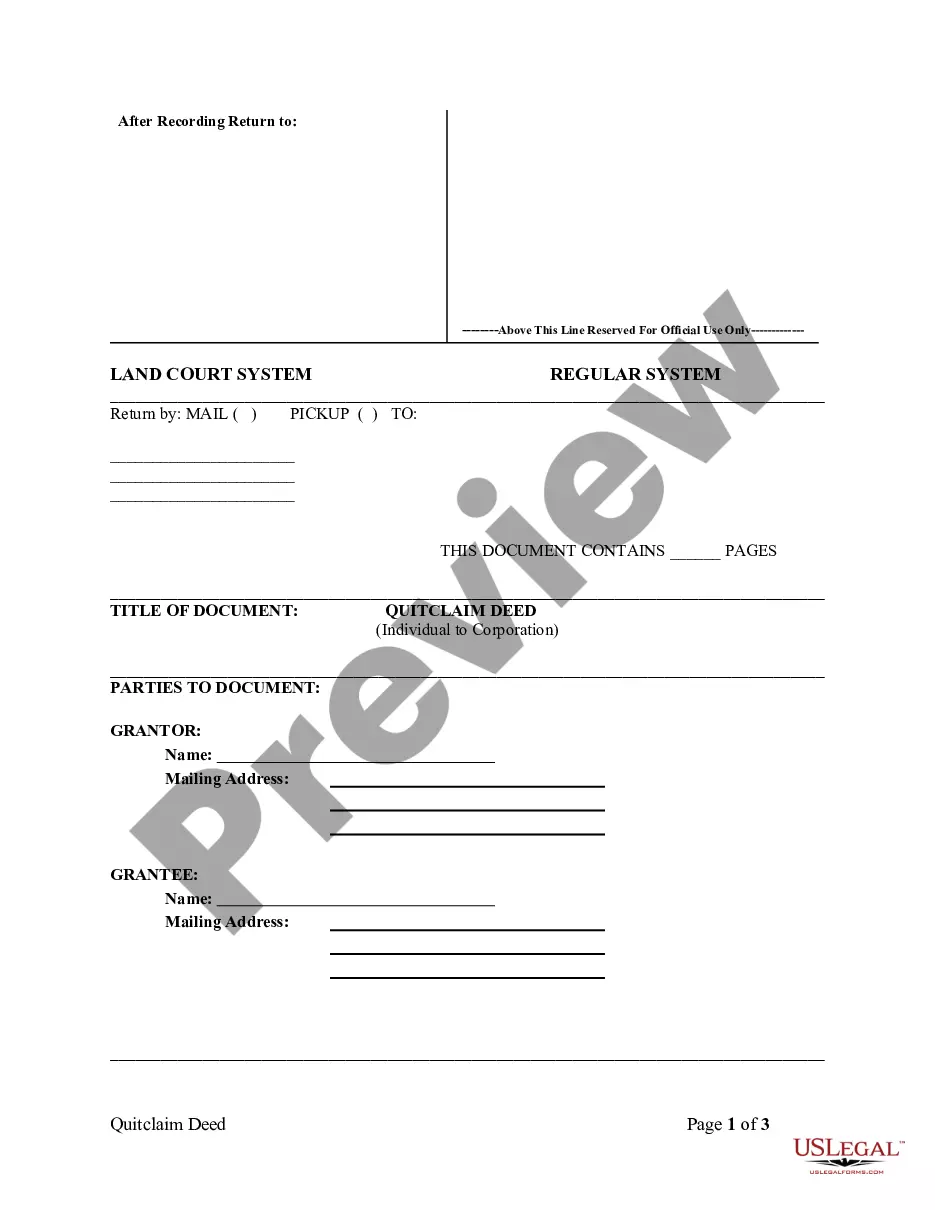

This form is a Quitclaim Deed where the grantor is an unmarried individual and the grantee is a corporation. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

Hawaii Quitclaim Deed from Individual to Corporation

Description Release Waiver And Quitclaim

How to fill out Waiver And Quitclaim Sample?

Get access to the most comprehensive catalogue of authorized forms. US Legal Forms is actually a system to find any state-specific document in a few clicks, including Hawaii Quitclaim Deed from Individual to Corporation samples. No requirement to spend hrs of the time seeking a court-admissible example. Our certified experts make sure that you receive up-to-date documents every time.

To benefit from the documents library, select a subscription, and register your account. If you already did it, just log in and click on Download button. The Hawaii Quitclaim Deed from Individual to Corporation sample will instantly get kept in the My Forms tab (a tab for every form you save on US Legal Forms).

To register a new profile, look at brief instructions below:

- If you're proceeding to utilize a state-specific documents, ensure you indicate the proper state.

- If it’s possible, look at the description to learn all the nuances of the document.

- Make use of the Preview option if it’s offered to look for the document's information.

- If everything’s right, click Buy Now.

- Right after selecting a pricing plan, create your account.

- Pay out by card or PayPal.

- Save the example to your computer by clicking Download.

That's all! You need to fill out the Hawaii Quitclaim Deed from Individual to Corporation form and check out it. To make certain that things are accurate, contact your local legal counsel for assist. Join and easily browse around 85,000 useful samples.

Hawaii Quit Claim Deed Form popularity

Quit Claim Deed Alabama Other Form Names

What Is A Quitclaim Deed In Hawaii FAQ

A quitclaim deed can convey title as effectively as a warranty deed if the grantor has a good title when the deed is delivered.A quitclaim deed is often used if the grantor is not sure of the status of the title (whether it contains any defects) or if the grantor wants no liability under the title covenants.

A Quitclaim Deed must be notarized by a notary public or attorney in order to be valid.Consideration in a Quitclaim Deed is what the Grantee will pay to the Grantor for the interest in the property.

Because no warranty or guarantee is made regarding the actual state of the title when a quitclaim deed is used, title insurance cannot be obtained. Title insurance is available when a warranty deed is used, because of the clear title guarantee associated with that type of instrument.

How to Quitclaim Deed to LLC. A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

A quitclaim deed only transfers the grantor's interests in a piece of real estate. It does not create any warranties on the title. Only whatever part of the land the grantor owns, if any, will transfer to the grantee. A warranty deed contains a guarantee that the grantor has legal title and rights to the real estate.

A quitclaim deed transfers title but makes no promises at all about the owner's title.A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.