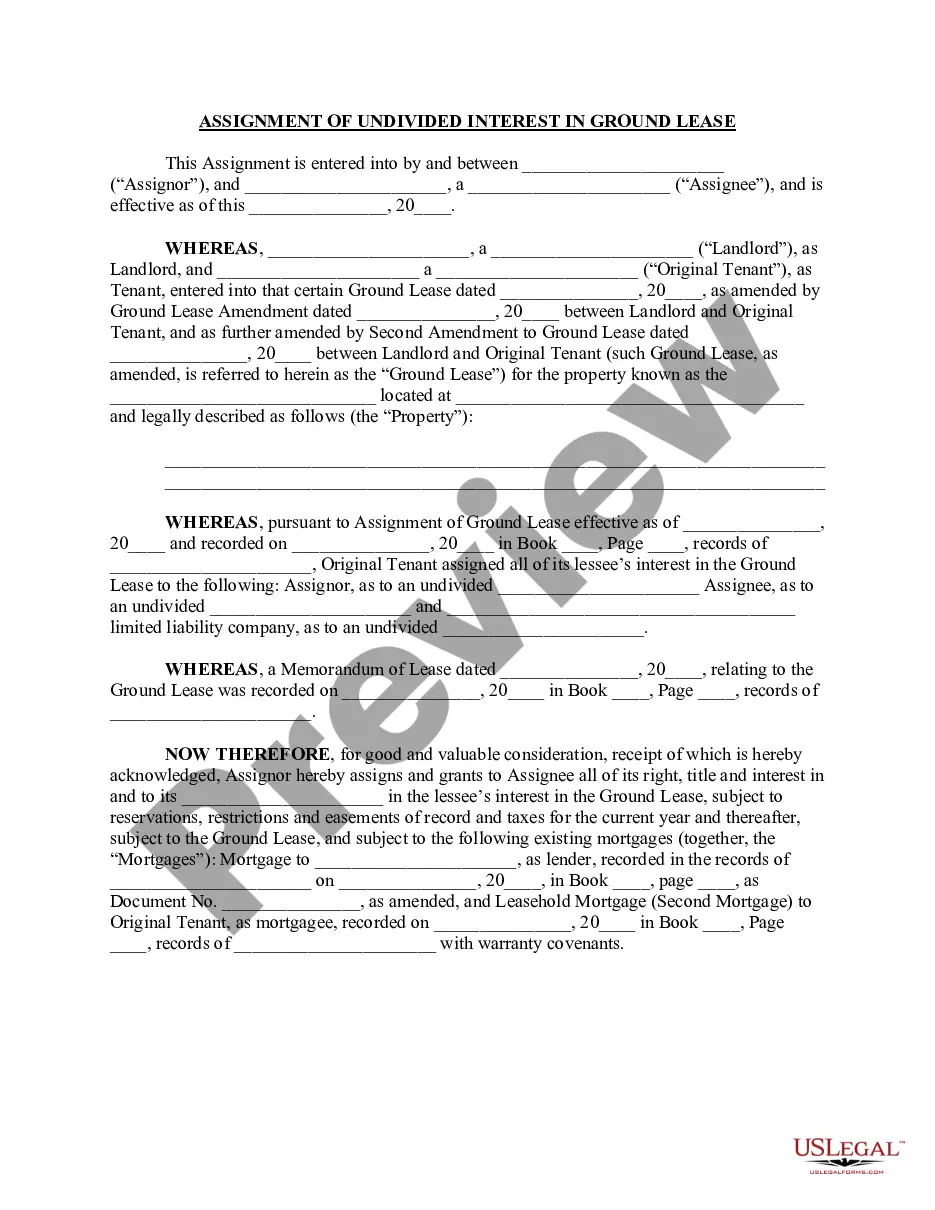

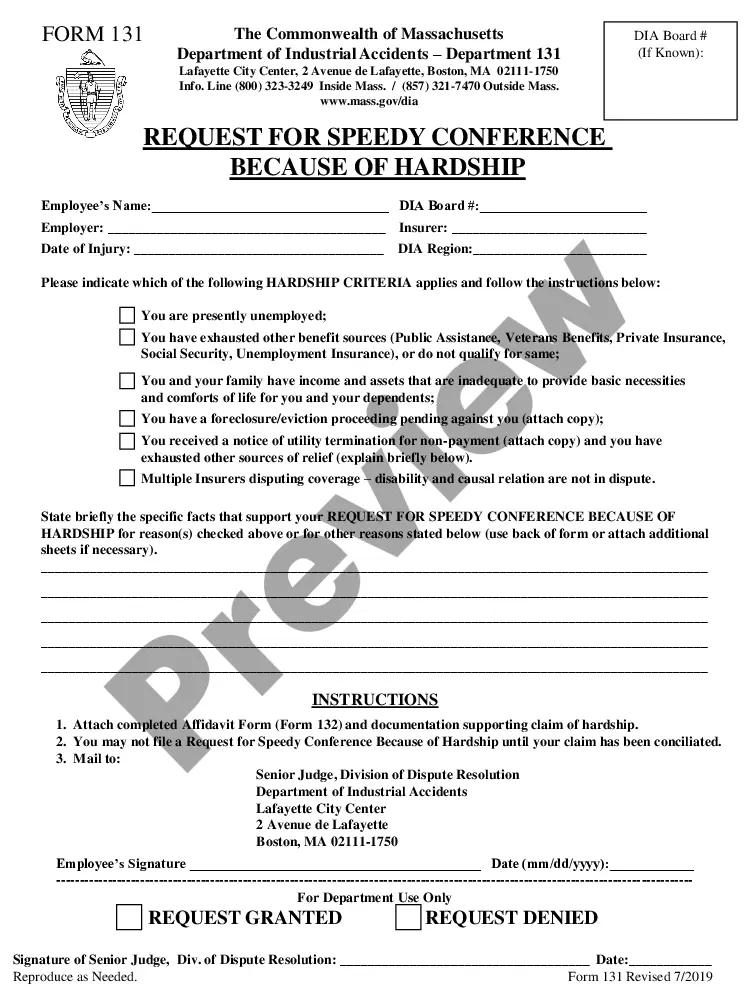

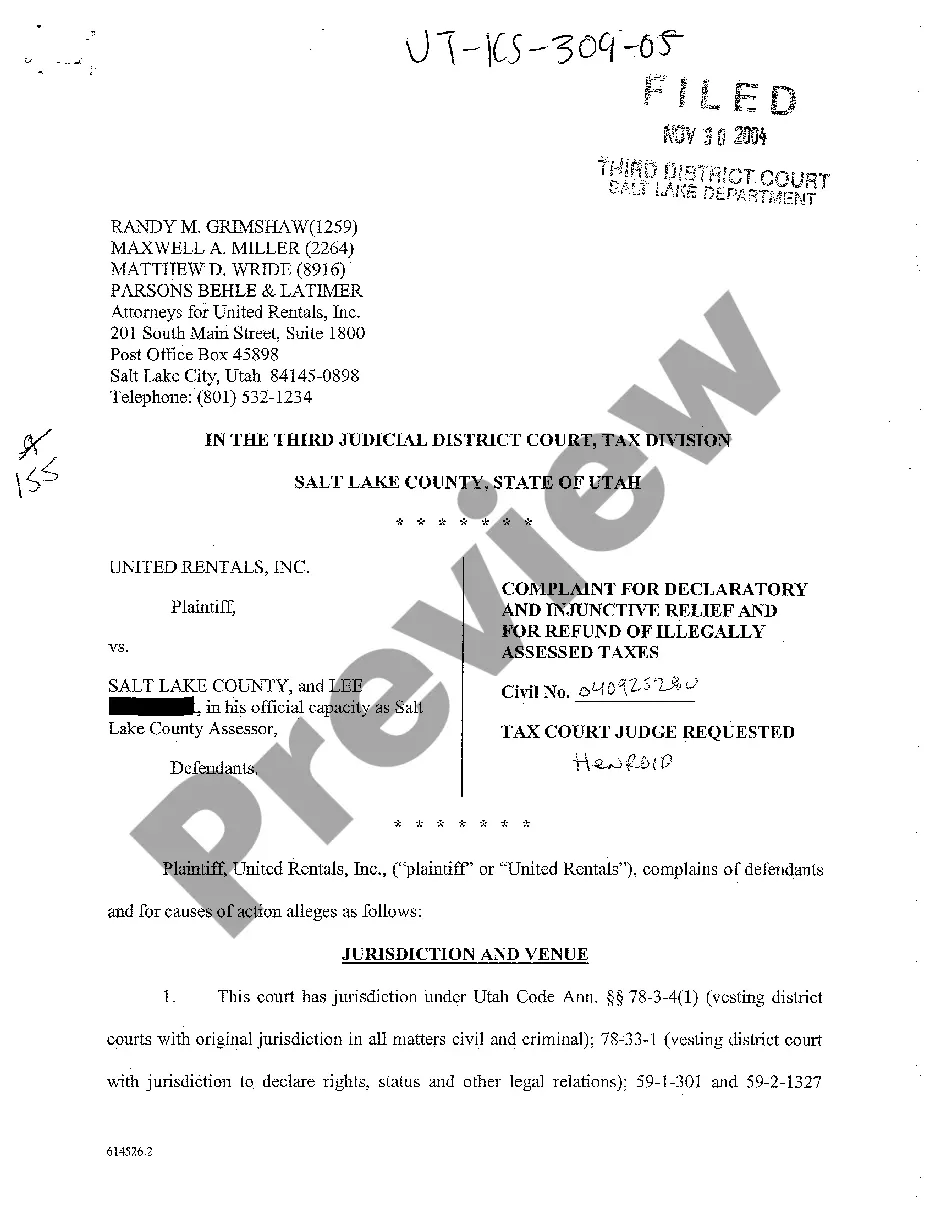

How to fill out Guam Data Entry Employment Contract - Self-Employed Independent Contractor?

If you have to comprehensive, acquire, or printing lawful papers themes, use US Legal Forms, the most important variety of lawful types, that can be found online. Make use of the site`s easy and practical lookup to find the paperwork you want. Different themes for company and specific functions are categorized by types and claims, or key phrases. Use US Legal Forms to find the Guam Data Entry Employment Contract - Self-Employed Independent Contractor with a number of click throughs.

When you are previously a US Legal Forms customer, log in to your profile and click the Acquire button to have the Guam Data Entry Employment Contract - Self-Employed Independent Contractor. Also you can gain access to types you earlier delivered electronically from the My Forms tab of your own profile.

If you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Ensure you have selected the shape to the correct area/country.

- Step 2. Utilize the Review solution to look over the form`s content. Do not neglect to learn the outline.

- Step 3. When you are not happy using the type, take advantage of the Search industry on top of the monitor to locate other variations of your lawful type template.

- Step 4. Upon having located the shape you want, go through the Buy now button. Choose the costs program you choose and add your qualifications to sign up for an profile.

- Step 5. Process the purchase. You can use your credit card or PayPal profile to accomplish the purchase.

- Step 6. Find the file format of your lawful type and acquire it on your own product.

- Step 7. Total, revise and printing or indication the Guam Data Entry Employment Contract - Self-Employed Independent Contractor.

Each lawful papers template you buy is the one you have permanently. You may have acces to each type you delivered electronically within your acccount. Go through the My Forms segment and select a type to printing or acquire once more.

Compete and acquire, and printing the Guam Data Entry Employment Contract - Self-Employed Independent Contractor with US Legal Forms. There are millions of professional and condition-specific types you may use to your company or specific demands.

Form popularity

FAQ

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Here's what you need to know to start and build a successful business as a self-employed contractor.Be Sure You Want to Be Self-Employed.Get Financing in Place Beforehand.Create a Business Plan.Name, Register, and Insure Your Contracting Business.Market Your Business.Be Your Own Accountant, for Starters.More items...?

Contractors can also be self-employed, but they perform tasks on a contractual basis, rather than selling any products or rolling, bookable services. For example, a plumber would work for a client according to an agreed, one-off contract.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Whatever you call yourself, if you are self-employed, an independent contractor, or a sole proprietor, a partner in a partnership, or an LLC member, you must pay self-employment taxes (Social Security and Medicare). Since you are not an employee, no Social Security/Medicare taxes are withheld from your wages.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Key takeaway: Independent contractors are not employed by the company they contract with; they are independent as long as they provide the service or product agreed to. Employees are longer-term, on the company's payroll, and generally not hired for one specific project.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.