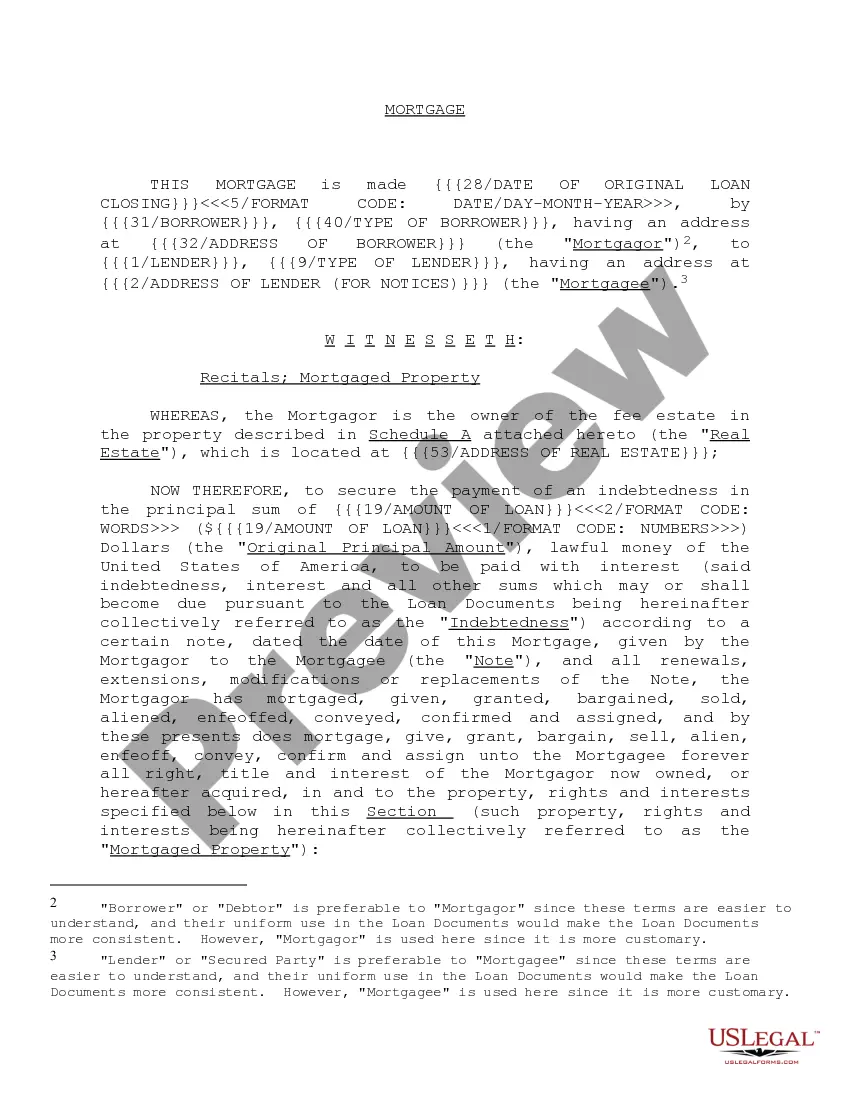

"Form of Mortgage Deed of Trust and Variations" is an American Lawyer Media form. The following form is for a mortgage deed of trust with variations.

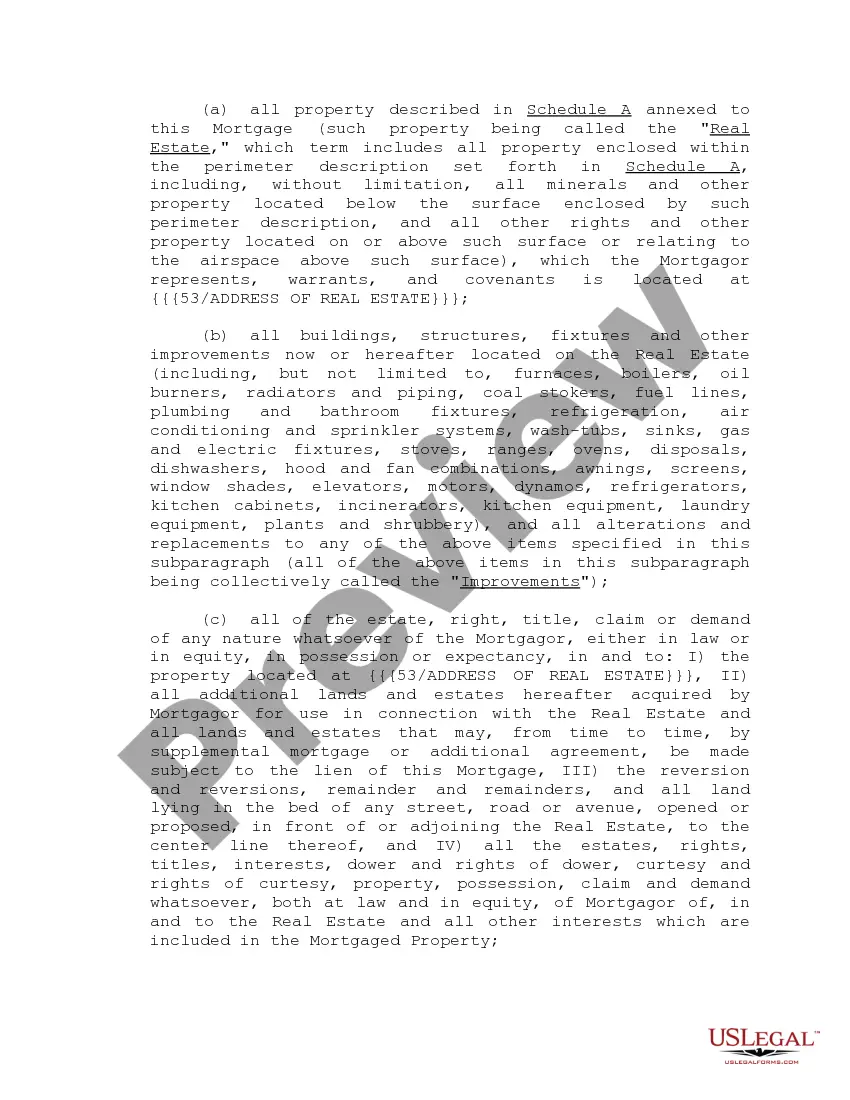

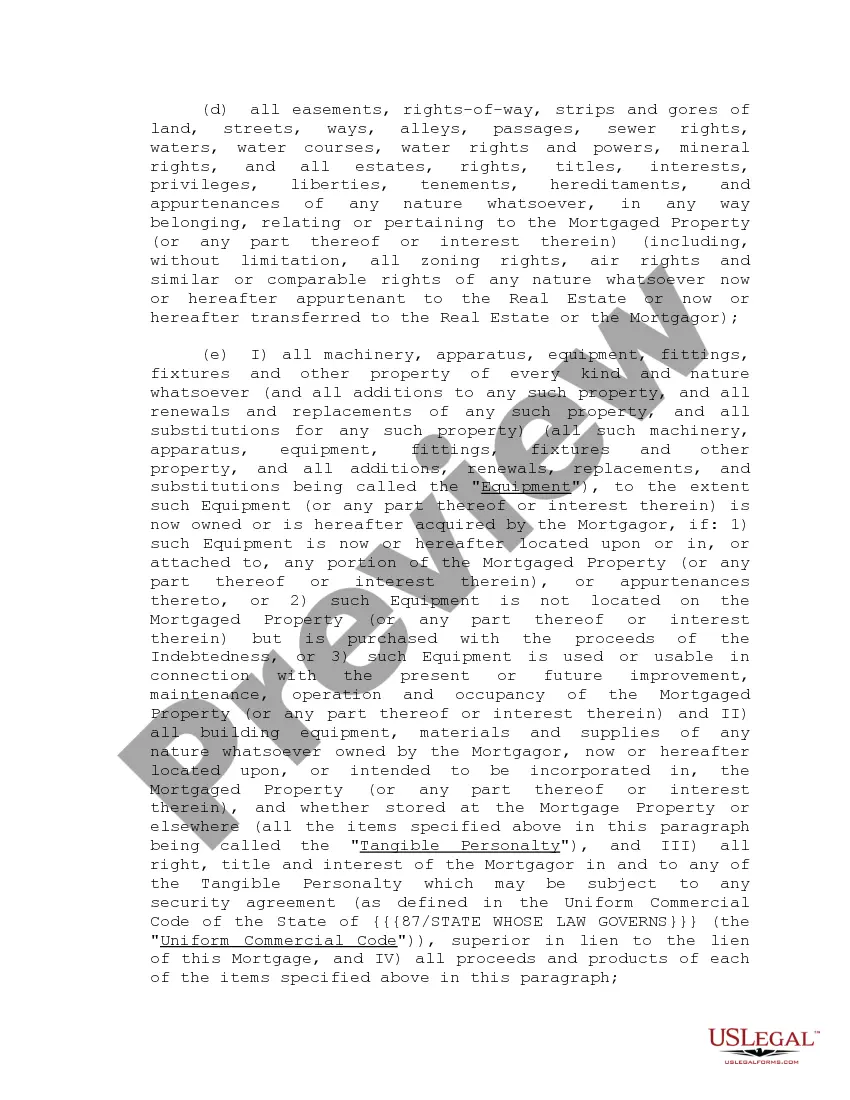

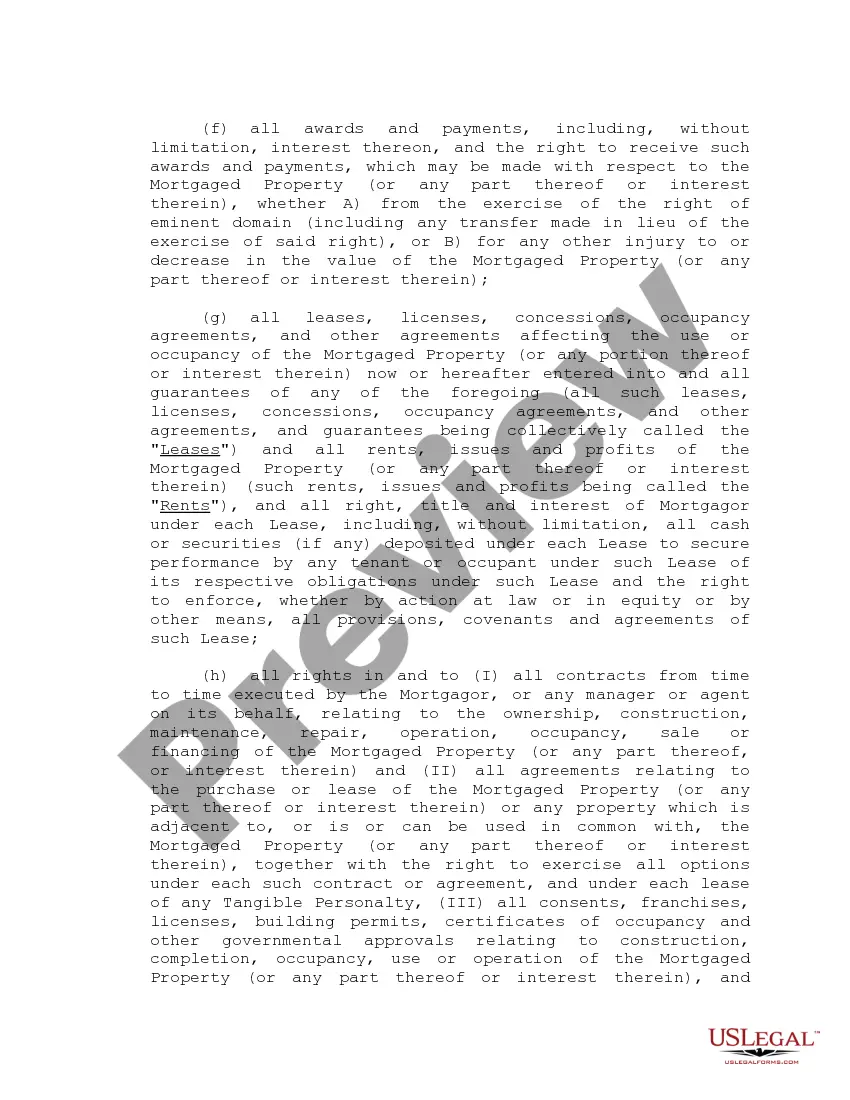

Guam Form of Mortgage Deed of Trust: A Comprehensive Guide Introduction to Guam Form of Mortgage Deed of Trust In the United States territory of Guam, a mortgage deed of trust is a legal agreement that serves as security for a loan on real estate property. It is a widely used method of financing a property purchase or obtaining a loan with real estate as collateral. The Guam Form of Mortgage Deed of Trust is a standardized document that outlines the terms and conditions of the agreement between the borrower, lender, and trustee. This legal instrument specifies the obligations and rights of each party involved in the transaction. It provides a clear framework for enforcing the terms of the loan and protects the interests of both the lender and the borrower. Key Elements of the Guam Form of Mortgage Deed of Trust The Guam Form of Mortgage Deed of Trust typically includes the following key elements: 1. Parties Involved: The document identifies the borrower, lender, and trustee. The borrower is the property owner seeking the loan, the lender is the institution or individual providing the loan, and the trustee is a neutral third party responsible for holding the property title until the loan is repaid. 2. Property Description: The document provides a detailed description of the property being used as collateral. This includes the physical address, legal description, and any unique identifiers such as lot or block numbers. 3. Loan Terms: The mortgage deed of trust outlines the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any applicable fees or penalties. It may also specify provisions for late payments, default, and foreclosure. 4. Rights and Obligations: The document specifies the rights and obligations of the borrower, lender, and trustee. This includes the borrower's responsibility to maintain the property, make timely payments, and provide insurance coverage. It also outlines the lender's right to initiate foreclosure in the event of default. Types and Variations of Guam Form of Mortgage Deed of Trust While the basic structure and content of the Guam Form of Mortgage Deed of Trust remain consistent, there may be variations based on specific loan programs or legal requirements. Some common types and variations include: 1. Residential Mortgage Deed of Trust: This form is specifically designed for residential properties, such as single-family homes, condos, or townhouses. It includes provisions tailored to the unique needs of residential borrowers and lenders. 2. Commercial Mortgage Deed of Trust: This variation is intended for commercial properties, including office buildings, retail spaces, and industrial facilities. It may have additional clauses related to leasing, tenants, or zoning regulations. 3. Government-backed Mortgage Deed of Trust: If the loan is guaranteed or insured by a government agency, such as the Federal Housing Administration (FHA) or Veterans Affairs (VA), the form will include specific clauses and disclosures required by the respective agency. Conclusion The Guam Form of Mortgage Deed of Trust is a crucial legal document that facilitates property financing and protects the rights of borrowers, lenders, and trustees in Guam. By stipulating the terms and conditions of the loan, it provides clarity and transparency in real estate transactions. Whether for residential or commercial properties, the Guam Form of Mortgage Deed of Trust serves as a reliable and standardized framework. It ensures that the rights and obligations of all parties involved are clearly defined and helps to maintain a fair and orderly real estate financing market in Guam.Guam Form of Mortgage Deed of Trust: A Comprehensive Guide Introduction to Guam Form of Mortgage Deed of Trust In the United States territory of Guam, a mortgage deed of trust is a legal agreement that serves as security for a loan on real estate property. It is a widely used method of financing a property purchase or obtaining a loan with real estate as collateral. The Guam Form of Mortgage Deed of Trust is a standardized document that outlines the terms and conditions of the agreement between the borrower, lender, and trustee. This legal instrument specifies the obligations and rights of each party involved in the transaction. It provides a clear framework for enforcing the terms of the loan and protects the interests of both the lender and the borrower. Key Elements of the Guam Form of Mortgage Deed of Trust The Guam Form of Mortgage Deed of Trust typically includes the following key elements: 1. Parties Involved: The document identifies the borrower, lender, and trustee. The borrower is the property owner seeking the loan, the lender is the institution or individual providing the loan, and the trustee is a neutral third party responsible for holding the property title until the loan is repaid. 2. Property Description: The document provides a detailed description of the property being used as collateral. This includes the physical address, legal description, and any unique identifiers such as lot or block numbers. 3. Loan Terms: The mortgage deed of trust outlines the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any applicable fees or penalties. It may also specify provisions for late payments, default, and foreclosure. 4. Rights and Obligations: The document specifies the rights and obligations of the borrower, lender, and trustee. This includes the borrower's responsibility to maintain the property, make timely payments, and provide insurance coverage. It also outlines the lender's right to initiate foreclosure in the event of default. Types and Variations of Guam Form of Mortgage Deed of Trust While the basic structure and content of the Guam Form of Mortgage Deed of Trust remain consistent, there may be variations based on specific loan programs or legal requirements. Some common types and variations include: 1. Residential Mortgage Deed of Trust: This form is specifically designed for residential properties, such as single-family homes, condos, or townhouses. It includes provisions tailored to the unique needs of residential borrowers and lenders. 2. Commercial Mortgage Deed of Trust: This variation is intended for commercial properties, including office buildings, retail spaces, and industrial facilities. It may have additional clauses related to leasing, tenants, or zoning regulations. 3. Government-backed Mortgage Deed of Trust: If the loan is guaranteed or insured by a government agency, such as the Federal Housing Administration (FHA) or Veterans Affairs (VA), the form will include specific clauses and disclosures required by the respective agency. Conclusion The Guam Form of Mortgage Deed of Trust is a crucial legal document that facilitates property financing and protects the rights of borrowers, lenders, and trustees in Guam. By stipulating the terms and conditions of the loan, it provides clarity and transparency in real estate transactions. Whether for residential or commercial properties, the Guam Form of Mortgage Deed of Trust serves as a reliable and standardized framework. It ensures that the rights and obligations of all parties involved are clearly defined and helps to maintain a fair and orderly real estate financing market in Guam.