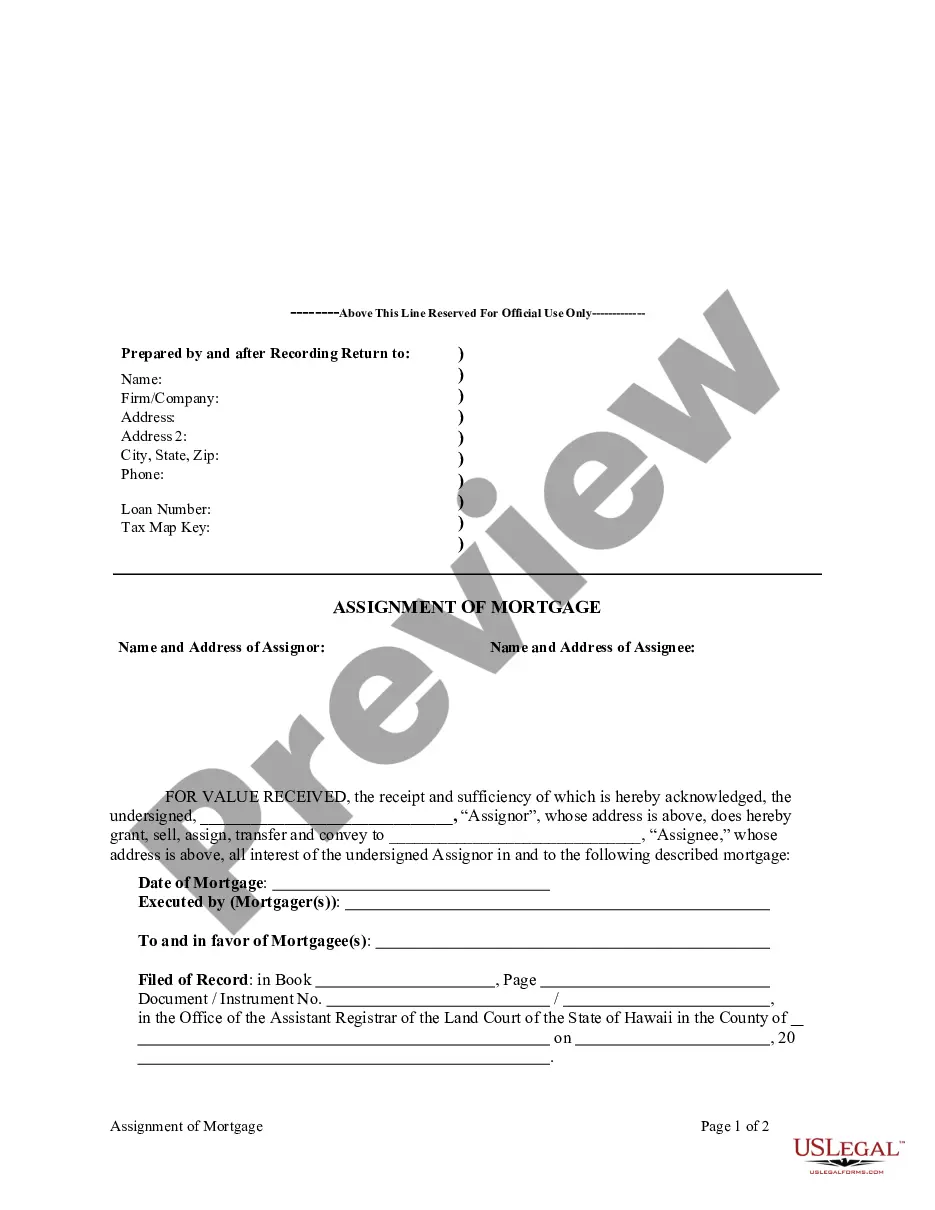

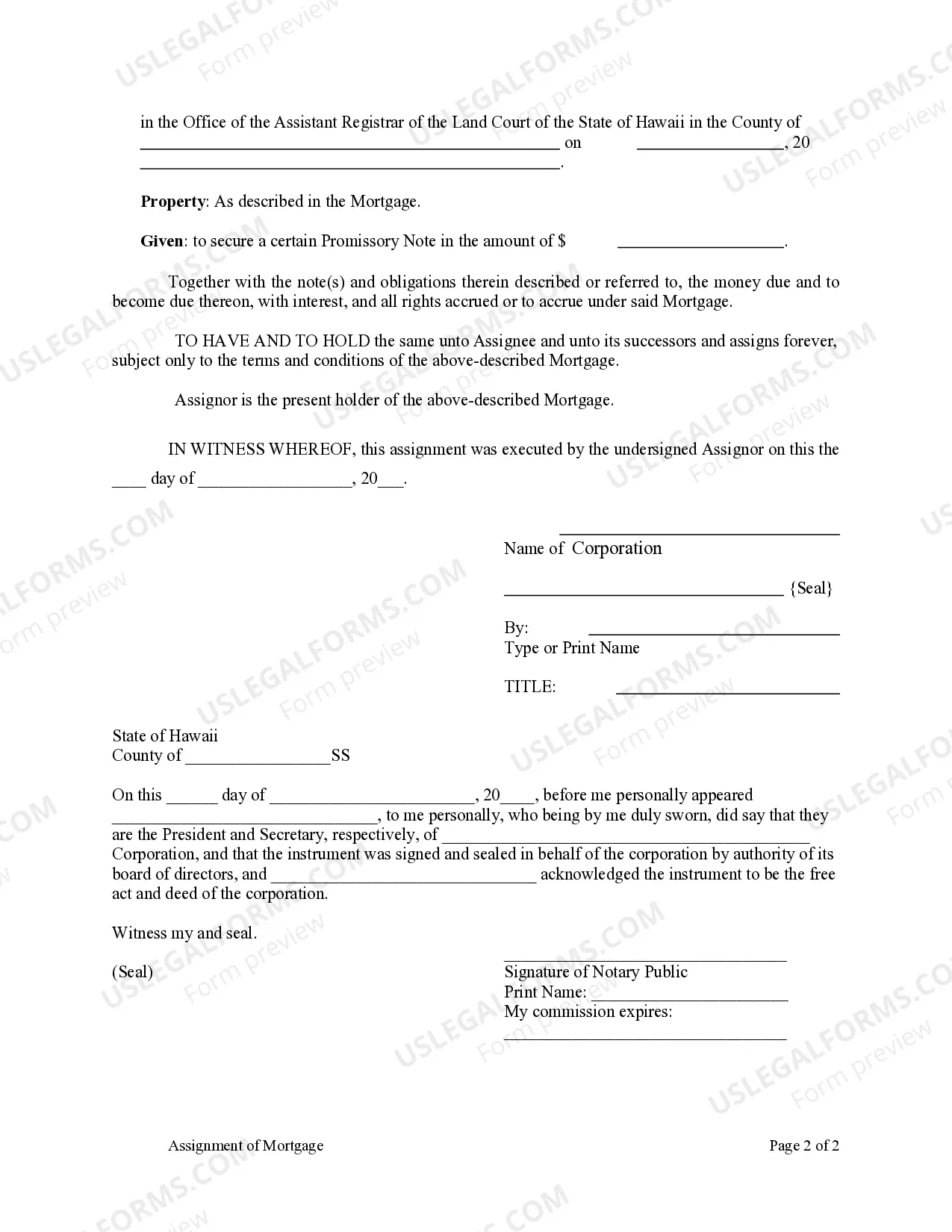

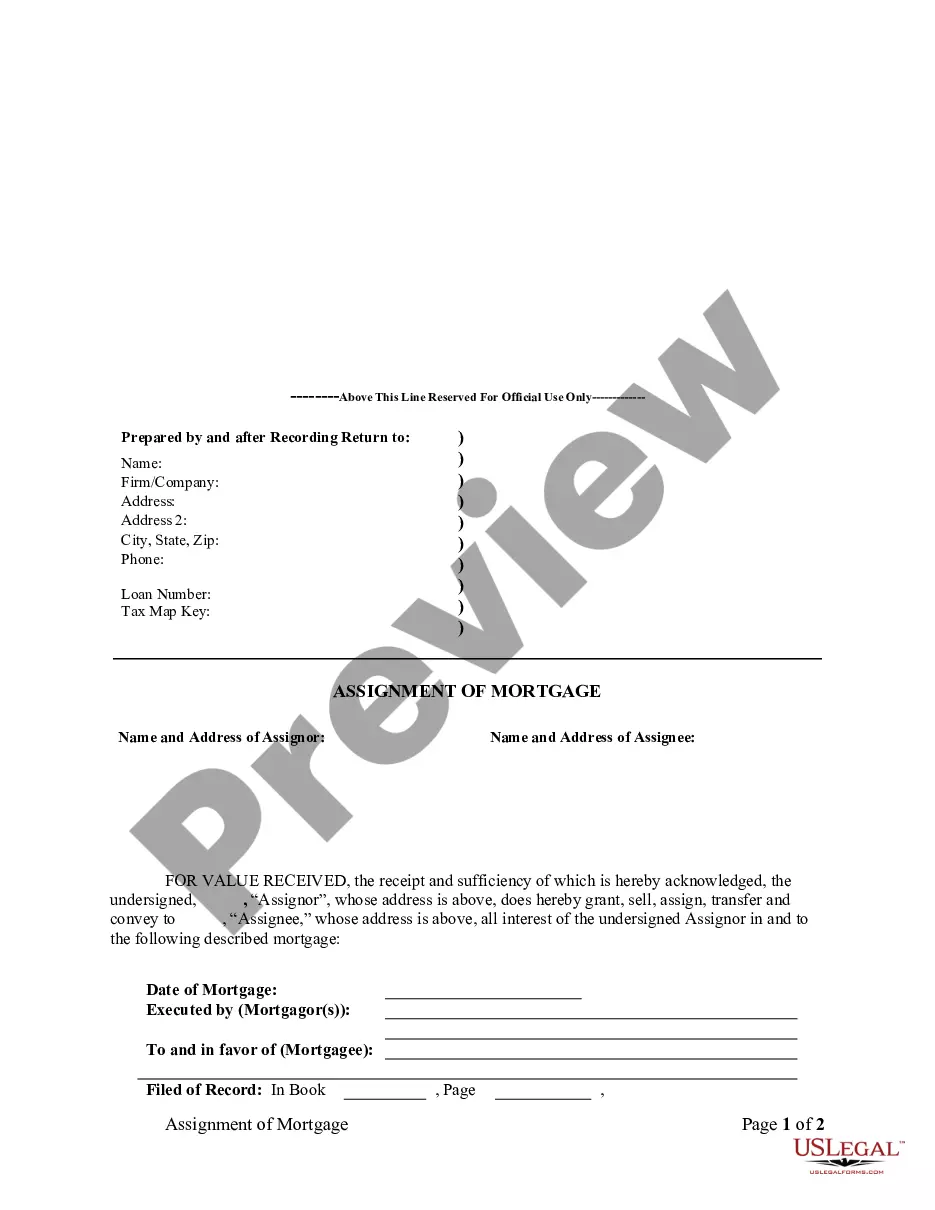

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Hawaii Assignment of Mortgage by Corporate Mortgage Holder

Description

How to fill out Hawaii Assignment Of Mortgage By Corporate Mortgage Holder?

Access one of the most holistic library of authorized forms. US Legal Forms is really a system where you can find any state-specific form in clicks, including Hawaii Assignment of Mortgage by Corporate Mortgage Holder samples. No requirement to spend time of your time trying to find a court-admissible example. Our licensed specialists ensure you get up-to-date examples every time.

To leverage the documents library, select a subscription, and create your account. If you registered it, just log in and click Download. The Hawaii Assignment of Mortgage by Corporate Mortgage Holder file will automatically get saved in the My Forms tab (a tab for every form you download on US Legal Forms).

To register a new account, look at quick guidelines listed below:

- If you're going to use a state-specific example, ensure you indicate the appropriate state.

- If it’s possible, review the description to learn all of the nuances of the form.

- Take advantage of the Preview function if it’s accessible to check the document's content.

- If everything’s right, click on Buy Now button.

- After selecting a pricing plan, create your account.

- Pay out by card or PayPal.

- Save the example to your computer by clicking Download.

That's all! You should submit the Hawaii Assignment of Mortgage by Corporate Mortgage Holder form and double-check it. To be sure that things are correct, speak to your local legal counsel for assist. Register and easily find over 85,000 valuable forms.

Form popularity

FAQ

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

An assignment is the document that is the legal record of this transfer from one mortgagee to another. In a typical transaction, when the mortgagee sells the debt to another bank, an assignment is recorded and the promissory note is endorsed (signed over) to the new bank.

Lender may, without notice whatsoever to anyone, sell, assign or transfer all of any Borrower's or any Affiliate Borrower's indebtedness, obligations and liabilities or any part thereof.

What does Assignment of Mortgage mean: The most common example of an Assignment of Mortgage is when a mortgage lender transfers/sells the mortgage to another lender. This can be done more than once until the balance is paid.If a borrower transfers the mortgage to another borrower, this is called an assumed mortgage.

A mortgage lender can transfer a mortgage to another company using an assignment agreement.Many banks and mortgage lenders sell outstanding loans in order to free up money to lend to new borrowers, and use an assignment of mortgage to legally grant the loan obligation to the new mortgage holder.

Corporate mortgage assignment defined. An assignment of a mortgage occurs when a loan for a piece of property (home or otherwise) is assigned to another party.A corporate assignment of a mortgage occurs when the third party that assumes the obligation for the loan is a corporation.

Salaried individuals.Latest Salary Slips.Bank account statements of the previous 3 months.PAN card/Aadhaar card.Address proof.Copy of the documents of the property to be mortgaged.IT returns.Self-employed individuals.Mortgage Loan Eligibility & Documents Required Bajaj Finserv\nwww.bajajfinserv.in > mortgage-loan-eligibility-and-documents

If you wish to get a certified copy of your deed, go to the bureau's website, hawaii.gov/dlnr/boc/index_html, click on "FAQs" in the right column, then No. 20 on the list; or call 587-0154 for information.

A Hawaii (HI) quitclaim deed allows a property's owner (grantor) to quickly transfer ownership of a property to another party (grantee), without any sort of guarantee of ownership or title discovery process.