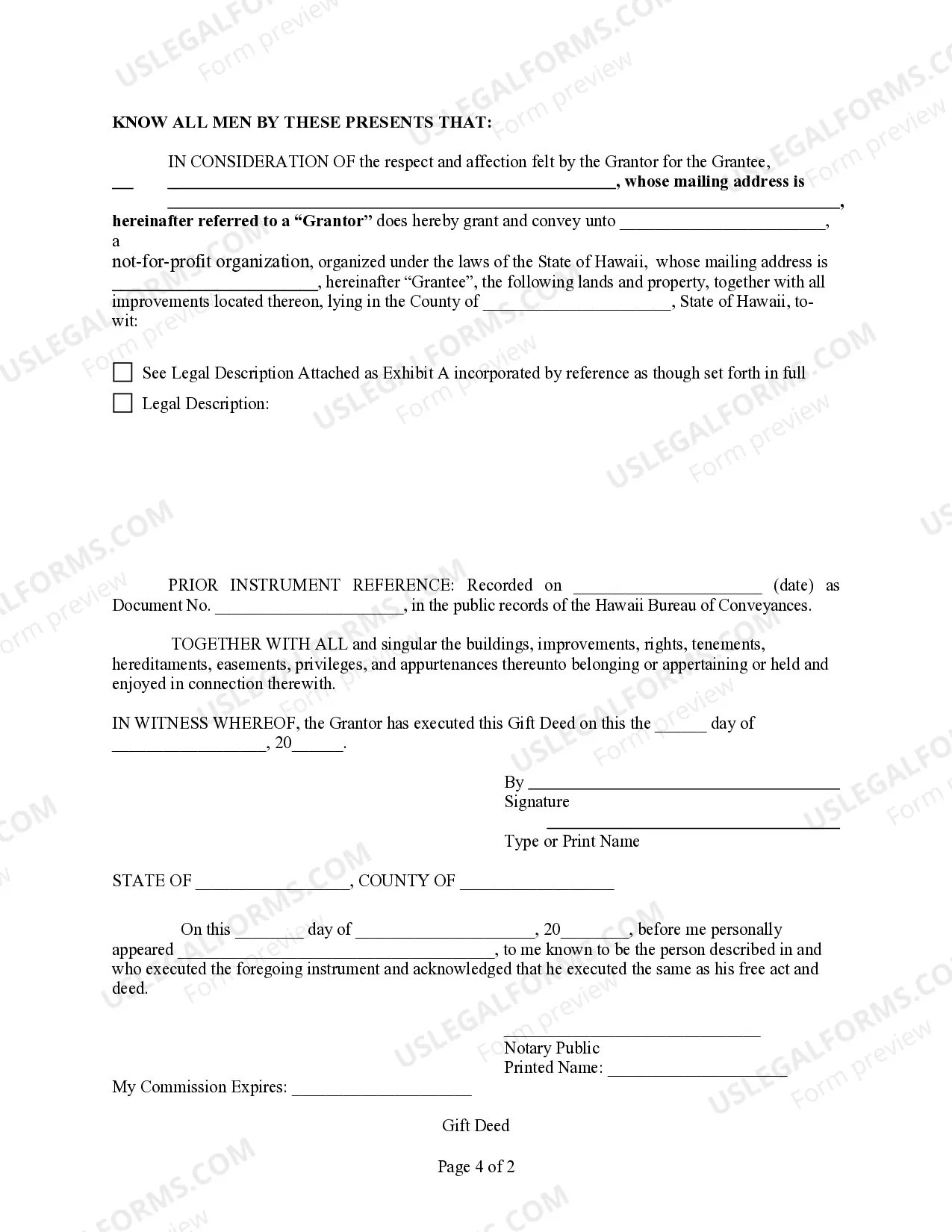

This form is a Gift Deed where the grantor is an individual and the grantee is an Unincorporated Association or a Not-for-Profit Organization. Grantor conveys and grants the described property to the grantee. This deed complies with all state statutory laws.

Hawaii Gift Deed from an Individual to an Unincorporated Association or a Not-for-Profit organization

Description Hawaii Unincorporated Editable

How to fill out Hawaii Unincorporated Purchase?

Get access to one of the most holistic catalogue of legal forms. US Legal Forms is actually a solution to find any state-specific file in a few clicks, even Hawaii Gift Deed from an Individual to an Unincorporated Association or a Not-for-Profit organization samples. No need to spend hours of your time trying to find a court-admissible example. Our qualified specialists ensure you get up to date examples all the time.

To benefit from the forms library, pick a subscription, and create your account. If you did it, just log in and then click Download. The Hawaii Gift Deed from an Individual to an Unincorporated Association or a Not-for-Profit organization file will immediately get saved in the My Forms tab (a tab for all forms you save on US Legal Forms).

To register a new account, follow the brief guidelines listed below:

- If you're going to utilize a state-specific example, make sure you indicate the right state.

- If it’s possible, review the description to understand all of the ins and outs of the form.

- Use the Preview function if it’s available to take a look at the document's content.

- If everything’s correct, click Buy Now.

- Right after choosing a pricing plan, create an account.

- Pay by credit card or PayPal.

- Save the sample to your computer by clicking Download.

That's all! You should complete the Hawaii Gift Deed from an Individual to an Unincorporated Association or a Not-for-Profit organization form and check out it. To be sure that things are exact, call your local legal counsel for support. Join and simply find over 85,000 helpful forms.

Hawaii Unincorporated Online Form popularity

Hawaii Unincorporated Contract Other Form Names

Not For Profit Organization FAQ

To set up an unincorporated association, all you need to do is write and agree a constitution in your group. If you do not plan to become a charity, your constitution should lay out whatever aims you want for your group.

An unincorporated association is not a legal entity. It is an organisation of two or more persons, who are the members of the association.The affairs of an unincorporated association are usually managed by a committee chosen by the members. An unincorporated association does not have limited liability.

Whenever two or more people decide to work together to accomplish a common purpose, they've formed an unincorporated association. If that purpose is to generate a profit, then the unincorporated association they've formed is a partnership or a joint venture.

Common examples of unincorporated associations include local sports clubs, investment clubs, residents' associations and voluntary organisations. Unincorporated associations may have trading or business objectives, carry on commercial activities or have a charitable purpose.

If you are not worried about liability, an unincorporated association may serve you well. If you are concerned with liability, you should probably choose incorporation. For most states, there is no application system to be an unincorporated nonprofit association. You can go straight to step 2 and apply for an EIN.

Most corporations don't get 1099-MISCs But not an LLC that's treated as an S-Corporation or C-Corporation. Here's another way to remember: Sole proprietor = Do send 1099-MISC. Unincorporated contractor or partnership/LLP = Do send 1099-MISC.

Both nonprofit organizations and associations are tax-exempt. Both types of entity can make a profit; however, they must retain or reinvest their profits in their organizations.

An unincorporated association is defined as an association of two or more persons formed for some religious, educational, charitable, social or other non-commercial purpose.

An unincorporated association serving in a volunteer capacity for the public good is considered an unincorporated nonprofit association. These organizations do not have to pay taxes or file a tax return if they have no more than $5,000 in revenues.