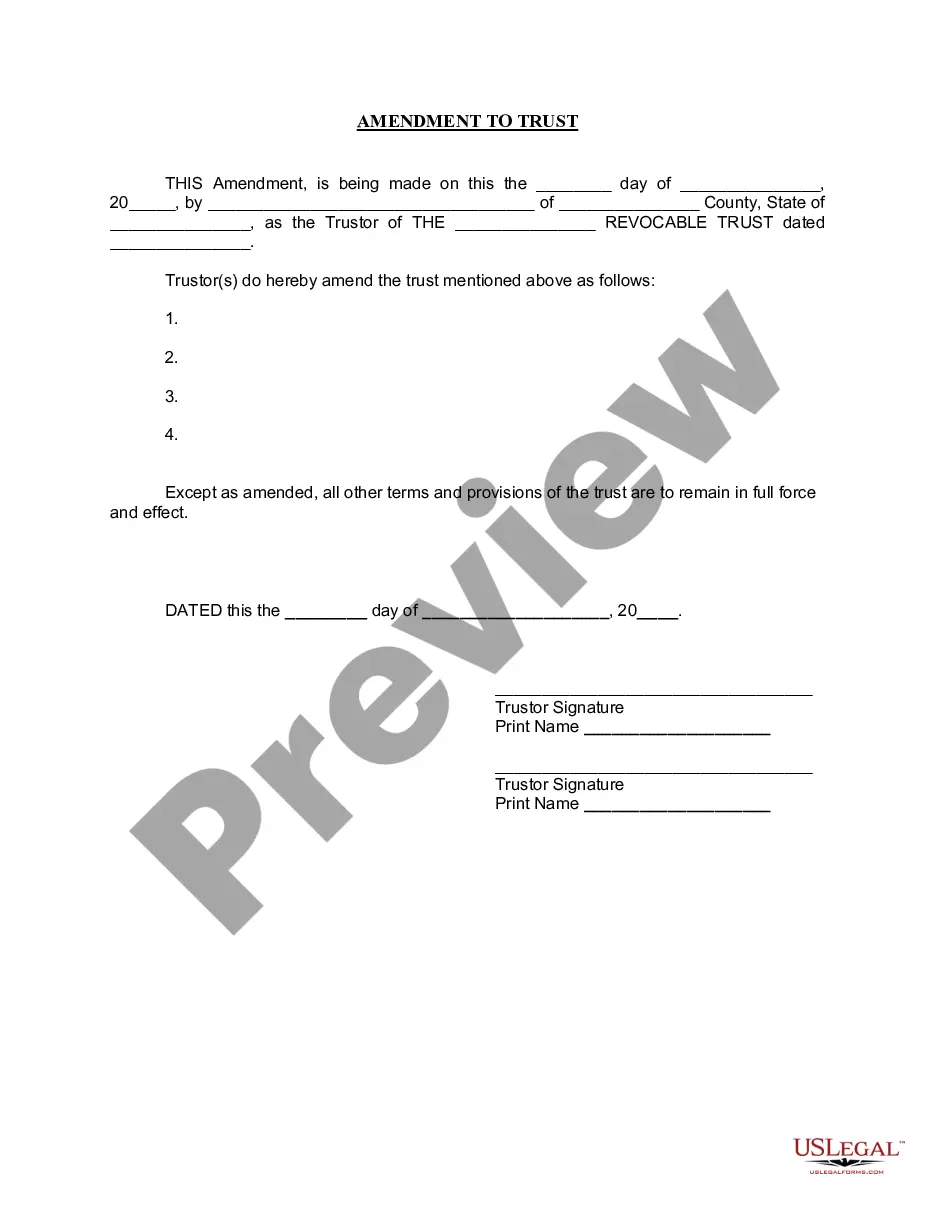

Hawaii Amendment to Living Trust

Description Hawaii Living Trust Template

How to fill out Hawaii Amendment To Living Trust?

Access one of the most comprehensive catalogue of legal forms. US Legal Forms is a system to find any state-specific document in a few clicks, such as Hawaii Amendment to Living Trust examples. No reason to waste hours of your time trying to find a court-admissible form. Our qualified specialists make sure that you receive up to date samples every time.

To make use of the documents library, choose a subscription, and sign-up an account. If you already created it, just log in and click on Download button. The Hawaii Amendment to Living Trust file will quickly get kept in the My Forms tab (a tab for every form you download on US Legal Forms).

To create a new account, follow the quick instructions below:

- If you're having to utilize a state-specific sample, make sure you indicate the appropriate state.

- If it’s possible, review the description to know all of the nuances of the document.

- Use the Preview option if it’s available to take a look at the document's content.

- If everything’s proper, click on Buy Now button.

- Right after picking a pricing plan, make your account.

- Pay out by credit card or PayPal.

- Save the document to your computer by clicking on Download button.

That's all! You ought to submit the Hawaii Amendment to Living Trust form and double-check it. To ensure that everything is correct, contact your local legal counsel for support. Sign up and easily look through more than 85,000 valuable forms.

Living Trust Amendment Form Form popularity

FAQ

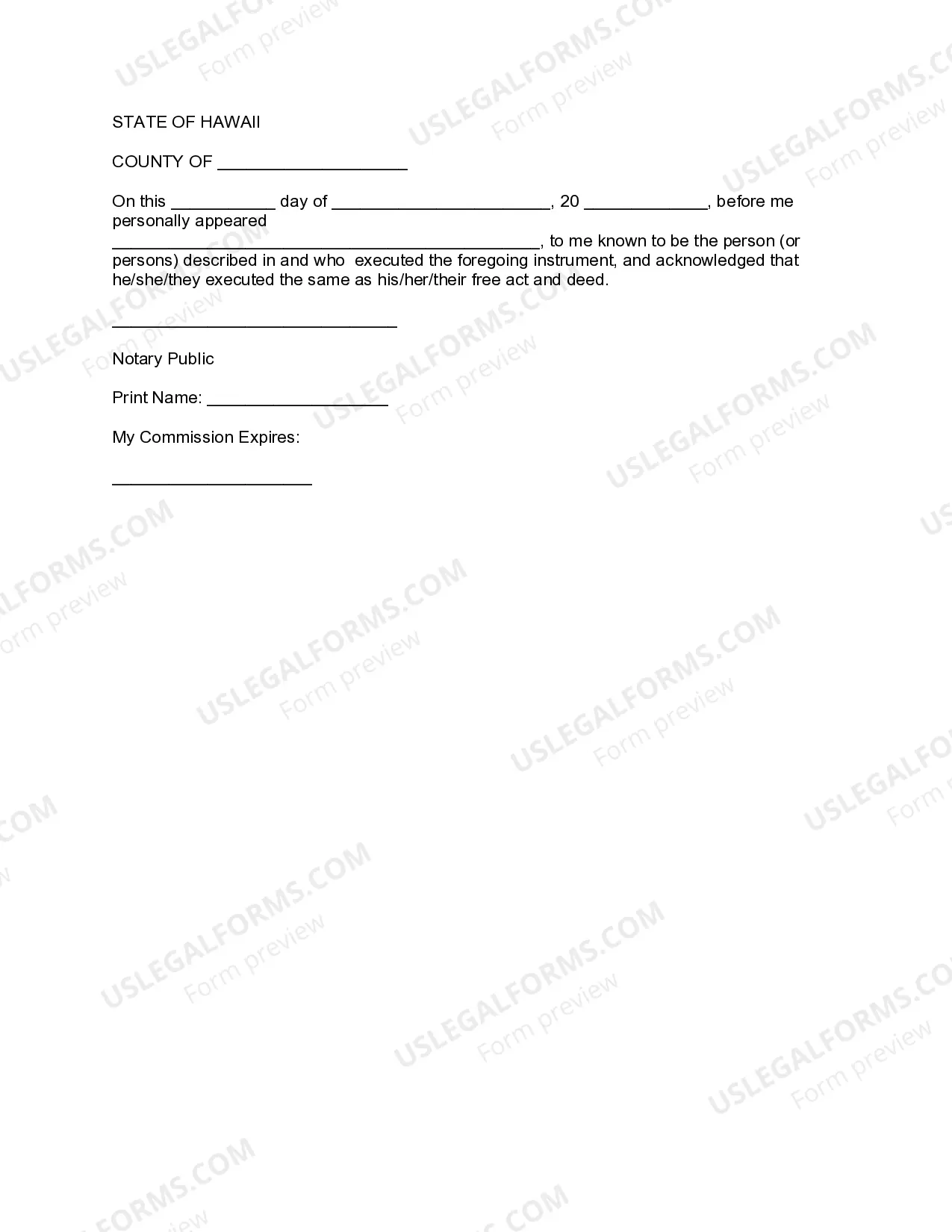

An amendment to a trust is not required to be notarized or witnessed unless the terms of the original trust require it.

A court can, when given reasons for a good cause, amend the terms of irrevocable trust when a trustee and/or a beneficiary petitions the court for a modification.Such modification provisions are common with charitable trusts, to allow modifications when federal tax law changes.

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them. You generally name yourself as the initial trustee.

Locate the original trust. The grantor must locate the original trust documents and identify the specific provisions that require amendment. Prepare an amendment form. Get the amendment form notarized. Attach amendment form to original trust.

You can change your living trust, usually without incurring lawyer bills.Because you and your spouse made the trust together, you should both sign the amendment, and when you sign it, get your signatures notarized, just like the original. Another way to go is to create a "restatement" of your trust.

Locate the original trust. The grantor must locate the original trust documents and identify the specific provisions that require amendment. Prepare an amendment form. Get the amendment form notarized. Attach amendment form to original trust.

So, going back to the question, the Trustor(s) or creator(s) of the document are the ones who have the power to make changes or even revoke it during their lifetime, and the Trustee(s) sign onto any changes made. But, when a person passes away, their revocable living trust then becomes irrevocable at their death.