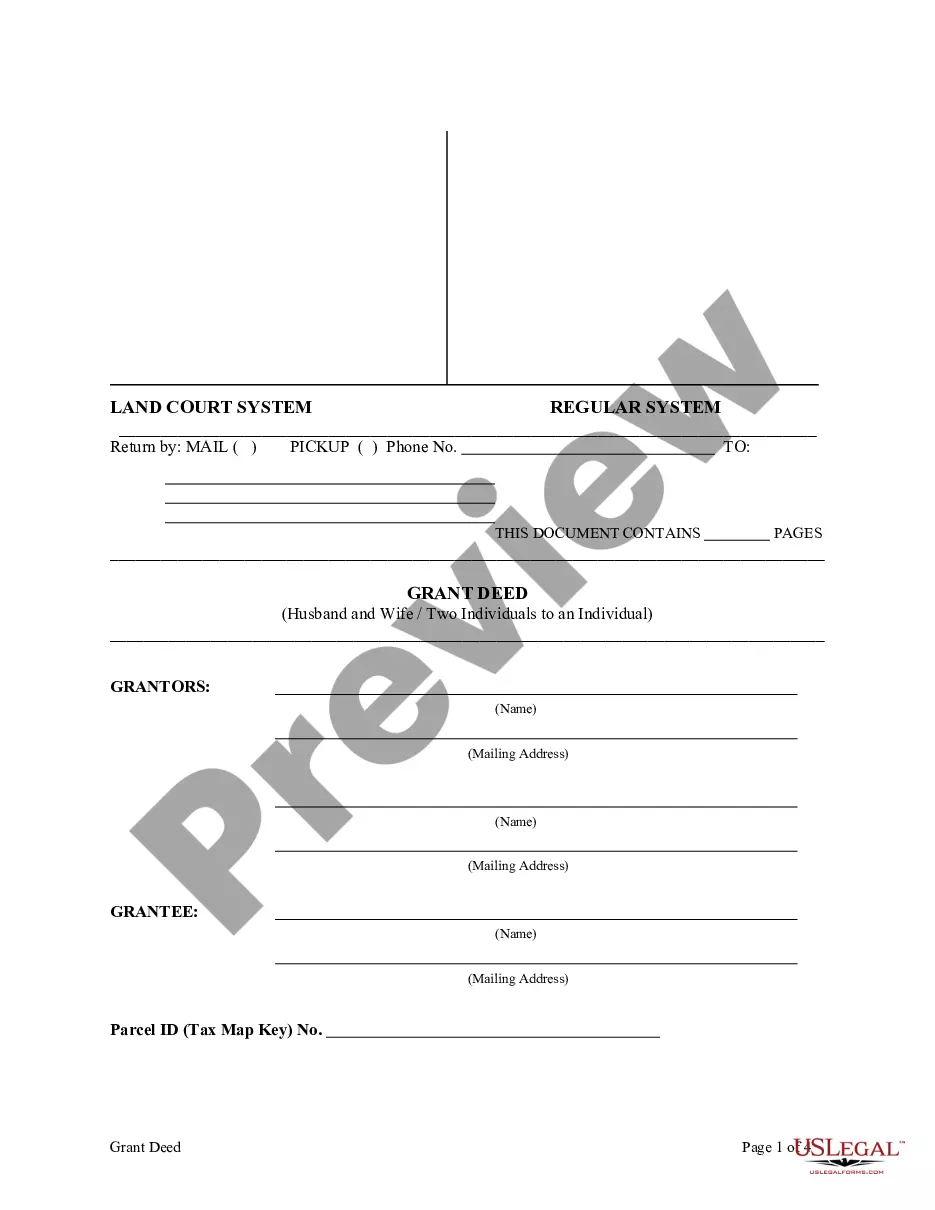

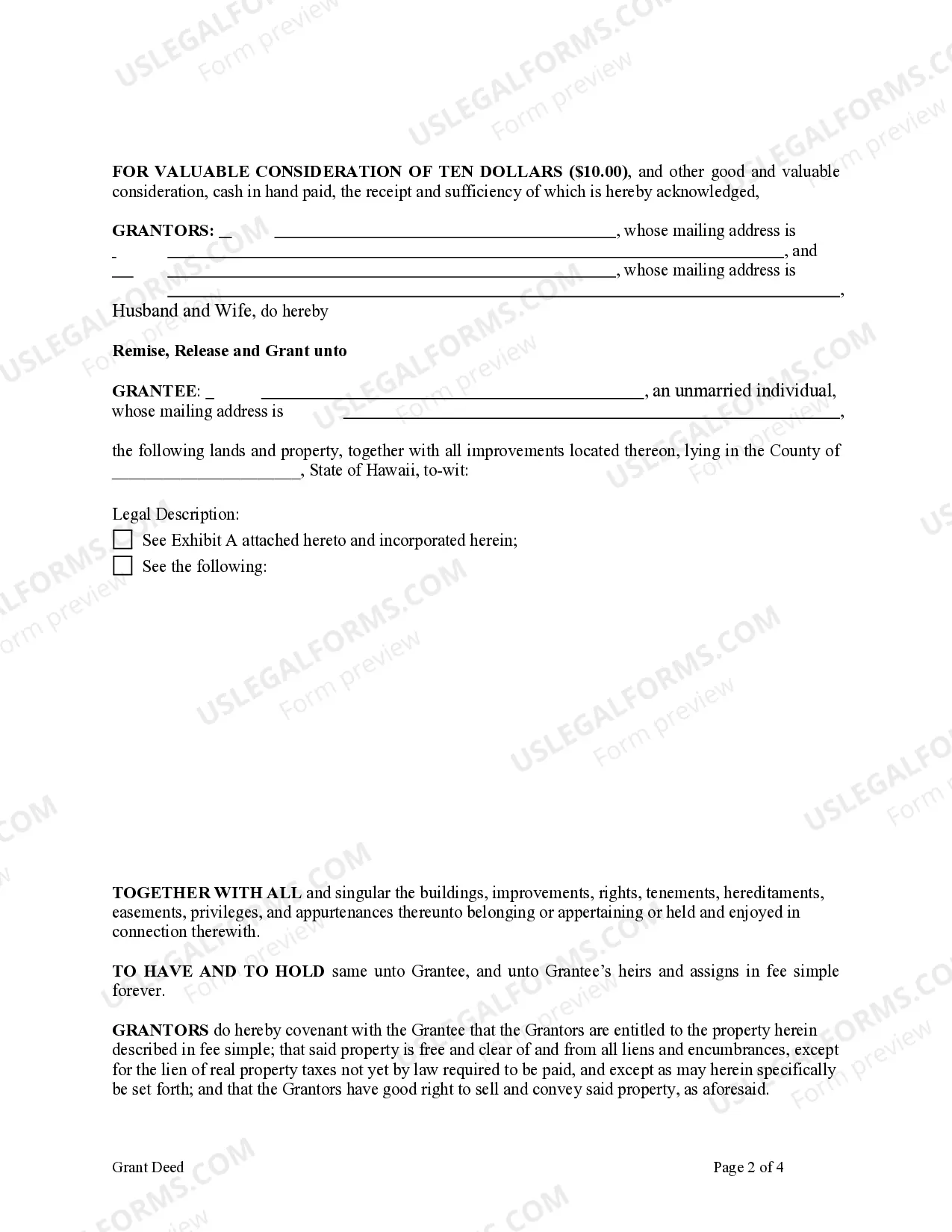

This form is a Grant Deed where the Grantors are Husband and Wife, or two individuals, and the Grantee is an Individual. Grantors grant and remise the described property to Grantee. This deed complies with all state statutory laws.

Hawaii Grant Deed from Husband and Wife, or two Individuals, to an Individual

Description

How to fill out Hawaii Grant Deed From Husband And Wife, Or Two Individuals, To An Individual?

Access one of the most extensive catalogue of authorized forms. US Legal Forms is really a system to find any state-specific document in clicks, even Hawaii Grant Deed from Husband and Wife, or two Individuals, to an Individual templates. No need to spend several hours of your time seeking a court-admissible sample. Our certified pros ensure that you receive up to date examples every time.

To benefit from the documents library, choose a subscription, and sign-up an account. If you registered it, just log in and then click Download. The Hawaii Grant Deed from Husband and Wife, or two Individuals, to an Individual file will automatically get saved in the My Forms tab (a tab for every form you save on US Legal Forms).

To create a new account, follow the quick guidelines listed below:

- If you're having to utilize a state-specific example, make sure you indicate the correct state.

- If it’s possible, look at the description to understand all of the ins and outs of the document.

- Make use of the Preview function if it’s accessible to look for the document's content.

- If everything’s appropriate, click on Buy Now button.

- After picking a pricing plan, register an account.

- Pay by credit card or PayPal.

- Downoad the sample to your device by clicking on Download button.

That's all! You ought to fill out the Hawaii Grant Deed from Husband and Wife, or two Individuals, to an Individual template and check out it. To ensure that things are correct, call your local legal counsel for support. Sign up and simply look through more than 85,000 useful forms.

Form popularity

FAQ

Grantor's name. Grantee's name and address. Description of grantee (ex: unmarried man, husband and wife, joint tenants) Person who requested grant deed. Address of real estate that is being transferred. Legal description of property (lot number) Original title order number for property.

A California Interspousal Transfer Grant Deed is used to create, transfer, or terminate a real property ownership interest between spouses. This instrument applies to a present owner's interest and has been drafted to comply with the Revenue and Taxation Code Section 63.

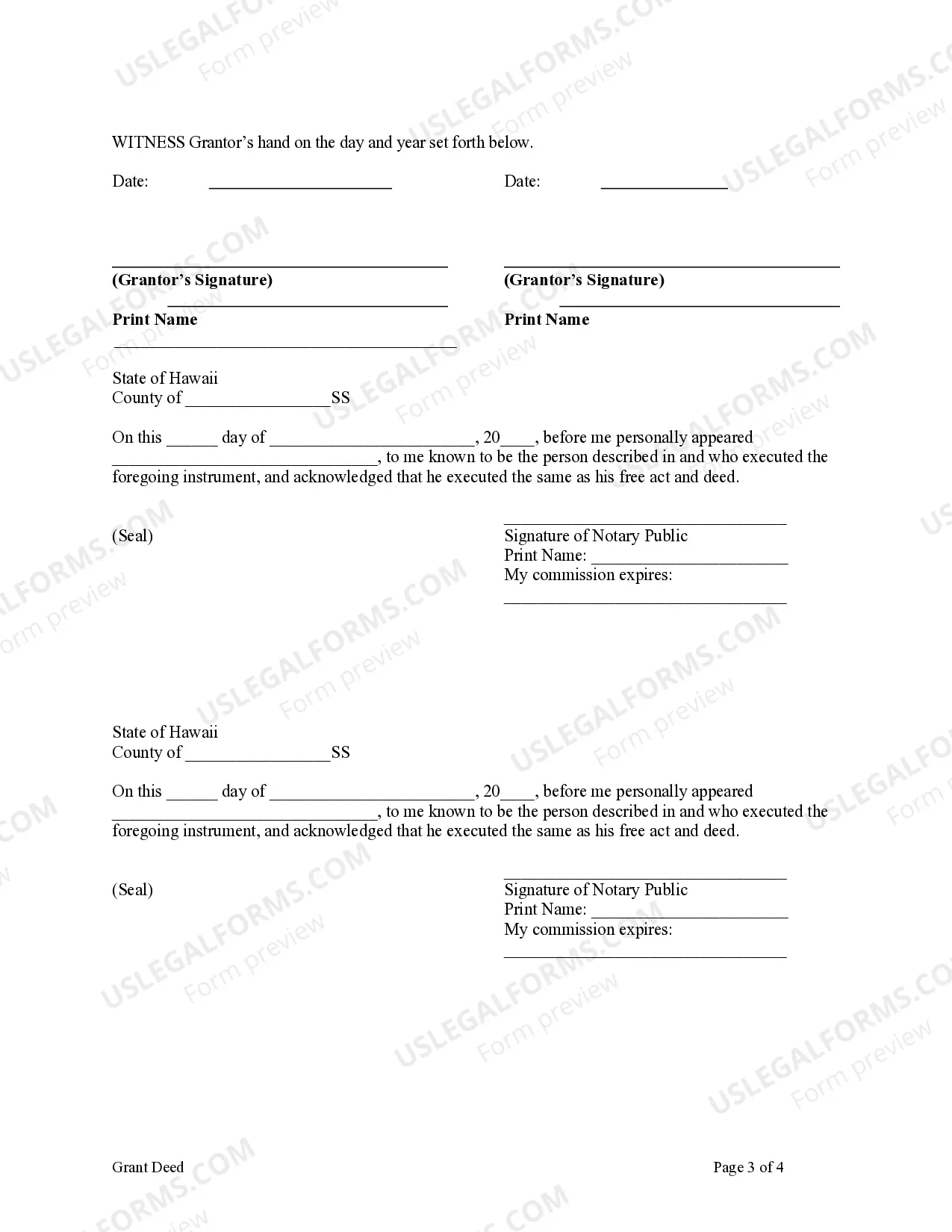

Print a grant deed from an online source. Sign the document in the presence of a notary public. Take the deed to the recorder's office in the county where the property is located.

The seller or the seller's broker will hire an attorney to prepare the real estate deed to ensure that all of the requirements in the creation of a valid deed are met before the seller conveys title to the property. All real estate deeds must be in writing.

Contrary to normal expectations, the Deed DOES NOT have to be recorded to be effective or to show delivery, and because of that, the Deed DOES NOT have to be signed in front of a Notary Public. However, if you plan to record it, then it does have to be notarized as that is a County Recorder requirement.

Two of the most common ways to transfer property in a divorce are through an interspousal transfer deed or quitclaim deed. When spouses own property together, but then one spouse executes an interspousal transfer or a quitclaim deed, this is known as transmutation.

No law forbids adding someone to your mortgaged home's deed or in signing your home over to others through one. Mortgage lenders understand deeds, though, and use loan due-on-sale clauses to prevent unauthorized property sales or transfers.

A grant deed is the instrument used to transfer title to an interest in real property from one owner to someone else.A deed of trust is the security instrument given to a lender to secure a loan or other obligation. Bare naked title is deeded to the trustee, who holds the power of sale or the power to re-convey.

In states like California and Florida, the spouses may use a quitclaim deed to transfer the property without warranting title. Other stateslike Texasrecognize a similar type of deed called a deed without warranty.