Guam Moving Services Contract - Self-Employed

Description

How to fill out Guam Moving Services Contract - Self-Employed?

If you wish to complete, down load, or print authorized file web templates, use US Legal Forms, the greatest collection of authorized kinds, that can be found online. Use the site`s easy and hassle-free research to obtain the files you will need. Numerous web templates for business and specific functions are categorized by categories and suggests, or search phrases. Use US Legal Forms to obtain the Guam Moving Services Contract - Self-Employed in just a handful of mouse clicks.

If you are previously a US Legal Forms buyer, log in to your bank account and click the Down load button to get the Guam Moving Services Contract - Self-Employed. You can also access kinds you previously delivered electronically from the My Forms tab of your own bank account.

If you are using US Legal Forms initially, refer to the instructions listed below:

- Step 1. Make sure you have selected the shape to the proper metropolis/country.

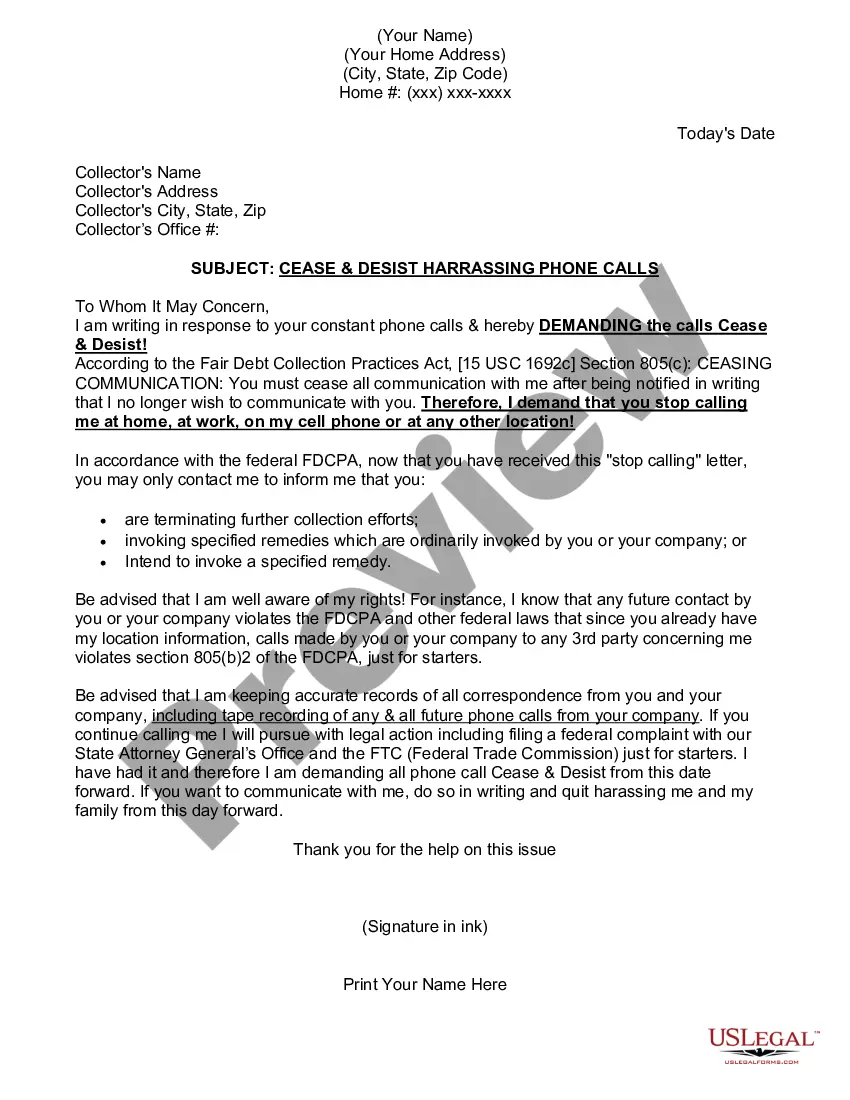

- Step 2. Take advantage of the Review choice to examine the form`s content. Never forget about to read the outline.

- Step 3. If you are unhappy with the kind, make use of the Search industry towards the top of the monitor to find other types of the authorized kind format.

- Step 4. When you have discovered the shape you will need, go through the Acquire now button. Opt for the pricing strategy you prefer and include your qualifications to register for an bank account.

- Step 5. Procedure the transaction. You may use your Мisa or Ьastercard or PayPal bank account to perform the transaction.

- Step 6. Select the format of the authorized kind and down load it in your product.

- Step 7. Full, change and print or indicator the Guam Moving Services Contract - Self-Employed.

Every authorized file format you get is yours eternally. You possess acces to each kind you delivered electronically within your acccount. Click on the My Forms area and pick a kind to print or down load yet again.

Compete and down load, and print the Guam Moving Services Contract - Self-Employed with US Legal Forms. There are millions of skilled and express-specific kinds you can utilize to your business or specific requires.

Form popularity

FAQ

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

You can file your 1040EZ online using MyGuamTax.com, an official service of the Guam Department of Revenue and Taxation. You will need to create a separate user account on MyGuamTax to file your 1040EZ online.

Purpose of Form Use Form 8898 to notify the IRS that you became or ceased to be a bona fide resident of a U.S. possession in accordance with section 937(c). See Bona Fide Residence, later.

The IRS says that someone is self-employed if they meet one of these conditions: Someone who carries on a trade or business as a sole proprietor or independent contractor, A member of a partnership that carries on a trade or business, or. Someone who is otherwise in business for themselves, including part-time business

The IRS 1040 form is one of the official documents that U.S. taxpayers use to file their annual income tax return. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive.

More In Forms and Instructions One purpose of the form is to report net earnings from self-employment (SE) to the United States and, if necessary, pay SE tax on that income. The Social Security Administration (SSA) uses this information to figure your benefits under the social security program.

To order by phone, call 800-908-9946 and follow the prompts in the recorded message. To request a 1040, 1040A or 1040EZ tax return transcript through the mail, complete IRS Form 4506T-EZ, Short Form Request for Individual Tax Return Transcript.

Generally, you are self-employed if any of the following apply to you. You carry on a trade or business as a sole proprietor or an independent contractor. You are a member of a partnership that carries on a trade or business. You are otherwise in business for yourself (including a part-time business or a gig worker).

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees. In contrast, actual company employees are considered W-2 employees.

Newspaper deliverers or news carriers: You are considered self-employed if you deliver or distribute newspapers or perform related tasks (such as soliciting customers), your pay is based on sales or other output and not on the number of hours you work, and you work under a contract which states that you are not an