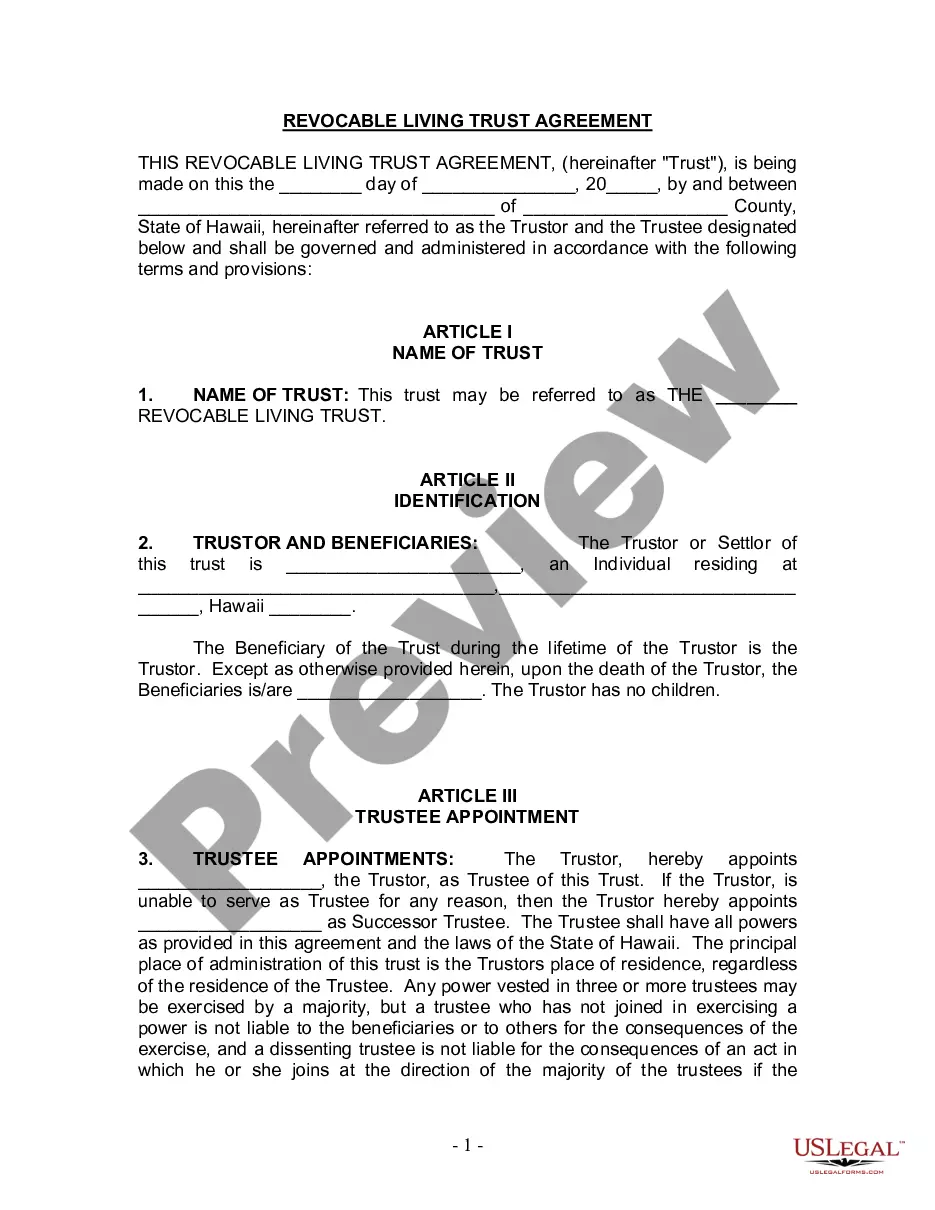

Hawaii Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Hawaii Living Trust For Individual Who Is Single, Divorced Or Widow (or Widower) With No Children?

Gain entry to one of the most extensive collections of authorized documents.

US Legal Forms provides a way to find any state-specific file in just a few clicks, including examples such as the Hawaii Living Trust for Individuals Who Are Single, Divorced, or Widowed (or Widower) without Children.

No need to spend hours searching for a court-acceptable form. Our certified experts ensure you receive the most current samples every time.

That's it! You should complete the Hawaii Living Trust for Individual Who is Single, Divorced, or Widow (or Widower) without Children template and verify it. To ensure accuracy, consult your local legal professional for assistance. Sign up and easily explore over 85,000 useful samples.

- To take advantage of the forms library, opt for a subscription and set up an account.

- If you have already created one, simply Log In and click on the Download button.

- The Hawaii Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children template will automatically be saved in the My documents tab (a section for each form you download on US Legal Forms).

- To create a new profile, follow the brief instructions provided below.

- If you intend to use a state-specific template, ensure you select the correct state.

- If possible, review the description to understand all the specifics of the document.

- Use the Preview feature if available to examine the content of the document.

- If everything looks correct, click Buy Now.

- Once you have chosen a pricing plan, register an account.

- Make your payment via credit card or PayPal.

- Download the template to your device by clicking the Download button.

Form popularity

FAQ

Yes, divorce can significantly impact a Hawaii Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children. When a divorce occurs, any assets in a living trust may need to be reassessed and possibly reallocated based on the divorce settlement. It's crucial to update your trust documents following a divorce to ensure they reflect your current wishes and accurately represent your new situation. Consulting with a qualified attorney can help you navigate these changes and maintain your estate plan.

The best person to set up a Hawaii Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children is typically an experienced estate planning attorney. These professionals understand the specific laws in Hawaii and can tailor the trust to meet your unique needs. They will ensure that your assets are managed according to your wishes, while also minimizing taxes and avoiding probate. By consulting with an attorney, you can gain peace of mind knowing that your living trust is set up correctly.

A childless couple should strongly consider establishing a trust. A Hawaii Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children allows couples to specify their beneficiaries clearly, ensuring that their wishes regarding asset distribution are respected. Additionally, it can help in managing estate taxes and provide protection during incapacity.

In the case where one spouse passes away, a living trust smoothly transitions assets to the surviving spouse. For those considering a Hawaii Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children, this means avoiding the lengthy probate process. Your assets remain protected, and management continues seamlessly, allowing for prompt and efficient handling of your estate.

Creating a trust is a wise choice for a single person, especially if you have specific wishes for your assets. A Hawaii Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children can protect your estate and streamline the management of your assets during incapacity. Moreover, this legal tool provides peace of mind, knowing that your property will be handled according to your preferences.

Yes, a Hawaii Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children is beneficial. It offers control over your assets, simplifies the transfer of your property, and avoids probate. Additionally, a trust can ensure your wishes are honored regarding asset distribution after your passing.

As of 2019, attorney fees can range from $1,000 to $2,500 to set up a trust, depending upon the complexity of the document and where you live. You can also hire an online service provider to set up your trust. As of 2019, you can expect to pay about $300 for an online trust.

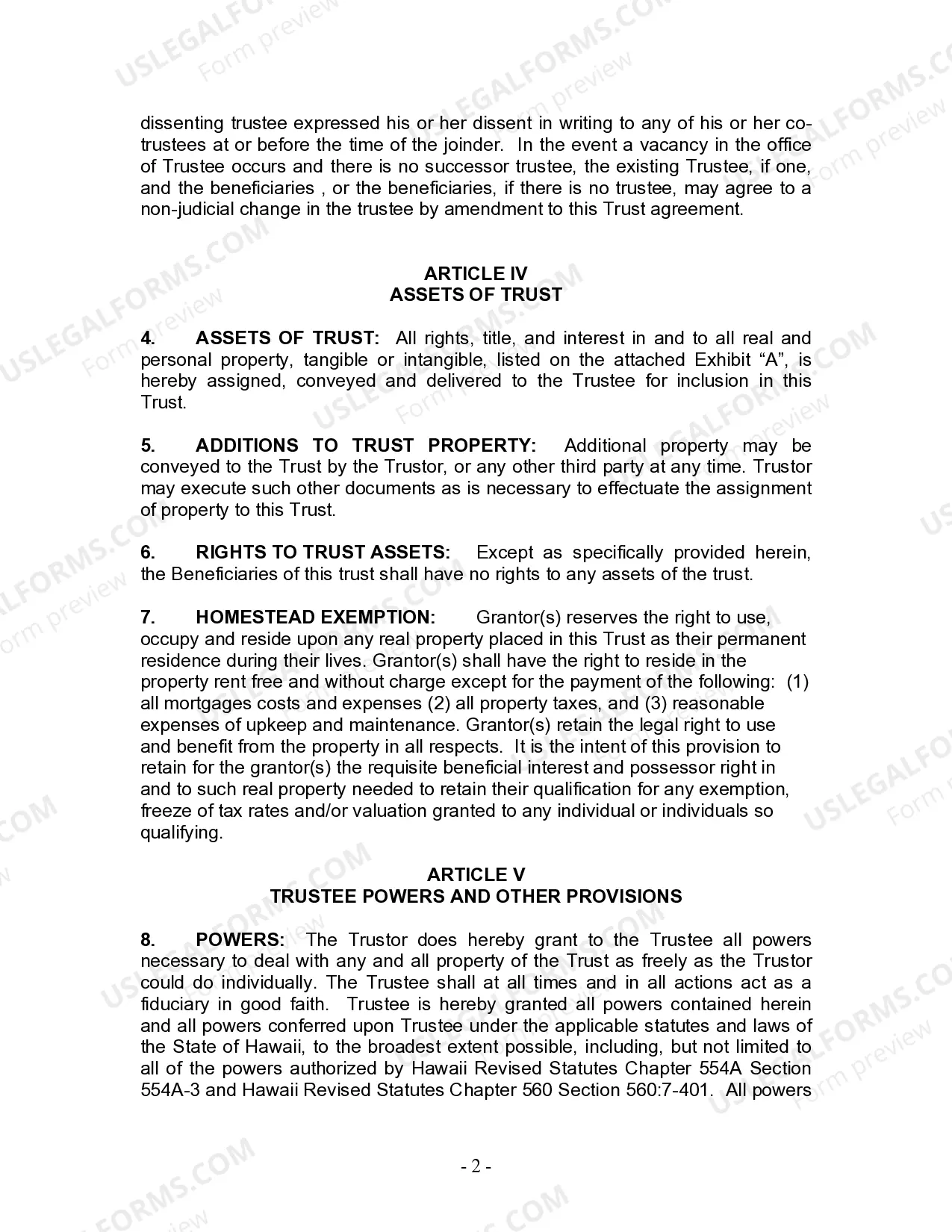

A significant advantage of a revocable living trust over a will is that it can prepare your estate in the event you become mentally incapacitated, not just when you die. Your successor trustee can also step in if you become mentally incompetent to the point where you can no longer handle your own affairs.

Choose the type of trust you want. Decide which of your assets you'd like to place in the living trust. Choose a trustee. Create your trust document. Sign the document. Place your assets into the trust.

Assuming you decide you want a revocable living trust, how much should you expect to pay? If you are willing to do it yourself, it will cost you about $30 for a book, or $70 for living trust software. If you hire a lawyer to do the job for you, get ready to pay between $1,200 and $2,000.