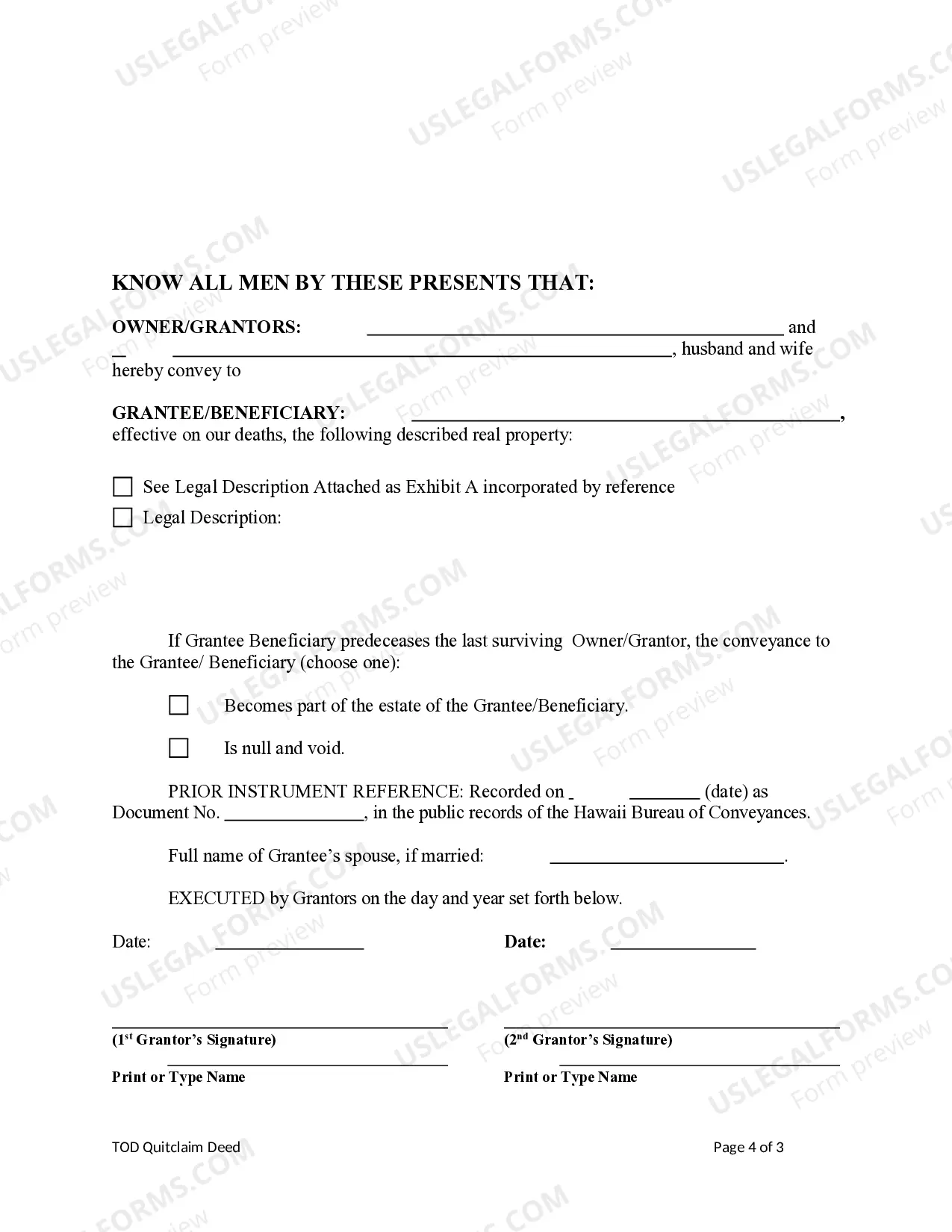

This form is a Transfer on Death Deed where the Grantor / Owners are two individuals or husband and wife and the Grantee is an individual. This transfer is revocable by Grantors until death and effective only upon the death of the last surviving Grantor. This deed complies with all state statutory laws.

Hawaii Transfer on Death Quitclaim Deed from Two Individuals or Husband and Wife to an Individual

Description Transfer On Death Deed Hawaii

How to fill out Hawaii Transfer On Death Quitclaim Deed From Two Individuals Or Husband And Wife To An Individual?

Get access to one of the most expansive catalogue of legal forms. US Legal Forms is really a solution to find any state-specific form in couple of clicks, including Hawaii Transfer on Death Quitclaim Deed from Two Individuals or Husband and Wife to an Individual samples. No need to waste time of the time looking for a court-admissible sample. Our licensed professionals ensure that you receive updated samples all the time.

To leverage the documents library, choose a subscription, and create an account. If you created it, just log in and click Download. The Hawaii Transfer on Death Quitclaim Deed from Two Individuals or Husband and Wife to an Individual template will instantly get stored in the My Forms tab (a tab for all forms you save on US Legal Forms).

To register a new profile, follow the short recommendations listed below:

- If you're going to utilize a state-specific example, be sure to indicate the right state.

- If it’s possible, go over the description to know all of the nuances of the document.

- Take advantage of the Preview function if it’s available to look for the document's content.

- If everything’s correct, click on Buy Now button.

- After choosing a pricing plan, create your account.

- Pay out by credit card or PayPal.

- Downoad the document to your device by clicking Download.

That's all! You should submit the Hawaii Transfer on Death Quitclaim Deed from Two Individuals or Husband and Wife to an Individual template and check out it. To ensure that things are precise, contact your local legal counsel for support. Sign up and simply look through over 85,000 useful forms.

Form popularity

FAQ

If you want to transfer the house in your wife's name, it will involve the stamp duty on the entire value of the property. There are two other methods by which the property can be transferred to your wife name. (1) By giving a gift of the property to your wife through Registered Gift Deed.

So long as the quitclaim deed is valid (properly notarized, etc.) it can be recorded even after the grantor's death, so property owned by the deceased which has been deeded in that quitclaim deed should not need to pass through probate.

When someone who owns real property dies, the property goes into probate or it automatically passes, by operation of law, to surviving co-owners. Often, surviving co-owners do nothing with the title for as long as they own the property. Yet the best practice is to remove the deceased owner's name from the title.

To transfer it, you will have to get a succession certificate (for moveable property) and a letter of administration (for Immoveable property). While doing so, get the son and daughter to give no objections in court that they have no objection if all the property is transferred to the widow.

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

To transfer it, you will have to get a succession certificate (for moveable property) and a letter of administration (for Immoveable property). While doing so, get the son and daughter to give no objections in court that they have no objection if all the property is transferred to the widow.

The surviving spouse has the right to Family Exempt Property.The surviving spouse has the right to receive Letters of Administration, which means that ahead of all other family members, he/she has the right to serve as the Administrator when someone dies intestate.

If one co-owner dies, their interest in the property automatically passes to the surviving co-owner(s), whether or not they have a will. As tenants in common, co-owners own specific shares of the property. Each owner can leave their share of the property to whoever they choose.

Death Certificate. The first thing in the list is Death Certificate. Claim Application Form. Claim form is the form which needs to be filled by you at the time of making the claim. Probate of WILL. Succession Certificate.