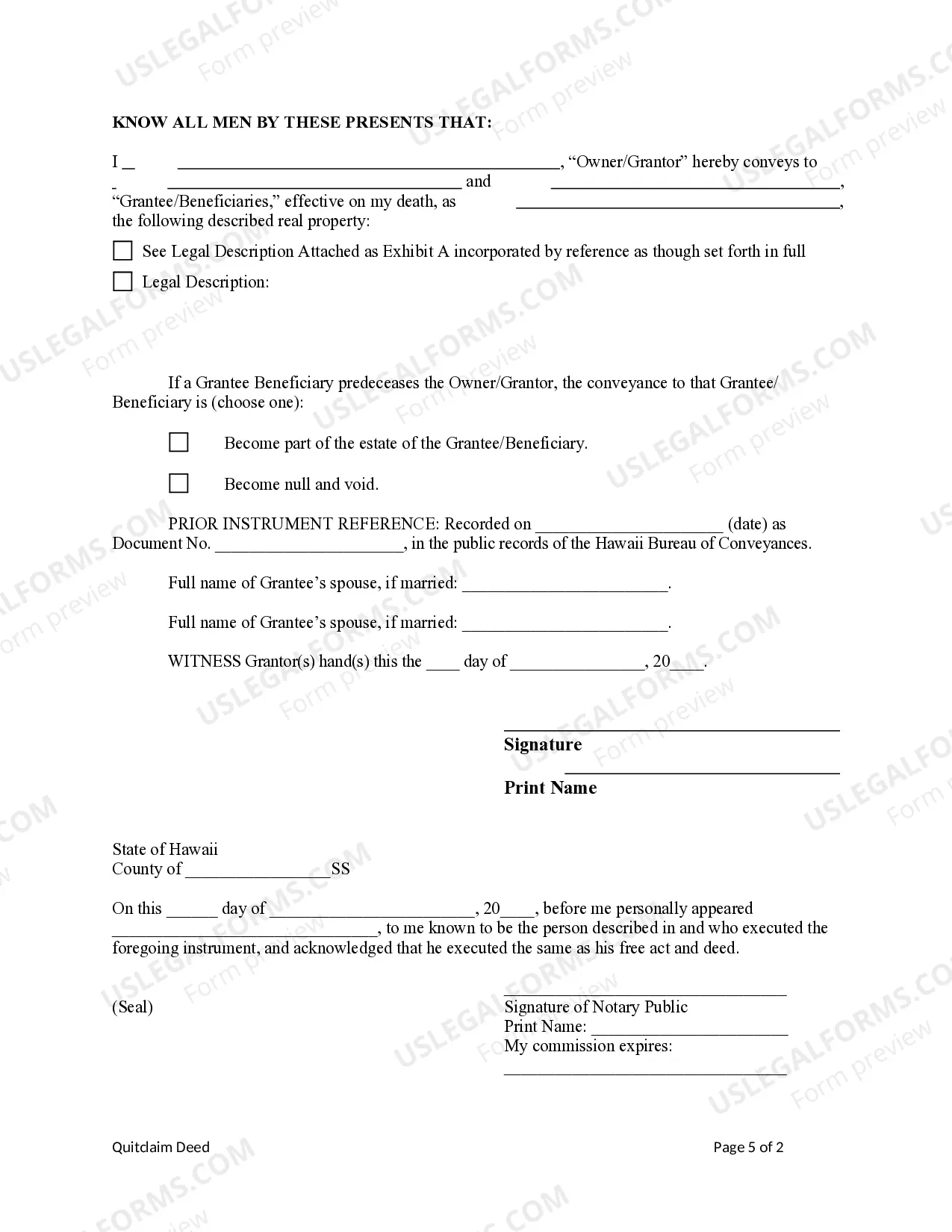

This form is a Transfer on Death Deed where the Grantor is an individual and the Grantees are two individuals or Husband and Wife. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. This deed complies with all state statutory laws.

Hawaii Transfer on Death Quitclaim Deed from Individual to Two Individuals or Husband and Wife

Description Hawaii Transfer Death Deed Form

How to fill out Transfer Death Individual?

Access one of the most extensive library of authorized forms. US Legal Forms is actually a system to find any state-specific file in couple of clicks, such as Hawaii Transfer on Death Quitclaim Deed from Individual to Two Individuals or Husband and Wife samples. No need to spend hrs of your time trying to find a court-admissible sample. Our accredited professionals ensure you get up-to-date examples every time.

To benefit from the forms library, choose a subscription, and sign up an account. If you created it, just log in and click on Download button. The Hawaii Transfer on Death Quitclaim Deed from Individual to Two Individuals or Husband and Wife sample will instantly get saved in the My Forms tab (a tab for every form you download on US Legal Forms).

To create a new account, follow the brief instructions below:

- If you're having to use a state-specific sample, make sure you indicate the right state.

- If it’s possible, look at the description to know all of the nuances of the form.

- Take advantage of the Preview function if it’s offered to check the document's information.

- If everything’s correct, click on Buy Now button.

- After picking a pricing plan, create an account.

- Pay out by credit card or PayPal.

- Downoad the document to your computer by clicking on Download button.

That's all! You should fill out the Hawaii Transfer on Death Quitclaim Deed from Individual to Two Individuals or Husband and Wife template and check out it. To be sure that things are accurate, call your local legal counsel for help. Join and easily browse above 85,000 helpful templates.

Transfer Deed Form Form popularity

Transfer Death Deed Sample Other Form Names

Transfer Death Deed Blank FAQ

When someone who owns real property dies, the property goes into probate or it automatically passes, by operation of law, to surviving co-owners. Often, surviving co-owners do nothing with the title for as long as they own the property. Yet the best practice is to remove the deceased owner's name from the title.

If the deceased owned real property in NSW as 'joint tenants' with another person, the property will need to be transferred to the surviving joint tenant.You do not need to apply for a grant of probate or letters of administration to transfer property held in joint names.

If the deceased was sole owner, or co-owned the property without right of survivorship, title passes according to his will. Whoever the will names as the beneficiary to the house inherits it, which requires filing a new deed confirming her title. If the deceased died intestate -- without a will -- state law takes over.

If one co-owner dies, their interest in the property automatically passes to the surviving co-owner(s), whether or not they have a will. As tenants in common, co-owners own specific shares of the property. Each owner can leave their share of the property to whoever they choose.

To transfer it, you will have to get a succession certificate (for moveable property) and a letter of administration (for Immoveable property). While doing so, get the son and daughter to give no objections in court that they have no objection if all the property is transferred to the widow.

In case a male dies intestate, i.e. without making a will, his assets shall be distributed according to the Hindu Succession Act and the property is transferred to the legal heirs of the deceased. The legal heirs are further classified into two classes- class I and class II.

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.

So long as the quitclaim deed is valid (properly notarized, etc.) it can be recorded even after the grantor's death, so property owned by the deceased which has been deeded in that quitclaim deed should not need to pass through probate.

A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.