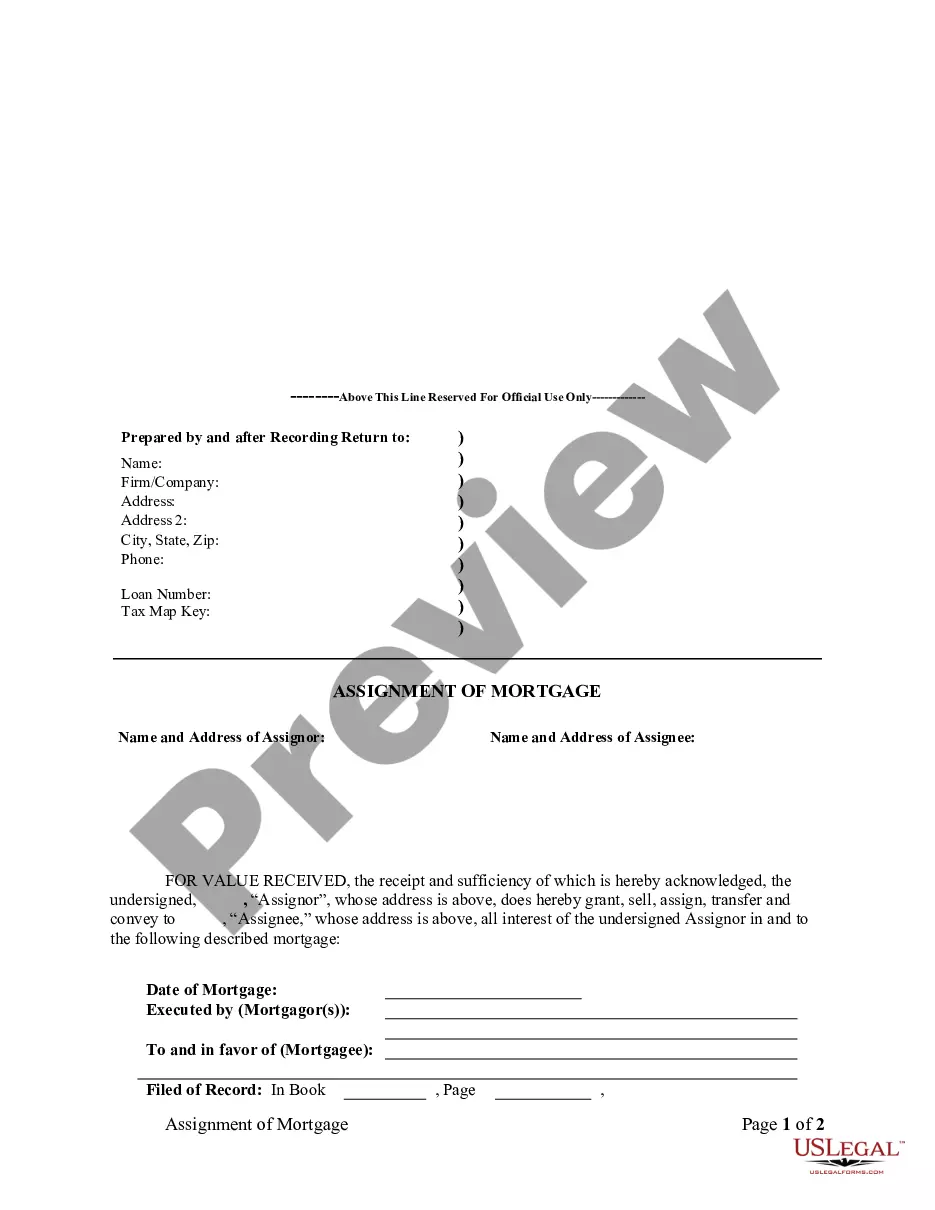

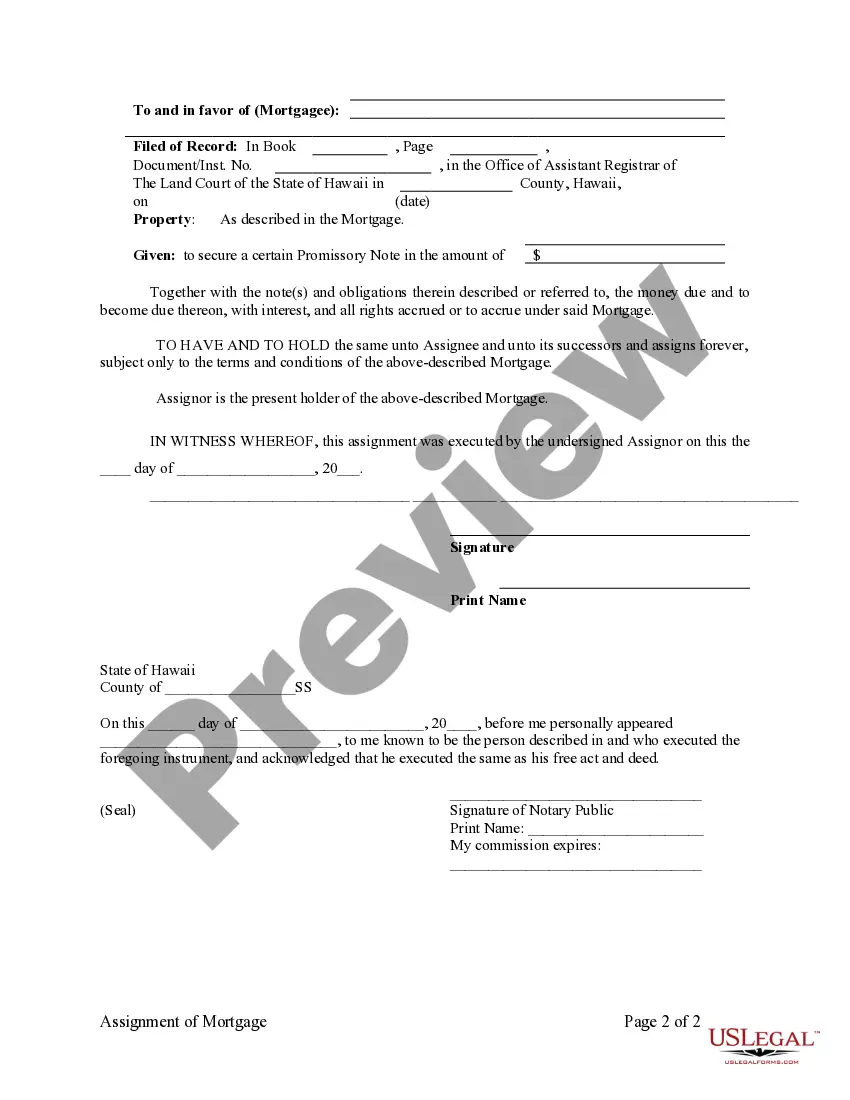

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Hawaii Assignment of Mortgage by Individual Mortgage Holder

Description

How to fill out Hawaii Assignment Of Mortgage By Individual Mortgage Holder?

Access one of the most extensive catalogue of legal forms. US Legal Forms is really a platform where you can find any state-specific form in couple of clicks, even Hawaii Assignment of Mortgage by Individual Mortgage Holder examples. No need to spend time of the time searching for a court-admissible example. Our certified experts ensure you receive up-to-date examples all the time.

To leverage the forms library, pick a subscription, and register an account. If you already registered it, just log in and click Download. The Hawaii Assignment of Mortgage by Individual Mortgage Holder sample will quickly get stored in the My Forms tab (a tab for all forms you download on US Legal Forms).

To register a new account, look at short recommendations listed below:

- If you're proceeding to use a state-specific documents, be sure you indicate the correct state.

- If it’s possible, go over the description to understand all the ins and outs of the form.

- Take advantage of the Preview function if it’s offered to look for the document's content.

- If everything’s correct, click Buy Now.

- Right after picking a pricing plan, register an account.

- Pay out by credit card or PayPal.

- Downoad the document to your computer by clicking on Download button.

That's all! You ought to complete the Hawaii Assignment of Mortgage by Individual Mortgage Holder template and double-check it. To make certain that everything is accurate, speak to your local legal counsel for assist. Register and simply look through around 85,000 valuable samples.

Form popularity

FAQ

If a lender takes longer than 90 days to record it, they can be charged up to $1,500 in penalties. So, in theory, a satisfaction should be recorded within 30-90 days of payoff regardless of what state you work in.

Step 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage. Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued. Step 3 File and Record the Form.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

In the case of mortgage liens, courts use the date of a recording to determine the priority for which liens should receive payment first. To understand which documents have been or must be recorded, check with your state and county recording division.

Key Takeaways. A satisfaction of mortgage is a signed document confirming that the borrower has paid off the mortgage in full and that the mortgage is no longer a lien on the property.

Lending institutions are responsible for preparing and filing the satisfaction of mortgage with the appropriate county recorder, land registry office, city registrar, or recorder of deeds. Some borrowers prepay their mortgages by making extra mortgage payments in an effort to pay off their mortgages faster.

In order to clear the title to the real property owned by the mortgagor, the Satisfaction of Mortgage document must be recorded with the County Recorder or Recorder of Deeds. If the mortgagee fails to record a satisfaction within the set time limits, the mortgagee may be responsible for damages set out by statute.

Go to the county recorder's office or local courthouse to find recorded mortgages. In states such as California, deeds, liens, mortgage documents and various types of land documents are available for review in the recorder's office.