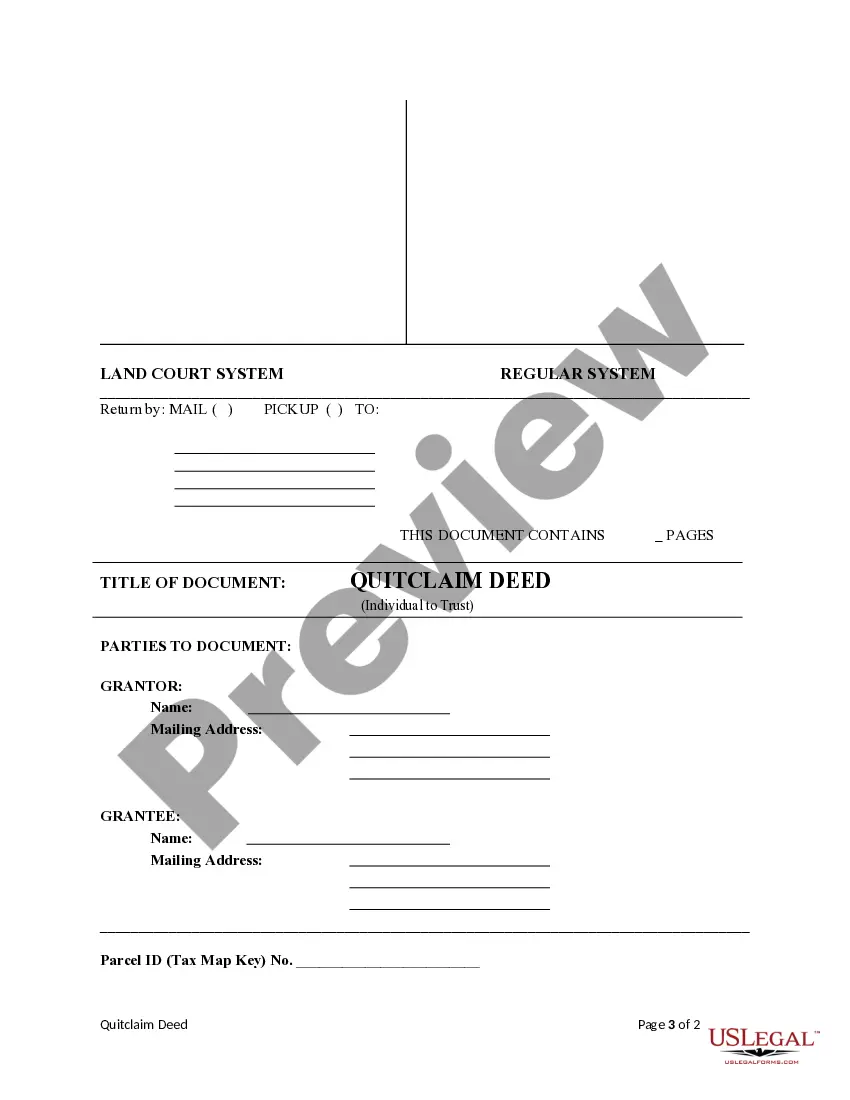

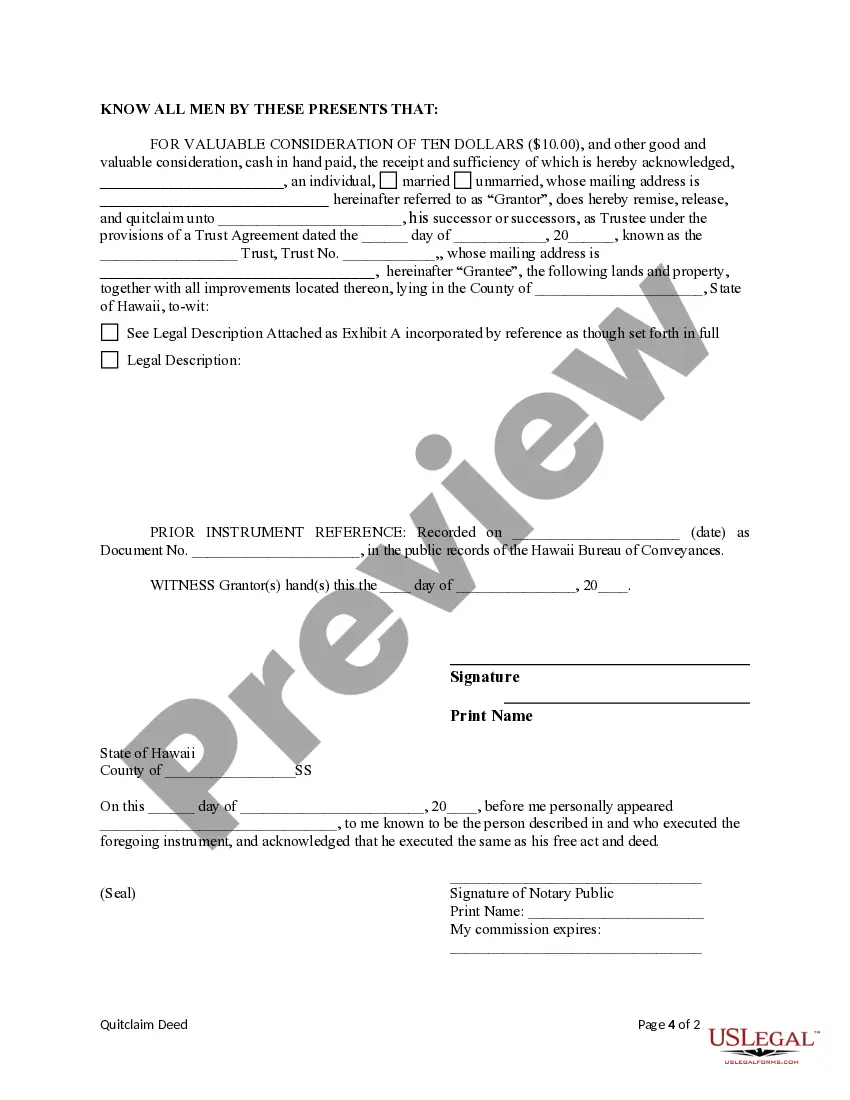

This form is a Quitclaim Deed where the Grantor is an individual and the Grantee is an individual. Grantor conveys and quitclaims any interest Grantor might have in the described property to Grantee. This deed complies with all state statutory laws.

Hawaii Quitclaim Deed from an Individual to a Trust

Description Hawaii Quit Claim Deed

How to fill out Hawaii Quitclaim Deed From An Individual To A Trust?

Get access to the most extensive library of authorized forms. US Legal Forms is really a solution where you can find any state-specific file in a few clicks, such as Hawaii Quitclaim Deed from an Individual to a Trust samples. No reason to spend time of your time searching for a court-admissible sample. Our qualified professionals make sure that you receive up to date documents every time.

To leverage the documents library, pick a subscription, and register an account. If you already did it, just log in and click on Download button. The Hawaii Quitclaim Deed from an Individual to a Trust file will automatically get stored in the My Forms tab (a tab for every form you download on US Legal Forms).

To create a new account, look at short instructions below:

- If you're proceeding to utilize a state-specific example, be sure you indicate the correct state.

- If it’s possible, look at the description to learn all the nuances of the document.

- Make use of the Preview option if it’s offered to take a look at the document's content.

- If everything’s right, click on Buy Now button.

- After picking a pricing plan, create your account.

- Pay by credit card or PayPal.

- Downoad the document to your device by clicking Download.

That's all! You should submit the Hawaii Quitclaim Deed from an Individual to a Trust template and check out it. To make sure that all things are accurate, contact your local legal counsel for help. Sign up and simply look through around 85,000 valuable templates.

Form popularity

FAQ

Yes, a quit claim deed supercedes the trust. The only thing that can be done is to file a suit in court challenging the deed as the product of fraud and undue influence. A court action like that will cost thousands of dollars, but might be worth it if the house was owned free and clear.

How To Establish A Trust. You will need to retain an estate attorney to draft and execute your trust document. For a simple revocable or irrevocable trust, it may cost anywhere from $2,000 $5,000.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

Transferring Real Property to a Trust You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).

No. And unless the deed identifies the trust as an owner, then father is the owner of an interest. It is a common mistake to set up a trust and then fail to deed property into the trust. However, you cannot force him to make the changes you are...

The act of transferring a property that is owned by an individual into a trust, will see the trust liable to pay stamp duty on acquisition of the asset. Additionally, the individual who is transferring ownership to the trust, will be liable to pay capital gains tax on the disposal of the asset.

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

No. And unless the deed identifies the trust as an owner, then father is the owner of an interest. It is a common mistake to set up a trust and then fail to deed property into the trust. However, you cannot force him to make the changes you are...

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.