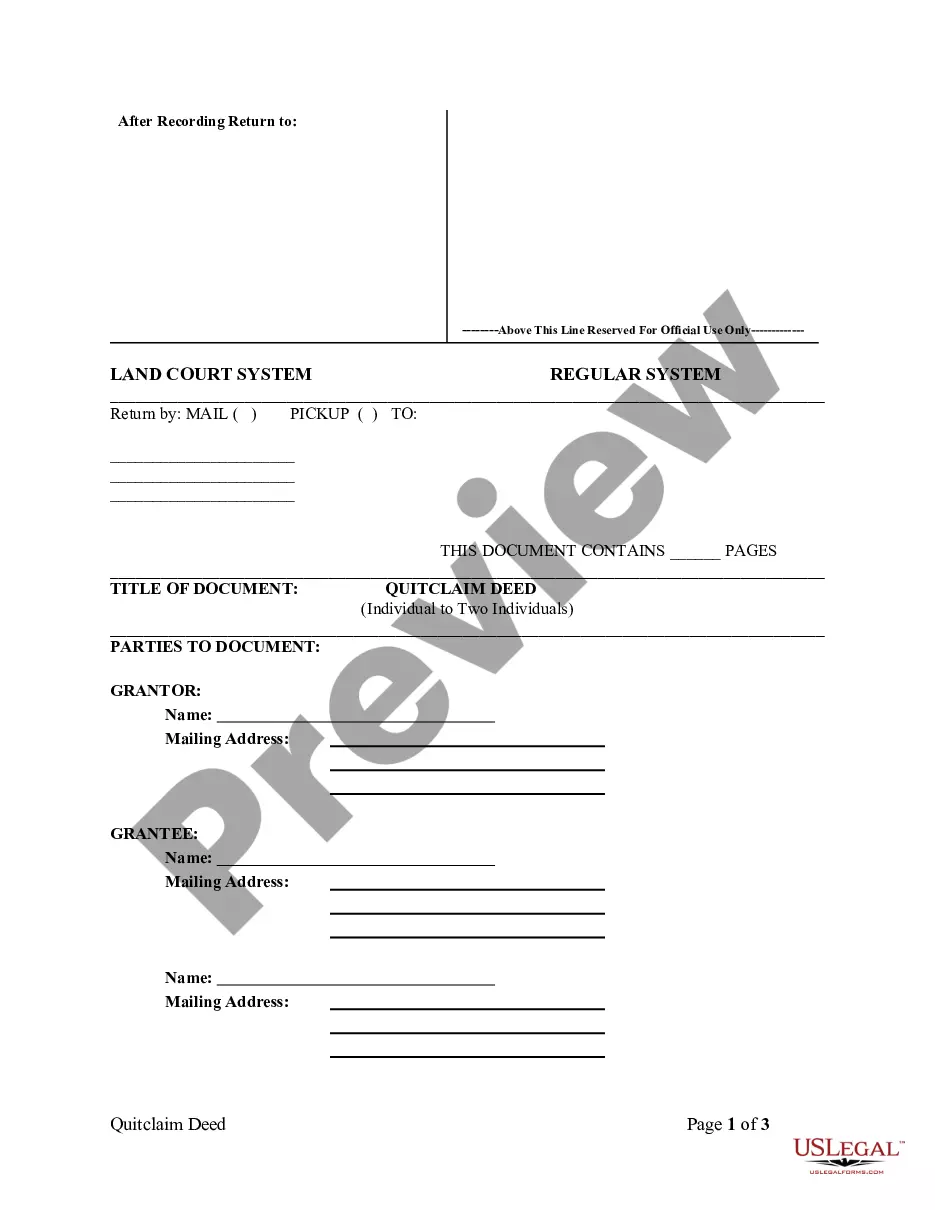

This form is a Quitclaim Deed where the grantor is an unmarried individual and the grantees are two individuals. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

Hawaii Quitclaim Deed from Individual to Two Individuals in Joint Tenancy

Description Hawaii Quitclaim Deed Form

How to fill out Tenancy Form Land?

Get access to one of the most expansive library of authorized forms. US Legal Forms is actually a solution to find any state-specific file in couple of clicks, even Hawaii Quitclaim Deed from Individual to Two Individuals in Joint Tenancy examples. No reason to waste time of the time seeking a court-admissible form. Our qualified specialists ensure that you receive up-to-date examples every time.

To benefit from the forms library, pick a subscription, and create your account. If you did it, just log in and click on Download button. The Hawaii Quitclaim Deed from Individual to Two Individuals in Joint Tenancy sample will quickly get kept in the My Forms tab (a tab for all forms you save on US Legal Forms).

To register a new account, look at quick guidelines below:

- If you're having to use a state-specific sample, make sure you indicate the correct state.

- If it’s possible, look at the description to understand all of the ins and outs of the document.

- Make use of the Preview option if it’s available to look for the document's information.

- If everything’s right, click Buy Now.

- Right after selecting a pricing plan, create your account.

- Pay out by card or PayPal.

- Downoad the sample to your device by clicking Download.

That's all! You should submit the Hawaii Quitclaim Deed from Individual to Two Individuals in Joint Tenancy template and check out it. To be sure that everything is exact, speak to your local legal counsel for help. Register and simply look through around 85,000 beneficial forms.

Deed Joint Tenancy Form popularity

Quitclaim 2 Application Other Form Names

Quitclaim Deed Tenancy FAQ

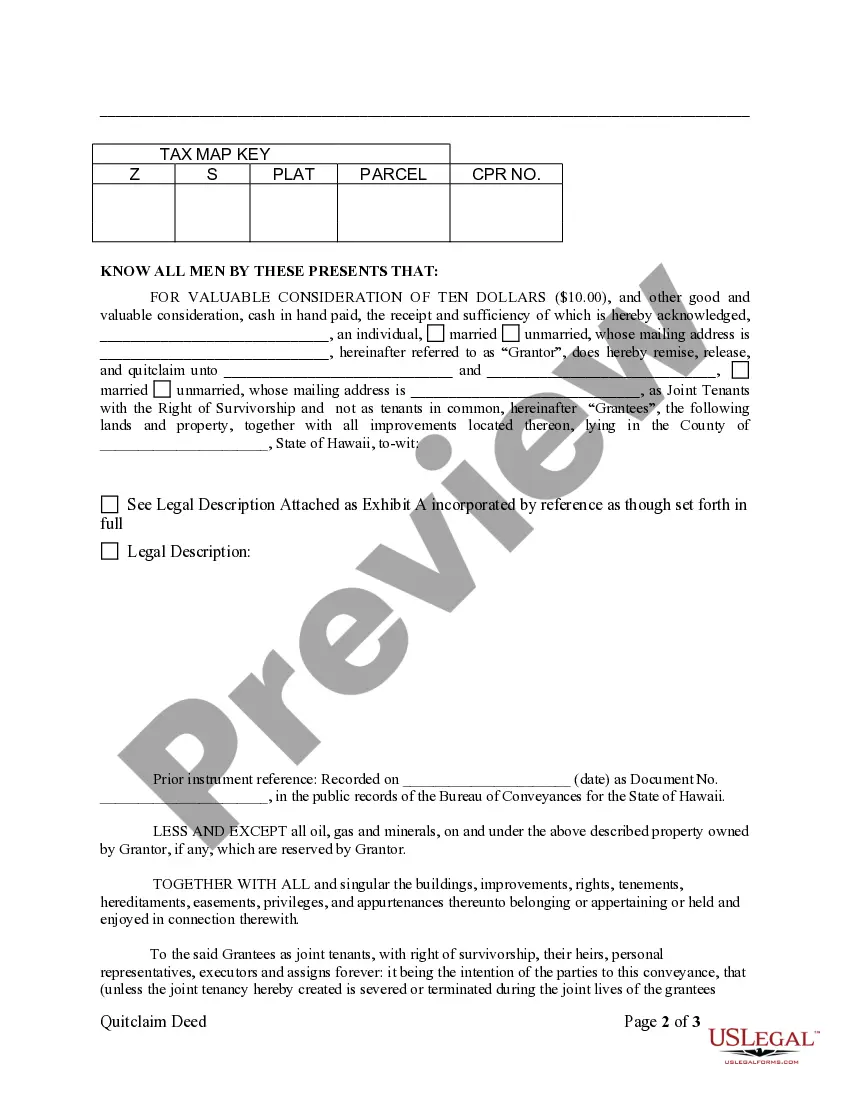

Fill out the quit claim deed form, which can be obtained online, or write your own using the form as a guide. The person giving up the interest in the property is the grantor, and the person receiving the interest is the grantee.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

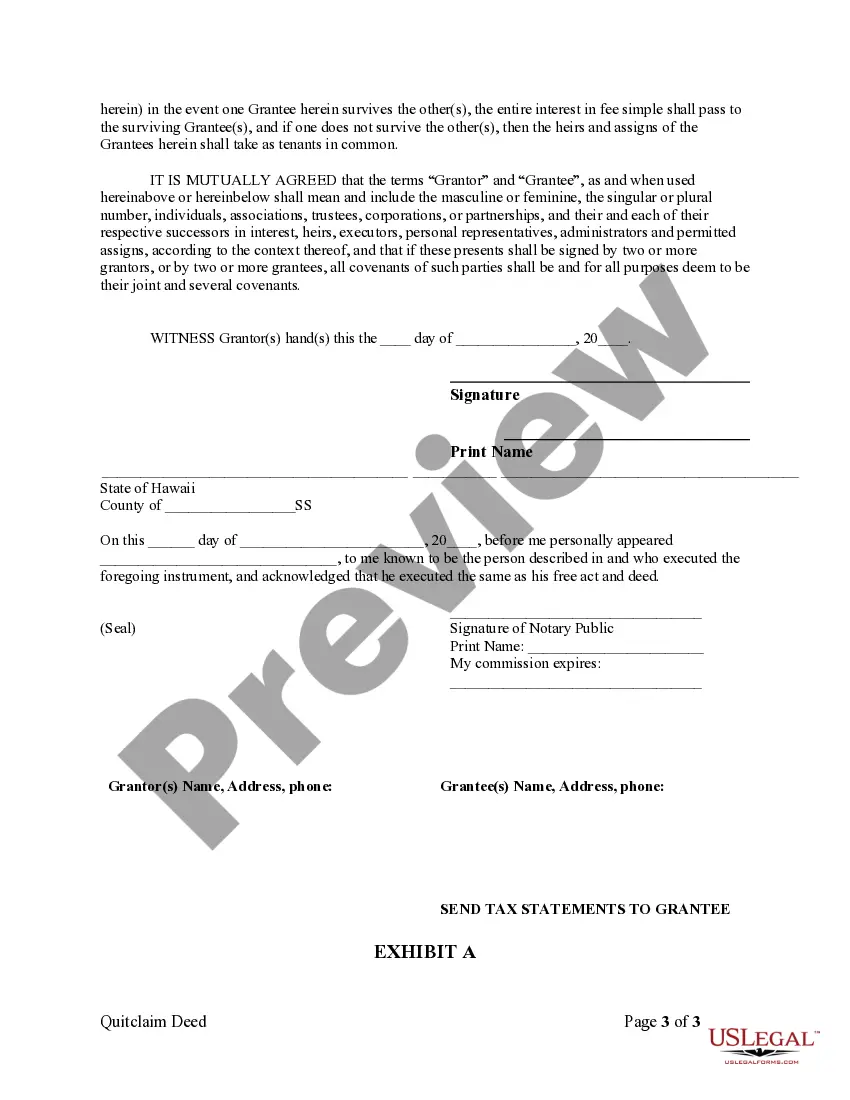

Once you sign a quitclaim deed and it has been filed and recorded with the County Clerks Office, the title has been officially transferred and cannot be easily reversed. In order to reverse this type of transfer, it would require your spouse to cooperate and assist in adding your name back to the title.

Discuss property ownership interests. Access a copy of your title deed. Complete, review and sign the quitclaim or warranty form. Submit the quitclaim or warranty form. Request a certified copy of your quitclaim or warranty deed.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

A Quitclaim Deed must be notarized by a notary public or attorney in order to be valid.Consideration in a Quitclaim Deed is what the Grantee will pay to the Grantor for the interest in the property.

In some instances, however, quitclaim deeds are used when the grantor has a mortgage. In this case, the grantor remains liable for the mortgage even after ownership has transferred through the execution of a quitclaim deed. Quitclaim deeds transfer title but do not affect mortgages.

Filing a quitclaim deed is a right of any property owner. You can file a quitclaim deed without refinancing your mortgage, but you are still responsible for the payments. Transferring the mortgage without refinancing is possible through an assumption of the loan, which requires lender approval.

Quitclaim deeds are most often used to transfer property between family members.Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners divorce and one spouse's name is removed from the title or deed.