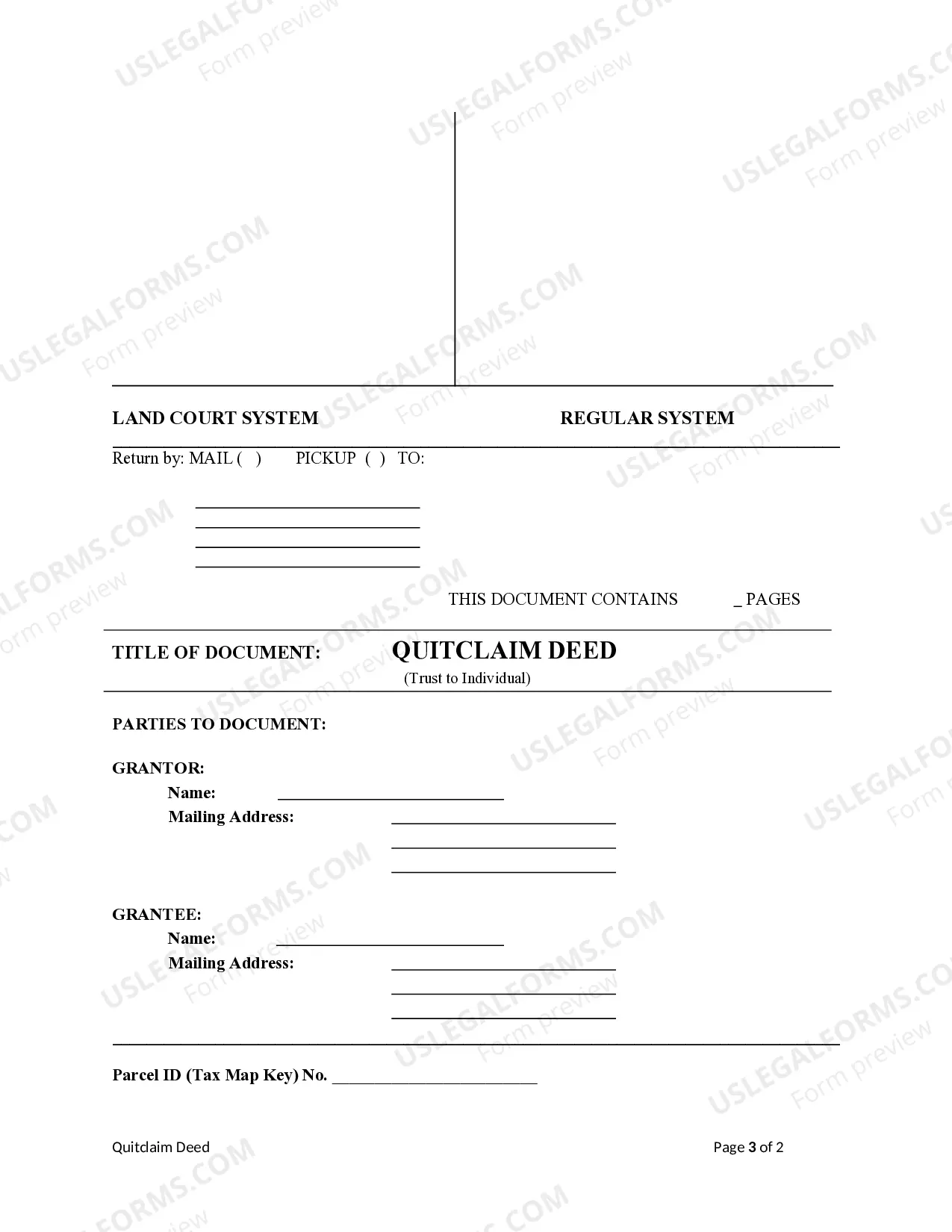

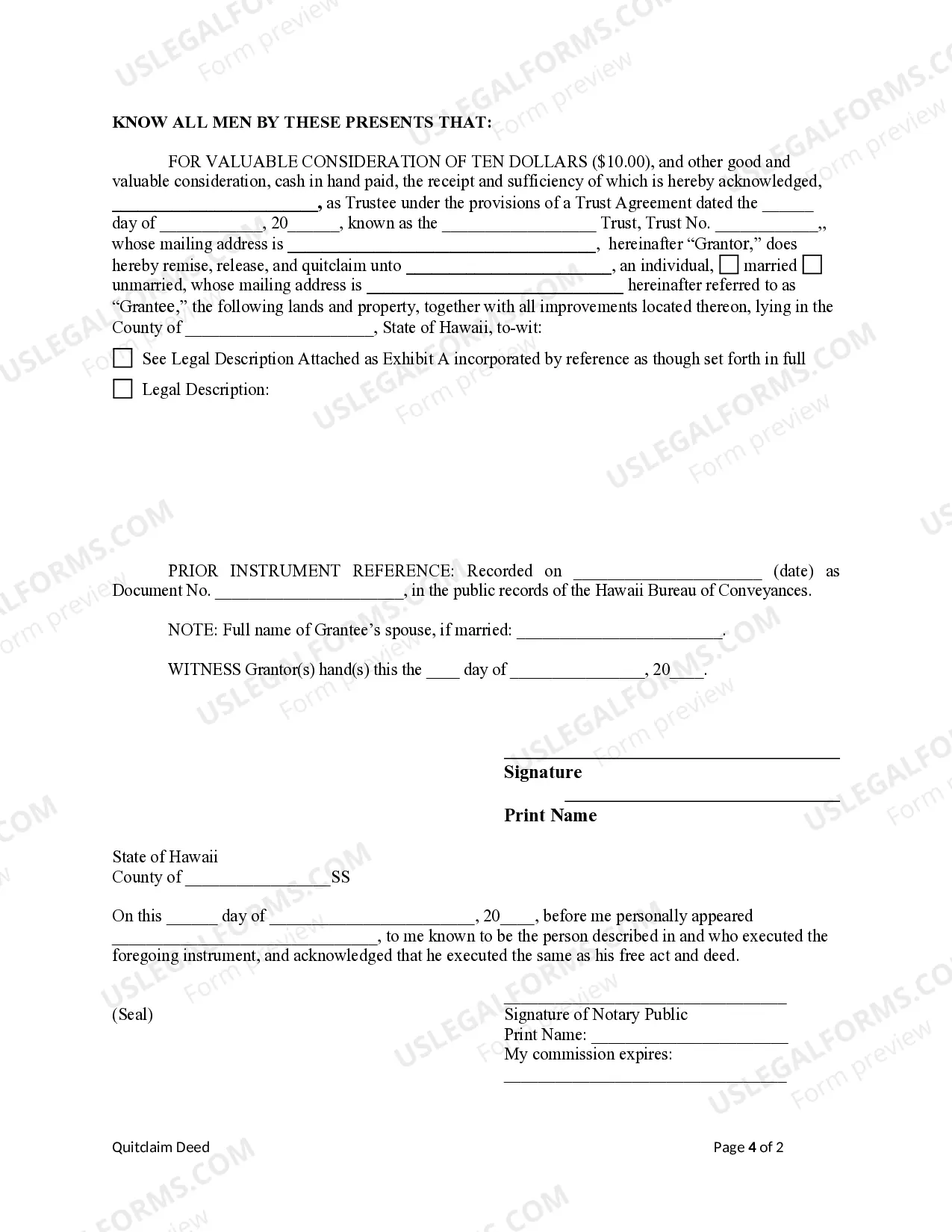

This form is a Quitclaim Deed where the Grantor is a trust and the Grantee is an individual. Grantor conveys and quitclaims any interest Grantor might have in the described property to Grantee. This deed complies with all state statutory laws.

Hawaii Quitclaim Deed - Trust to Individual

Description

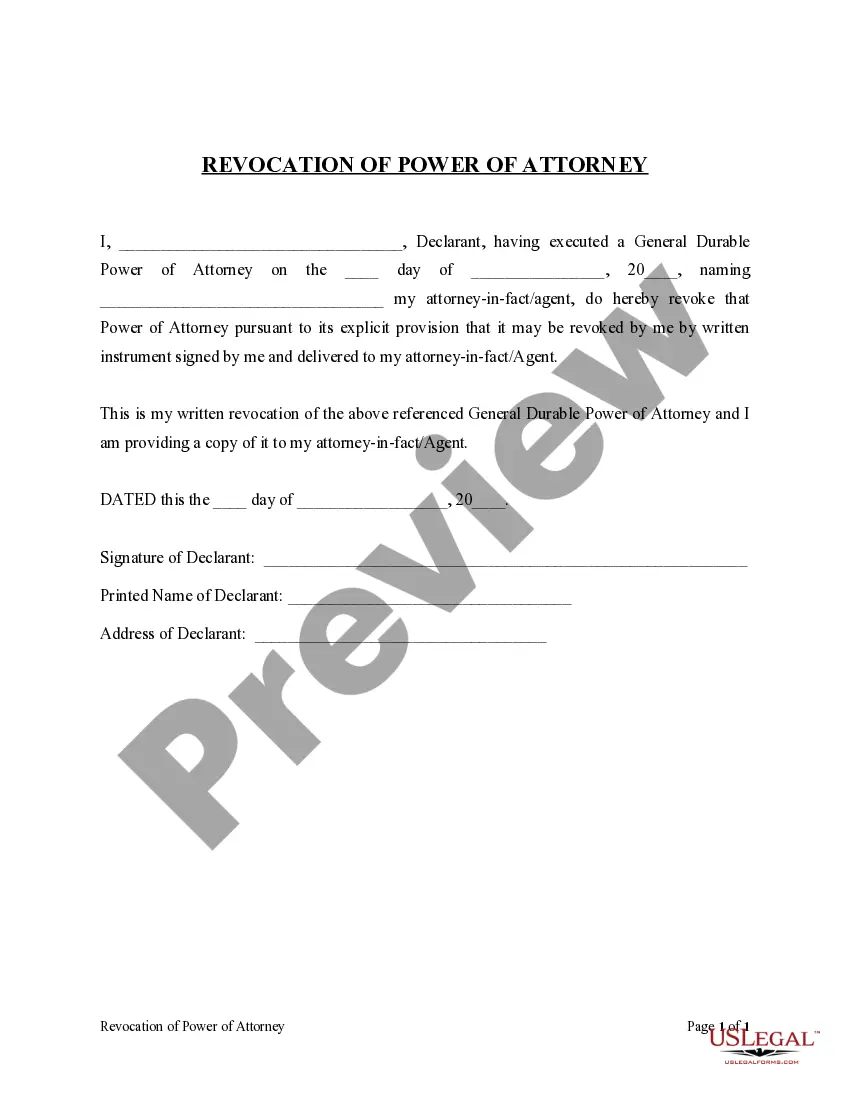

How to fill out Hawaii Quitclaim Deed - Trust To Individual?

Get one of the most extensive library of authorized forms. US Legal Forms is really a system to find any state-specific form in clicks, even Hawaii Quitclaim Deed - Trust to Individual templates. No need to waste hrs of the time trying to find a court-admissible sample. Our licensed experts ensure you get updated documents all the time.

To benefit from the forms library, pick a subscription, and register your account. If you already did it, just log in and click on Download button. The Hawaii Quitclaim Deed - Trust to Individual template will immediately get saved in the My Forms tab (a tab for every form you download on US Legal Forms).

To register a new profile, follow the short instructions below:

- If you're proceeding to use a state-specific documents, make sure you indicate the right state.

- If it’s possible, look at the description to learn all of the ins and outs of the document.

- Make use of the Preview function if it’s available to look for the document's information.

- If everything’s right, click Buy Now.

- After selecting a pricing plan, create an account.

- Pay by credit card or PayPal.

- Downoad the document to your computer by clicking Download.

That's all! You ought to fill out the Hawaii Quitclaim Deed - Trust to Individual form and double-check it. To ensure that everything is correct, call your local legal counsel for help. Sign up and easily find over 85,000 beneficial samples.

Form popularity

FAQ

If the quitclaim deed requires the signature of all co-owners, the deed is invalid unless all co-owners have signed it and the deed is then delivered to the grantee.If one individual owns real estate and desires to add a co-owner such as a spouse, a quitclaim deed might be used.

Quitclaim deeds are most often used to transfer property between family members.Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners divorce and one spouse's name is removed from the title or deed.

Locate the deed that's in trust. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office.

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.

A quitclaim deed can be used to transfer property from a trust, but a Special Warranty Deed seems to be a more common way to do this.

Transfer property quickly and easily using this simple legal form. You can use a quitclaim deed to:transfer property you own by yourself into co-ownership with someone else. change the way owners hold title to the property.

California Property TaxesTransferring real property to yourself as trustee of your own revocable living trust -- or back to yourself -- does not trigger a reassessment for property tax purposes. (Cal. Rev. & Tax Code § 62(d).)

A quitclaim deed is dangerous if you don't know anything about the person giving you the property. You should be sure that a person actually has rights to a property before signing it over with a quitclaim deed.