Hawaii Assumption Agreement of Mortgage and Release of Original Mortgagors

Description

How to fill out Hawaii Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

Obtain the most comprehensive directory of legal documents.

US Legal Forms is essentially a platform where you can locate any state-specific document in just a few clicks, including samples of Hawaii Assumption Agreement of Mortgage and Release of Original Mortgagors.

There’s no need to waste several hours searching for a legally-recognized sample. Our skilled experts guarantee you receive updated documents each time.

After selecting a pricing plan, set up your account. Make payment via credit card or PayPal. Download the document to your device by clicking Download. That’s it! You should fill out the Hawaii Assumption Agreement of Mortgage and Release of Original Mortgagors form and verify it. To ensure everything is correct, consult your local legal advisor for assistance. Register and easily browse over 85,000 useful templates.

- To utilize the forms collection, select a subscription and register an account.

- If you have already created one, simply Log In and then select Download.

- The Hawaii Assumption Agreement of Mortgage and Release of Original Mortgagors sample will automatically be saved in the My documents section (a section for each form you save on US Legal Forms).

- To create a new account, follow the brief instructions below.

- If you intend to use a state-specific sample, make sure you select the correct state.

- If possible, review the description to understand all the details of the document.

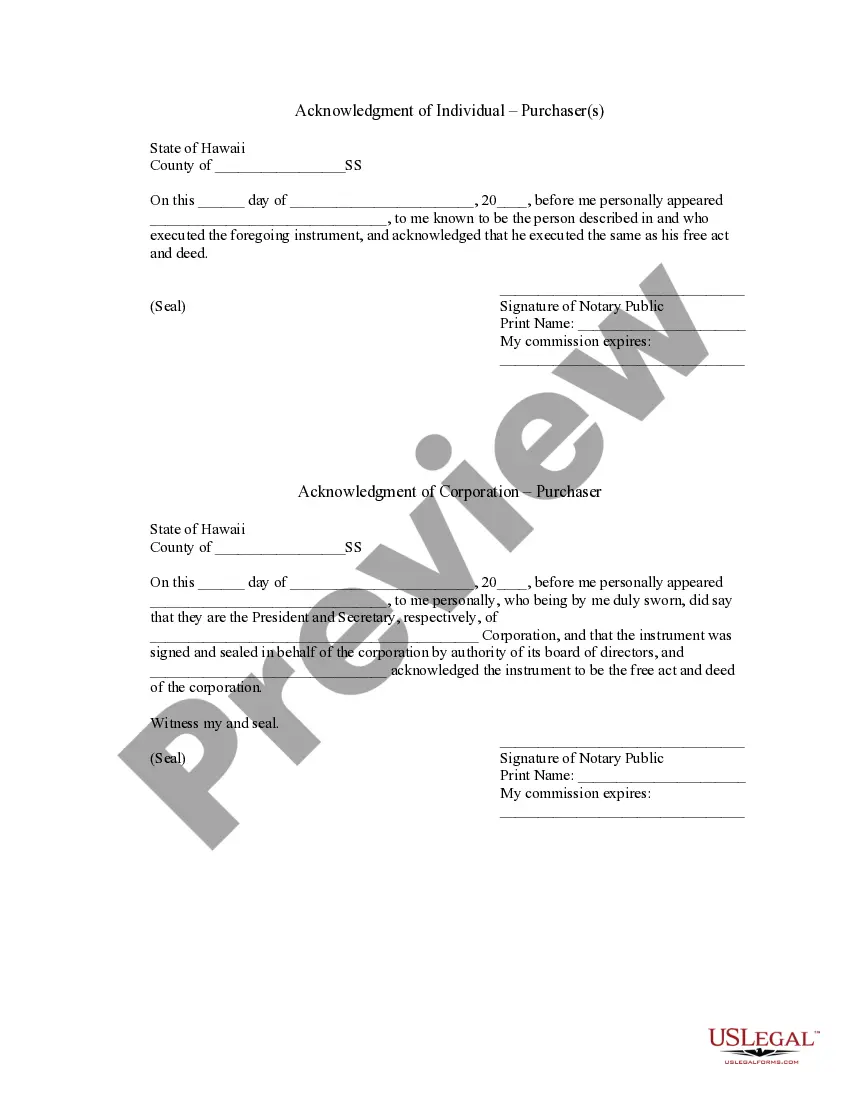

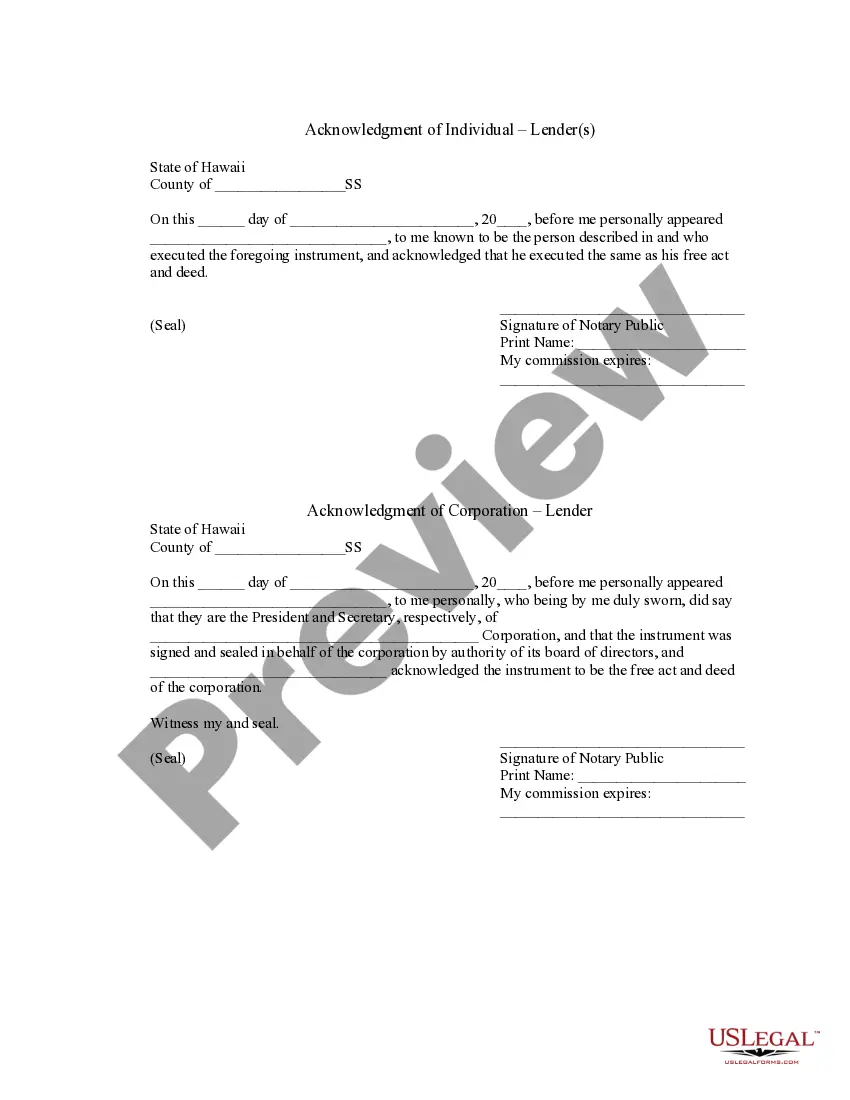

- Utilize the Preview feature if it’s accessible to view the content of the document.

- If everything is accurate, click on the Buy Now button.

Form popularity

FAQ

Assuming a mortgage involves several key steps and conditions. Primarily, the Hawaii Assumption Agreement of Mortgage and Release of Original Mortgagors must be completed to initiate the process. You also need to demonstrate your financial ability to take over the payments, typically through income verification or credit checks. Additionally, coordinating with the mortgage lender for any specific requirements can help clarify the entire procedure.

To assume a mortgage in Hawaii, you typically need a few critical documents. First, the Hawaii Assumption Agreement of Mortgage is essential, as it formally transfers the mortgage responsibility to the new borrower. You will also require proof of your creditworthiness, such as financial statements or credit reports, to ensure eligibility. Lastly, obtaining the original mortgage documents from the lender adds to the process, helping to facilitate a smooth transition.

Yes, you may encounter certain closing costs when you assume a mortgage. These costs can include fees for the title search, appraisal, and transfer of ownership, among others. It’s important to review the specifics outlined in the Hawaii Assumption Agreement of Mortgage and Release of Original Mortgagors to get a complete picture of potential costs. Engaging with platforms like uslegalforms can simplify this process and help clarify any uncertainties.

While assumable mortgages offer several advantages, there can be catches. For instance, the original mortgage terms may not be favorable compared to current offerings. Furthermore, potential liabilities can arise if you fail to meet the obligations outlined in the Hawaii Assumption Agreement of Mortgage and Release of Original Mortgagors. Always consult with a professional to understand all aspects.

Assuming a mortgage can be a beneficial option when the interest rate is lower than current market rates, making monthly payments more manageable. Moreover, it allows you to bypass some of the costs associated with securing a new mortgage. Therefore, if you're considering the Hawaii Assumption Agreement of Mortgage and Release of Original Mortgagors, it’s essential to evaluate your financial situation and long-term goals.

One potential downside of assuming a mortgage is that you may inherit the previous borrower's financial obligations, which could include a higher interest rate than current market rates. Additionally, the lender may require a thorough financial assessment to ensure you qualify for the mortgage, potentially causing delays. It is essential to review the Hawaii Assumption Agreement of Mortgage and Release of Original Mortgagors to understand these implications fully.

An example of a mortgage assumption occurs when a buyer agrees to take over the mortgage payments from the seller, usually with the lender's approval. In this scenario, the Hawaii Assumption Agreement of Mortgage and Release of Original Mortgagors outlines the terms of the transfer, relieving the seller of further responsibility. This arrangement often benefits buyers who want to take advantage of lower interest rates or avoid the complexities of securing a new mortgage. It's a win-win situation for all parties involved.