This operating agreement exhibit provides that the Operator shall prepare and file all required federal and state partnership income tax returns. In preparing the returns Operator shall use its best efforts and in doing so shall incur no liability to any other Party with regard to the returns.

Guam Exhibit G to Operating Agreement Tax Partnership Agreement

Description

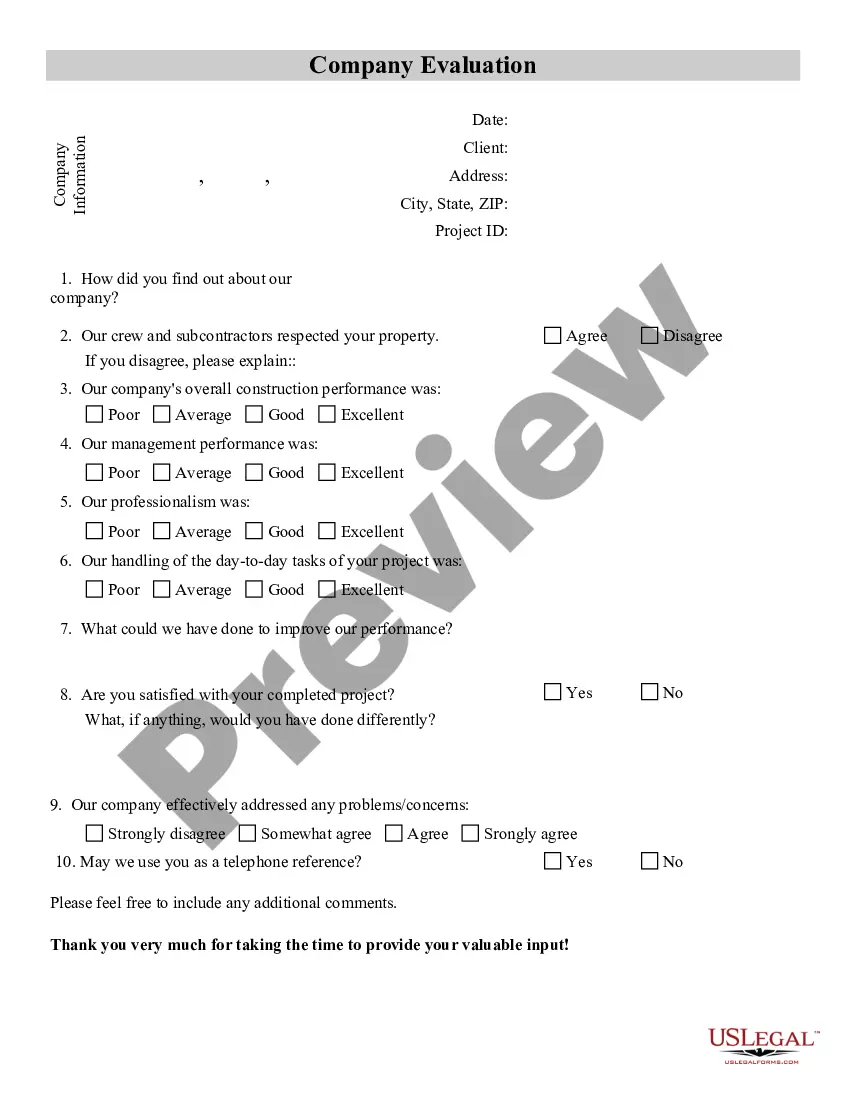

How to fill out Exhibit G To Operating Agreement Tax Partnership Agreement?

Choosing the best legitimate file template could be a battle. Naturally, there are plenty of themes available on the Internet, but how can you obtain the legitimate develop you want? Make use of the US Legal Forms internet site. The service delivers 1000s of themes, such as the Guam Exhibit G to Operating Agreement Tax Partnership Agreement, which you can use for organization and private requirements. Each of the forms are examined by pros and fulfill state and federal requirements.

Should you be previously authorized, log in in your bank account and then click the Obtain key to obtain the Guam Exhibit G to Operating Agreement Tax Partnership Agreement. Use your bank account to appear from the legitimate forms you possess purchased in the past. Proceed to the My Forms tab of your own bank account and have one more version of your file you want.

Should you be a fresh customer of US Legal Forms, listed here are simple guidelines that you can follow:

- Very first, make sure you have selected the proper develop for your town/region. You may look over the shape making use of the Review key and browse the shape explanation to guarantee this is basically the right one for you.

- In case the develop is not going to fulfill your needs, take advantage of the Seach discipline to discover the appropriate develop.

- Once you are certain that the shape would work, go through the Get now key to obtain the develop.

- Pick the rates program you desire and type in the needed information. Design your bank account and pay for the order with your PayPal bank account or credit card.

- Choose the file formatting and acquire the legitimate file template in your system.

- Full, revise and printing and sign the attained Guam Exhibit G to Operating Agreement Tax Partnership Agreement.

US Legal Forms is definitely the largest library of legitimate forms where you will find a variety of file themes. Make use of the company to acquire expertly-manufactured files that follow status requirements.

Form popularity

FAQ

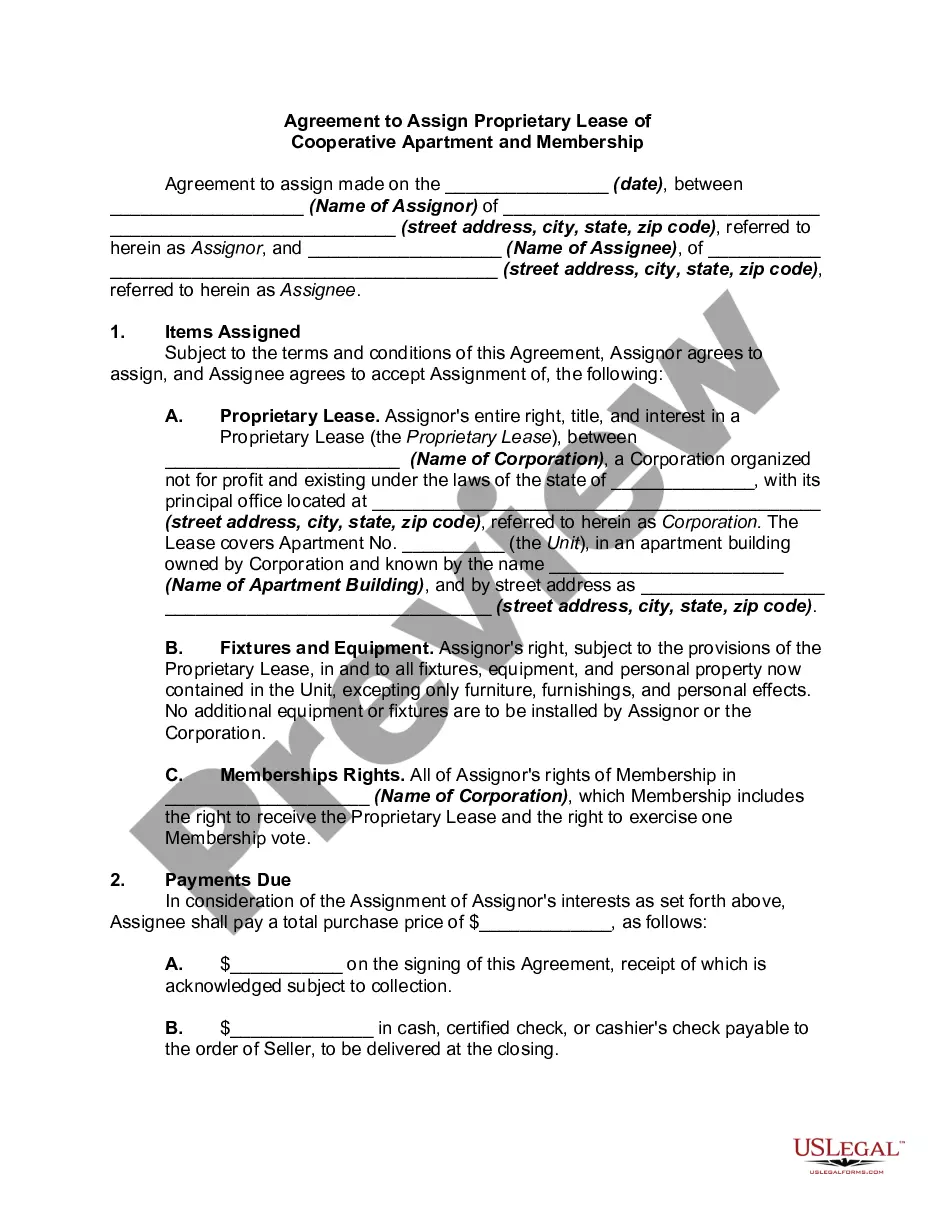

Most often, operating agreements provide that each owner's distributive share corresponds to his or her percentage of ownership in the LLC. For example, because Tony owns only 35% of his LLC, he receives just 35% of its profits and losses.

Joint operations, which give parties that have joint control of the arrangement the direct rights to the assets and obligations for the liabilities. Joint ventures, which give the parties that have joint control of the arrangement the rights to the net assets of the arrangement.

A joint operating agreement is a contract that sets forth the duties and obligations of both the operator and nonoperating working interest owners of a mineral lease.

An S corp operating agreement is a business entity managing document. Typically, an operating agreement is a document that defines how a limited liability company will be managed. An S corp actually uses corporate bylaws and articles of incorporation for the purpose of organizing the business operation.

The partnership agreement lays out the terms of the partnership covering topics such as sharing in profits and losses, how partners can leave the partnership, the percentage of control held by each partner, and similar issues. Joint ventures, on the other hand, may not necessarily have an agreement in place.

A partnership agreement and an operating agreement are very similar in what they define: ownership and investment stakes, division of profits and losses, and so on. However, a partnership agreement is used in partnerships, while operating agreements are used in LLCs.

? D. Martyn, ?Upstream Oil and Gas Agreements? (1996). The Joint Operating Agreement (JOA) in oil and gas industry is an underlying contractual framework of a Joint Venture (JV). The JOA is a contract where two or more parties agree to undertake a common task to explore and exploit an area for hydrocarbons.

A joint operator is a party to a joint operation that has joint control of that joint operation. A joint venture is a joint arrangement whereby the parties that have joint control of the arrangement have rights to the net assets of the arrangement.