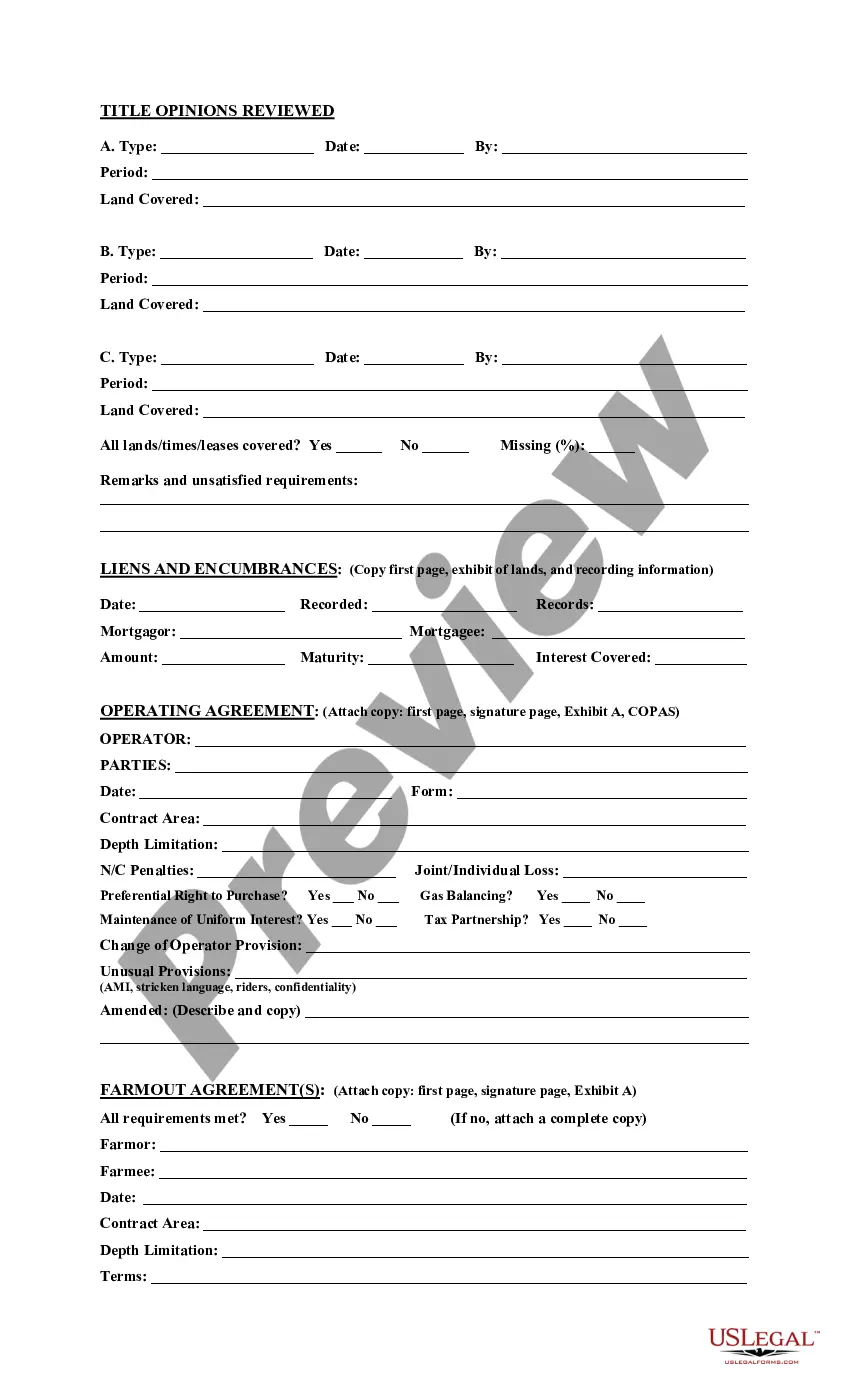

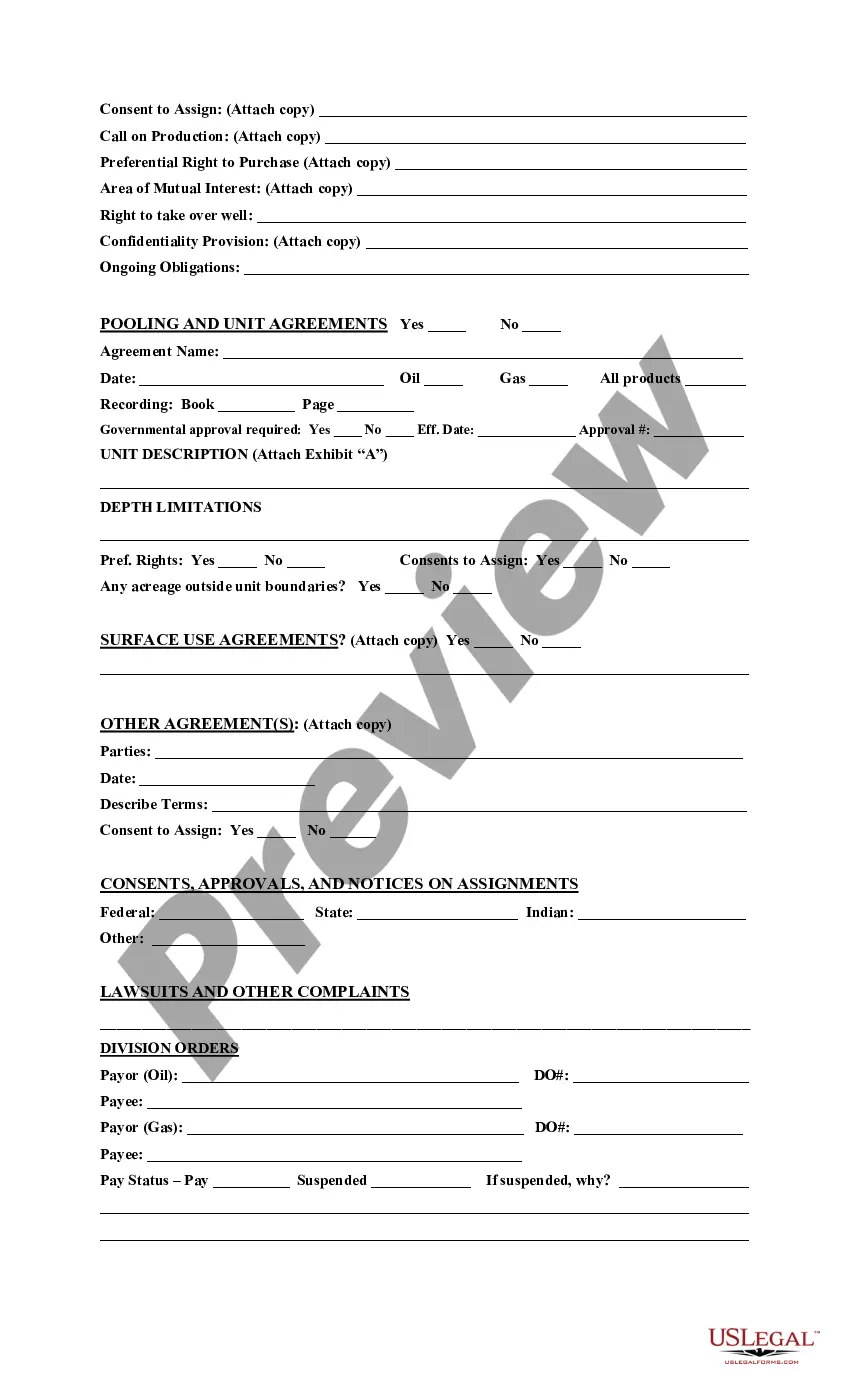

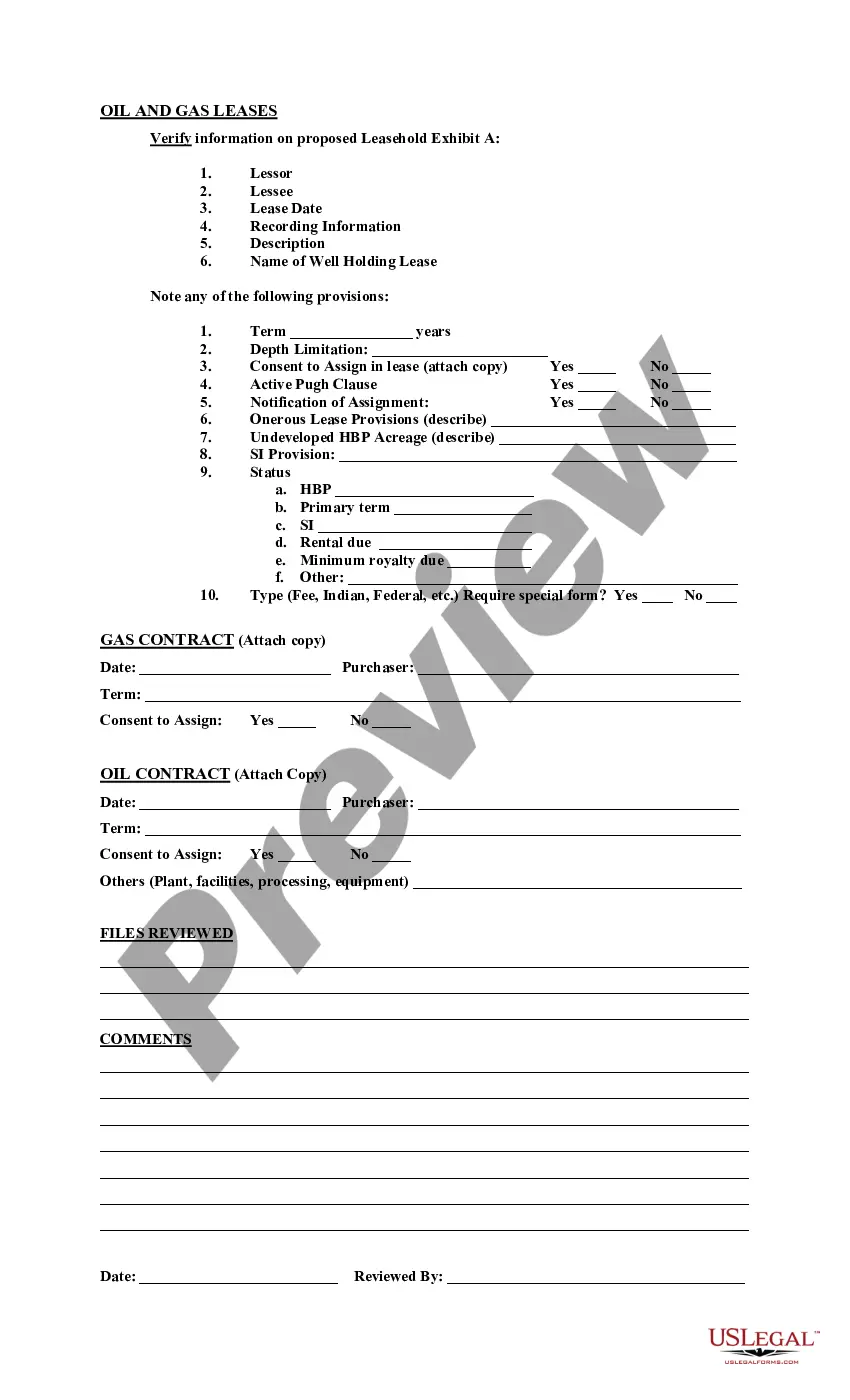

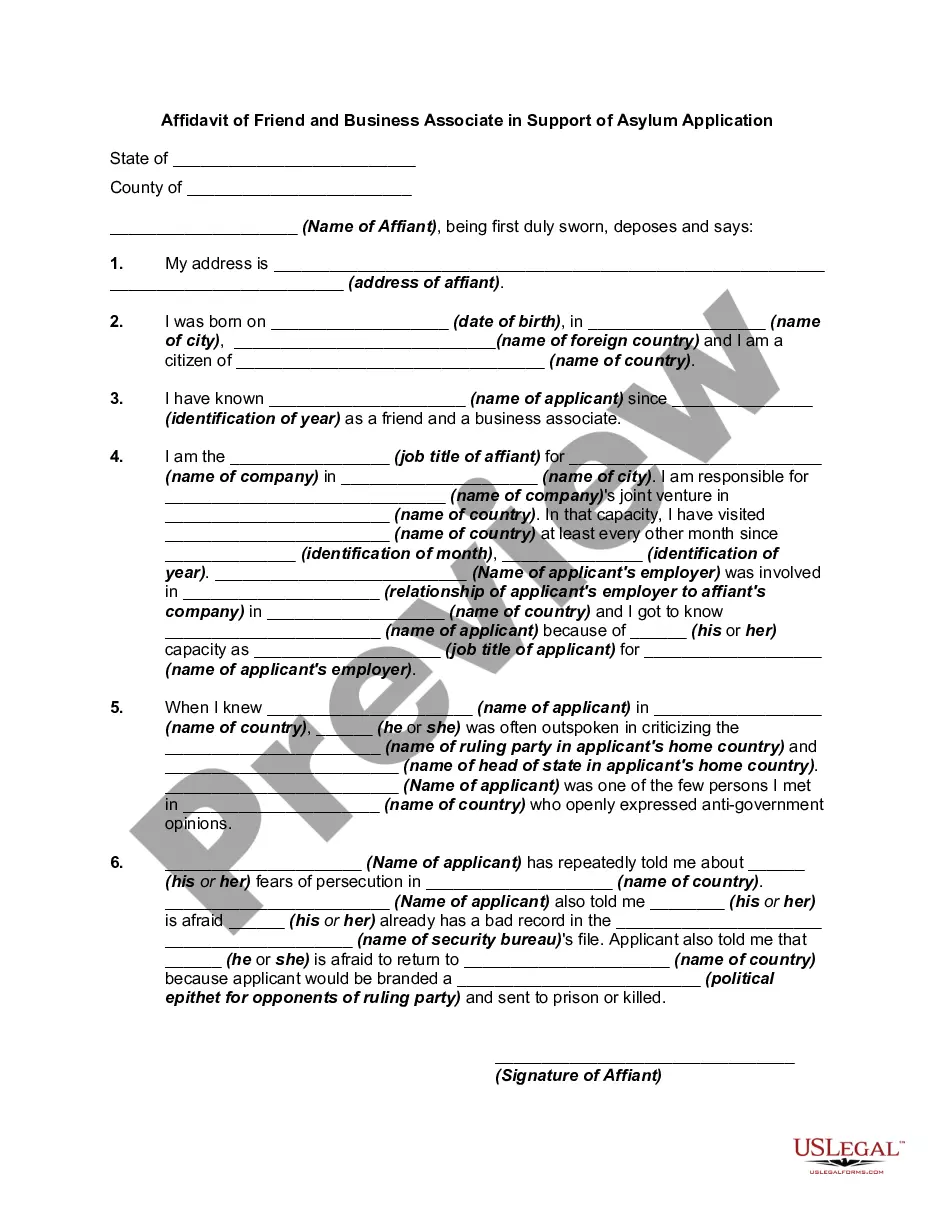

Guam Acquisition Due Diligence Report is a comprehensive evaluation of the potential acquisition of a business or property in the U.S. territory of Guam. It provides a detailed analysis of the financial, legal, and operational aspects of the acquisition to assess its feasibility and identify any potential risks. The Guam Acquisition Due Diligence Report typically includes a thorough examination of the target company's financial statements, accounting practices, tax liabilities, and potential areas of improvement. It involves an in-depth review of the company's assets, liabilities, and cash flow to determine its true value and potential for growth. Additionally, the report investigates the target company's legal and regulatory compliance, including licenses, permits, and potential liabilities such as lawsuits, environmental issues, or pending legal disputes. It also examines the company's contractual obligations, leases, and intellectual property rights to ensure there are no hidden legal risks involved in the acquisition. Furthermore, the report may explore the target company's operational structure, including its key personnel, organizational culture, and potential synergies with the acquiring organization. It may assess the company's supply chain, customer base, market share, and competitive landscape to evaluate its market position and future growth prospects. Different types of Guam Acquisition Due Diligence Reports may include: 1. Financial Due Diligence Report: This report primarily focuses on analyzing the target company's financial statements, tax records, and financial reporting practices assessing its financial health and potential risks. 2. Legal Due Diligence Report: This report delves into the legal aspects of the acquisition, examining the target company's compliance with local laws and regulations, potential legal liabilities, pending litigation, and contractual obligations. 3. Operational Due Diligence Report: This report assesses the operational aspects of the target company, including its operational processes, supply chain management, customer relationships, and potential synergies with the acquiring organization. 4. Environmental Due Diligence Report: This report investigates any potential environmental risks associated with the target company, such as pollution, hazardous waste, or non-compliance with environmental regulations. 5. Commercial Due Diligence Report: This report focuses on evaluating the target company's market position, competitive landscape, industry trends, and future growth opportunities. In conclusion, a Guam Acquisition Due Diligence Report is a comprehensive analysis of various aspects of a potential acquisition in Guam. It helps the acquiring organization make informed decisions by uncovering potential risks, financial health, legal compliance, operational efficiency, and market opportunities of the target company.

Guam Acquisition Due Diligence Report

Description

How to fill out Guam Acquisition Due Diligence Report?

Are you in the place the place you need to have files for sometimes enterprise or individual purposes just about every working day? There are a lot of authorized file themes accessible on the Internet, but getting kinds you can rely isn`t straightforward. US Legal Forms provides a huge number of develop themes, much like the Guam Acquisition Due Diligence Report, which are written to meet state and federal requirements.

If you are previously informed about US Legal Forms internet site and get your account, just log in. Afterward, you may download the Guam Acquisition Due Diligence Report web template.

Should you not come with an profile and want to begin using US Legal Forms, follow these steps:

- Get the develop you want and ensure it is for your correct metropolis/county.

- Utilize the Review option to check the shape.

- Read the explanation to ensure that you have selected the proper develop.

- In the event the develop isn`t what you`re looking for, take advantage of the Look for industry to get the develop that suits you and requirements.

- If you find the correct develop, just click Purchase now.

- Pick the prices prepare you need, fill out the necessary information to create your bank account, and pay money for an order making use of your PayPal or charge card.

- Pick a convenient document file format and download your duplicate.

Get all the file themes you may have purchased in the My Forms food selection. You can aquire a more duplicate of Guam Acquisition Due Diligence Report whenever, if needed. Just go through the needed develop to download or print out the file web template.

Use US Legal Forms, one of the most considerable variety of authorized types, in order to save time as well as stay away from errors. The service provides appropriately made authorized file themes that can be used for a variety of purposes. Generate your account on US Legal Forms and commence generating your life a little easier.