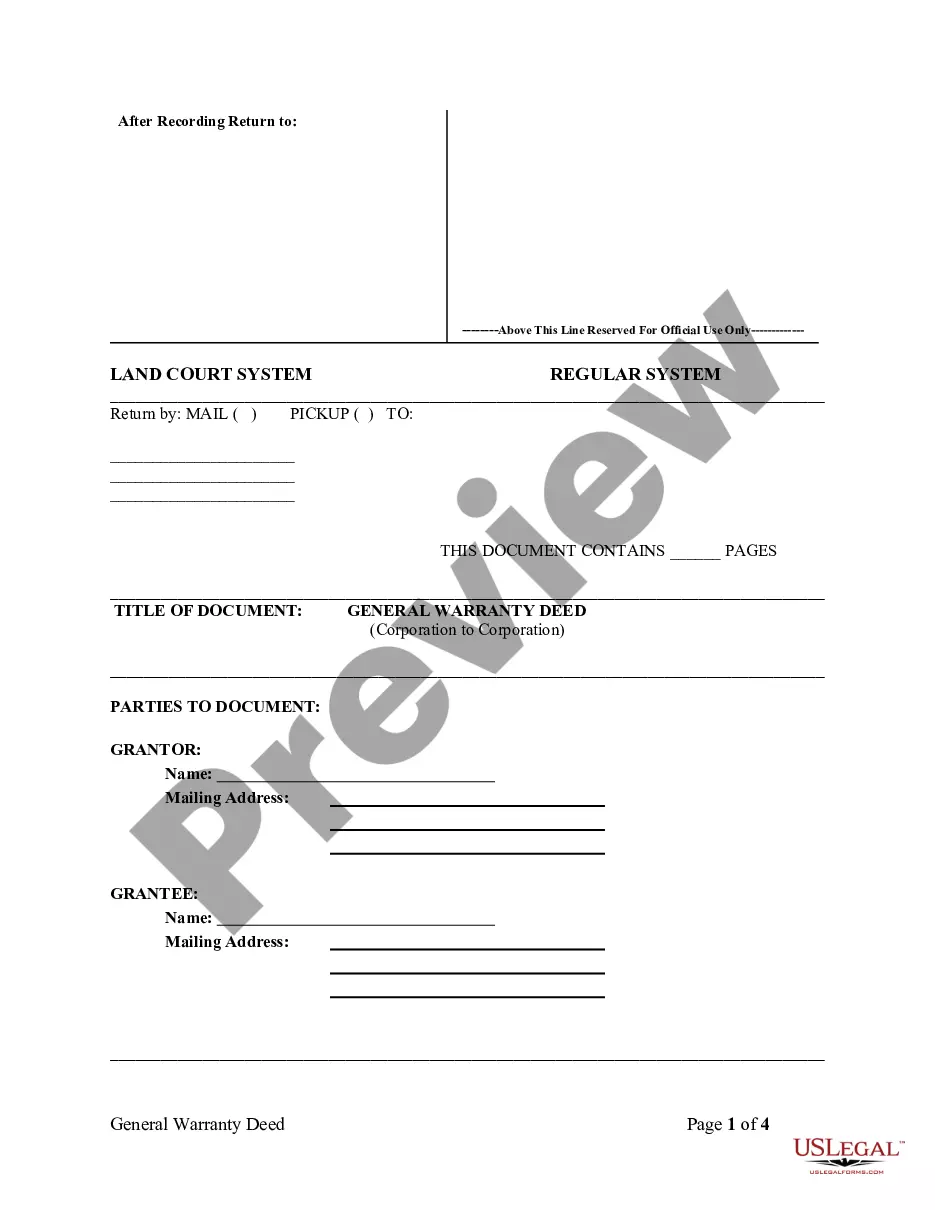

Hawaii Warranty Deed from Corporation to Corporation

Description Special Warranty Deed Form Hawaii

How to fill out Hawaii Warranty Deed From Corporation To Corporation?

Get access to the most extensive library of authorized forms. US Legal Forms is a platform where you can find any state-specific form in a few clicks, such as Hawaii Warranty Deed from Corporation to Corporation templates. No requirement to waste hours of your time seeking a court-admissible form. Our accredited experts make sure that you receive updated documents all the time.

To benefit from the forms library, pick a subscription, and sign-up your account. If you already registered it, just log in and click on Download button. The Hawaii Warranty Deed from Corporation to Corporation template will instantly get kept in the My Forms tab (a tab for all forms you download on US Legal Forms).

To register a new profile, follow the simple guidelines below:

- If you're proceeding to utilize a state-specific documents, be sure you indicate the appropriate state.

- If it’s possible, go over the description to know all the ins and outs of the document.

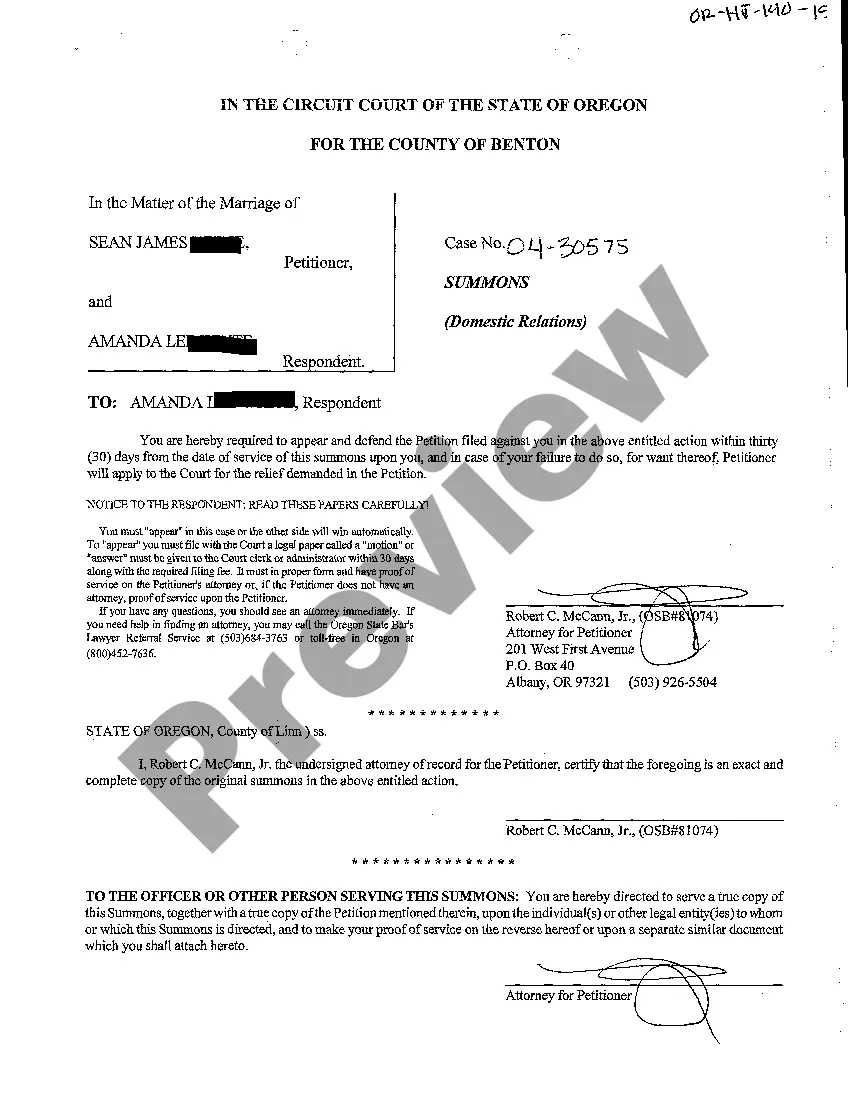

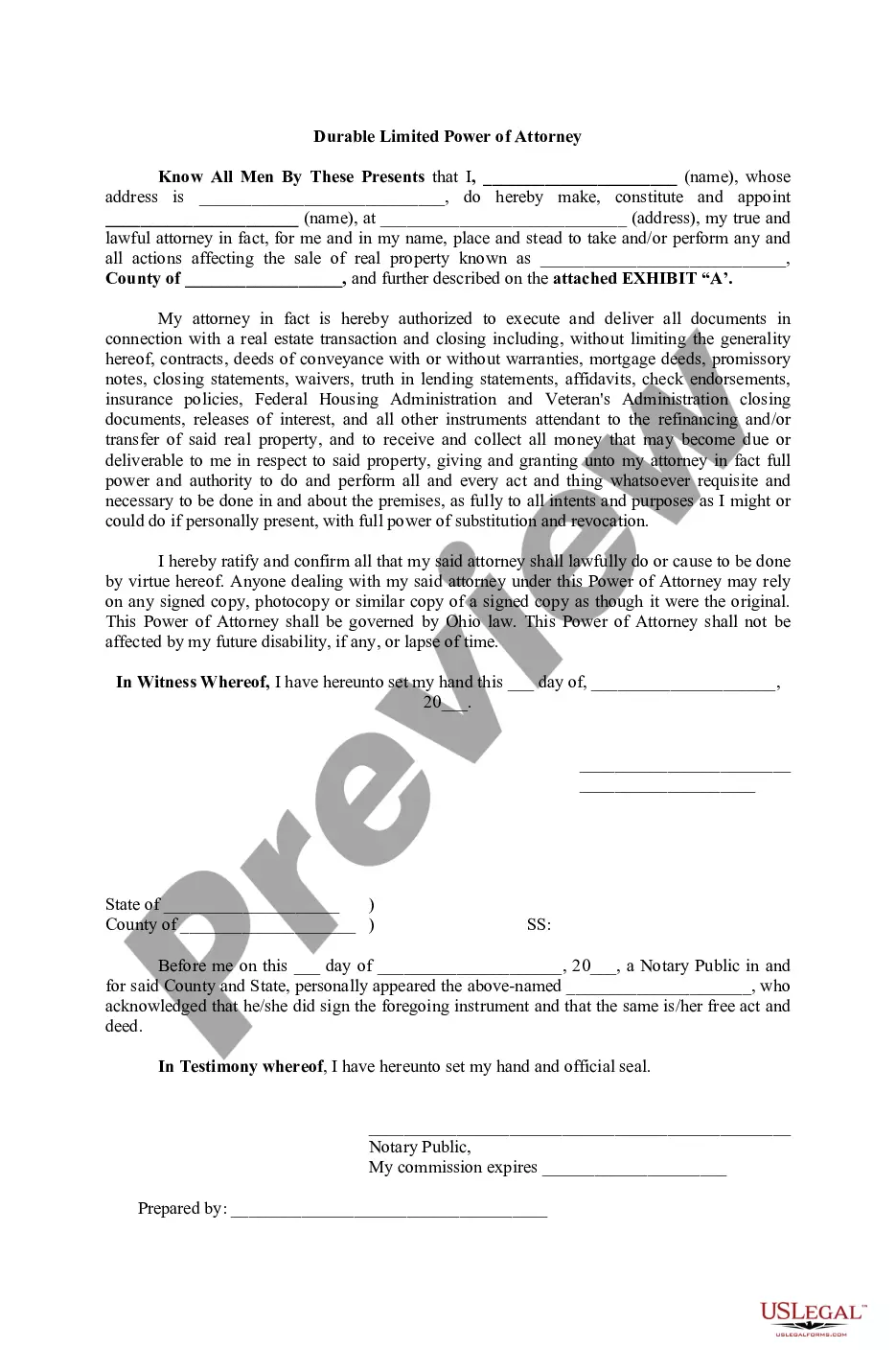

- Take advantage of the Preview function if it’s available to check the document's information.

- If everything’s right, click Buy Now.

- After choosing a pricing plan, register your account.

- Pay by card or PayPal.

- Save the sample to your computer by clicking Download.

That's all! You should submit the Hawaii Warranty Deed from Corporation to Corporation form and check out it. To make sure that things are correct, call your local legal counsel for assist. Sign up and easily look through above 85,000 beneficial templates.

Form popularity

FAQ

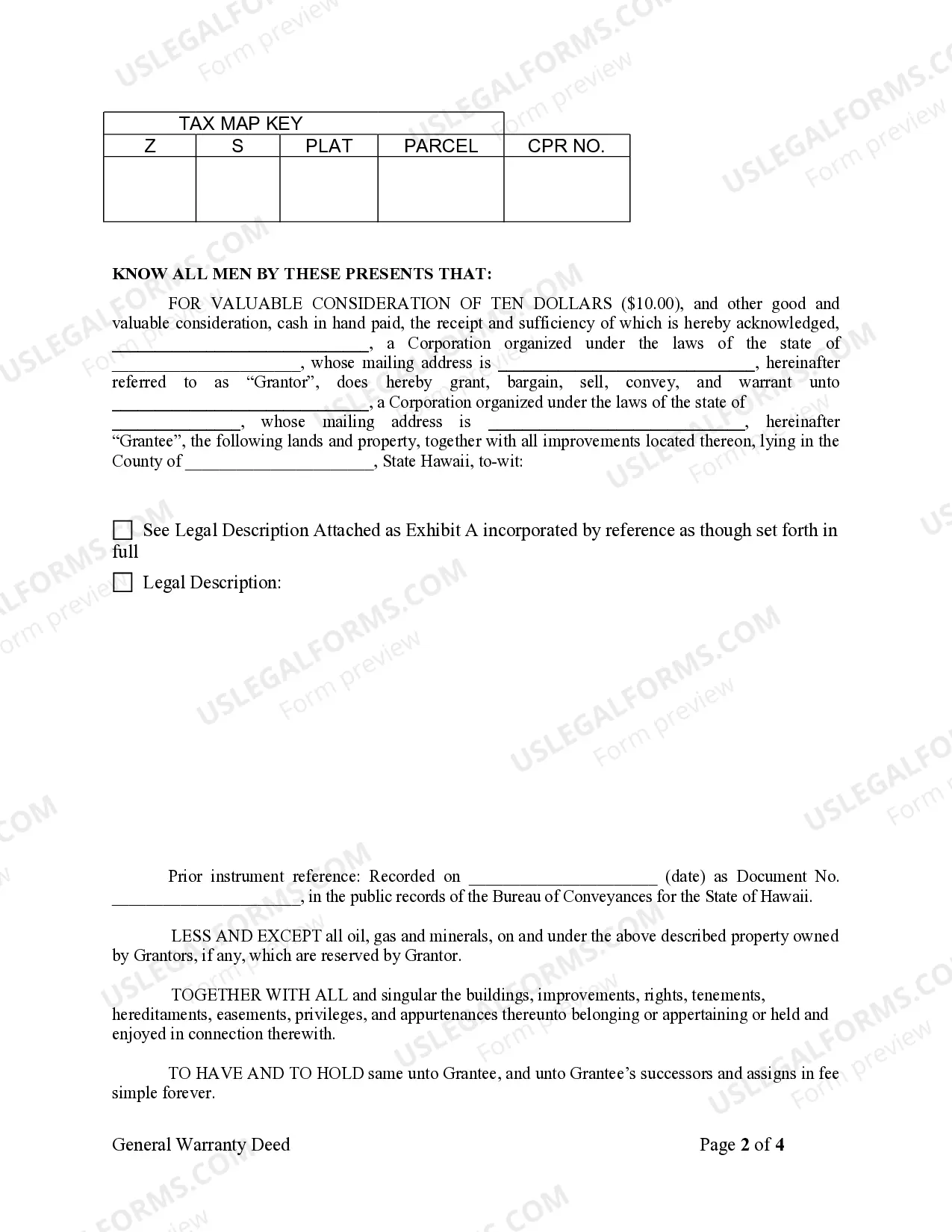

Let's start with the definition of a deed: DEED: A written instrument by which one party, the Grantor, conveys the title of ownership in property to another party, the Grantee. A Warranty Deed contains promises, called covenants, that the Grantor makes to the Grantee.

Corporate warranty deeds offer the seller's guarantee to the buyer in regards to the validity of the chain of title. Generally, special warranty deeds only protect against problems occurring since the seller purchased the property.

A statutory warranty deed is different from a warranty deed because it is a shorter form made available through your state's statutes and it may not outright list the promise that the title is guaranteed to be clear. Instead, because it is a statutory form, this guarantee is implied and is still legally enforceable.

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating

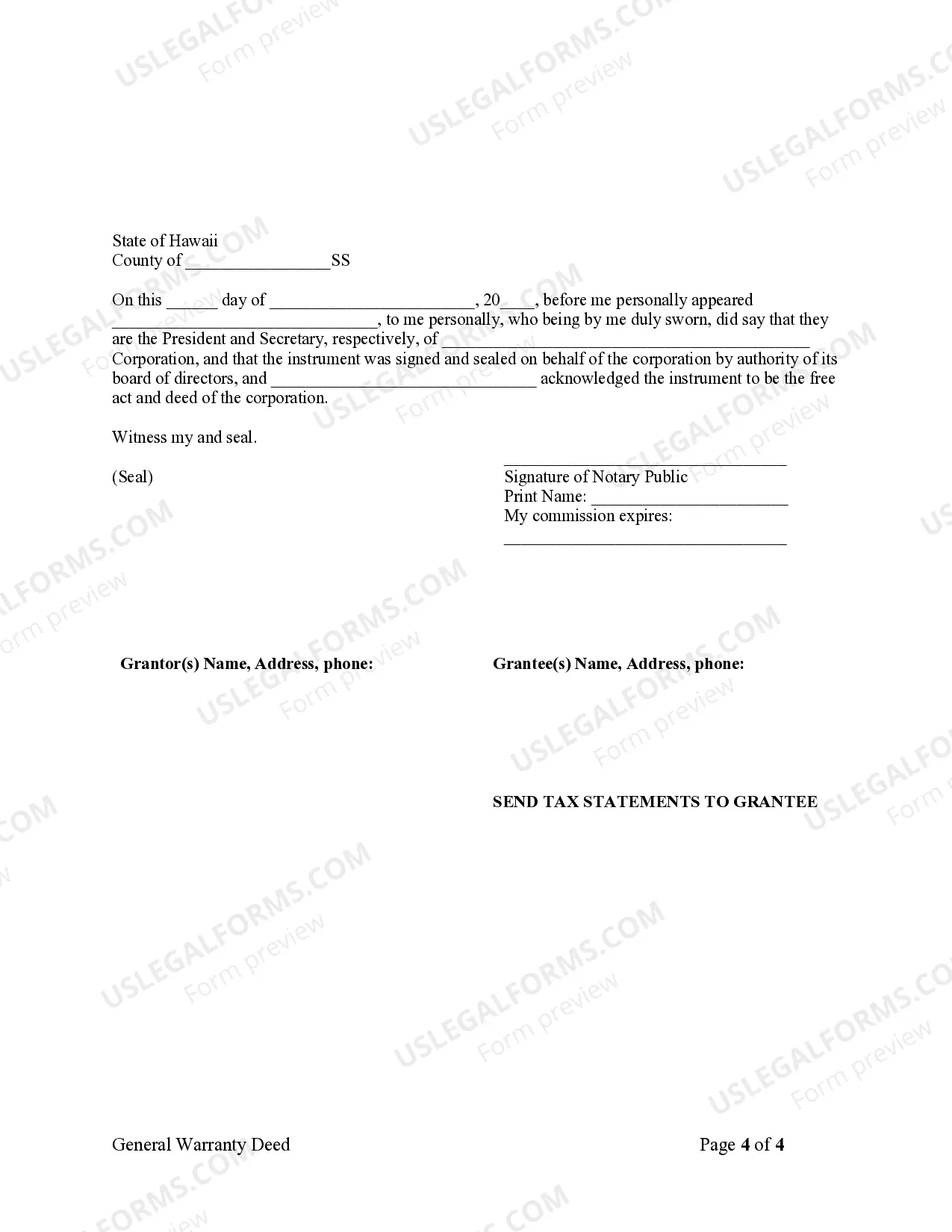

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

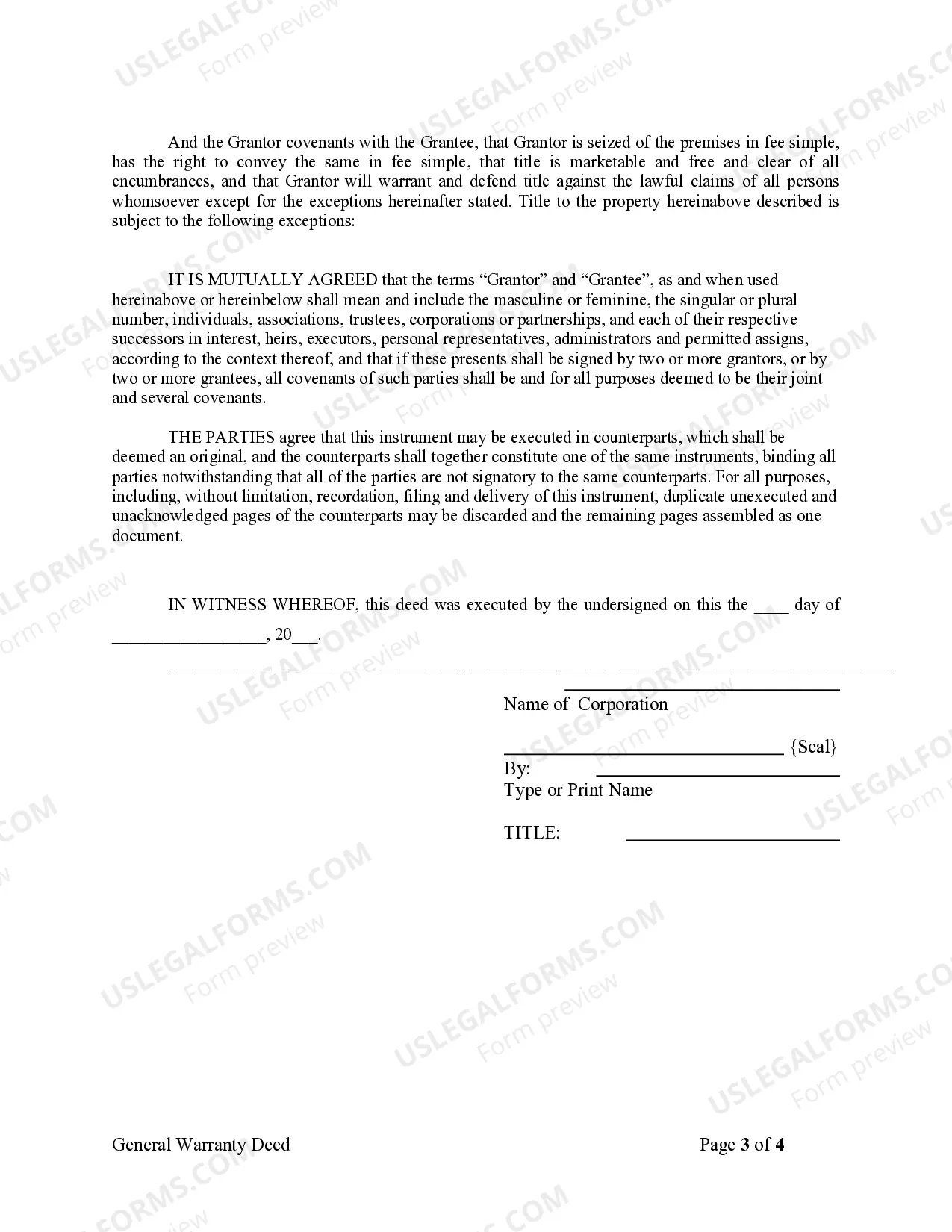

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

Contrary to normal expectations, the Deed DOES NOT have to be recorded to be effective or to show delivery, and because of that, the Deed DOES NOT have to be signed in front of a Notary Public. However, if you plan to record it, then it does have to be notarized as that is a County Recorder requirement.

Failure to record a deed effectively makes it impossible for the public to know about the transfer of a property. That means the legal owner of the property appears to be someone other than the buyer, a situation that can generate serious ramifications.

In order to make the Warranty Deed legally binding, the Seller needs to sign it front of a notary public. Then signed and notarized deed must be filed at the city or county office for recording property documents. Before filing with this office all previously billed property taxes must be paid in full.