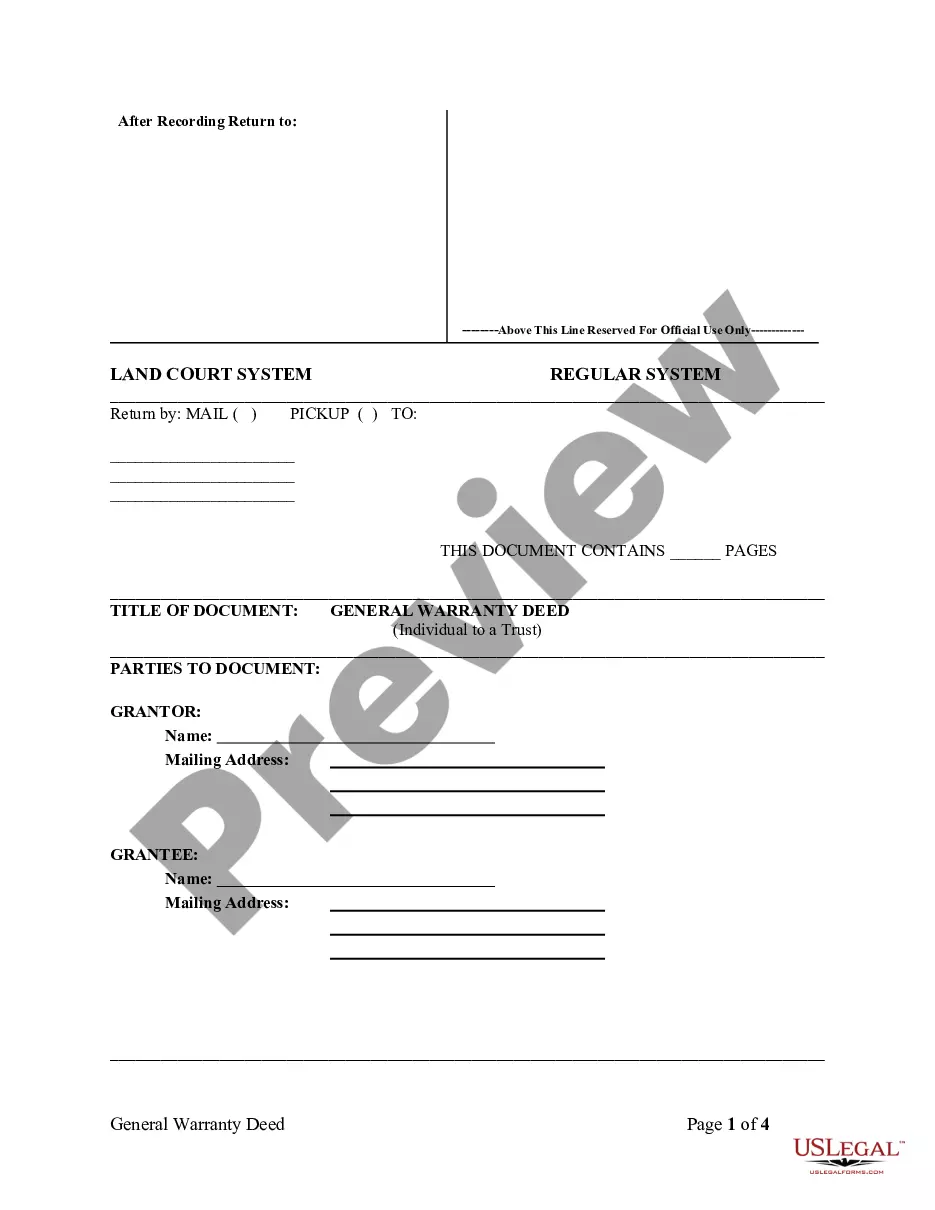

Hawaii Warranty Deed from Individual to a Trust

Description Hawaii Trust Contract

How to fill out Warranty Deed General Form Pdf?

Access one of the most holistic library of legal forms. US Legal Forms is actually a solution to find any state-specific document in couple of clicks, such as Hawaii Warranty Deed from Individual to a Trust templates. No need to waste several hours of your time searching for a court-admissible sample. Our qualified specialists make sure that you get up-to-date documents all the time.

To leverage the documents library, select a subscription, and register an account. If you registered it, just log in and then click Download. The Hawaii Warranty Deed from Individual to a Trust file will immediately get stored in the My Forms tab (a tab for all forms you download on US Legal Forms).

To register a new account, follow the brief recommendations below:

- If you're going to use a state-specific example, be sure to indicate the appropriate state.

- If it’s possible, review the description to understand all of the nuances of the document.

- Use the Preview option if it’s accessible to take a look at the document's content.

- If everything’s appropriate, click on Buy Now button.

- Right after picking a pricing plan, create an account.

- Pay out by credit card or PayPal.

- Downoad the sample to your device by clicking on Download button.

That's all! You ought to complete the Hawaii Warranty Deed from Individual to a Trust template and check out it. To make sure that everything is accurate, speak to your local legal counsel for help. Register and easily find around 85,000 useful forms.

Hawaii Trust Form popularity

Hawaii Purchase Date Other Form Names

Hawaii Trust Blank FAQ

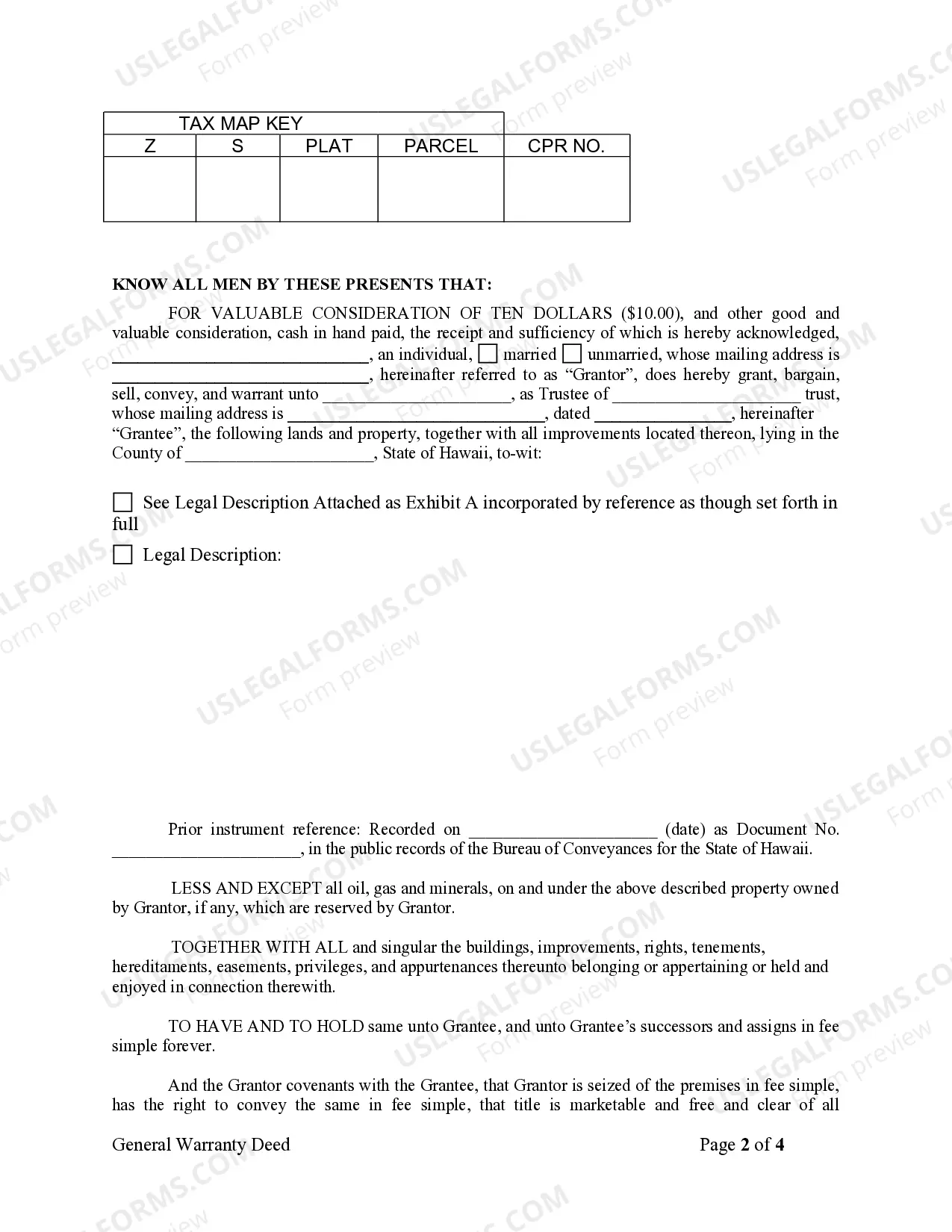

The mortgage company usually prepares this deed as part of the loan package and delivers it to the title company for you to sign at closing. The title company is commonly the trustee to the deed and holds legal title to the property until the loan gets fully repaid.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

Trustee's deeds convey real estate out of a trust.This type of conveyance is named for the person using the form the trustee who stands in for the beneficiary of the trust and holds title to the property.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

A trustee deed offers no such warranties about the title.

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

The deed did not meet the written requirements (such as if it failed to accurately describe the property); The deed was forged; The deed was induced by fraud, misrepresentation, coercion, duress, or undue influence; The deed was not delivered, or not delivered properly, and there was no acceptance by the grantee.

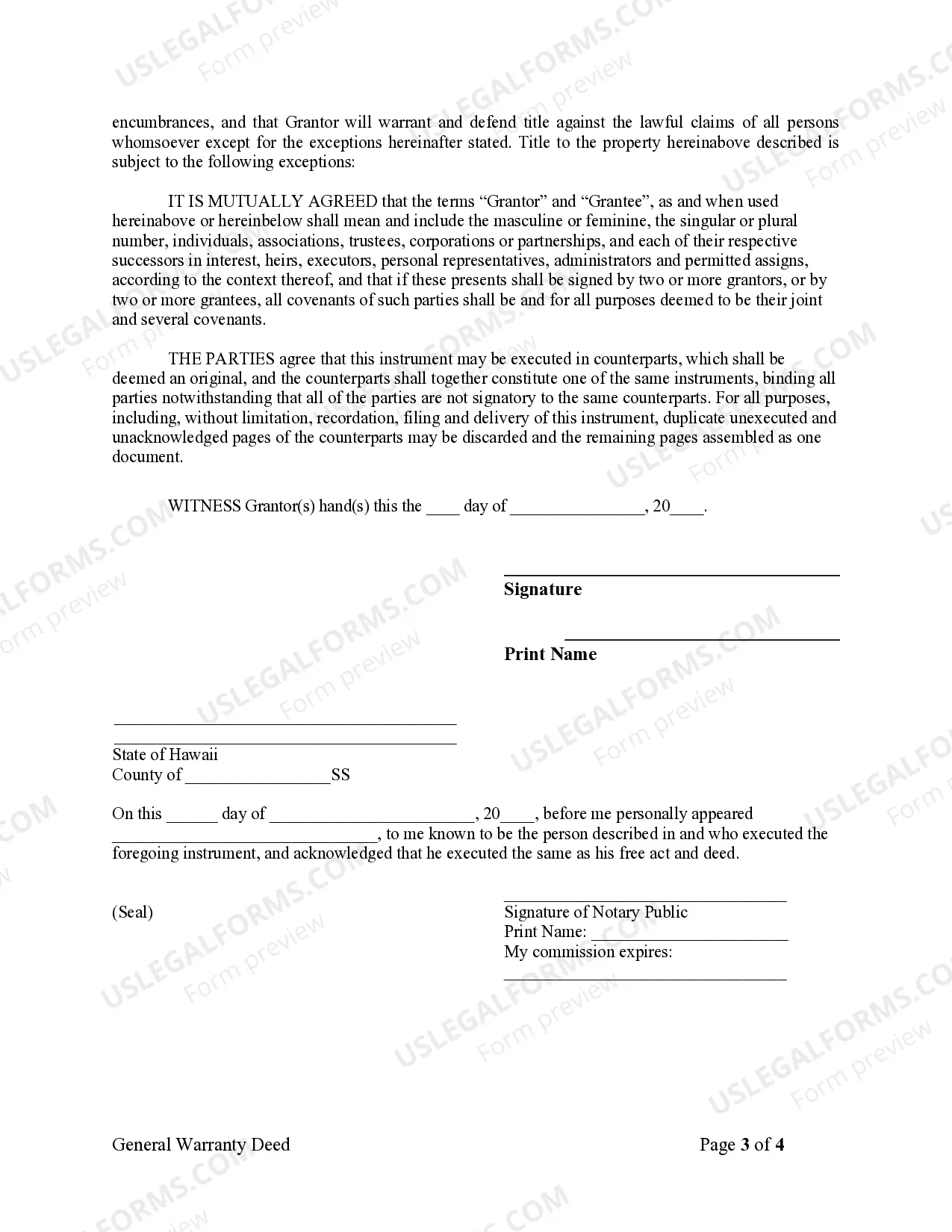

Contrary to normal expectations, the Deed DOES NOT have to be recorded to be effective or to show delivery, and because of that, the Deed DOES NOT have to be signed in front of a Notary Public. However, if you plan to record it, then it does have to be notarized as that is a County Recorder requirement.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.