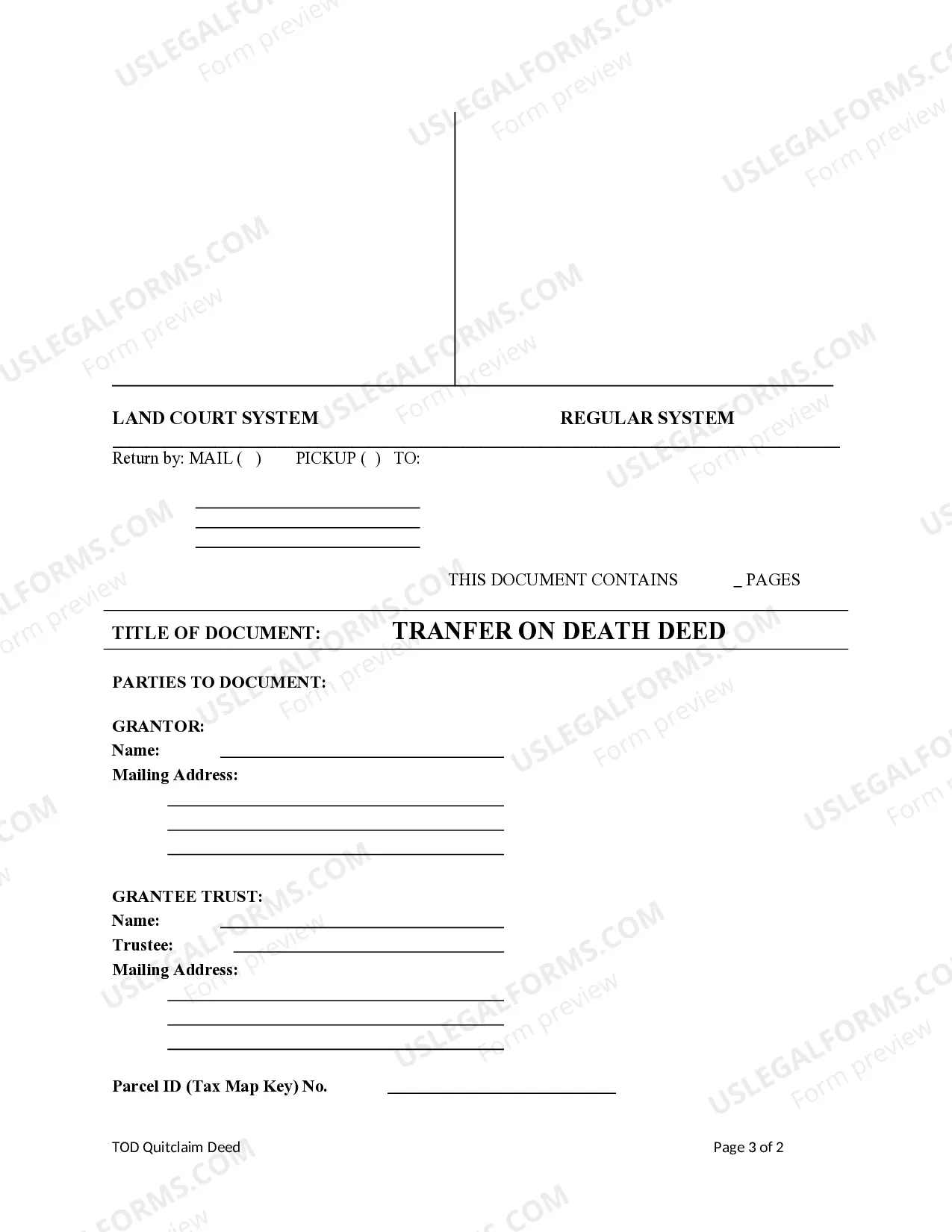

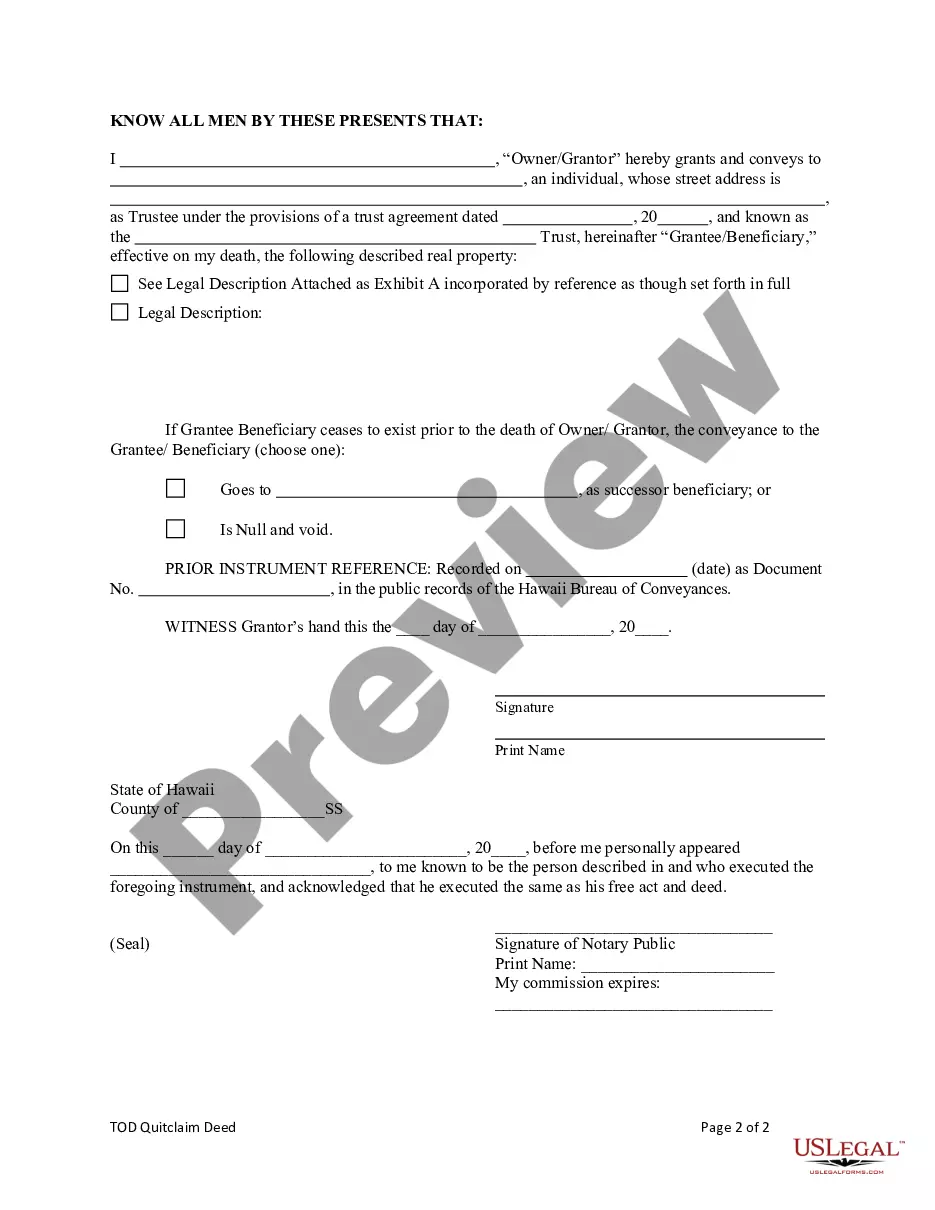

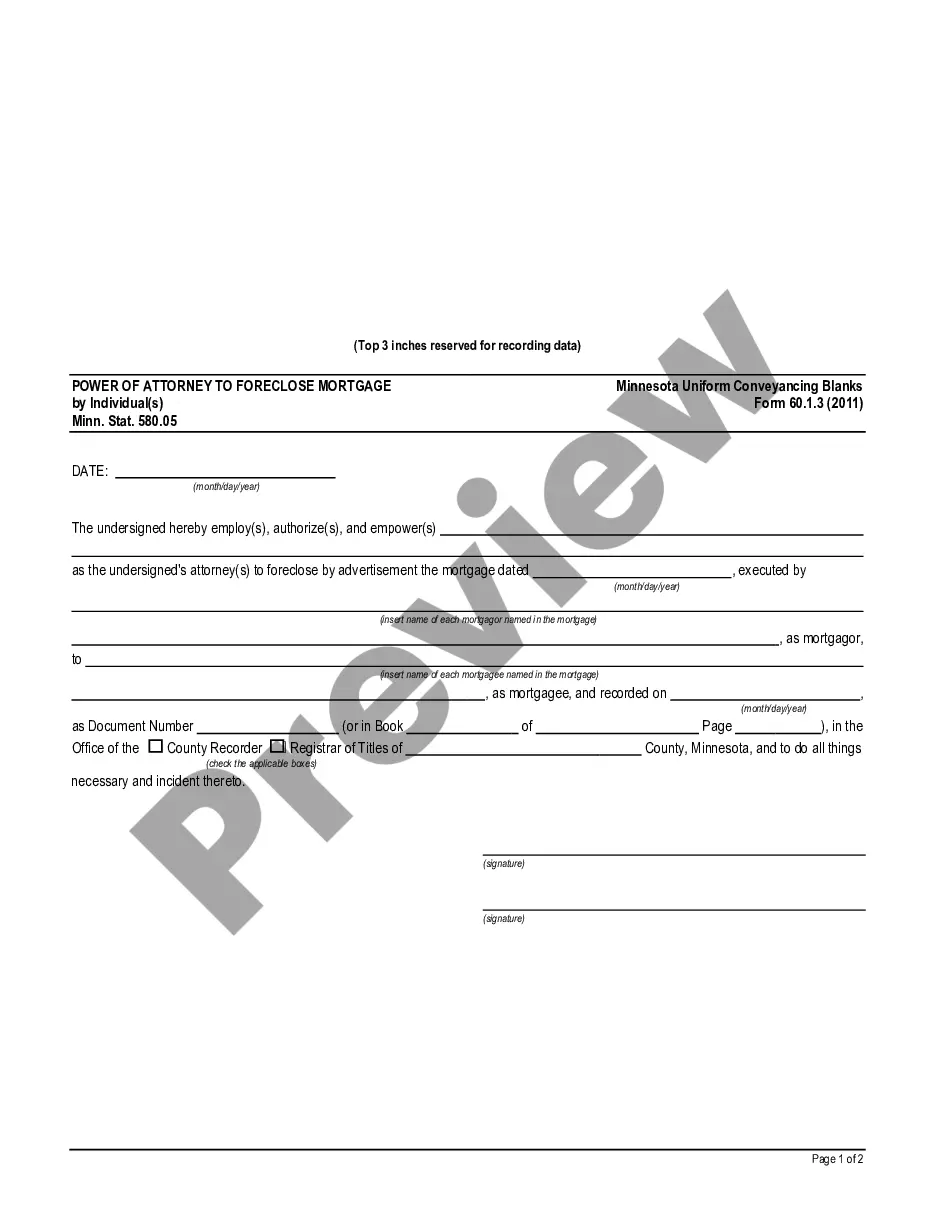

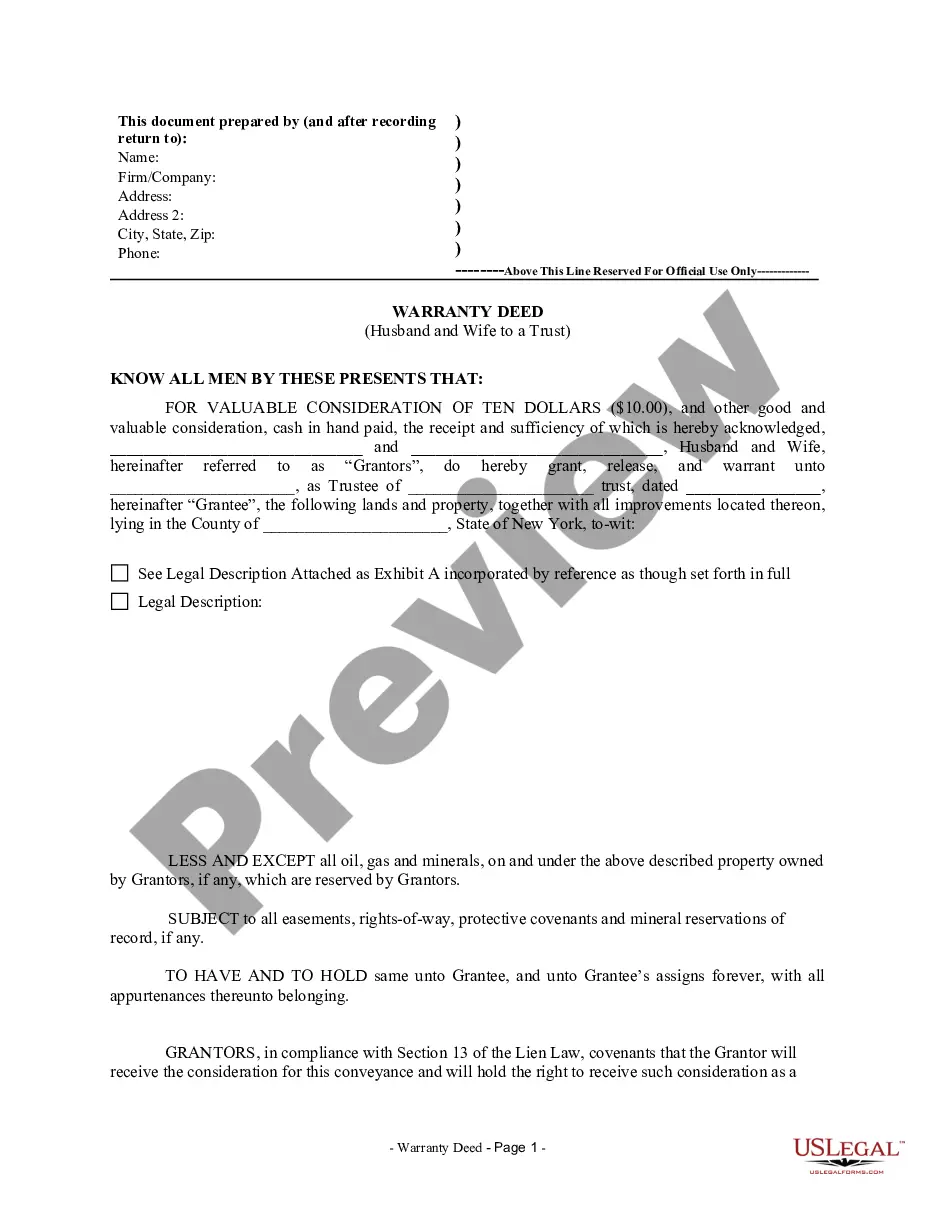

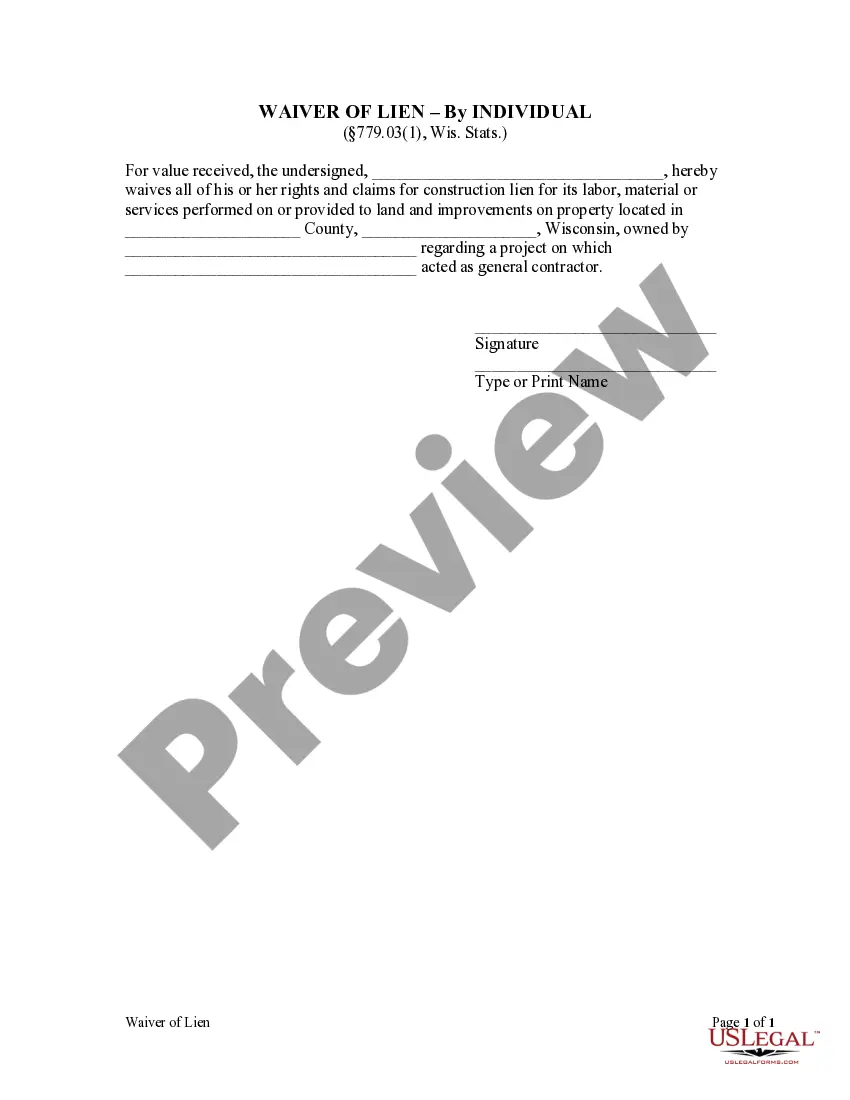

This form is a Transfer on Death Deed where the Grantor is an individual and the Grantee is a Trust. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. This deed complies with all state statutory laws.

Hawaii Transfer on Death Quitclaim Deed from Individual to a Trust

Description Transfer Death To

How to fill out Hawaii Death Deed?

Get the most holistic catalogue of legal forms. US Legal Forms is actually a system to find any state-specific file in couple of clicks, such as Hawaii Transfer on Death Quitclaim Deed from Individual to a Trust samples. No reason to spend hours of your time looking for a court-admissible sample. Our certified pros ensure you receive up to date documents every time.

To make use of the forms library, select a subscription, and sign up an account. If you created it, just log in and click on Download button. The Hawaii Transfer on Death Quitclaim Deed from Individual to a Trust sample will quickly get saved in the My Forms tab (a tab for all forms you download on US Legal Forms).

To register a new profile, follow the quick instructions below:

- If you're going to use a state-specific documents, be sure to indicate the right state.

- If it’s possible, review the description to know all of the ins and outs of the form.

- Make use of the Preview option if it’s available to look for the document's content.

- If everything’s right, click Buy Now.

- After picking a pricing plan, create an account.

- Pay out by credit card or PayPal.

- Save the example to your computer by clicking on Download button.

That's all! You need to complete the Hawaii Transfer on Death Quitclaim Deed from Individual to a Trust template and double-check it. To make certain that all things are precise, contact your local legal counsel for help. Sign up and easily find above 85,000 beneficial samples.

Hawaii Deed To Form popularity

Hawaii Quitclaim To Other Form Names

Hawaii Transfer Deed FAQ

How To Establish A Trust. You will need to retain an estate attorney to draft and execute your trust document. For a simple revocable or irrevocable trust, it may cost anywhere from $2,000 $5,000.

No. And unless the deed identifies the trust as an owner, then father is the owner of an interest. It is a common mistake to set up a trust and then fail to deed property into the trust. However, you cannot force him to make the changes you are...

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

A trust will spare your loved ones from the probate process when you pass away. Putting your house in a trust will save your children or spouse from the hefty fee of probate costs, which can be up to 3% of your asset's value.Any high-dollar assets you own should be added to a trust, including: Patents and copyrights.

A TOD beneficiary designation means Transfer on Death. Some financial institutions also call this a POD designation (or Pay on Death). Usually the people who name TOD beneficiaries on an account or transfer it to a Trust are trying to avoid probate.

Yes, a quit claim deed supercedes the trust. The only thing that can be done is to file a suit in court challenging the deed as the product of fraud and undue influence. A court action like that will cost thousands of dollars, but might be worth it if the house was owned free and clear.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

The advantages of placing your house in a trust include avoiding probate court, saving on estate taxes and possibly protecting your home from certain creditors. Disadvantages include the cost of creating the trust and the paperwork.

Take the signed and notarized quitclaim deed to your county recorder's office to complete the transfer of title into your revocable trust. Check in two to four weeks to ensure it has been recorded. Include the address of the property on the asset list addendum attached to your trust.