Hawaii Warranty Deed from Corporation to Husband and Wife

Description

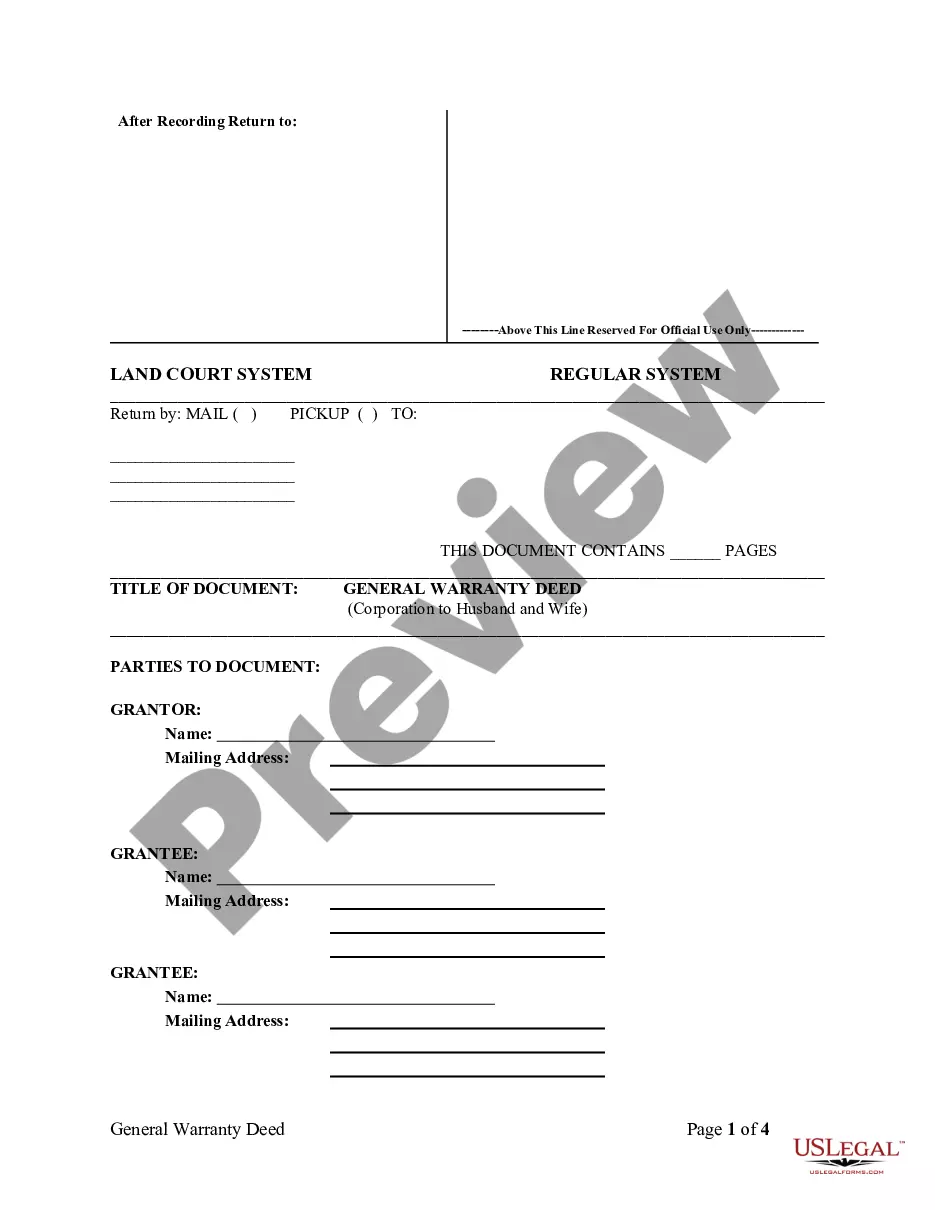

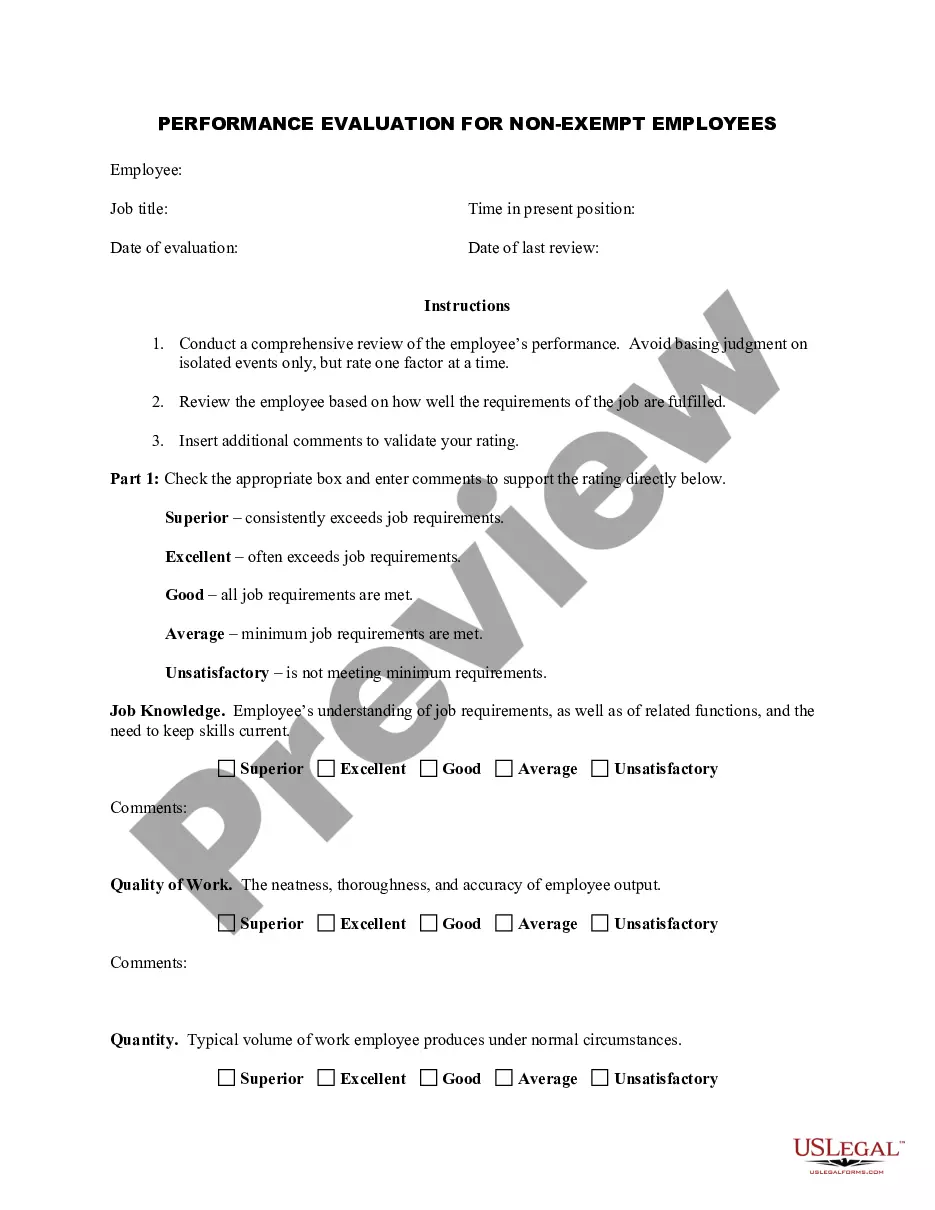

How to fill out Hawaii Warranty Deed From Corporation To Husband And Wife?

Access the most expansive catalogue of authorized forms. US Legal Forms is really a platform to find any state-specific form in couple of clicks, even Hawaii Warranty Deed from Corporation to Husband and Wife examples. No reason to waste several hours of the time looking for a court-admissible example. Our certified experts ensure you get updated examples every time.

To take advantage of the documents library, choose a subscription, and sign-up your account. If you already did it, just log in and click Download. The Hawaii Warranty Deed from Corporation to Husband and Wife file will immediately get kept in the My Forms tab (a tab for all forms you save on US Legal Forms).

To register a new profile, follow the simple instructions below:

- If you're going to utilize a state-specific sample, be sure to indicate the correct state.

- If it’s possible, review the description to learn all the ins and outs of the form.

- Use the Preview function if it’s offered to look for the document's information.

- If everything’s correct, click on Buy Now button.

- Right after choosing a pricing plan, make your account.

- Pay out by credit card or PayPal.

- Save the sample to your device by clicking on Download button.

That's all! You need to complete the Hawaii Warranty Deed from Corporation to Husband and Wife form and check out it. To be sure that things are exact, speak to your local legal counsel for help. Register and simply look through over 85,000 beneficial samples.

Form popularity

FAQ

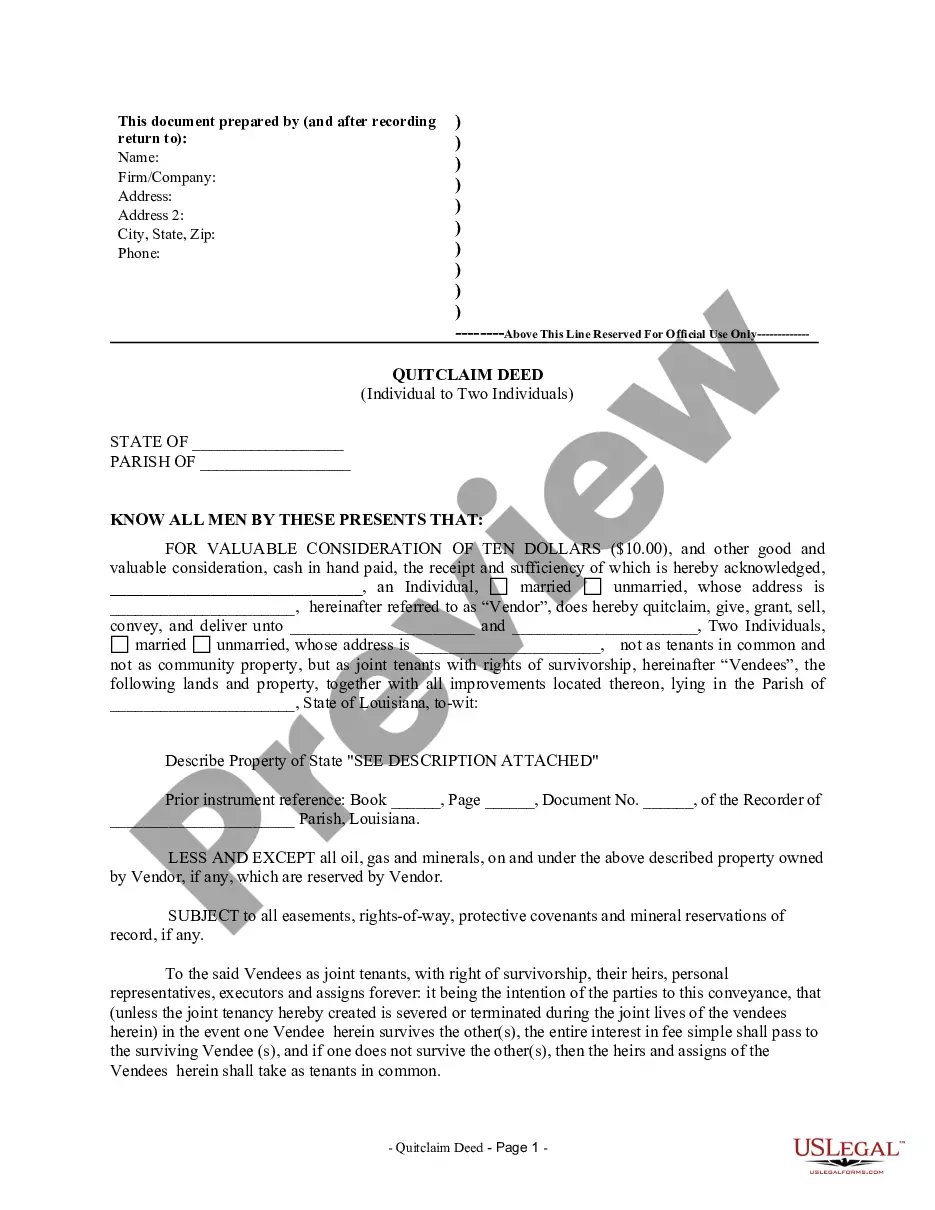

Two of the most common ways to transfer property in a divorce are through an interspousal transfer deed or quitclaim deed. When spouses own property together, but then one spouse executes an interspousal transfer or a quitclaim deed, this is known as transmutation.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

Contrary to normal expectations, the Deed DOES NOT have to be recorded to be effective or to show delivery, and because of that, the Deed DOES NOT have to be signed in front of a Notary Public. However, if you plan to record it, then it does have to be notarized as that is a County Recorder requirement.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

If you live in a common-law state, you can keep your spouse's name off the title the document that says who owns the property.You can put your spouse on the title without putting them on the mortgage; this would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.

A In order to make your partner a joint owner you will need to add his name at the Land Registry, for which there is a fee of £280 (assuming you transfer half the house to him). You won't, however, have to pay capital gains tax, as gifts between civil partners (and spouses) are tax free.