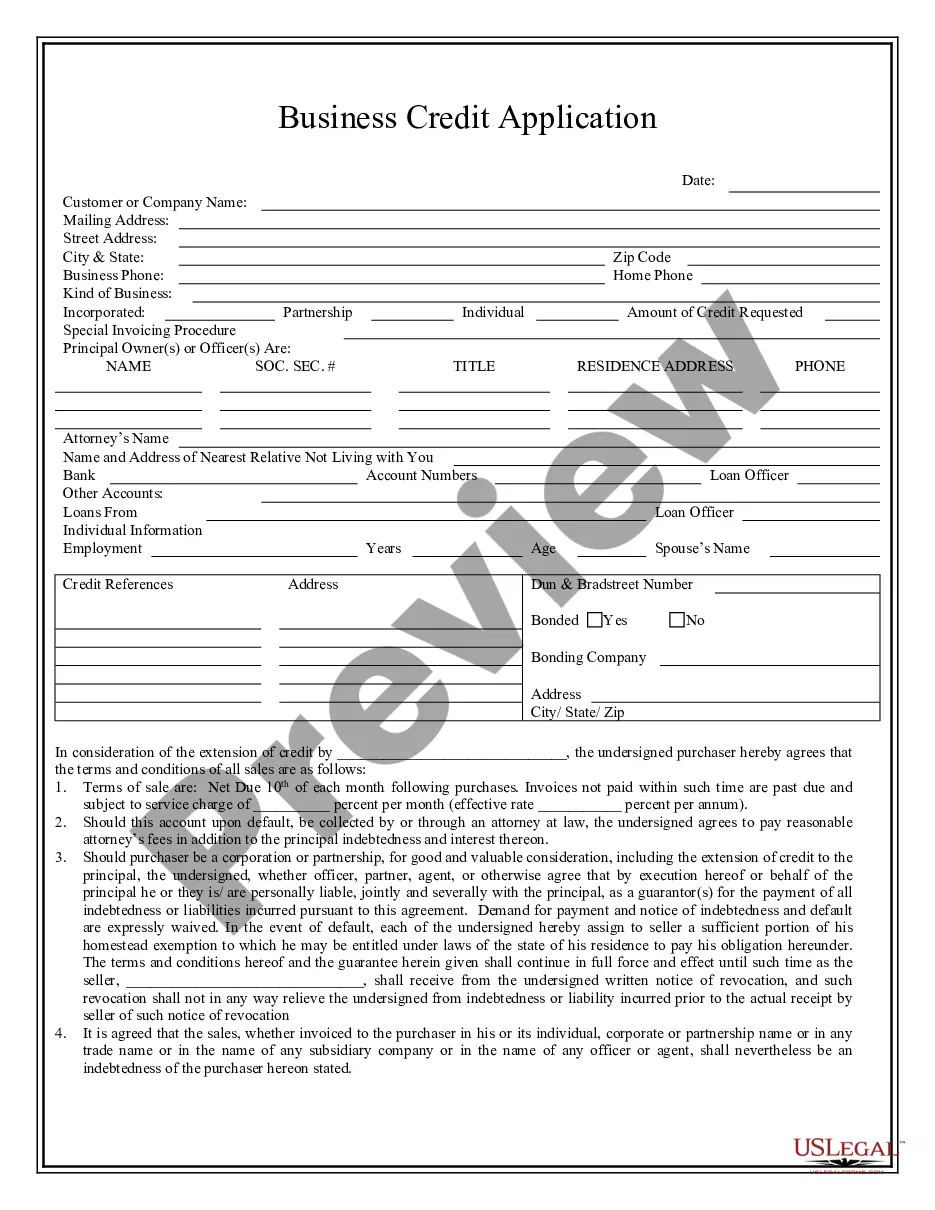

This is a credit application for obtaining credit at a business. Upon ordering, you may download the form in Word or Rich Text formats.

Hawaii Business Credit Application

Description

How to fill out Hawaii Business Credit Application?

Access the most comprehensive collection of approved forms.

US Legal Forms is essentially a platform where you can locate any state-specific template in just a few clicks, like samples of Hawaii Business Credit Application.

No need to waste hours searching for a court-approved document.

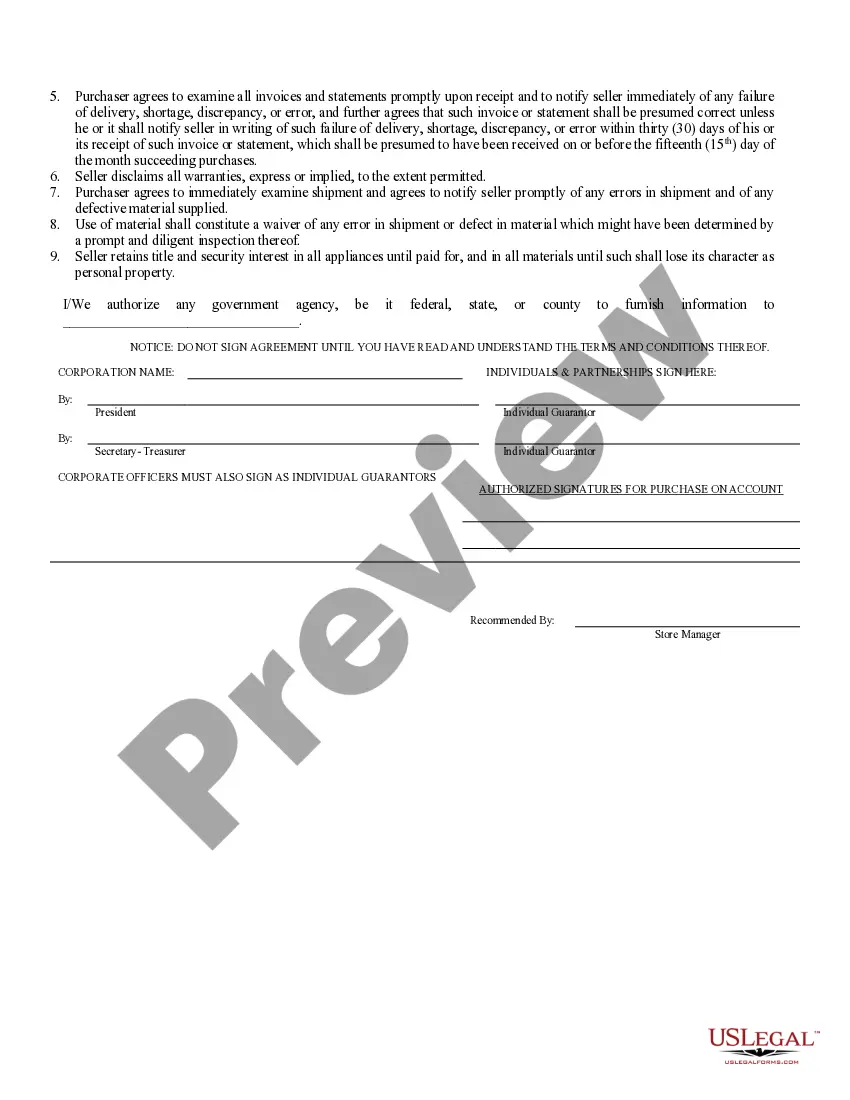

Utilize the Preview feature if available to review the document's content. If everything is correct, click on the Buy Now button. After choosing a payment plan, create your account. Make your payment using a credit card or PayPal. Download the sample to your device by pressing the Download button. That’s it! You must complete the Hawaii Business Credit Application form and submit it. To ensure accuracy, consult your local legal advisor for assistance. Join and effortlessly navigate through over 85,000 useful templates.

- Our certified professionals guarantee that you receive updated documents consistently.

- To utilize the document library, choose a subscription and create an account.

- Once registered, just Log In and hit the Download button.

- The sample for Hawaii Business Credit Application will be automatically stored in the My documents section (a section for each form saved on US Legal Forms).

- To create a new profile, follow the straightforward suggestions outlined below.

- If you intend to use a state-specific document, ensure you select the correct state.

- If possible, review the description to understand all the details of the document.

Form popularity

FAQ

The quickest method to secure business credit for an LLC involves applying for a Hawaii Business Credit Application through reputable lenders. Additionally, ensure that your LLC is registered properly, obtain an Employer Identification Number (EIN), and open a dedicated business banking account. By managing finances and debts separately, you accelerate your path to obtaining business credit.

To qualify for business credit, a personal credit score of 680 or higher is often recommended. This score helps lenders assess your creditworthiness when you apply for a Hawaii Business Credit Application. A strong personal credit score can support your new LLC's credibility, making it easier to secure loans and establish business credit.

A new LLC typically does not have a credit score at the outset. Instead, it begins to build its credit profile through actions such as applying for a Hawaii Business Credit Application. Over time, consistent, timely payments on business debts will help establish a solid credit history, which is essential for future financing options.

To establish business credit for the first time, begin by organizing your business documentation and registering your entity. Apply for a Hawaii Business Credit Application through trusted financial institutions to obtain credit products. Following that, utilize trade credit and vendor accounts, while consistently paying your bills on time to enhance your creditworthiness.

Starting credit for a business involves several key steps. First, register your business and acquire necessary licenses. Then, complete a Hawaii Business Credit Application to obtain your business credit report. Establish credit with suppliers who report to credit agencies, ensuring to make timely payments that help build your business credit profile.

An LLC can obtain credit by establishing its business structure and ensuring its financial activities are separate from personal finances. Start by applying for a Hawaii Business Credit Application to set up credit accounts in the LLC's name. This process may involve building relationships with vendors and ensuring timely payments, which promotes a positive credit history.

Filling out a credit authorization form is straightforward. First, gather your business information, including your legal name, address, and employer identification number. Next, clearly provide any necessary financial details required by the Hawaii Business Credit Application. Finally, review all the entered information for accuracy before submitting the form to ensure a smooth application process.

To close a business in Hawaii, you need to take several important steps. First, settle any outstanding debts and obligations, ensuring that you fulfill all financial responsibilities. Then, file a dissolution document with the Business Registration Division to formally end your business. Ending your business on good terms is crucial, and understanding procedures can help if you plan to apply for future opportunities, such as a Hawaii Business Credit Application.

Doing business in each state involves establishing a physical presence or conducting significant activities within that state. This includes offices, employees, or even regular sales. Each state has its own specific criteria, so it's vital to review these details when preparing your Hawaii Business Credit Application.

A small business in Hawaii is generally defined as an enterprise with fewer than 500 employees. However, revenue thresholds can also play a role, depending on the industry. Accurately describing your business in the Hawaii Business Credit Application can help tailor your funding options.