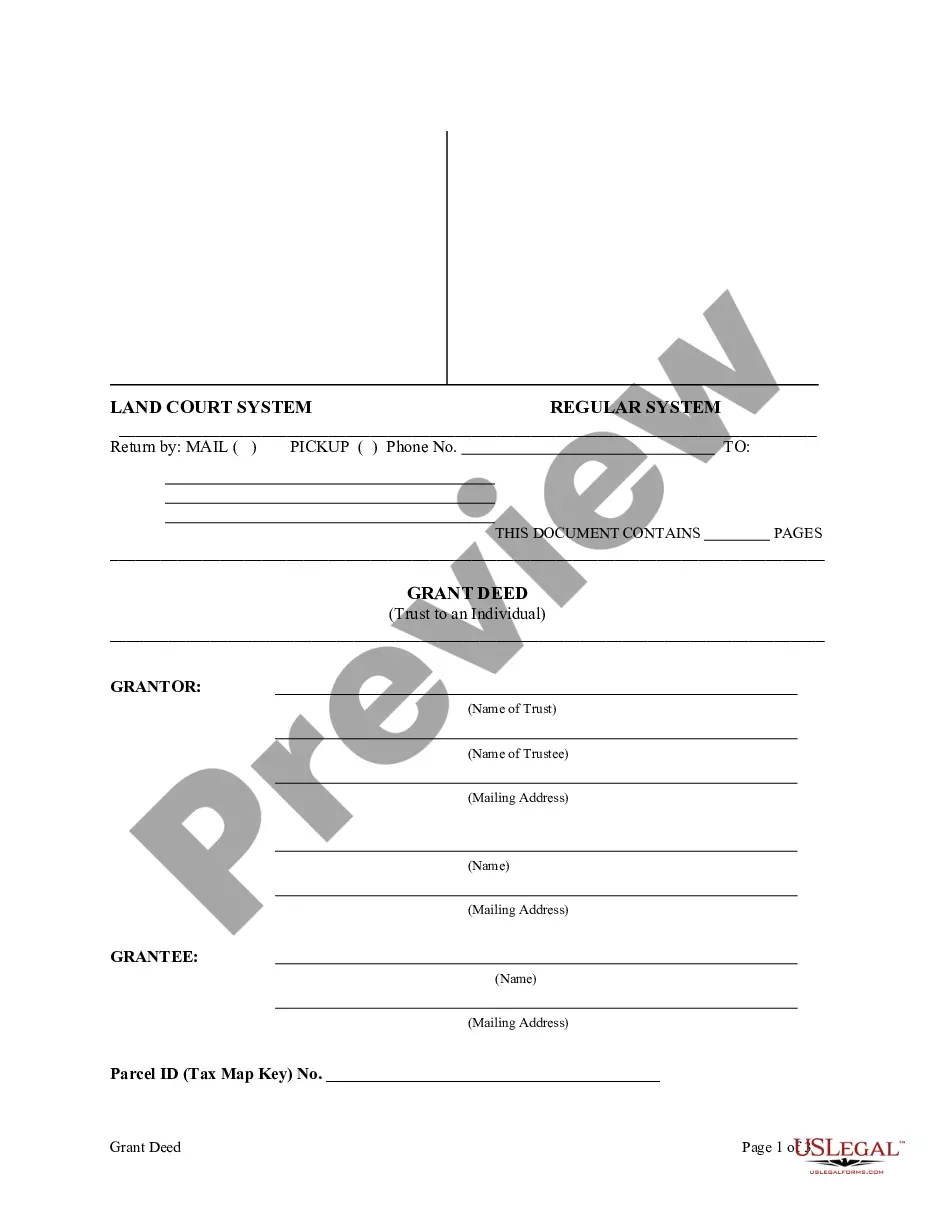

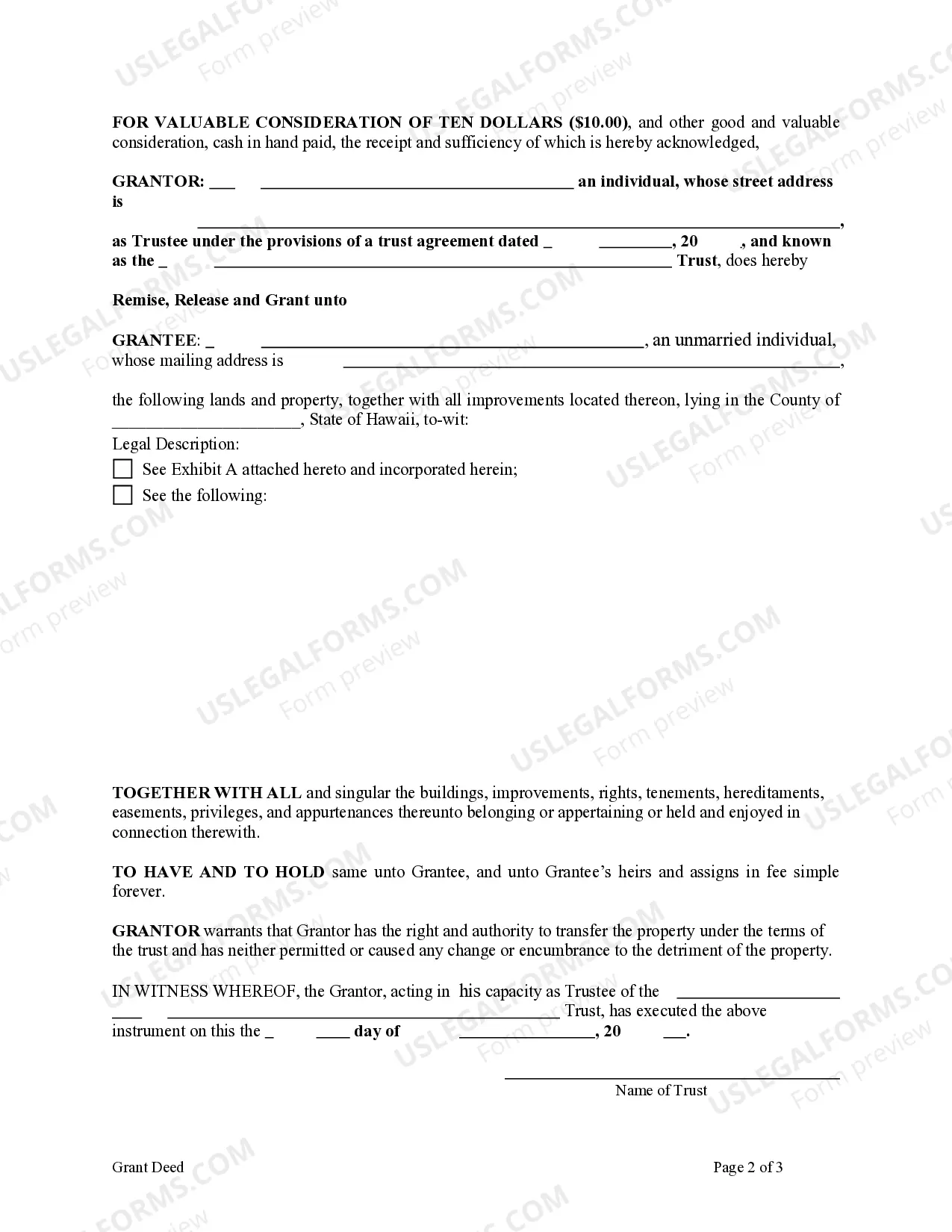

This form is a Warranty Deed where the Grantor is a Trust and the Grantee is an Individual. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Hawaii Warranty Deed from a Trust to an Individual

Description Deed Trust Form

How to fill out Hawaii Warranty?

Get access to the most comprehensive catalogue of authorized forms. US Legal Forms is really a platform where you can find any state-specific document in a few clicks, even Hawaii Warranty Deed from a Trust to an Individual samples. No reason to spend hours of the time searching for a court-admissible form. Our qualified experts make sure that you receive up to date samples all the time.

To make use of the documents library, choose a subscription, and sign-up an account. If you already did it, just log in and click on Download button. The Hawaii Warranty Deed from a Trust to an Individual file will automatically get stored in the My Forms tab (a tab for all forms you download on US Legal Forms).

To create a new profile, look at brief recommendations listed below:

- If you're having to utilize a state-specific example, make sure you indicate the proper state.

- If it’s possible, review the description to learn all of the nuances of the document.

- Utilize the Preview function if it’s offered to take a look at the document's content.

- If everything’s right, click on Buy Now button.

- Right after picking a pricing plan, make your account.

- Pay out by credit card or PayPal.

- Downoad the document to your computer by clicking on Download button.

That's all! You should fill out the Hawaii Warranty Deed from a Trust to an Individual form and double-check it. To make certain that everything is exact, call your local legal counsel for help. Register and simply browse more than 85,000 beneficial templates.

Hawaii Grantee Online Form popularity

Hawaii Grantee Application Other Form Names

Hawaii Deed FAQ

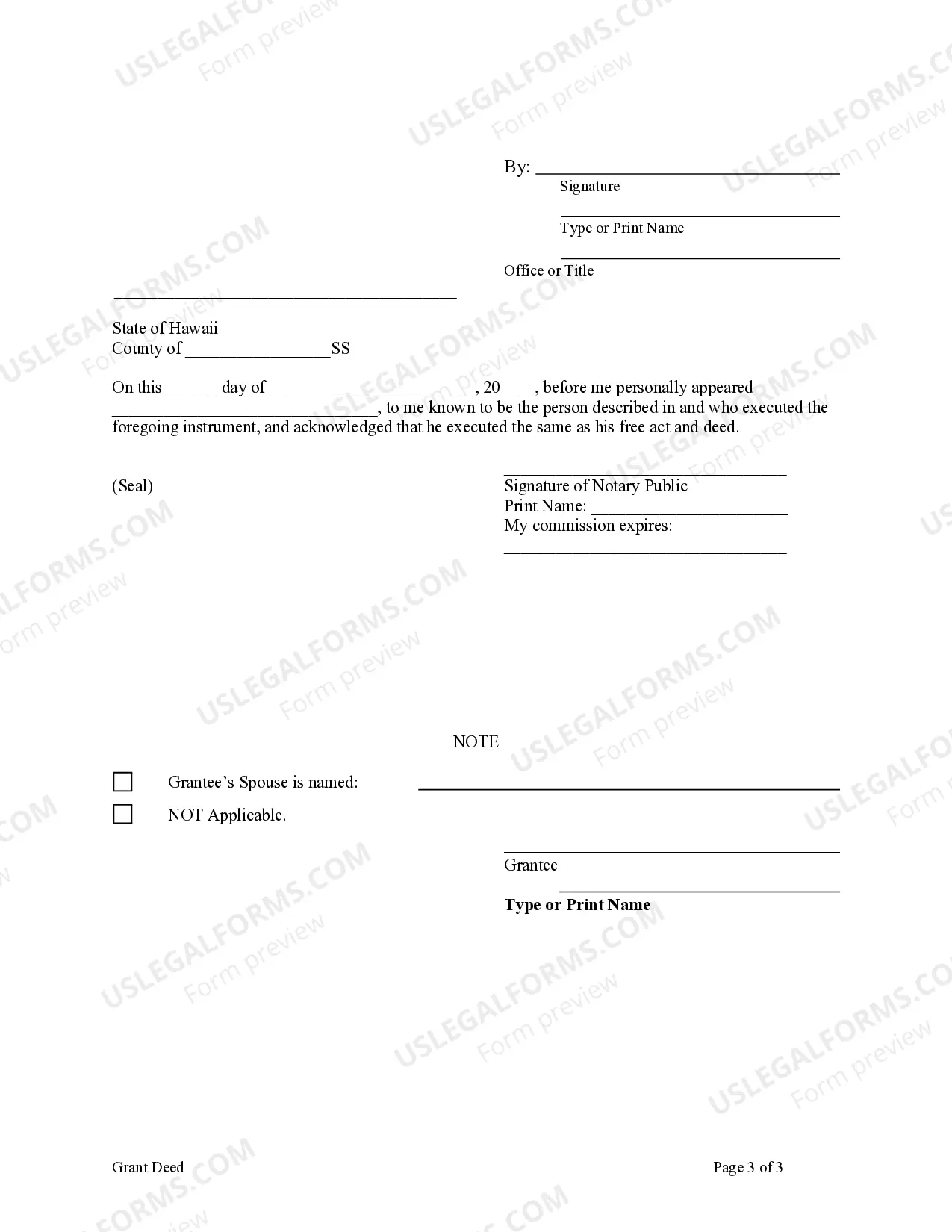

Locate the deed that's in trust. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office.

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

A quitclaim deed can be used to transfer property from a trust, but a Special Warranty Deed seems to be a more common way to do this.

The mortgage company usually prepares this deed as part of the loan package and delivers it to the title company for you to sign at closing. The title company is commonly the trustee to the deed and holds legal title to the property until the loan gets fully repaid.

A trustee deed offers no such warranties about the title.

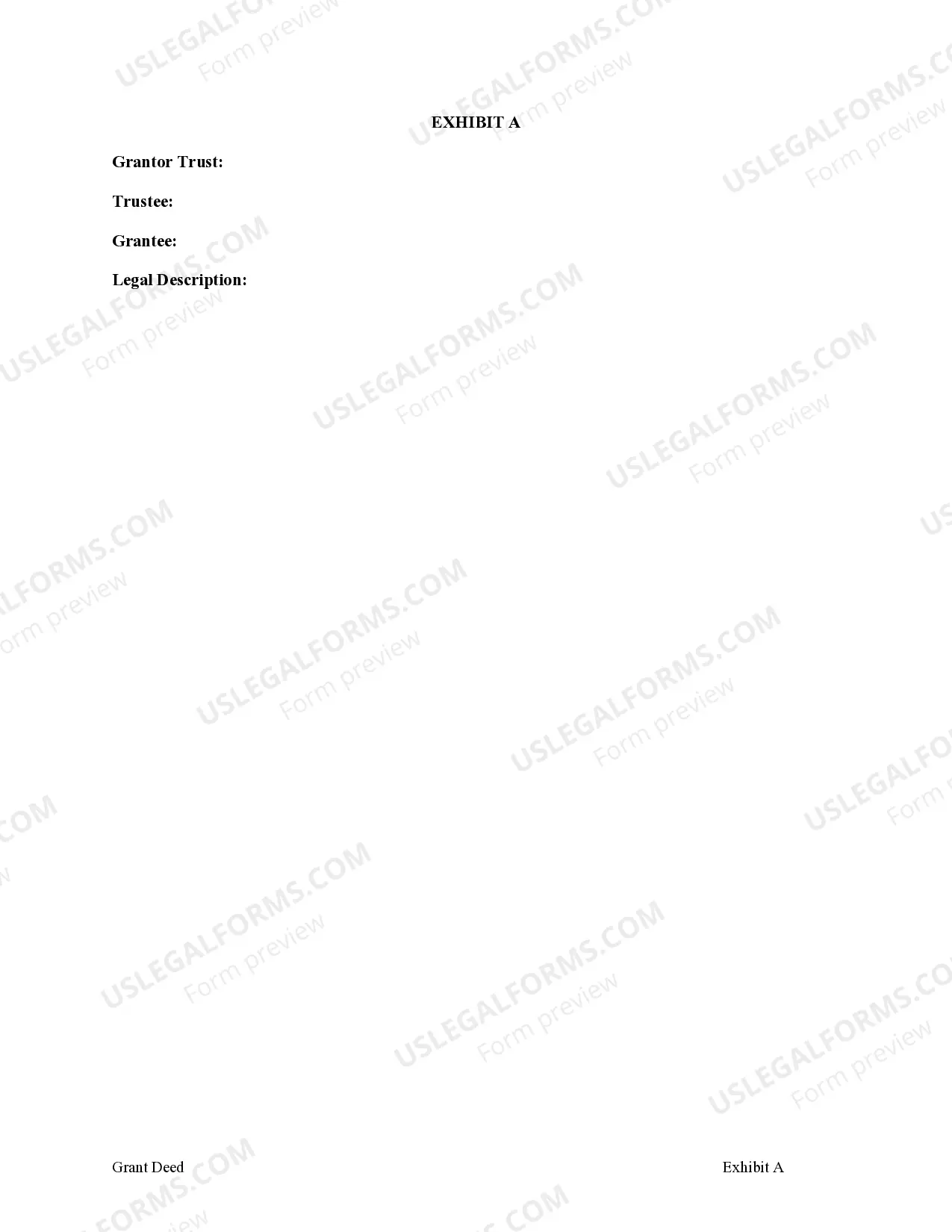

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

Trustee's deeds convey real estate out of a trust.This type of conveyance is named for the person using the form the trustee who stands in for the beneficiary of the trust and holds title to the property.