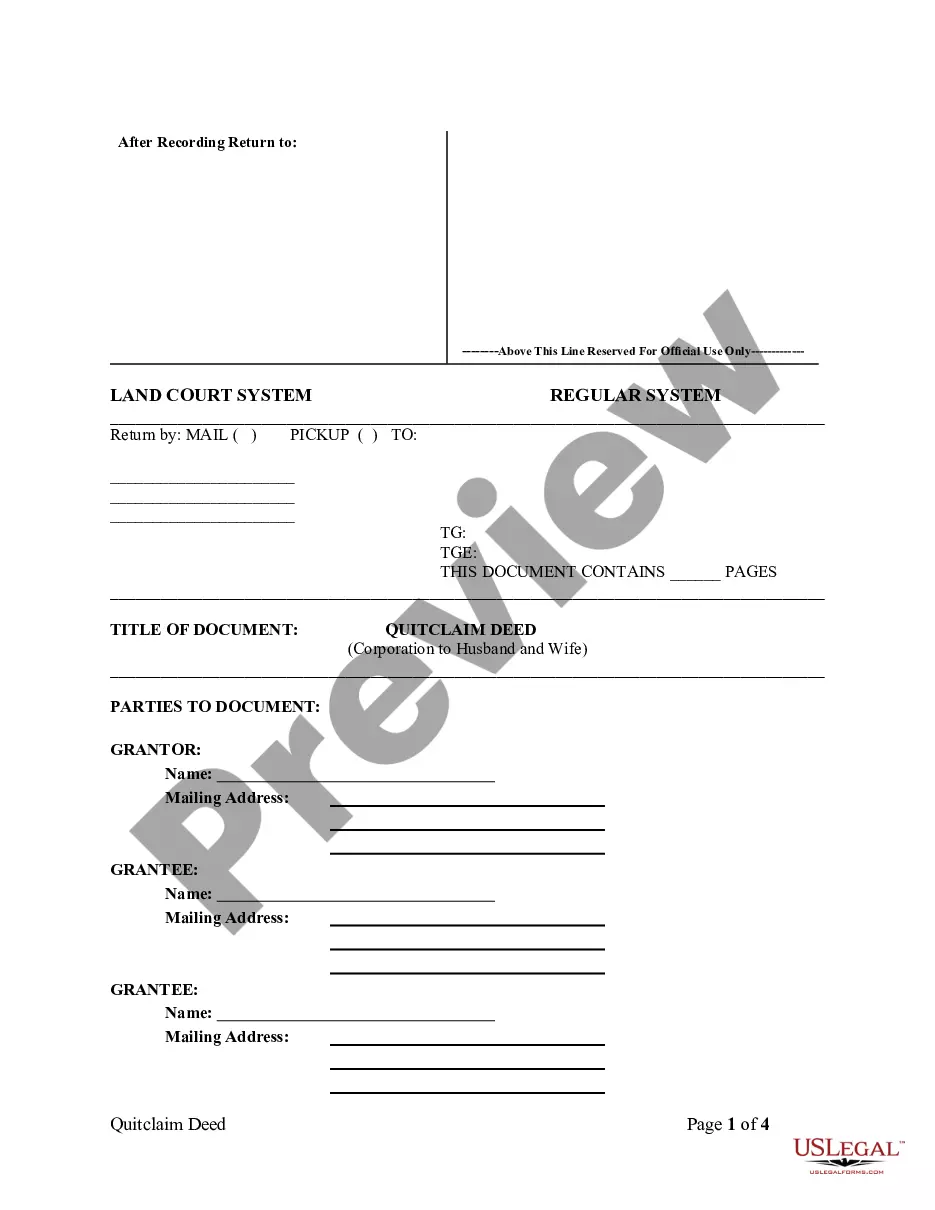

Hawaii Quitclaim Deed from Corporation to Husband and Wife

Description

How to fill out Hawaii Quitclaim Deed From Corporation To Husband And Wife?

Access one of the most expansive library of legal forms. US Legal Forms is really a solution where you can find any state-specific document in a few clicks, even Hawaii Quitclaim Deed from Corporation to Husband and Wife examples. No need to spend hrs of your time looking for a court-admissible form. Our accredited professionals make sure that you get up-to-date documents every time.

To benefit from the forms library, choose a subscription, and sign-up your account. If you already created it, just log in and click on Download button. The Hawaii Quitclaim Deed from Corporation to Husband and Wife file will automatically get stored in the My Forms tab (a tab for every form you save on US Legal Forms).

To register a new profile, look at brief recommendations below:

- If you're proceeding to utilize a state-specific sample, make sure you indicate the right state.

- If it’s possible, review the description to learn all the ins and outs of the document.

- Utilize the Preview option if it’s available to take a look at the document's information.

- If everything’s correct, click on Buy Now button.

- Right after picking a pricing plan, register your account.

- Pay out by card or PayPal.

- Downoad the example to your device by clicking on Download button.

That's all! You ought to submit the Hawaii Quitclaim Deed from Corporation to Husband and Wife form and double-check it. To ensure that all things are correct, contact your local legal counsel for assist. Sign up and easily find above 85,000 beneficial forms.

Form popularity

FAQ

A quitclaim deed doesn't always need to be signed before the divorce is final. Your divorce judgment will detail the terms of your property settlement agreement, and the requirement for transferring title will likely be incorporated into this agreement.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

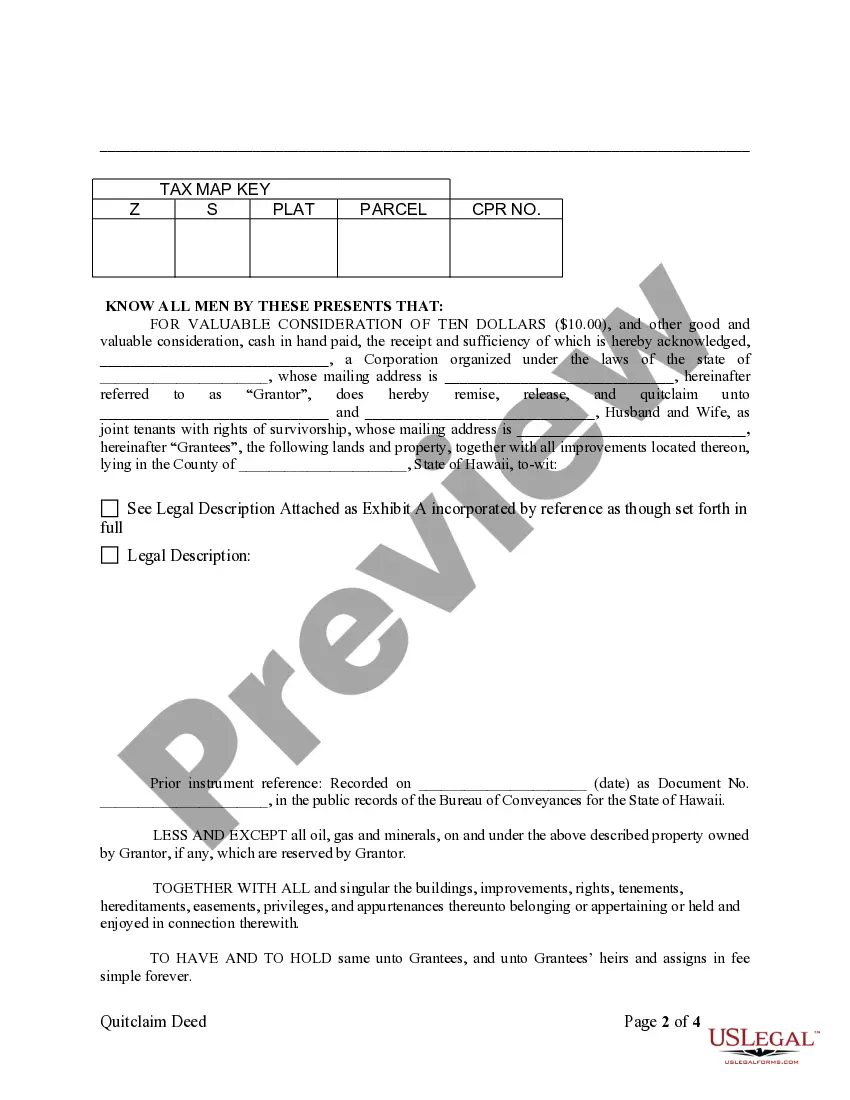

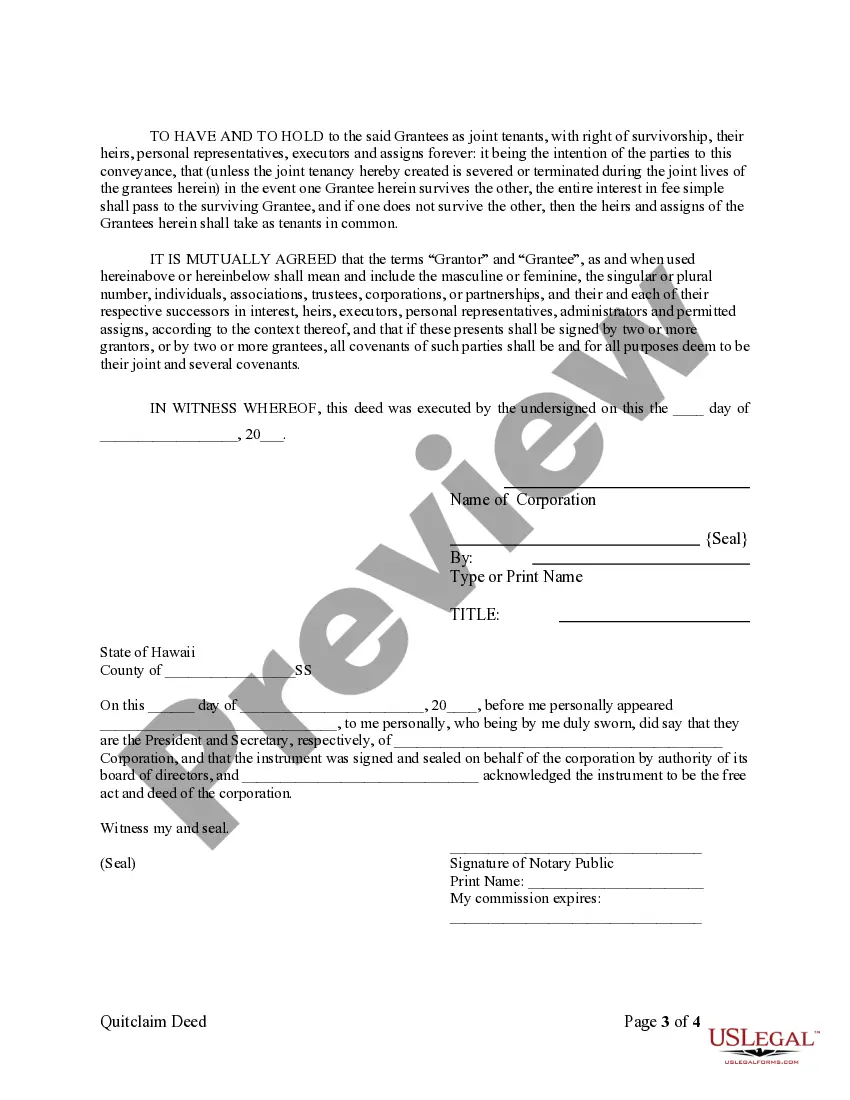

Hawaii Quit Claim Deed Form In Hawaii, quit claim deeds must be signed by the Grantor in the presence of a Notary Public (§ 502-41). Once the quit claim deed is signed and notarized, it must be filed with the Bureau of Conveyance along with the proper filing fees.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

Once a quitclaim is signed and recorded, can the deed be challenged in court? Yes, it can. Recording your deed only provides notice of your ownership claim to the public. It does not guarantee ownership.

The issue becomes complicated when the party being bought out does not want to sign the Quitclaim Deed until he receives his money. Logically, this makes sense.The key to signing a Quitclaim Deed prior to refinancing is holding the Quitclaim Deed in escrow until the closing of the refinanced loan takes place.

Fill out the quit claim deed form, which can be obtained online, or write your own using the form as a guide. The person giving up the interest in the property is the grantor, and the person receiving the interest is the grantee.

Ex said he can do loan modification but lender requires I sign a quit claim deed before it can be modified and decree will need amendment removing clause that house is to be sold.Ex said Quit Claim will supersede decree and no amendment needs to be done.