Guam Contract Administrator Agreement - Self-Employed Independent Contractor

Description

How to fill out Guam Contract Administrator Agreement - Self-Employed Independent Contractor?

It is possible to devote hours on the web trying to find the legitimate papers design that meets the federal and state requirements you want. US Legal Forms supplies thousands of legitimate kinds that happen to be analyzed by pros. You can actually download or print the Guam Contract Administrator Agreement - Self-Employed Independent Contractor from our service.

If you already possess a US Legal Forms bank account, it is possible to log in and then click the Obtain switch. Next, it is possible to full, change, print, or indication the Guam Contract Administrator Agreement - Self-Employed Independent Contractor. Every legitimate papers design you acquire is yours permanently. To acquire one more backup of the acquired kind, proceed to the My Forms tab and then click the related switch.

If you work with the US Legal Forms internet site the very first time, stick to the basic guidelines below:

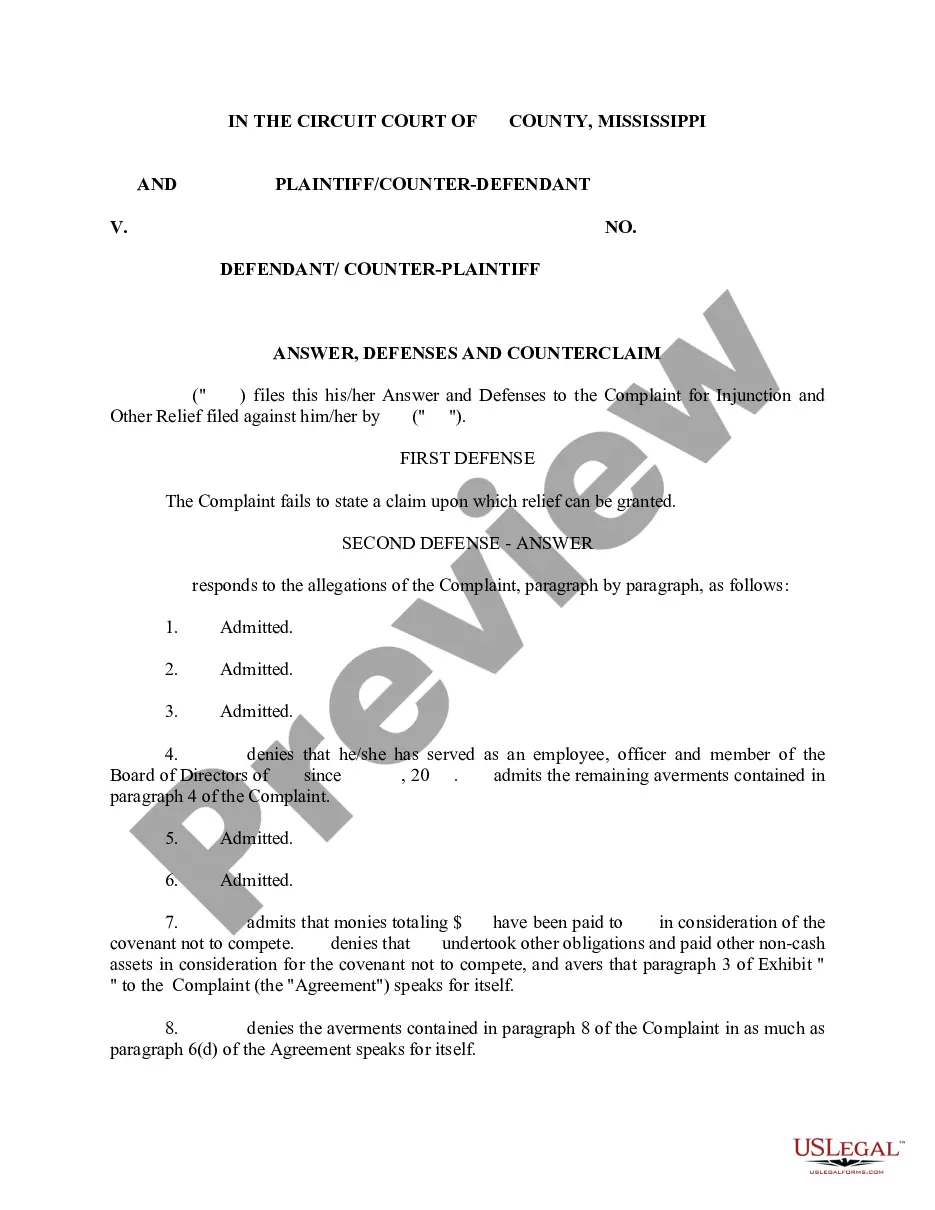

- First, ensure that you have chosen the correct papers design for the county/area of your liking. See the kind information to ensure you have chosen the appropriate kind. If readily available, take advantage of the Review switch to appear with the papers design at the same time.

- If you want to discover one more version from the kind, take advantage of the Search industry to discover the design that meets your needs and requirements.

- When you have discovered the design you need, just click Buy now to carry on.

- Find the rates strategy you need, type in your qualifications, and sign up for a free account on US Legal Forms.

- Full the transaction. You should use your Visa or Mastercard or PayPal bank account to fund the legitimate kind.

- Find the file format from the papers and download it to your product.

- Make modifications to your papers if needed. It is possible to full, change and indication and print Guam Contract Administrator Agreement - Self-Employed Independent Contractor.

Obtain and print thousands of papers templates utilizing the US Legal Forms Internet site, that provides the greatest selection of legitimate kinds. Use skilled and status-distinct templates to handle your business or specific requires.

Form popularity

FAQ

A business may pay an independent contractor and an employee for the same or similar work, but there are important legal differences between the two. For the employee, the company withholds income tax, Social Security, and Medicare from wages paid. For the independent contractor, the company does not withhold taxes.

Since they own their own limited company, you would be dealing with the individual directly, rather than liaising with an agency. Freelancers on the other hand, always work on their own. As an employer, you reach out to them directly, you do not have to go via an agency or a vendor to hire a freelancer.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

A contract worker, also known as an independent contractor or 1099 employee (based on the 1099 tax form they receive), is an individual who enters into a contractual agreement with a business in order to provide a service in exchange for a fee.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

1. PURPOSE. To establish a legal contract between the college and individuals who provide a service to the college and to determine whether an individual is an independent contractor or an employee based on Internal Revenue Service criteria.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.