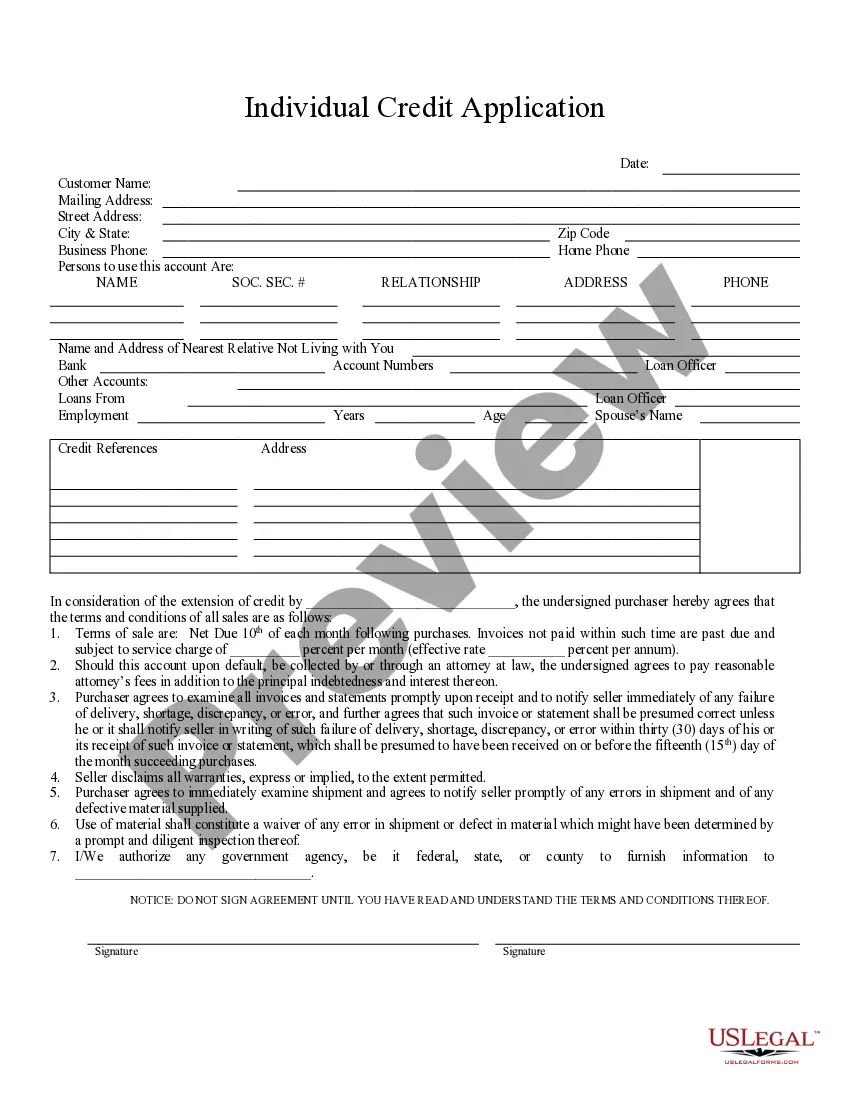

This is a credit application for obtaining credit from an individual. Upon ordering, you may download the form in Word or Rich Text formats.

Hawaii Individual Credit Application

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Hawaii Individual Credit Application?

Access one of the most comprehensive collections of legal documents.

US Legal Forms is indeed a platform to discover any state-specific document in just a few clicks, including Hawaii Individual Credit Application samples.

No need to waste your valuable time looking for a court-approved document.

If everything is correct, click Buy Now. After selecting a pricing plan, register your account. Pay using your credit card or PayPal. Save the document to your computer by clicking on the Download button. That's it! You should submit the Hawaii Individual Credit Application form and take care of it. To ensure everything is accurate, consult your local legal advisor for assistance. Sign up and easily browse over 85,000 valuable templates.

- To take advantage of the forms library, choose a subscription and create your account.

- If you have already created it, just Log In and then click Download.

- The Hawaii Individual Credit Application template will be instantly saved in the My documents tab (a section for each document you download from US Legal Forms).

- To create a new account, follow the simple instructions outlined below.

- If you're planning to use a state-specific example, ensure you select the correct state.

- If possible, read the description to understand all the details of the document.

- Use the Preview option, if available, to check the information contained in the document.

Form popularity

FAQ

Yes, it is possible to get denied a line of credit based on factors such as your credit score, income, and existing debt. Each lender has its own criteria for approval. By submitting a Hawaii Individual Credit Application, you can explore different lending options and understand why you might be denied, allowing you to improve your chances in the future.

The difficulty of obtaining a personal line of credit largely depends on your overall creditworthiness. If you have a good credit score and a stable income, you may find it easier to secure funding. Through a Hawaii Individual Credit Application, you can connect with various lenders who specialize in lines of credit, making the process more accessible.

Joining a Hawaii Credit Union typically involves filling out an application, providing identification, and meeting membership criteria. You will often need to reside or work in the area served by the credit union. By using a Hawaii Individual Credit Application, you can seamlessly navigate this process, ensuring you meet all necessary requirements while exploring your credit options.

A personal credit application is a document that allows individuals to request credit from lenders. This application requires personal information, such as income, employment, and credit history. By utilizing a Hawaii Individual Credit Application, you streamline the process and ensure that you are providing all necessary details on one form, making it easy for lenders to assess your request.

While there is no universal minimum credit score for a personal line of credit, most lenders look for scores of at least 600. Keep in mind, higher scores often lead to better terms. When you complete a Hawaii Individual Credit Application, you might discover options tailored to different credit scores, offering a higher chance of favorable approval.

The approval process for lines of credit can be challenging but depends largely on your financial background. Lenders evaluate factors like your credit score and debts. Submitting a Hawaii Individual Credit Application can help streamline this process and provide you with personalized loans that align with your credit profile.

Getting approved for a personal line of credit can vary based on your credit history and financial situation. Generally, a stable income and a good credit score increase your chances of approval. By applying for a Hawaii Individual Credit Application, you can find options that suit your financial needs. Many institutions also provide tools to help you understand your eligibility.

The CR tax form in Hawaii is used for claiming certain tax credits, including solar tax benefits. It is essential for residents seeking to maximize their tax refunds related to solar investments. Completing your Hawaii Individual Credit Application can guide you through using the CR form effectively and ensuring you receive all eligible credits.

The solar tax credit in Hawaii for 2025 is set to continue at a percentage that encourages the use of renewable energy. While the exact amount may change, residents can expect incentives that significantly reduce their tax burden. When planning your solar investment, include this information while completing your Hawaii Individual Credit Application to optimize your benefits.

To fill out a credit authorization form, start by providing your personal information, including your name, address, and social security number. It’s important to read and understand the consent requirements before signing. Ensuring accuracy and clarity in this process, especially when dealing with a Hawaii Individual Credit Application, can help prevent delays in processing.