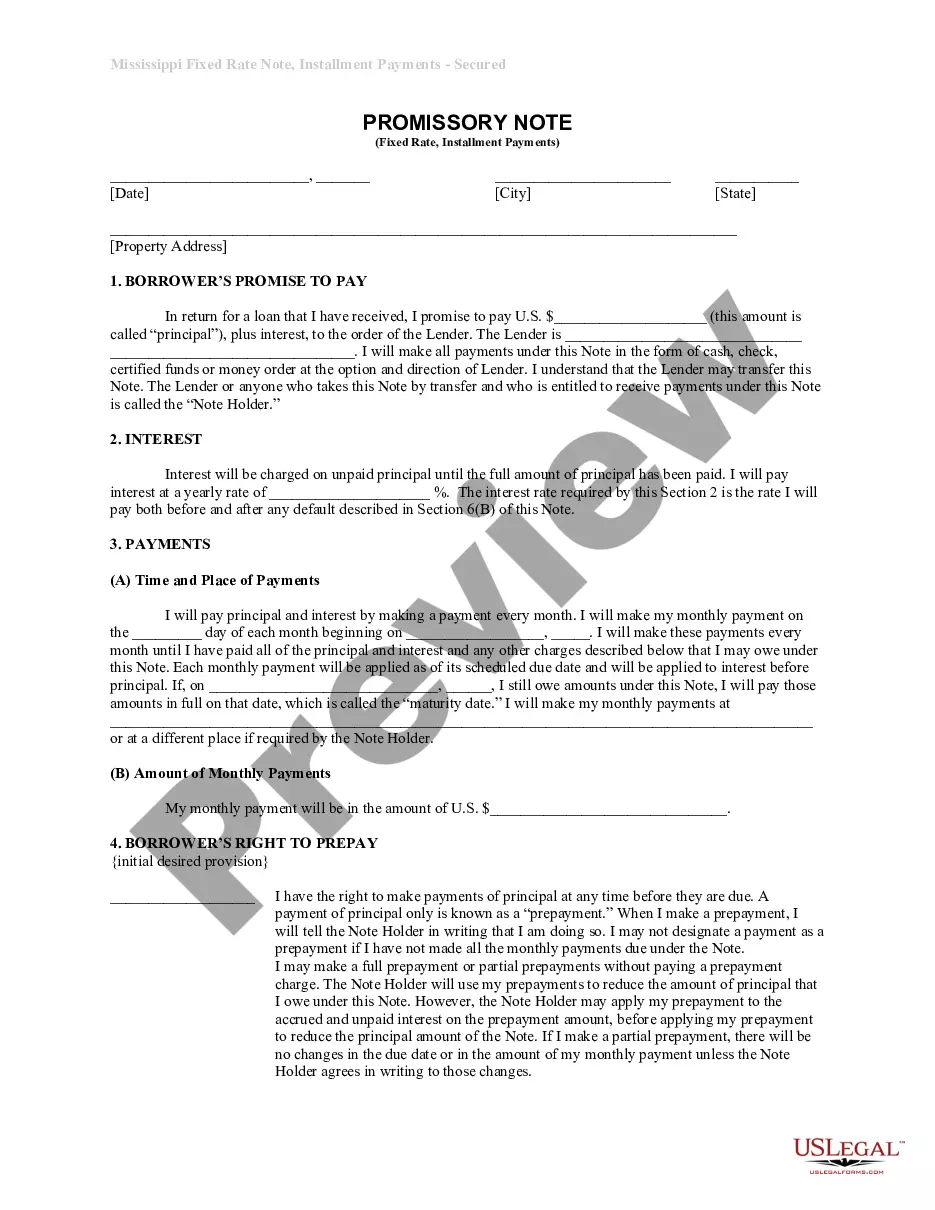

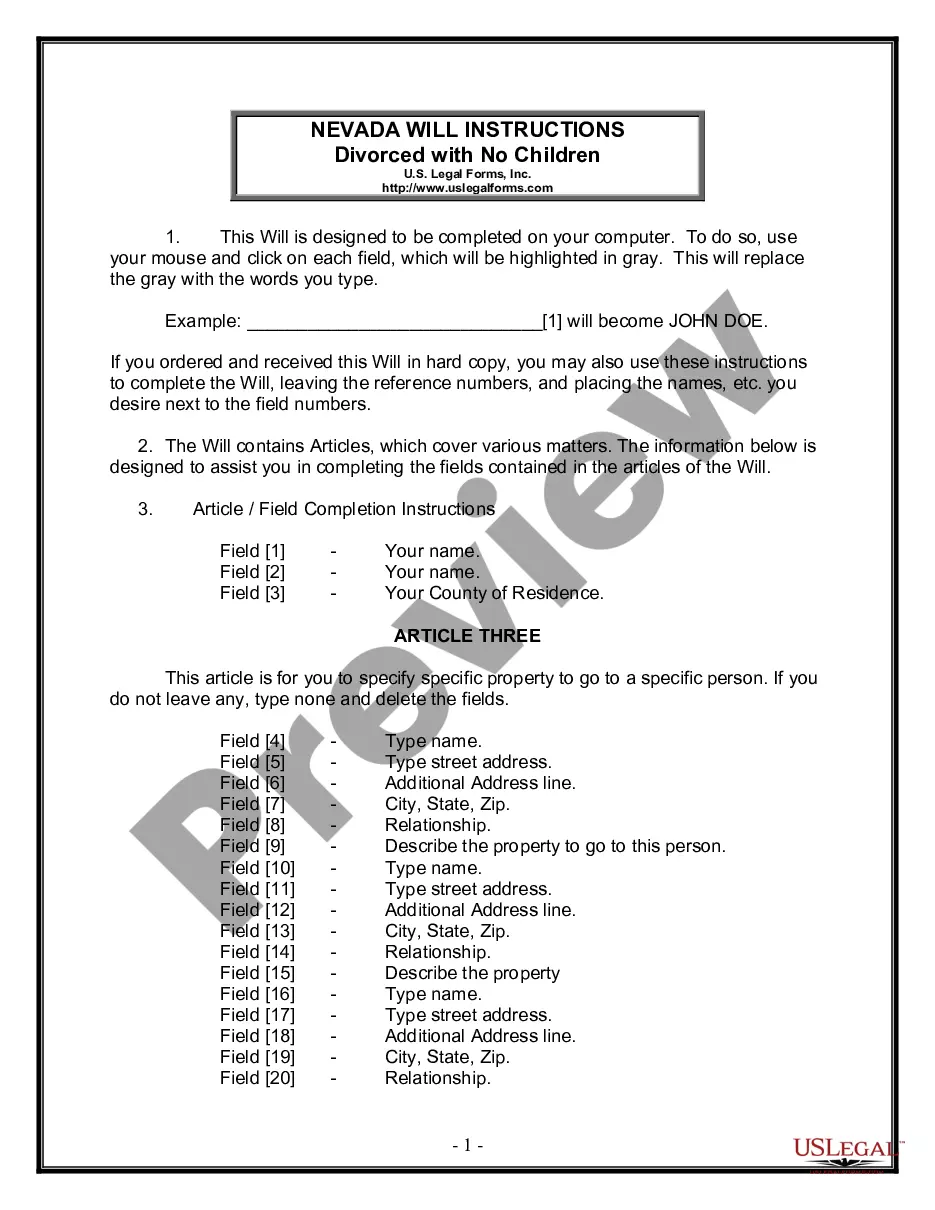

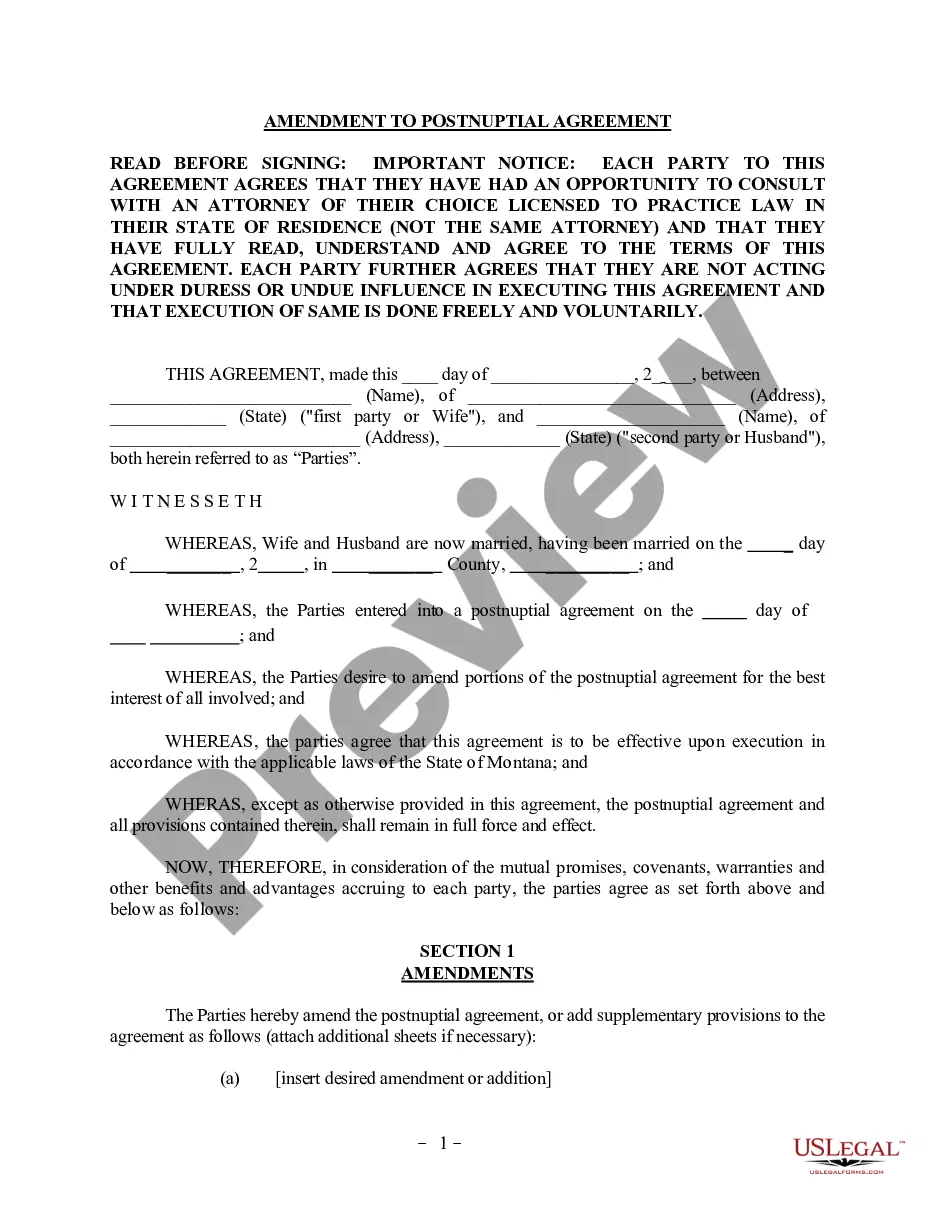

Hawaii Small Estate Affidavit for Estates under $100,000

Description Hawaii Estate

How to fill out Hawaii Small Estate Affidavit For Estates Under $100,000?

Get access to the most comprehensive library of authorized forms. US Legal Forms is a system to find any state-specific form in clicks, even Hawaii Small Estate Affidavit for Estates under 100,000 samples. No reason to spend time of your time trying to find a court-admissible example. Our licensed specialists ensure you get up-to-date documents every time.

To leverage the forms library, choose a subscription, and register an account. If you registered it, just log in and then click Download. The Hawaii Small Estate Affidavit for Estates under 100,000 sample will immediately get kept in the My Forms tab (a tab for all forms you download on US Legal Forms).

To register a new account, look at simple guidelines below:

- If you're having to use a state-specific documents, be sure to indicate the correct state.

- If it’s possible, go over the description to learn all the ins and outs of the form.

- Utilize the Preview option if it’s available to take a look at the document's content.

- If everything’s right, click Buy Now.

- Right after selecting a pricing plan, make your account.

- Pay out by credit card or PayPal.

- Save the example to your computer by clicking Download.

That's all! You should submit the Hawaii Small Estate Affidavit for Estates under 100,000 template and check out it. To make sure that everything is exact, call your local legal counsel for help. Sign up and easily find over 85,000 useful forms.

Form popularity

FAQ

The Illinois small estate affidavit provides a streamlined way for an heir-at-law of a decedent to gather and distribute the assets of the estate of a person who died, provided that no other petition to open an estate in probate court has been filed and that the assets of the person who died do not exceed $100,000.

Information about Small Estates Fill in this form where the person who has died ('the deceased') was domiciled in the United Kingdom (UK) and their estate qualifies as a Small Estate under the Small Estates Acts. About the person who has died. Surname.

To be able to file a small estate affidavit in Texas for a loved one, when no will was executed, you must be a person who would inherit under Texas intestacy law (this is generally the spouse and children, or other close relatives if there are no spouse or children).

Guadalupe County Small Estate Affidavit Checklist Individuals then fill out a form without reading the statute and without understanding Texas intestacy law. They pay a $261 filing fee and expect approval.

Fortunately, not all property needs to go through this legal process before it passes to your heirs.The quick rule of thumb is probate is not required when the estate is small, or the property is designed to pass outside of probate. It doesn't matter if you leave a will.

Probate is required when an estate's assets are solely in the deceased's name. In most cases, if the deceased owned property that had no other names attached, an estate must go through probate in order to transfer the property into the name(s) of any beneficiaries.

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.

When you use a small estate affidavit , you have to pay the decedent's bills before paying money to anyone else. For example, the decedent might have owed money to a credit card company when they died. If you use the small estate affidavit, you must give money from the estate to pay the credit card company.